Table of Contents

ADDENDA.

PAGE 33.—Consular-Agent of France at Wellington: J. Macintosh, Esq., vice H. Beauchamp, Esq. Consul of Denmark at Christchurch: H. B. Sorensen, Esq.

Page 34.—Consul of Japan at Wellington: T Young, Esq.

Page 36.—Honours held: Knight Commander of the Most Distinguished Order of St. Michael and St. George—Sir James Mills. Knights Bachelor—Walter Kennaway, George McLean (1909). Imperial Service Order—Colonel R. J. Collins, V.D.; W. C. Kensington, Esq.; J. M. Logan, Esq. (1909).

Page 36.—Secretary to High Commissioner: C. W. Palliser, Esq., vice Sir W. Kennaway, Kt. Bach., retired.

Page 39.—Executive Council: Commissioner of State Forests, Right Hon. Sir J. G. Ward; Minister of Labour, Hon, J. A. Millar, vice A. W. Hogg, resigned; Minister of Customs, Hon. G. Fowlds, vice A. W. Hogg, resigned; Minister of Agriculture, Hon. T. MacKenzie, vice Right Hon. Sir J. G. Ward, resigned.

Page 40.—Legislative Councillors: Hon. J. Holmes and Hon J. Marshall, reappointed 17th April, 1909.

Page 42.—Chairman of Committees: Thomas Mason Wilford appointed.

Page 43.—Roll of Members of Parliament: R. W. Smith, Esq., elected for Rangitikei in place of A. E. Remington, deceased.

ERRATA.

Page 16.—Three King Islands discovered “1043.”

Page 304.—First line, “including” should read “not including.”

Page 362.—Fourth paragraph, third line, “higher” should read “lower”.

Table of Contents

Table of Contents

NEW ZEALAND, formerly a colony, has, since September, 1907, by Royal Proclamation, been granted the designation of “Dominion,” and is referred to accordingly in this book. It consists of three main islands, with several groups of smaller islands lying at some distance from the principal group. The main islands, known as the North, the South, and Stewart Islands, have a coastline 4,330 miles in length: North Island, 2,200 miles; South Island, 2,000 miles; and Stewart Island, 130 miles. Other islands included within the Dominion are the Chatham, Auckland, Campbell, Three Kings, Antipodes, Bounty, and Kermadec Islands. The annexation of the Cook and sundry other islands has necessitated an enlargement of the boundaries of the Dominion, which will be specially treated of further on.

New Zealand is mountainous in many parts, but has, nevertheless, large plains in both North and South Islands. In the North Island, which is highly volcanic, is situated the famous Thermal-Springs District, of which a special account will be given. The South Island is remarkable for its lofty mountains, with their magnificent glaciers, and for the deep sounds or fiords on the western coast.

New Zealand is firstly a pastoral and secondly an agricultural country. Sown grasses are grown almost everywhere, the extent of land laid down being more than thirteen millions and a half of acres. The soil is admirably adapted for receiving these grasses, and, after the bush has been burnt off, is mostly sown over without previous ploughing. In the South Island a large area is covered with native grasses, all used for grazing purposes. The large extent of good grazing-land has made the Dominion a great wool, meat, and dairy-produce country; while its agricultural capabilities are, speaking generally, very considerable. The abundance of water and the quantity of valuable timber are other natural advantages.

New Zealand is, besides, a mining country. Large deposits of coal are met with, chiefly on the west coast of the South Island. Gold, alluvial and in quartz, is found in both Islands, the yield having been over seventy-three millions and a half sterling in value to the present time. Full statistical information on this subject is given further on, compiled up to the latest dates.

The first authentic account of the discovery of New Zealand is that given by Abel Jansen Tasman, the Dutch navigator. He left Batavia on the 14th August, 1642, in the yacht “Heemskirk,” accompanied by the “Zeehaen” (or “Sea-hen”) fly-boat. After having visited Mauritius, and discovered Tasmania, named by him “Van Diemen's Land,” in honour of Anthony van Diemen. Governor of the Dutch possessions in the East Indies, he steered eastward, and on the 13th December of the same year sighted the west coast of the South Island of New Zealand, described by him as “a high mountainous country, which is at present marked in the charts as New Zealand.”

Tasman, under the belief that the land he saw belonged to a great polar continent, and was part of the country discovered some years before by Schouten and Le Maire, to which the name of Staaten Land had been given, gave the same name of Staaten Land to New Zealand; but within about three months afterwards Schouten's “Staaten Land” was found to be merely an inconsiderable island. Upon this discovery being announced, the country that Tasman had called Staaten Land received again the name of “New Zealand,” by which it has ever since been known. Tasman sailed along the coast to a bay, where he anchored. To this he gave the name of Murderers (since termed Massacre or Golden) Bay, on account of an unprovoked attack on a boat's crew by the Natives, and the massacre of four white men. Thence he steered along the west coast of the North Island, and gave the name of Cape Maria van Diemen to the north-western extremity thereof. After sighting the islands of the Three Kings he finally departed, not having set foot in the country.

There is no record of any visit to New Zealand after Tasman's departure until the time of Captain Cook, who, after leaving the Society Islands, sailed in search of a southern continent then believed to exist. He sighted land on the 6th October, 1769, at Young Nick's Head, and on the 8th of that month cast anchor in Poverty Bay. After having coasted round the North Island and the South and Stewart Islands—which last he mistook for part of the South Island—he took his departure from Cape Farewell on the 31st March, 1770, for Australia. He visited New Zealand again in 1773, in 1774, and in 1777.

M. de Surville, a French officer in command of the vessel “Saint Jean Baptiste,” while on a voyage of discovery, sighted the northeast coast of New Zealand on the 12th December, 1769, and remained for a short time. A visit was soon after paid by another French officer, M. Marion du Fresne, who arrived on the west coast of the North Island of New Zealand on the 24th March, 1772, but was, on the 12th June following, treacherously murdered at the Bay of Islands by the Natives.

In 1793 the “Dédalus,” under the command of Lieutenant Hanson, was sent by the Government of New South Wales to New Zealand, and two chiefs were taken thence to Norfolk Island. There was after this an occasional intercourse between the islands of New Zealand and the English settlements in New South Wales.

In 1814 the first missionaries arrived in New Zealand—Messrs. Hall and Kendall—who had been sent as forerunners by Mr. Marsden, chaplain to the New South Wales Government. After a short stay they returned to New South Wales, and on the 19th November of that year again embarked in company with Mr. Marsden, who preached his first sermon in New Zealand on Christmas Day, 1814. He returned to Sydney on the 23rd March, 1815, leaving Messrs. Hall and Kendall, who formed the first mission station at Rangihoua, Bay of Islands, under the auspices of the Church Missionary Society. Six years later, in 1821, the work of evangelization was put on a more durable basis; but the first station of the Wesleyan mission, established by Mr. Leigh and his wife, at the valley of the Kaeo, Whangaroa, was not taken possession of until the 10th June, 1823.

The first attempt at colonisation was made in 1825 by a company formed in London. An expedition was sent out under the command of Captain Herd, who bought two islands in the Hauraki Gulf and a strip of land at Hokianga. The attempt, however, was a failure, owing to the savage character of the inhabitants. In consequence of frequent visits of whaling-vessels to the Bay of Islands, a settlement grew up at Kororareka—now called Russell—and in 1833 Mr. Busby was appointed British Resident there. A number of Europeans gradually settled in different parts of the country, and married Native women.

In 1838 a colonisation company, known as the New Zealand Company, was formed to establish settlement on systematic principles. A preliminary expedition, under the command of Colonel William Wakefield, was despatched from England on the 12th May, 1839, and arrived in New Zealand in the following August. Having purchased land from the Natives, Colonel Wakefield selected the shore of Port Nicholson, in Cook Strait, as the site of the first settlement. On the 22nd January, 1840, the first body of immigrants arrived, and founded the town of Wellington. About the same time —namely, on the 29th January, 1840—Captain Hobson, R.N., arrived at the Bay of Islands, empowered, with the consent of the Natives, to proclaim the sovereignty of Queen Victoria over the Islands of New Zealand, and to assume the government thereof. A compact called the Treaty of Waitangi, to which in less than six months five hundred and twelve names were affixed, was entered into, whereby all rights and powers of sovereignty were ceded to the Queen, all territorial rights being secured to the chiefs and their tribes. New Zealand was then constituted a dependency of the Colony of New South Wales, but on the 3rd May, 1841, was proclaimed a separate colony. The seat of Government had been previously established at Waitemata (Auckland), round which a settlement was formed.

The New Zealand Company having decided to form another settlement, to which the name of “Nelson” was to be given, despatched a preliminary expedition from England in April, 1841, for the purpose of selecting a site. The spot chosen was the head of Blind Bay, where a settlement was established. About the same time a number of pioneers arrived in Taranaki, despatched thither by the New Plymouth Company, a colonising society which had been formed in England, and had bought 50,000 acres of land from the New Zealand Company.

The next important event in the progress of colonisation was the arrival at Port Chalmers, on the 23rd March, 1848, of the first of two emigrant ships sent out by the Otago Association for the foundation of a settlement by persons belonging to or in sympathy with the Free Church of Scotland.

In 1849 the “Canterbury Association for founding a Settlement in New Zealand” was incorporated. On the 16th December, 1850, the first emigrant ship despatched by the association arrived at Port Cooper, and the work of opening up the adjoining country was set about in a systematic fashion, the intention of the promoters being to establish a settlement complete in itself, and composed entirely of members of the then United Church of England and Ireland.

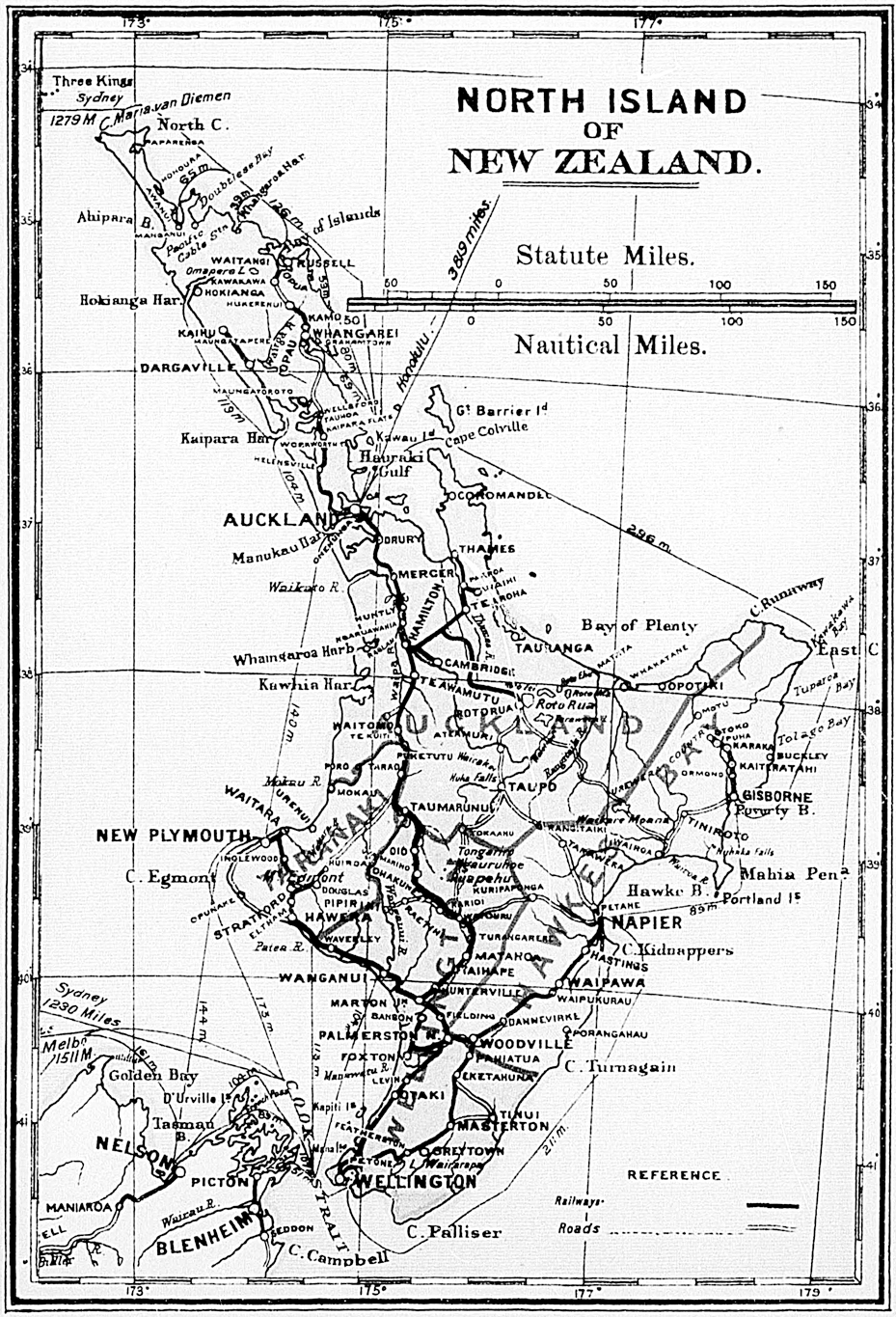

MAP OF NORTH ISLAND OF NEW

ZEALAND SHOWING LAND DISTRICTS.

(See

Part IV.)

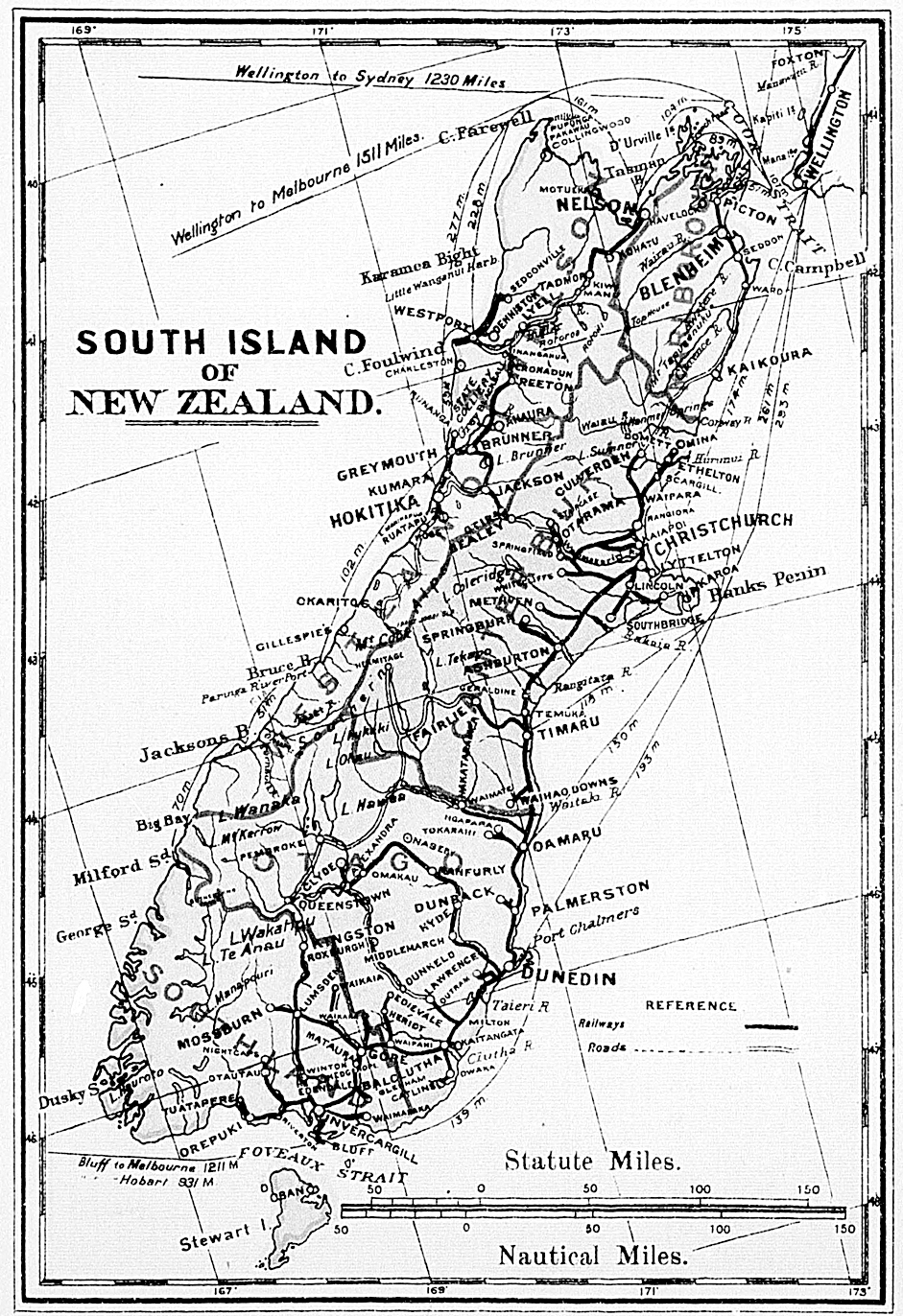

MAP OF SOUTH ISLAND OF NEW

ZEALAND SHOWING LAND DISTRICTS.

(See

Part IV.)

Prior to the colonisation of New Zealand by Europeans, the earliest navigators and explorers found a race of people already inhabiting both Islands. Papers written in 1874 by Mr. (afterwards Sir) William Fox and Sir Donald McLean (then Native Minister) state that at what time the discovery of these Islands was made by the Maoris, or from what place they came, are matters of tradition only, and that much has been lost in the obscurity enveloping the history of a people without letters. Nor is there anything on record respecting the origin of the Maori people themselves, beyond the general tradition of the Polynesian race, which seems to show a series of successive migrations from west to east, probably by way of Malaysia to the Pacific. Little more can now be gathered from their traditions than that they were immigrants, and that they probably found inhabitants on the east coast of the North Island belonging to the same race as themselves—the descendants of a prior migration, whose history is lost. The tradition runs that, generations ago, the Maoris dwelt in a country named Hawaiki, and that one of their chiefs, after a long voyage, reached the northern island of New Zealand. Returning to his home with a flattering description of the country he had discovered, this chief, it is said, persuaded a number of his kinsfolk and friends, who were much harassed by war, to set out with a fleet of double canoes for the new land. The names of most of the canoes are still remembered, and each tribe agrees in its account of the doings of the people of the principal canoes after their arrival in New Zealand; and from these traditional accounts the descent of the numerous tribes has been traced. Calculations, based on the genealogical staves kept by the tohungas, or priests, and on the well-authenticated traditions of the people, indicate that about twenty-one generations have passed since the migration, which may therefore be assumed to have taken place about five hundred and twenty-five years ago. The position of the legendary Hawaiki is unknown, but many places in the South Seas have been thus named in memory of the motherland. The Maoris speak a very pure dialect of the Polynesian language, the common tongue, with more or less variation, in all the eastern Pacific islands. When Captain Cook first visited New Zealand he availed himself of the services of a Native from Tahiti, whose speech was easily understood by the Maoris. In this way much information respecting the early history of the country and its inhabitants was obtained which could not have otherwise been had.

For results of recent researches as to probable origin of the Maoris, see Year-book for 1901.

The Proclamation of Captain Hobson on the 30th January, 1840, gave as the boundaries of what was then the colony the following degrees of latitude and longitude: On the north, 34°30' S. lat.; on the south, 47° 10' S. lat.; on the east, 179° 0' E. long.; on the west, 166° 5' E. long. These limits excluded small portions of the extreme north of the North Island and of the extreme south of Stewart Island.

In April, 1842, by Royal Letters Patent, and again by the Imperial Act 26 and 27 Vict., c. 23 (1863), the boundaries were altered so as to extend from 33° to 53° of south latitude and from 162° of east longitude to 173° of west longitude. By Proclamation bearing date the 21st July, 1887, the Kermadec Islands, lying between the 29th and 32nd degrees of south latitude and the 177th and 180th degrees of west longitude, were declared to be annexed to and to become part of the then Colony of New Zealand.

By Proclamation bearing date the 10th June, 1901, the Cook Group of islands, and all the other islands and territories situate within the boundary-lines mentioned in the following Schedule, were included:—

A line commencing at a point at the intersection of the twenty-third degree of south latitude and the one-hundred-and-fifty-sixth degree of longitude west of Greenwich, and proceeding due north to the point of intersection of the eighth degree of south latitude and the one-hundred-and-fifty-sixth degree of longitude west of Greenwich; thence due west to the point of intersection of the eighth degree of south latitude and the one-hundred-and-sixty-seventh degree of longitude west of Greenwich; thence due south to the point of intersection of the seventeenth degree of south latitude and the one-hundred-and-sixty-seventh degree of longitude west of Greenwich; thence due west to the point of intersection of the seventeenth degree of south latitude and the one-hundred-and-seventieth degree of longitude west of Greenwich; thence due south to the point of intersection of the twenty-third degree of south latitude and the one-hundred-and seventieth degree of longitude west of Greenwich; and thence due east to the point of intersection of the twenty-third degree of south latitude and the one-hundred-and-fifty-sixth degree of longitude west of Greenwich.

The following now constitutes the Dominion of New Zealand:—

The island commonly known as the North Island, with its adjacent islets, having an aggregate area of 44,468 square miles, or 28,459,520 acres.

The island known as the South Island, with adjacent islets, having an aggregate area of 58,525 square miles, or 37,456,000 acres.

Stewart Island, and adjacent islets, having an area of 665 square miles, or 425,390 acres.

The Chatham Islands, situate 536 miles eastward of Lyttelton in the South Island, with an area of 375 square miles, or 239,920 acres.

The Auckland Islands, about 200 miles south of Stewart Island, extending about 30 miles from north to south, and nearly 15 from east to west, the area being 210,650 acres.

Campbell Island, in latitude 52° 33' 26” south, and longitude 169° 8' 41” west, about 30 miles in circumference, with an area of 45,440 acres.

The Antipodes Islands, about 458 miles in a south-easterly direction from Port Chalmers, in the South Island. These are detached rocky islands, and extend over a distance of between 4 and 5 miles from north to south. Area, 12,960 acres.

The Bounty Islands, a small group of islets, thirteen in number, lying north of the Antipodes Islands, and about 415 miles in an east-south-easterly direction from Port Chalmers. Area, 3,300 acres.

The Kermadec Islands, a group lying about 614 miles to the north-east of Russell, in the Bay of Islands. Raoul, or Sunday Island, the largest of these, is about 20 miles in circuit. The next in size is Macaulay Island, about 3 miles round. Area of the group, 8,208 acres.

Islands forming the Cook Group:—

Rarotonga.—Distance from Auckland, 1,638 miles; circumference, 20 miles; height, 2,920 ft.

Mangaia.—Distance from Rarotonga, 116 miles: circumference, 30 miles; height, 656 ft.

Atiu.—Distance from Rarotonga, 116 miles: circumference, 20 miles; height, 374 ft.

Aitutaki.—Distance from Rarotonga, 140 miles; circumference, 12 miles: height, 366 ft.

Mauke.—Distance from Rarotonga, 150 miles; circumference, 6 miles; height, about 60 ft.

Mitiaro.—Distance from Rarotonga, 140 miles; circumference, 5 miles; height, about 50 ft.

Takutea.—Distant from Rarotonga, 125 miles.

The Herveys (Manuae and Aoutu).—Distant from Rarotonga, 120 miles;

Total area of above Group, 150 square miles.

Islands outside the Cook Group:—

Savage or Niue.—Distance from Rarotonga, 580 miles; circumference, 40 miles; height, 200 ft.; area, about 100 square miles.

Palmerston.—Distance from Rarotonga, 273 miles; an atoll, 4 miles by 2 miles.

Penrhyn, or Tongareva.—Distance 735 miles from Rarotonga; an atoll, 12 miles by 7 miles.

Humphrey, or Manahiki.—Distance from Rarotonga, 650 miles; an atoll, 6 miles by 5 miles.

Rierson, or Rakaanga.—Distance from Rarotonga, 700 miles; an atoll, 3 miles by 3 miles.

Danger, or Pukapuka.—Distance from Rarotonga, 700 miles; an atoll, 3 miles by 3 miles.

Suwarrow.—Distance from Rarotonga, 530 miles; an atoll.

Total area of islands outside the Cook Group, 130 square miles.

The total area of the Dominion is thus about 104,751 square miles, of which the aggregate area of the outlying groups of islands that are practically useless for settlement amounts to about 498 square miles.

The areas of the several Australian States, as stated by different authorities, vary considerably. The total area of the Australian Continent is given as 2,944,628 square miles, according to a computation made by the late Surveyor-General of Victoria, Mr. J. A. Skene, from a map of Continental Australia compiled and engraved under his direction; but the following areas are taken from latest official records:—

| Square Miles. | |

|---|---|

| Queensland | 670,500 |

| New South Wales | 310,372 |

| Victoria | 87,884 |

| South Australia | 903,690 |

| Western Australia | 975,920 |

| Total, Continent of Australia | 2,948,366 |

| Tasmania | 26,215 |

| Total, Commonwealth of Australia | 2,974,581 |

The size of these States (with New Zealand) may be better realised by comparison of their areas with those of European countries. The areas of the following countries—Austria-Hungary, Germany, France, Belgium, Holland, Denmark, Sweden and Norway, Portugal, Spain, Italy (including Sardinia and Sicily), Switzerland, Greece, Romania, Bulgaria, Servia, Eastern Roumelia, and Turkey in Europe—containing on the whole rather less than 1,600,000 square miles, amount to little more than half the extent of the Australian Continent. If the area of Russia in Europe be added to those of the other countries the total would be about one-seventh larger than the Australian Continent, and about one-twelfth larger than the Australian States, with New Zealand.

The area of the Dominion of New Zealand is about one-seventh less than the area of Great Britain and Ireland, the South Island of New Zealand being a little larger than the combined areas of England and Wales.

| United Kingdom. | Area in Square Miles. |

|---|---|

| England and Wales | 58,311 |

| Scotland | 30,463 |

| Ireland | 32,531 |

| Total | 121,305 |

| New Zealand | Area in Square Miles. |

| North Island | 44,468 |

| South Island | 58,525 |

| Stewart Island | 665 |

| Chatham Islands | 375 |

| Other islands | 718 |

| Total | 104,751 |

The North Island extends over a little more than seven degrees of latitude, a distance in a direct line from north to south of 430 geographical or 498 statute miles; but, as the northern portion of the Dominion, which covers more than three degrees of latitude, trends to the westward, the distance in a straight line from the North Cape to Cape Palliser, the extreme northerly and southerly points of the island, is about 515 statute miles.

This Island is, as a whole, hilly, and in parts mountainous in character, but there are large areas of plain or comparatively level country that are, or by clearing may be made, available for agricultural purposes. Of these, the principal are the plains in Hawke's Bay on the east coast, the Wairarapa Plain in the Wellington District, and a strip of country along the west coast, about 250 miles in length, extending from a point about thirty miles from the City of Wellington to a little north of New Plymouth. The largest plain in the North Island, Kaingaroa, extends from the shore of Lake Taupo in a north-north-easterly direction to the sea-coast in the Bay of Plenty; hut a great part of it is covered with pumice-sand, and is unfit for tillage or pasture. There are several smaller plains and numerous valleys suitable for agriculture. The level or undulating country in this Island fit, or capable of being made fit, for agriculture has been roughly estimated at 13,000,000 acres. This includes lands now covered with standing forest and swamps that can be drained; also large areas of clay-marl and pumice-covered land. The clay-marl in its natural state is cold and uninviting to the farmer, but under proper drainage and cultivation it can be brought to a high state of productiveness. This kind of land is generally neglected at the present time, as settlers prefer soils more rapidly remunerative and less costly to work. The larger portion of the North Island was originally covered with forest. Although the area of hush land is still very great, yet year by year the amount is being reduced, chiefly to meet the requirements of settlement, the trees being cut down and burnt, and grass-seed sown on the ashes to create pasture. Hilly as the country is, yet from the nature of the climate it is especially suited for the growth of English grasses, which will flourish wherever there is any soil, however steep the land may be; once laid down in grass very little of the land is too poor to supply food for cattle and sheep. The area of land in the North Island deemed purely pastoral or capable of being made so, while too steep for agricultural purposes, is estimated at 14,200,000 acres. In the centre of the Island is a lake, about twenty miles across either way, called Taupo. A large area adjacent to the lake is pumice country. The Waikato River, the largest in the North Island, flows out of the north-eastern corner of this lake, and runs thence north-westward until it enters the ocean a little distance south of the Manukau Harbour. This river is navigable for small steamers for about a hundred miles from its mouth. The Maori King-country, partly occupied by Natives who for several years isolated themselves from Europeans, lies between Lake Taupo and the western coast. The River Thames, or Waihou, having its sources north of Lake Taupo, flows northward into the Firth of Thames. It is navigable for about fifty miles, but only for small steamers. The other navigable rivers in this island are the Wairoa (Kaipara), the Wanganui, and the Manawatu, the two last of which flow towards the south-west into Cook Strait.

The mountains in the North Island are estimated to occupy about one-tenth of the surface, and do not exceed 4,000 ft. in height, with the exception of a few volcanic mountains that are more lofty. Of these, the three following are the most important:—

The Tongariro Mountain, situated to the southward of Lake Taupo. It consists of a group of distinct volcanic cones, the lava-streams from which have so overlapped in their descent as to form one compact mountain-mass at the base. The highest of these cones is called Ngauruhoe, and attains an elevation of 7,515 ft. The craters of Ngauruhoe, the Red Crater (6,140 ft.), and Te Mari (4,990 ft.) are the three vents from which the latest discharges of lava have taken place, the most recent having occurred in 1868. These craters are still active, steam and vapour issuing from them with considerable force and noise, the vapours, charged with pungent gases and acids, making it dangerous to approach too near the crater-lips. An unusual disturbance occurred in 1909, a quantity of scoria-ash being discharged, but no lava.

Ruapehu. This mountain lies to the south of Ngauruhoe and Tongariro. It is a volcanic cone in the solfatara stage, and reaches the height of 9,008 ft., being in part considerably above the line of perpetual snow. The most remarkable feature of this mountain is the crater lake on its summit, which is subject to slight and intermittent eruptions, giving rise to vast quantities of steam. In March, 1895, such an eruption took place, forming a few hot springs on the margin of the lake, and increasing the heat in the lake itself. This lake lies at the bottom of a funnel-shaped crater, the steep sides of which are mantled with ice and snow. The water occupies a circular basin about 500 ft. in diameter, some 300 ft. below the enclosing peaks, and is quite inaccessible except by the use of ropes. This lake, and the three craters previously mentioned on Tongariro, are all in one straight line, which, if produced, would pass through the boiling springs at Tokaanu on the southern margin of Lake Taupo, the volcanic country north-east of that lake, and White Island, an active volcano in the Bay of Plenty, situated about twenty-seven miles from the mainland.

Mount Egmont. This is an extinct volcanic cone, rising to a height of 8,260 ft. The upper part is always covered with snow. This mountain is situated close to New Plymouth, and is surrounded by one of the most fertile districts in New Zealand. Rising from the plains in solitary grandeur, it is an object of extreme beauty, the cone being one of the most perfect in the world.

It is estimated that the area of mountain-tops and barren country at too high an altitude for sheep, and therefore worthless for pastoral purposes, amounts, in the North Island, to 300,000 acres.

Without a doubt the hot springs form the most remarkable feature of the North Island. They are found over a large area, extending from Tongariro, south of Lake Taupo, to Ohaeawai, in the extreme north—a distance of some 300 miles; but the principal seat of hydrothermal action appears to be in the neighbourhood of Lake Rotorua, about forty miles north-north-east from Lake Taupo. By the destruction of the famed Pink and White Terraces at Lake Rotomahana during the eruption of Mount Tarawera on the 10th June, 1886, the neighbourhood has been deprived of attractions unique in character and of unrivalled beauty; but the natural features of the country—the numerous lakes, geysers, and hot springs, some of which possess remarkable curative properties in certain complaints—are still very attractive to tourists and invalids. The world-wide importance of conserving this region as a sanatorium for all time has been recognised by the Government, and it is dedicated by Act of Parliament to that purpose.

Notwithstanding the length of coast-line, good harbours in the North Island are not numerous. Those on the west coast north of New Plymouth are bar harbours, unsuitable for large vessels. The principal harbours are the Waitemata Harbour, on which Auckland is situated—this is rather a deep estuary than a harbour; several excellent havens in the northern peninsula; and Port Nicholson, on the borders of which Wellington is situated. This is a landlocked harbour, about six miles across, having a comparatively narrow but deep entrance from the ocean. The water is deep nearly throughout.

The Cape Colville Peninsula contains gold-bearing quartz, and at the southern end rich gold is being found in the Ohinemuri County got from the famous Waihi Mine.

Cook Strait separates the North and South Islands. It is some sixteen miles across at its narrowest part, but in the widest about ninety. The strait is invaluable for the purpose of traffic between different parts of the Dominion.

The extreme length of the South Island, from Jackson's Head, in Cook Strait, to Puysegur Point, at the extreme south-west, is about 525 statute miles; the greatest distance across at any point is in Otago (the southernmost) District, about 180 miles.

The South Island is intersected along almost its entire length by a range of mountains known as the Southern Alps. Some of the summits reach a height of from 10,000 ft. to 12,000 ft., Mount Cook, the highest peak, rising to 12,349 ft.

In the south, in the neighbourhood of the sounds and Lake Te Anau, there are many magnificent peaks, which, though not of great height, are, owing to their latitude, nearly all crowned with perpetual ice and snow. Further north the mountains increase in height—Mount Earnslaw, at Lake Wakatipu; and Mount Aspiring, which has been aptly termed the New Zealand Matterhorn, 9,949 ft. in height, at Lake Wanaka. Northward of this again are Mount Cook (or Aorangi), Mount Sefton, and other magnificent peaks.

For beauty and grandeur of scenery the Southern Alps of New Zealand may worthily compare with, while in point of variety they are said actually to surpass, the Alps of Switzerland. In New Zealand few of the mountains have been scaled; many of the peaks and most of the glaciers are as yet unnamed; and there is still, in parts of the South Island, a fine field for exploration and discovery—geographical, geological, and botanical. The wonders of the Southern Alps are only beginning to be known; but the more they are known the more they are appreciated. The snow-line in New Zealand being so much lower than in Switzerland, the scenery, though the mountains are not quite so high, is of surpassing grandeur.

There are extensive glaciers on both sides of the range, those on the west being of exceptional beauty, as, from the greater abruptness of the mountain-slopes on that side, they descend to within about 700ft. of the sea-level, and into the midst of the evergreen forest. The largest glaciers on either side of the range are easily accessible.

The following gives the sizes of some of the glaciers on the eastern slope:—

| Name. | Area of Glacier. | Length of Glacier. | Greatest Width. | Average Width. | |||

|---|---|---|---|---|---|---|---|

| Acres. | Miles | ch. | Miles | ch. | Miles | ch. | |

| Tasman | 13,664 | 18 | 0 | 2 | 14 | 1 | 15 |

| Murchison | 5,800 | 10 | 70 | 1 | 5 | 0 | 66 |

| Godley | 5,312 | 8 | 0 | 1 | 55 | 1 | 3 |

| Mueller | 3,200 | 8 | 0 | 0 | 61 | 0 | 50 |

| Hooker | 2,416 | 7 | 25 | 0 | 54 | 0 | 41 |

The Alletsch Glacier in Switzerland, according to Ball, in the “Alpine Guide,” has an average width of one mile. It is in length and width inferior to the Tasman Glacier.

Numerous sounds or fiords penetrate the south-western coast. They are long, narrow, and deep (the depth of water at the upper part of Milford Sound is 1,270 ft., although at the entrance only 130 ft.), surrounded by giant mountains clothed with foliage to the snow-line, with waterfalls, glaciers, and snowfields at every turn. Some of the mountains rise almost precipitously from the water's edge to 5,000 ft. and 6,000 ft. above the sea. Near Milford, the finest of these sounds, is the great Sutherland Waterfall, 1,904 ft. high.

The general surface of the northern portion of the South Island, comprising the Provincial Districts of Nelson and Marlborough, is mountainous, but the greater part is suitable for grazing purposes. There are some fine valleys and small plains suitable for agriculture, of which the Wairau Valley or Plain is the largest. Deep sounds, extending for many miles, break the coast-line abutting on Cook Strait. The City of Nelson is situated at the head of Blind Bay, which has a depth inwards from Cook Strait of about forty statute miles.

The Provincial District of Canterbury lies to the south of the Marlborough District, and on the eastern side of the Island. Towards the north the land is undulating; then there is a stretch of almost perfectly level country extending towards the south-west 160 miles, after which, on the south, the country is undulating as far as the borders of the Otago District. On the east a block of hill country rises abruptly from the plain and extends for some miles seaward. This is Banks Peninsula, containing several good harbours, the principal being Port Cooper, on the north, on which is situated Lyttelton, the chief port of the district: the harbour of Akaroa, one of the finest in the Dominion, is on the southern coast of this peninsula.

The District of Otago is, on the whole, mountainous, but has many fine plains and valleys suitable for tillage. The mountains, except towards the west coast, are generally destitute of timber, and suitable for grazing sheep. There are goldfields of considerable extent in the interior of this district. The inland lakes are also very remarkable features. Lake Wakatipu extends over fifty-four miles in length, but its greatest width is not more than four miles, and its area only 114 square miles. It is 1,070 ft. above sea-level, and has a depth varying from 1,170 ft. to 1,296 ft. Te Anau Lake is somewhat larger, having an area of 132 square miles. These lakes are bounded on the west by broken, mountainous, and wooded country, extending to the ocean.

The chief harbours in Otago are Port Chalmers, at the head of which Dunedin is situated, and the Bluff Harbour, at the extreme south.

The District of Westland, extending along the west coast of the South Island, abreast of Canterbury, is more or less auriferous throughout. The western slopes of the central range of mountains are clothed with forest trees to the snow-line; but on the eastern side timber is scarce, natural grasses covering the ground.

The rivers in the South Island are for the most part mountain-torrents, fed by glaciers in the principal mountain-ranges. When the snow melts they rise in flood, forming, where not confined by rocky walls, beds of considerable width, generally covered by enormous deposits of shingle. The largest river in the Dominion as regards volume of water is the Clutha. It is 154 miles in length, but is only navigable for boats or small river-steamers for about thirty miles. The Rivers Buller, Grey, and Hokitika, on the west coast, are navigable for a short distance from their mouths. They form the only ports in the Nelson South-west and Westland Districts. In their unimproved state they admitted, owing to the bars at their mouths, none but vessels of small draught; but, in consequence of the importance of the Grey and Buller Rivers as the sole ports available for the coal-export trade, large harbour-works have been undertaken, resulting in the deepening of the beds of these rivers, and giving a depth up to 26 ft. of water on the bars.

The area of level or undulating land in the South Island available for agriculture is estimated at about 15,000,000 acres. About 13,000,000 are suitable for pastoral purposes only, or may become so when cleared of forest and sown with grass-seed. The area of barren land and mountain-tops is estimated at about 9,000,000 acres.

Foveaux Strait separates the South from Stewart Island. This last island has an area of only 425,390 acres.

Stewart Island is a great tourist resort during the summer months, and is easily reached by steamer from the Bluff, distant about 25 miles.

The principal peak is Mount Anglem, 3,200 ft. above sea-level, which has an extinct crater at its summit. Most of the island is rugged and forest-clad; the climate is mild, frost being seldom experienced; and the soil, when cleared of bush, is fertile.

The chief attractions are the numerous bays and fiords. Paterson Inlet is a magnificent sheet of water, about ten miles by four miles, situated close to Half-moon Bay, the principal port, where over two hundred people live. Horseshoe Bay and Port William are within easy reach of Half-moon Bay. Port Pegasus, a land-locked sheet of water about eight miles by a mile and a half, is a very fine harbour. At “The Neck” (Paterson Inlet) there is a Native settlement of Maoris and half-castes. The bush is generally very dense, with thick undergrowth. Rata, black-pine, white-pine, miro, and totara are the principal timber trees. Fish are to be had in great abundance and variety; oysters form an important industry. Wild pigeons, ducks, and mutton-birds are plentiful.

The outlying group of the Chatham Islands, lying between the parallels of 43° 30' and 44° 30' south latitude, and the meridians of 175° 40' and 177° 15' west longitude, 480 statute miles east-southeast from Wellington, and 536 miles eastward of Lyttelton, consists of two principal islands and several unimportant islets. They were discovered by Lieutenant Broughton and named by him in honour of the Earl of Chatham. The largest island contains about 222,490 acres, of which an irregular-shaped lake or lagoon absorbs 45,960 acres. About one-quarter of the surface of the land is covered with forest, the rest with fern or grass. The hills nowhere rise to a great height. Pitt Island is the next in size; the area is 15,330 acres. The greater portion of both islands is used for grazing sheep.

The Kermadec Group of islands, four in number, is situated between 29° 10' and 31° 30' south latitude, and between 177° 45' and 179° west longitude. They are named Raoul or Sunday Island, Macaulay Island, Curtis Islands, and L'Espérance or French Rock. The principal island, Sunday, is 600 miles distant from Auckland, and lies a little more than half-way to Tonga, but 100 miles to the eastward of the direct steam route to that place. It is 300 miles eastward of the steam route to Fiji, and 150 miles westward of the steam route from Auckland to Rarotonga. Macaulay Island (named after the father of Lord Macaulay) and Curtis Island were discovered in May, 1788, by Lieutenant Watts, in the “Penrhyn” a transport ship. The remainder of the group was discovered in 1793, by Admiral Bruni d'Entrecasteaux. The Admiral gave the name of “Kermadec” to the whole group of islands, after the captain of his consort ship “L'Espérance,” and the name of the Admiral's ship “La Recherche” was given to the largest island. The name so given was not continued, but that of “Raoul” has taken its place, which would appear to have been given after the sailing-master of the “La Recherche,” whose name was Joseph Raoul. The name of “Sunday” may also have become attached to the island from the fact that it was discovered on a Sunday. The islands are volcanic, and in two of them signs of activity are still to be seen. The rainfall is plentiful, but not excessive. The climate is mild and equable, and slightly warmer than the north of New Zealand. The following are the areas of the islands and islets of the group: Sunday Island, 7,200 acres; Herald group of islets, 85 acres; Macaulay Island, 764 acres; Curtis Islands, 128 acres and 19 acres; L'Espérance, 12 acres: total, 8,208 acres. Sunday Island is twenty miles in circumference, roughly triangular in shape, and at the highest point 1,723 ft. above the sea-level. It is rugged and broken over a very large extent of its surface, and, except in a few places, covered with forest. The soil everywhere on the island is very rich, being formed by the decomposition of a dark-coloured pumiceous tuff and a black andesitic lava, with which is closely mixed a fine vegetable mould. The great luxuriance and richness of the vegetation bear witness to the excellence of the soil, which is everywhere—except where destroyed by eruptions, and on the steep cliffs—the same rich loam. Want of water is one of the drawbacks. Three of the four lakes on the island are fresh, but so difficult of approach as to be practically useless.

The Auckland Islands were discovered during a whaling voyage on 18th August, 1806, by Captain Abraham Bristow, in the ship “Ocean.” The discoverer named the group after Lord Auckland, again visited the islands in 1807 and then took formal possession of them. They lie about 290 miles south of Bluff Harbour, their accepted position being given as latitude 50° 32' S., and longitude 166° 13' E. They have several good harbours. Port Ross, at the north end of the principal island, was described by the eminent French commander D'Urville, as one of the best harbours of refuge in the known world. At the southern end of the island there is a through passage extending from the east to the west coast. It has been variously named Adams Strait and Carnley Harbour, and forms a splendid sheet of water. The largest of the islands is about 27 miles long by about 15 miles broad, and is very mountainous, the highest part being about 2,000 ft. above the sea. The west coast is bold and precipitous, but the east coast has several inlets. The wood on the island is, owing to the strong prevailing wind, scrubby in character. The New Zealand Government maintains at this island a depot of provisions and clothing for the use of shipwrecked mariners

The THREE KINGS, a cluster of islands lying thirty-eight miles west-north-west of Cape Maria van Diemen; accepted position, 34° 6' 20” south, and longitude 172° 9' 45” east. They were discovered in 1863 by Tasman, and named in honour of the day of the discovery, it being the feast of the Epiphany.

The ANTIPODES, an isolated group, consisting of several detached rocky islands lying nearly north and south over a space of four to five miles; accented position, 49° 41' 15” south, and longitude 178° 43' east.

The BOUNTY ISLANDS, a little cluster of islets, thirteen in number, and without verdure, discovered in 1788 by Captain Bligh, R.N., of H.M.S. “Bounty.” Position verified by observation, 47° 43' south, longitude 179° 0 ½' east.

CAMPBELL ISLAND was discovered in 1810 by Frederick Hazel-burgh, master of the brig “Perseverance,” owned by Mr. Robert Campbell, of Sydney. It is mountainous, and of a circumference of about thirty miles. There are several good harbours.

The COOK ISLANDS, with others now included within the extended boundaries of the Dominion, are as under:*—

RAROTONGA (Cook Group): A magnificent island, rising to a height of 3,000 ft., clothed to the tops of the mountains with splendid vegetation. It has abundant streams, considerable tracts of sloping land, and rich alluvial valleys. The two harbours are poor.

MANGAIA, the south-easternmost of the Cook Group, is of volcanic origin, and about thirty miles in circumference. The productions, which are numerous and cheap, are obtained by assiduous labour.

ATIU (Cook Group) resembles Mangaia in appearance and extent. It is a mere bank of coral, 10 ft. or 12 ft. high, steep and rugged, except where there are small sandy beaches and some clefts, where the ascent is gradual.

AITUTAKI (Cook Group) presents a most fruitful appearance, its shores being bordered by flat land, on which are innumerable cocoa-nut and other trees, the higher ground being beautifully interspersed with lawns. It is eighteen miles in circuit.

MAUKE or Parry Island (Cook Group) is a low-lying island; it is about two miles in diameter, well wooded, and inhabited.

MITIARO (Cook Group) is a low-lying island, from three to four miles long and one mile wide.

HERVEY ISLANDS (Cook Group): This group consists of two islands, surrounded by a reef, which may be 10 ½ miles in circumference.

* See Part IV, “Notes on Cook and other Islands” following descriptions of land districts.

NIUE, or Savage Island, lying east of the Friendly Islands, is a coral island, thirty-six miles in circumference, rising to a height of 200 ft. It has the usual tropical productions.

PALMERSTON ISLAND, lying about 500 miles east of Niue and about 220 from the nearest island of the Cook Group (Aitutaki), is remarkable as the “San Pablo” of Magellan, the first island discovered in the South Sea. It has no harbour. The soil is fairly fertile, and there is some good hardwood timber.

PENRHYN ISLAND (Tongareva) lies about 300 miles north-east of Manahiki. It is one of the most famous pearl islands in the Pacific, and there is a splendid harbour, a lagoon with two entrances, fit for ships of any size.

MANAHIKI, lying about 400 miles eastward of Danger Island, is an atoll, about thirty miles in circumference, valuable from the extent of the coconut groves. The interior lagoon contains a vast deposit of pearl-shell.

RAKAANGA is an atoll, three miles in length and of equal breadth.

DANGER ISLAND (Pukapuka): Next to the 10th parallel, but rather north of the latitude of the Navigators, and east of them are a number of small atolls. Of these, the nearest to the Samoan Group—about 500 miles—is Danger Island, hearing north-west of Suwarrow about 250 miles.

SUWARROW ISLAND has one of the best harbours in the Pacific. It lies about 500 miles east of Apia, the capital of the Samoan Group. It is a coral atoll, of a triangular form, fifty miles in circumference, the reef having an average width of half a mile across, enclosing a land-locked lagoon twelve miles by eight, which forms an excellent harbour. The entrance is half a mile wide, and the accommodation permits of ships riding in safety in all weathers, with depths of from three to thirty fathoms. It is out of the track of hurricanes, uninhabited, but capable by its fertility of supporting a small population. As a depot for the collection of trade from the various islands it ought to be very valuable.

The climate of New Zealand is determined by the geographical situation of the Islands with respect to the Equator, and their isolated position in the great Pacific Ocean. Its latitude in the Southern Hemisphere corresponds very nearly with that of Italy in the Boreal—Auckland having about the same latitude as Cape Passaro, in the south of Sicily, Wellington the same as Naples, Christchurch the same as Florence, and Dunedin the same as Venice. Although the weather is not always or everywhere comparable with the best in Italy, yet, on the whole, the climate of New Zealand is by no means inferior to the Italian. Its freedom from intense heat in summer and cold in winter are distinct advantages to animal and vegetable life, and one only needs to point out that, while continental lands are exposed by turns to winds that in summer bear radiant heat, and in winter bring piercing cold, yet, as the waters of the ocean are subject to but little change upon their surface, and tend always to modify the atmosphere in their vicinity, so warmth is preserved in winter, and the heat of summer is tempered by their influence. Thus the surrounding ocean gives to New Zealand not only the marvellous salubrity it enjoys, but insures that equability of temperature and abundant rainfall which afford it one of the best climates in the world. It must also be borne in mind that no part of New Zealand is more than seventy-five miles distant from the greatest ocean in the world. On account of its great length, however—stretching as it does from latitude 34° southwards for a thousand miles—it is exposed to different conditions of isolation, and other local variations of climate are accounted for by differences of aspect, exposure to prevailing winds, and, above all, by the influence of the lofty mountain-chains which intersect the country.

The climate of the Dominion can best be studied by reference to standards of the whole compiled from a collection of meteorological statistics of various parts. It is thus possible for any one to arrive at valuable conclusions with regard to the climatic conditions prevailing in different districts by making simple meteorological allowances for aspect, latitude, elevation, &c. For example, temperature decreases 1° Fahr. for every 300 ft. of altitude, and in this country by about the same amount for each degree of latitude southwards.

Means or averages of the various climatic elements are used for the sake of comparison between different seasons and countries, and the climatological means compiled in the Meteorological Office of New Zealand are based upon results obtained from reliable standardised instruments and a carefully selected number of representative stations. By taking a number of these results together, not only are useful monthly, seasonal, and annual means established, but errors of observation, &c., are often altogether eliminated, and the normals thus obtained are less subject to local and temporary changes than records from a single meteorological observatory. It is found convenient to treat the two main Islands of New Zealand as separate climatic regions, and, by taking the means of about ten stations in each Island, to arrive at fair averages which help to describe the climate of the country. The mean annual temperature of the North Island is thus found to be 55.4° Fahr., and that of the South Island 51.8° Fahr., while means of the absolute daily maxima and minima of temperature show a mean diurnal range of 15.9° in the North and 16.5° in the South Island. On account of atmospheric and terrestrial effects following their solar causes, the meteorological seasons are later than the solar or astronomical seasons. Thus, in the Southern Hemisphere July is usually the coldest and wettest month of the year, while January is the driest and warmest. The seasons are thus roughly divided into: Winter—June, July, August; spring—September, October, November; summer—December, January, February; autumn—March, April, May. The mean temperatures (degrees Fahrenheit) of the seasons are,—

| Winter. | Spring. | Summer. | Autumn. | Year. | |

|---|---|---|---|---|---|

| North Island | 49.0 | 54.2 | 61.8 | 56.6 | 55.4 |

| South Island | 44.2 | 51.2 | 59.0 | 52.3 | 51.8 |

Mean temperatures of particular places are usually employed in climatic comparisons, and the following annual means and monthly means of the extreme months of the summer and winter are instructive:—

| NEW ZEALAND. | |||||

|---|---|---|---|---|---|

| Auckland. | Gisborne. | Wellington. | Christchurch. | Hokitika. | |

| Annual | 59.0 | 57.2 | 55.25 | 52.8 | 53.25 |

| January | 66.6 | 64.1 | 62.6 | 62.0 | 62.6 |

| July | 51.4 | 51.2 | 47.6 | 42.5 | 47.6 |

| AUSTRALIA. | |||||

| Brisbane. | Sydney. | Adelaide. | |||

| Annual | 67.8 | 62.8 | 63.1 | ||

| January | 75.6 | 71.2 | 74.1 | ||

| July | 57.7 | 52.2 | 51.3 | ||

| INDIA. | |||||

| Calcutta. | Bombay. | Madras. | Colombo. | ||

| Annual | 79.5 | 77.7 | 81.9 | 80.1 | |

| January | 65.1 | 73.0 | 75.6 | 80.8 | |

| July | 81.0 | 82.9 | 85.3 | 77.9 | |

| EUROPE. | ||||||

|---|---|---|---|---|---|---|

| London. | Edinburgh. | Paris. | Rome. | Naples. | Palermo. | |

| Annual | 49.8 | 46.9 | 50.0 | 59.5 | 60.8 | 64.2 |

| January | 38.1 | 37.8 | 36.1 | 44.2 | 47.1 | 52.2 |

| July | 63.1 | 58.3 | 64.9 | 76.6 | 75.7 | 77.5 |

| AMERICA. | ||||||

| Montreal. | Chicago. | St. Louis. | Washington. | |||

| Annual | 41.9 | 48.4 | 55.6 | 54.7 | ||

| January | 12.4 | 23.4 | 30.6 | 33.3 | ||

| July | 68.9 | 72.0 | 788 | 76.8 | ||

The absolutely highest and lowest temperatures recorded every day afford most valuable climatic records, and means of these extremes give the best idea of equability of the temperature.

| MEANS OF THE EXTREMES AND RANGE. | |||||

|---|---|---|---|---|---|

| North Island. | |||||

| Winter. | Spring. | Summer. | Autumn. | Annual. | |

| Mean maximum | 56.5 | 62.6 | 71.2 | 63.7 | 63.5 |

| Mean minimum | 42.0 | 46.9 | 53.9 | 47.9 | 47.7 |

| Mean diurnal range | 14.5 | 15.7 | 17.3 | 15.8 | 15.8 |

| South Island. | |||||

| Mean maximum | 51.8 | 60.1 | 68.7 | 59.4 | 60.0 |

| Mean minimum | 36.9 | 43.3 | 50.1 | 43.9 | 43.5 |

| Mean diurnal range | 14.9 | 16.8 | 18.6 | 15.5 | 16.5 |

The mean maximum of the warmest month of the year and the mean minimum of the coldest show the mean absolute range of temperature during the year. Thus, we obtain—

| Mean. | North Island. | South Island. |

|---|---|---|

| January, maximum | 72.2 | 69.9 |

| July, minimum | 42.6 | 30.3 |

| 29.6 | 33.6 |

| Mean. | Wellington. Lat 41° 16' S. |

|---|---|

| January, maximum | 69.5 |

| July, maximum | 42.1 |

| Mean annual range | 27.4 |

| Mean. | Vienna. Lat. 48° 12 N. |

| July, maximum | 90.7 |

| January, minimum | 10.2 |

| Mean annual range | 80.5 |

New Zealand has an abundant rainfall, which, though well distributed throughout the months of the year, especially in the South Island, is heaviest and most prevalent in the months of winter and spring. The averages from the climatological tables are—

| Winter. | Spring. | Summer. | Autumn | Annual. | |

|---|---|---|---|---|---|

| North Island | 13.86 | 14.07 | 12.08 | 11.34 | 51.35 in. |

| South Island | 11.97 | 13.31 | 10.96 | 10.39 | 46.63 in. |

| Rainy Days (0.005 in, or more). | |||||

| North Island | 47 | 49 | 34 | 21 | 151 days |

| South Island | 40 | 38 | 35 | 38 | 151 days |

| ANNUAL RAINFALLS (INCHES). | ||||||||

|---|---|---|---|---|---|---|---|---|

| Auckland, 43 years. | Wellington, 43 years. | Wanganui, 42 years. | Gisborne, 29 years. | Christchurch, 43 years. | Hokitika, 28 years. | Dunedin, 43 years. | Invercargill, 30 years. | |

| Average | 41.68 | 50.62 | 37.70 | 46.98 | 25.16 | 115.59 | 38.40 | 45.38 |

| Maximum | 53.81 | 67.36 | 51.09 | 64.33 | 35.29 | 154.45 | 54.50 | 63.60 |

| Minimum | 28.14 | 31.36 | 23.58 | 26.09 | 13.54 | 88.21 | 22.15 | 33.26 |

| MEAN NUMBER OF DAYS WITH RAIN (0.01 IN. OR MORE). | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Gisborne (29 years), Wellington (41 years), Canterbury (39 years), and Hokitika (26 years). | |||||||||||||

| — | January. | February. | March. | April. | May. | June. | July. | August. | September. | October. | November. | December. | Annual Mean Total. |

| Gisborne | 9 | 10 | 12 | 13 | 16 | 17 | 17 | 16 | 14 | 12 | 12 | 9 | 157 |

| Wellington | 10 | 9 | 11 | 13 | 16 | 17 | 18 | 17 | 16 | 14 | 13 | 12 | 166 |

| Canterbury | 9 | 8 | 10 | 9 | 11 | 12 | 13 | 12 | 10 | 10 | 9 | 9 | 122 |

| Hokitika | 15 | 11 | 14 | 14 | 16 | 15 | 16 | 12 | 12 | 18 | 17 | 17 | 177 |

The climate of New Zealand, like that of all other countries in the Temperate Zones of the earth is a variable one, and all its atmospheric phenomena are subject to the control of passing disturbances, which in these latitudes come from the west and move eastward, seldom lasting more than three days. High pressure of the barometer—i.e., above 30 in.—is usually associated with bright and warm days, but cold and clear nights, with dew in summer and frost in winter. Low pressure with the barometer, below 30 in., usually brings more humid conditions; and while the barometer falls the wind is in the north and the weather is warm and wet. When the wind turns by the west to the south for the rise of the barometer, the weather is colder, and sometimes very wet and snowy on the ranges. The changes, though frequent, are never really sudden, and the storms have not the intensity of those of higher and lower latitudes.

Having a marine climate, the winds are stronger than in continental countries; but many parts of New Zealand are so sheltered by mountain-ranges that their records are very small indeed. Another surprising feature is that as shown by means of the various months, the winds of summer are higher than those of winter. The prevailing winds throughout the year are planetary anti-trade-winds—westerlies—which go round the world, and are used by mariners to take them eastward by Cape Horn, home (to England), and on their return they pick them up off the Cape of Good Hope. In summer, however, to the north of Auckland, the easterly trade-winds often blow with much regularity for weeks together.

Bright sunshine is abundant not only in summer in New Zealand, but a very large percentage is maintained even in winter. This is surprising to those who have taken consideration only of the rainfall, but it is accounted for by the fact that the rain and clouds are usually associated with the fall of night and early morning. Self-registering rain-gauges show comparative few hours with rain, and these mostly at night. Records of sunshine at Nelson. Christchurch, &c., rival those of the finest climates in the world, At Gisborne, in 1906, the Rev. H. Williams, M.A. F.R.Met.Soc., recorded 2,202 hours or 52 per cent. of the possible. At Napier the Very Rev. D. Kennedy, D.D., F.R.Met.Soc., recorded 2,692 hours 29 minutes, being 62 per cent. of the possible, or an average of 7 hours 23 minutes per day throughout the year.

Over the northern part of the British Isles the average is 1,200 hours, or 27 per cent., and in the south it is 1,600 hours, or 36 per cent.; and Italy has averages from 2,000 to 2,400 hours, or from 45 to 54 per cent. of the possible.

In few parts of the world are climatic conditions so favourable to human life and its industries as in New Zealand. The native Maori is one of the finest races in the world, and European families under these skies have generally developed into finer and stronger men and women than their parents. Imported seed and stock have in most cases thriven marvellously in the fields, where throughout winter and summer they usually find all the nourishment they need, and require no other protection than the bush, which, wherever allowed, grows most luxuriantly. From youth to age men can in such a climate keep in vigorous health, and enjoy life to the fullest extent.

British sovereignty was proclaimed over New Zealand in January, 1840, and the country became a dependency of New South Wales until the 3rd May, 1841, when it was made a separate colony. The seat of Government was at Auckland, and the Executive included the Governor, and three gentlemen holding office as Colonial Secretary, Attorney-General, and Colonial Treasurer.

The successors of these gentlemen, appointed in August, 1841, May, 1842, and January, 1844, respectively, continued in office until the establishment of Responsible Government on the 7th May, 1856. Only one of them—Mr. Swainson, the Attorney-General—sat as a member of the first General Assembly, opened on the 27th May, 1854. During the session of that year there were associated with the permanent members of the Executive Council certain members of the General Assembly. These latter held no portfolios.

The Government of the colony was at first vested in the Governor, who was responsible only to the Crown; but in 1852 an Act granting representative institutions to the colony was passed by the Imperial Legislature. Under it the constitution of a General Assembly for the whole colony was provided for, to consist of a Legislative Council, the members of which were to be nominated by the Governor, and of an elective House of Representatives. The first session of the General Assembly was opened on the 27th May, 1854, but the members of the Executive were not responsible to Parliament. The first Ministers under a system of Responsible Government were appointed in the year 1856. By the Act of 1852 the colony was divided into six provinces, each to be presided over by an elective Superintendent, and to have an elective Provincial Council, empowered to legislate, except on certain specified subjects. The franchise amounted practically to household suffrage. In each case the election was for four years, but a dissolution of the Provincial Council by the Governor could take place at any time, necessitating a fresh election both of the Council and of the Superintendent. The Superintendent was chosen by the whole body of electors of the province; each member of the Provincial Council by the electors of a district. The Provincial Governments, afterwards increased to nine, remained as integral parts of the Constitution of the colony until the 1st November, 1876, when they were abolished by an Act of the General Assembly, that body having been vested with the power of altering the Constitution Act. On the same day an Act of the General Assembly which subdivided the colony (exclusive of the areas included within municipalities) into counties, and established a system of local county government, came into force.

By resolutions passed by the House of Representatives on the 12th July, 1907, and by the Legislative Council on the 16th July, 1907, addresses were forwarded to His Majesty the King respectfully requesting that the necessary steps might be taken to change the designation of New Zealand from the Colony of New Zealand to the Dominion of New Zealand; and His Majesty the King, by Order in Council dated 9th September, 1907, and by Proclamation issued 10th September, 1907, was graciously pleased to change the style and designation of the Colony of New Zealand to “The Dominion of New Zealand”; such change taking effect from Thursday, the 26th day of September, 1907.

The Governor is appointed by the King. His salary is £5,000 a year, with an annual allowance of £1,500 on account of his establishment, and of £500 for travelling-expenses, provided by the Dominion.

Members of the Legislative Council hold their seats under writs of summons from the Governor. Till the year 1891 the appointments were for life; but in September of that year an Act was passed making appointments after chat time tenable for seven years only, though Councillors may be reappointed. In either case seats may be vacated by resignation or extended absence. Two members of the Council are aboriginal Native chiefs.

The members of the House of Representatives (now designated M.P.) are elected for three years from the time of each general election; but at any time a dissolution of Parliament by the Governor may render a general election necessary. Four of the members are representatives of Native constituencies. For the purposes of European representation the Dominion is divided into seventy-six electoral districts, each returning one member. The full number of members composing the House of Representatives is thus eighty. Members of the House of Representatives are chosen by the votes of the electors in every electoral district appointed for that purpose.

In 1889 an amendment of the Representation Act was passed, which contained a provision prohibiting any elector from giving his vote in respect of more than one electorate at any election. In 1893 women of both races were granted by law the right to vote at the elections for members of the House of Representatives. The qualification for registration is the same for both sexes. No person is entitled to be registered on more than one electoral roll within the Dominion. Women are not qualified to be elected as members of the House of Representatives. The electoral laws are the subject of special comment further on in this work. Every man registered as an elector, and not specially excepted by the Legislature Act now in force, is qualified to be elected a member of the House of Representatives for any electoral district. For European representation every adult person, if resident one year in the Dominion and three months in one electoral district, can be registered as an elector. Freehold property of the value of £25 held for six months preceding the day of registration until 1896 entitled a man or woman to register, if not previously registered under the residential qualification; but in 1896 the property qualification was abolished (except in case of existing registrations), and residence alone now entitles a man or woman to have his or her name placed upon an electoral roll. For Maori representation every adult Maori resident in any Maori electoral district (of which there are four only in the Dominion) can vote. Registration is not required in Native districts. [The above provisions are now incorporated in “The Legislature Act, 1908,” which consolidates the electoral laws.]

Up to the year 1865 the seat of Government of New Zealand was at Auckland. Several attempts were made by members of Parliament, by motions in the Legislative Council and House of Representatives, to have it removed to some more central place; but it was not until November, 1863, that Mr. Domett (the then ex-Premier) was successful in carrying resolutions in the House of Representatives that steps should be taken for appointing some place in Cook Strait as the permanent seat of Government. The resolutions adopted were: “(1.) That it has become necessary that the seat of Government in the colony should be transferred to some suitable locality in Cook Strait. (2.) That, in order to promote the accomplishment of this object, it is desirable that the selection of the particular site in Cook Strait should be left to the arbitrament of an impartial tribunal. (3.) That, with this view, a Bill should he introduced to give effect to the above resolutions.” On the 25th November an address was presented to the Governor, Sir George Grey, K.C.B., by the Commons of New Zealand, requesting that the Governors of the Colonies of New South Wales, Victoria, and Tasmania, might each be asked to appoint one Commissioner for the purpose of determining the best site in Cook Strait. Accordingly, the Hon. Joseph Docker, M.L.C., New South Wales; the Hon. Sir Francis Murphy, Speaker of the Legislative Council, Victoria; and R. C. Gunn, Esq., Tasmania, were appointed Commissioners.

These gentlemen, having made a personal inspection of all suitable places, arrived at the unanimous decision “that Wellington, in Port Nicholson, was the site upon the shores of Cook Strait which presented the greatest advantages for the administration of the government of the colony.”

The seat of Government was, therefore, in accordance with the recommendation of the Commissioners, removed to Wellington in February, 1865.

Nearly all the public works of New Zealand are in the hands of the Government of the Dominion, and in the early days they simply kept pace with the spread of settlement. In 1870, however, a great impetus was given to the progress of the whole country by the inauguration of the “Public Works and Immigration Policy,” which provided for carrying out works in advance of settlement. Railways, roads, and water-races were constructed, and immigration was conducted on a large scale. As a consequence, the population increased from 267,000 in 1871 to 501,000 in 1881, and to 960,642 in December, 1908; besides whom there were 47,731 Maoris, and also 12,340 persons residing in the Cook and other Pacific Islands within the extended boundaries of the Dominion.

Table of Contents

Captain William Hobson, R.N., from Jan., 1840, to 10 Sept., 1842.

[British sovereignty was proclaimed by Captain Hobson in January, 1840, and New Zealand became a dependency of the Colony of New South Wales until 3rd May, 1841, at which date it was proclaimed a separate colony. From January, 1840, to May, 1841, Captain Hobson was Lieutenant-Governor of New Zealand under Sir George Gipps, Governor of New South Wales, and from May, 1841, Governor of New Zealand; the seat of Government being at Auckland, where he died in September, 1842. From the time of Governor Hobson's death, in September, 1842, until the arrival of Governor Fitzroy, in December, 1843, the Government was carried on by the Colonial Secretary, Lieutenant Shortland.]

Lieutenant Shortland, Administrator, from 10 Sept., 1842, to 26 Dec., 1843.

Captain Robert Fitzroy, R.N., from 26 Dec., 1843, to 17 Nov., 1845.

Captain Grey (became Sir George Grey, K.C.B., in 1848), from 18 Nov., 1845, to 31 Dec., 1853.

[Captain Grey held the commission as Lieutenant-Governor of the colony until the 1st January, 1848, when he was sworn in as Governor-in-Chief over the Islands of New Zealand, and as Governor of the Province of New Ulster and Governor of the Province of New Munster. After the passing of the New Zealand Constitution Act, Sir George Grey was, on the 13th September, 1852, appointed Governor of the colony, the duties of which office he assumed on the 7th March, 1853. In August, 1847, Mr. E. J. Eyre was appointed Lieutenant-Governor of New Munster: he was sworn in, 28th January, 1848. On 3rd January, 1848, Major-General George Dean Pitt was appointed Lieutenant-Governor of New Ulster: he was sworn in, 14th February, 1848; died, 8th January, 1851; and was succeeded as Lieutenant-Governor by Lieutenant-Colonel Wynyard, appointed 14th April, 1851; sworn in, 26th April, 1851. The duties of the Lieutenant-Governor ceased on the assumption by Sir George Grey of the office of Governor, on the 7th March, 1853.]

Lieutenant-Colonel Robert Henry Wynyard, C.B., Administrator, from 3 Jan., 1854, to 6 Sept., 1855.

Colonel Thomas Gore Browne, C.B., from 6 Sept., 1855 to 2 Oct., 1861.

Sir George Grey, K.C.B., Administrator, from 3 Oct., 1861; Governor, from 4 Dec., 1861, to 5 Feb., 1868.

Sir George Ferguson Bowen, G.C.M.G., from 5 Feb., 1868, to 19 Mar., 1873.

Sir George Alfred Arney, Chief Justice, Administrator, from 21 Mar. to 14 June, 1873.

Sir James Fergusson, Baronet, P.C., from 14 June, 1873, to 3 Dec., 1874.

The Marquis of Normanby, P.C., G.C.M.G., Administrator, from 3 Dec., 1874; Governor, from 9 Jan., 1875, to 21 Feb., 1879.

James Prendergast, Esquire, Chief Justice, Administrator, from 21 Feb. to 27 Mar., 1879.

Sir Hercules George Robert Robinson, G.C.M.G., Administrator, from 27 Mar., 1879; Governor, from 17 April, 1879, to 8 Sept., 1880.

James Prendergast, Esquire, Chief Justice, Administrator, from 9 Sept. to 29 Nov., 1880.

The Honourable Sir Arthur Hamilton Gordon, G.C.M.G., from 29 Nov., 1880, to 23 June, 1882.

Sir James Prendergast, Chief Justice, Administrator, from 24 June, 1882, to 20 Jan., 1883.

Lieutenant - General Sir William Francis Drummond Jervois, G.C.M.G., C.B., from 20 Jan., 1883, to 22 Mar., 1889.

Sir James Prendergast, Chief Justice, Administrator, from 23 Mar. to 2 May, 1889.

The Earl of Onslow, G.C.M.G., from 2 May, 1889, to 24 Feb., 1892.

Sir James Prendergast, Chief Justice, Administrator, from 25 Feb., to 6 June, 1892.

The Earl of Glasgow, G.C.M.G., from 7 June, 1892, to 6 Feb., 1897.

Sir James Prendergast, Chief Justice, Administrator, from 8 Feb., 1897, to 9 Aug., 1897.

The Earl of Ranfurly, G.C.M.G., from 10 Aug., 1897, to 19 June, 1904.

The Right Honourable William Lee, Baron Plunket, K.C.M.G., K.C.V.O., from 20 June, 1904.

Table of Contents

Sir W. Martin, appointed Chief Justice, 10 Jan., 1842. Resigned, 12 June, 1857.

H. S. Chapman, appointed, 26 Dec., 1843. Held office until March, 1852. Reappointed, 23 Mar., 1864. Resigned, 31 Mar., 1875.

S. Stephen, appointed, 30 July, 1850. Appointed Acting Chief Justice, 20 Oct., 1855. Died, 13 Jan., 1858.

Daniel Wakefield, appointed, Oct., 1855. Died, Oct., 1857.

Hon. H. B. Gresson, appointed temporarily, 8 Dec, 1857. Permanently, 1 July, 1862. Resigned, 31 Mar., 1875.

Sir G. A. Arney, appointed Chief Justice, 1 Mar., 1858. Resigned 31 Mar., 1875.

A. J. Johnston, appointed, 2 Nov., 1858. Died, 1 June, 1888.

C. W. Richmond, appointed, 20 Oct., 1862. Died, 3 Aug., 1895.

J. S. Moore, appointed temporarily, 15 May, 1866. Relieved, 30 June, 1868.

C. D. R. Ward, appointed temporarily, 1 Oct., 1868. Relieved, May, 1870. Appointed temporarily, 21 Sept., 1886. Relieved, 12 Feb., 1889.

Sir J. Prendergast, appointed Chief Justice, 1 April, 1875. Resigned, 25 May, 1899.

T. B. Gillies, appointed, 3 Mar., 1875. Died, 26 July, 1889.

J. S. Williams, appointed, 3 Mar., 1875.

J. E. Denniston, appointed, 11 Feb., 1889.

E. T. Conolly, appointed, 19 Aug., 1889. Resigned, 9 Sept., 1903.

Hon. Sir P. A. Buckley, K.C.M.G., appointed, 20 Dec., 1895, Died, 18 May, 1896.

W. B. Edwards, appointed, 11 July, 1896.

F. W. Pennefather, appointed temporarily, 25 April, 1898. Resigned, 24 April, 1899.

Hon. Sir Robert Stout, K.C.M.G., appointed Chief Justice, 22 June, 1899.

J. C. Martin, Acting Judge, appointed, 12 April, 1900. Resigned, 4 Dec., 1900.

Theophilus Cooper, appointed, 21 Feb., 1901.

F. R. Chapman, appointed, 11 Sept., 1903.

C. E. Button, appointed temporarily, 12 March, 1907. Resigned, 29th Feb., 1908.

Willoughby Shortland, Colonial Secretary, from 3 May, 1841, to 31 Dec., 1843; succeeded by Mr. Sinclair.

Francis Fisher, Attorney-General, from 3 May to 10 Aug., 1841; succeeded by Mr. Swainson.

George Cooper, Colonial Treasurer, from 3 May, 1841, to 9 May, 1842; succeeded by Mr. Shepherd.

William Swainson, Attorney-General, from 10 Aug., 1841, to 7 May, 1856.

Alexander Shepherd, Colonial Treasurer, from 9 May, 1842, to 7 May, 1856.

Andrew Sinclair, Colonial Secretary, from 6 Jan., 1844, to 7 May, 1856.

[The three gentlemen last mentioned were nominated by Her late Majesty as ex officio members of the Executive Council. Two of them, the Colonial Secretary and the Colonial Treasurer, were not members of the General Assembly, opened for the first time 27th May, 1854, but all three remained in office until the establishment of Responsible Government.]

James Edward FitzGerald, M.H.R., without portfolio, from 14 June to 2 Aug., 1854.

Henrv Sewell, M.H.R., without portfolio, from 14 June to 2 Aug., 1854.

Frederick Aloysius Weld, M.H.R., without portfolio, from 14 June to 2 Aug., 1854.

Francis Dillon Bell, M.L.C., without portfolio, from 30 June to 11 July, 1854.

Thomas Houghton Bartley, M.L.C., without portfolio, from 14 July to 2 Aug., 1854.

Thomas Spencer Forsaith, M.H.R., without portfolio, from 31 Aug. to 2 Sept., 1854.

Edward Jerningham Wakefield, M.H.R., without portfolio, from 31 Aug. to 2 Sept., 1854.

William Thomas Locke Travers, M.H.R., without portfolio, 31 Aug. to 2 Sept., 1854.

James Macandrew, M.H.R., without portfolio, from 31 Aug. to 2 Sept., 1854.

| Parliament. | Date of Opening of Sessions. | Date of Prorogation. |

|---|---|---|

| First (dissolved 15th September, 1855) | 27 May, 1854 | 9 August, 1854. |

| 31 August, 1854 | 16 September, 1854. | |

| 8 August, 1855 | 15 September, 1855. | |

| Second (dissolved 5th November, 1860) | 15 April, 1856 | 16 August, 1856. |

| (No session in 1857) | ||

| 10 April, 1858 | 21 August, 1858. | |

| (No session in 1859) | ||

| 30 July, 1860 | 5 November, 1860. | |

| Third (dissolved 27th January, 1866) | 3 June, 1861 | 7 September, 1861. |

| 7 July, 1862 | 15 September, 1862. | |

| 19 October, 1863 | 14 December, 1863. | |

| 24 November 1864 | 13 December, 1864. | |

| 26 July, 1865 | 30 October, 1865. | |

| Fourth (dissolved 30th December, 1870) | 30 June, 1866 | 8 October, 1866. |

| 9 July, 1867 | 10 October, 1867. | |

| 9 July, 1868 | 20 October, 1868. | |

| 1 June, 1869 | 3 September, 1869. | |

| 14 June, 1870 | 13 September, 1870. | |

| Fifth (dissolved 6th December, 1875) | 14 August, 1871 | 16 November, 1871. |

| 16 July, 1872 | 25 October, 1872. | |

| 15 July, 1873 | 3 October, 1873. | |

| 3 July, 1874 | 31 August, 1874. | |

| 20 July, 1875 | 21 October, 1875. | |

| Sixth (dissolved 15th August, 1879 | 15 June, 1876 | 31 October, 1876. |

| 19 July, 1877 | 10 December, 1877. | |

| 26 July, 1878 | 2 November, 1878. | |

| 11 July, 1879 | 11 August, 1879. | |

| Seventh (dissolved 8th November, 1881 | 24 September, 1879 | 19 December, 1879. |

| 28 May, 1880 | 1 September, 1880. | |

| 9 June, 1881 | 24 September, 1881. | |

| Eighth (dissolved 27th June, 1884) | 18 May, 1882 | 15 September, 1882. |

| 14 June, 1883 | 8 September, 1883. | |

| 5 June, 1884 | 24 June, 1884. | |

| Ninth (dissolved 15th July, 1887) | 7 August, 1884 | 10 November, 1884. |

| 11 June, 1885 | 22 September, 1885. | |

| 13 May, 1886 | 18 August, 1886. | |

| 26 April, 1887 | 10 July, 1887. | |

| Tenth (dissolved 3rd October, 1890) | 6 October, 1887 | 23 December, 1887. |

| 10 May, 1888 | 31 August, 1888. | |

| 20 June, 1889 | 19 September, 1889. | |

| 19 June, 1890 | 18 September, 1890. | |

| Eleventh (dissolved 8th November, 1893) | 23 January, 1891 | 31 January, 1891. |

| 11 June, 1891 | 25 September, 1891. | |

| 23 June, 1892 | 12 October, 1892. | |

| 22 June, 1893 | 7 October, 1893. | |

| Twelfth (dissolved 14th November, 1896) | 21 June, 1894 | 24 October, 1894. |

| 20 June, 1895 | 2 November, 1895. | |

| 11 June, 1896 | 19 October. 1896. | |

| Thirteenth (dissolved 15th November, 1899) | 7 April, 1897 | 12 April, 1897. |

| 23 September, 1897 | 22 December, 1897. | |

| 24 June, 1898 | 5 November, 1898. | |

| 23 June, 1899 | 24 October, 1899. | |

| Fourteenth (dissolved 5th November, 1902) | 22 June, 1900 | 22 October, 1900. |

| 1 July, 1901 | 8 November, 1901. | |

| 1 July, 1902 | 4 October, 1902. | |