Te Pukapuka Houanga Whaimana o Aotearoa

Statistics New Zealand

In answer to a telephone call, email, visit or letter, Statistics New Zealand information analysts can provide statistical information, or tell you more about the department's other services, including how to access statistics on the INFOS computer database and the Statistics New Zealand website.

Website:

www.stats.govt.nz

Telephone: 0508-525-525 (toll free)

Email: info@stats.govt.nz

| AUCKLAND | WELLINGTON | CHRISTCHURCH |

|---|---|---|

| 70 Symonds Street | Aorangi House | Dollan House |

| Private Bag 92003 | 85 Molesworth Street | 401 Madras Street |

| Telephone: (09) 920-9100 | PO Box 2922 | Private Bag 4741 |

| Facsimile: (09) 920-9198 | Telephone: (04) 931-4600 | Telephone: (03) 964-8700 |

| Facsimile: (04) 931-4610 | Facsimile: (03) 964-8964 |

The New Zealand flag

The New Zealand flag is the symbol of the realm, government and people of New Zealand. The flag features, on a royal blue background, a Union Jack in the first quarter and four five-pointed red stars of the Southern Cross on the fly. The stars have white borders. The royal blue background is reminiscent of New Zealand's blue sea and clear sky, while the stars of the Southern Cross emphasise New Zealand's location in the South Pacific Ocean. The Union Jack gives recognition to New Zealand's historical foundations and the fact that the country was once a British colony and dominion.

Te Hakituatahi o Aotearoa -

1835

The first flag

of New Zealand

For a detailed history of Te Hakituatahi o Aotearoa, see Chapter 3: Government. The flag features, on a white field, a red St George's Cross. In the upper canton next to the staff, on a blue field, a smaller St George's Cross in red, severed from the blue by a fimbriation of black half the width of the red, and, in the centre of each blue quarter, a white eight-pointed star.

The New Zealand coat of arms

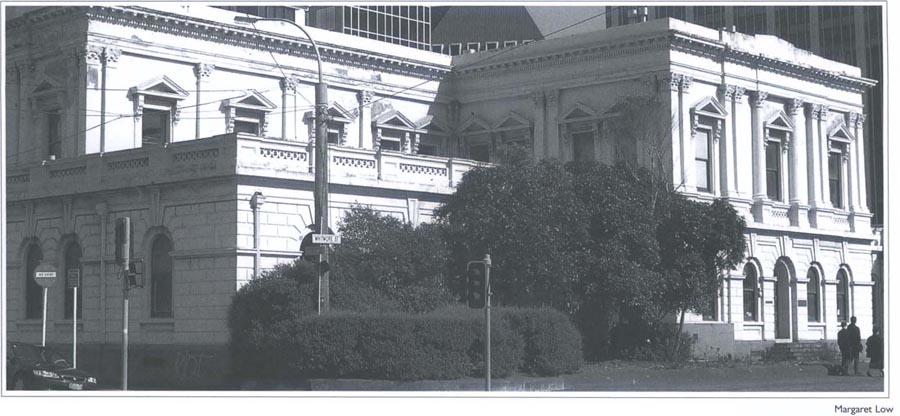

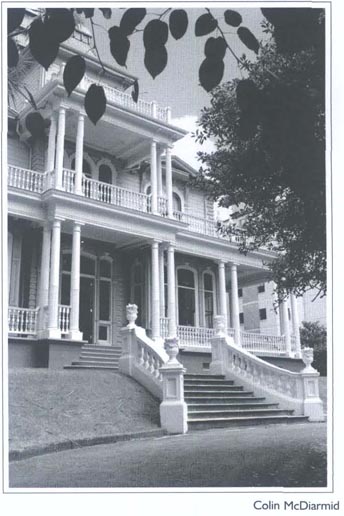

New Zealand has had its own coat of arms since 1911. Before that the United Kingdom coat of arms (featuring a lion and a unicorn on either side of a shield and crown) was used. This design still adorns the top of the pediment on the Old Government Buildings in Lambton Quay, Wellington, which were built in 1875 to house the colony's public service, but which now house Victoria University's law school. One of the few specific changes to flow on from the granting of Dominion status in 1907 was the right for New Zealand to have its own coat of arms. The design was approved by royal warrant on 26 August 1911. The coat of arms was revised in 1956 following further constitutional changes when the country became the ‘Realm of New Zealand’ instead of the ‘Dominion of New Zealand’. Accordingly, the British lion holding aloft the Union Jack was replaced by St Edward's Crown, worn by Queen Elizabeth II at her coronation. At the same time, the dress of the figures at the side of the shield was revamped, some Victorian-looking scroll work at the base of the design was replaced by two ferns, and the motto ‘Onward’ was replaced with ‘New Zealand’.

New Zealand Official Yearbook

2004

ISSN 0078

0170

ISBN 0-478-26925-0

This book is copyright. Except for the purpose of fair review, no part may be stored or transmitted in any form or by any means, electronic or mechanical, including recording or storage in any information retrieval systems, without permission in writing from the publisher. No reproduction may be made, whether by photocopying or by any other means, unless a licence has been obtained from the publisher or their agent.

Copyright © Statistics New Zealand 2004.

Published in 2004 by David Bateman Ltd, 30 Tarndale Grove, Albany, Auckland, New Zealand.

Printed by PrintLink, Wellington, New Zealand.

Table of Contents

List of Figures

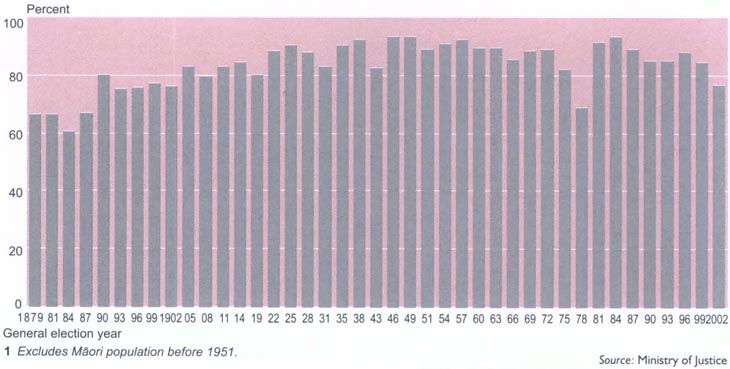

- 1.02. Climate norms

- 3.03. Voter turnout

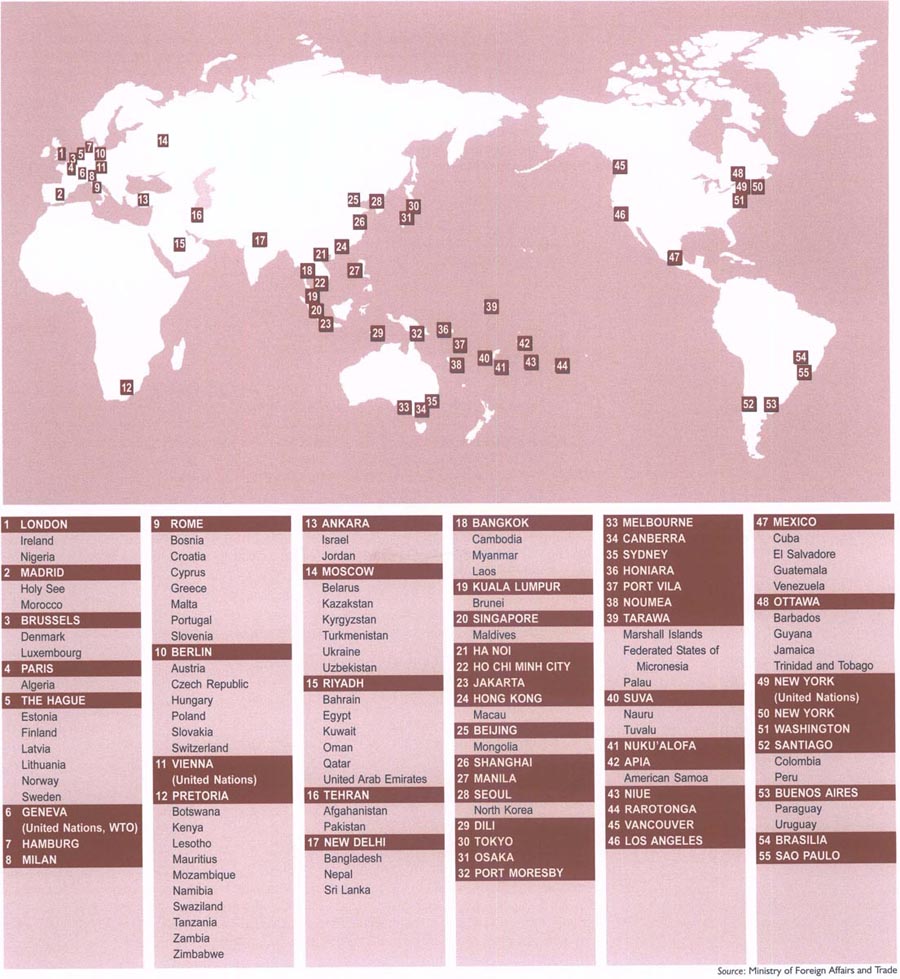

- 4.01. Overseas representation

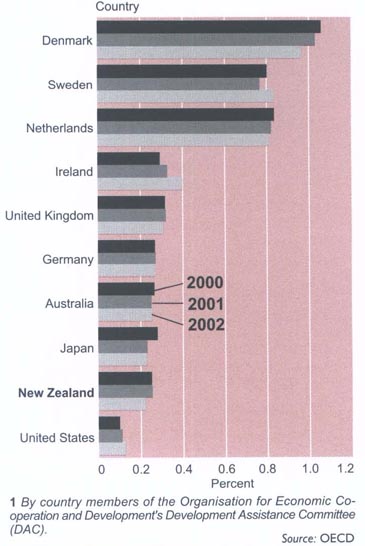

- 4.02. Net official development assistance

As proportion of gross national product Years ending 31 December1

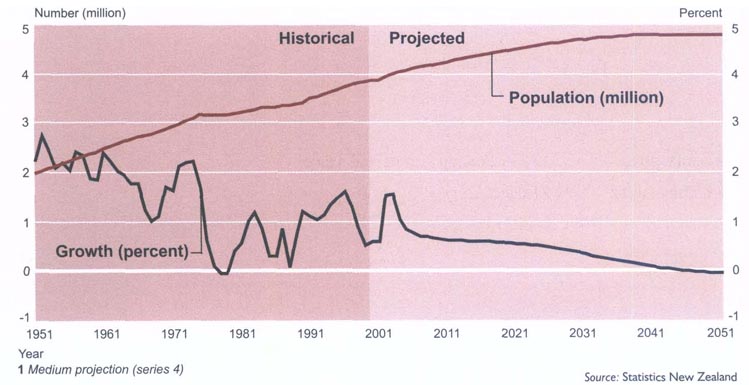

- 5.06. Components of annual population changeNatural increase1 and net

migration2 Years ending 31 March

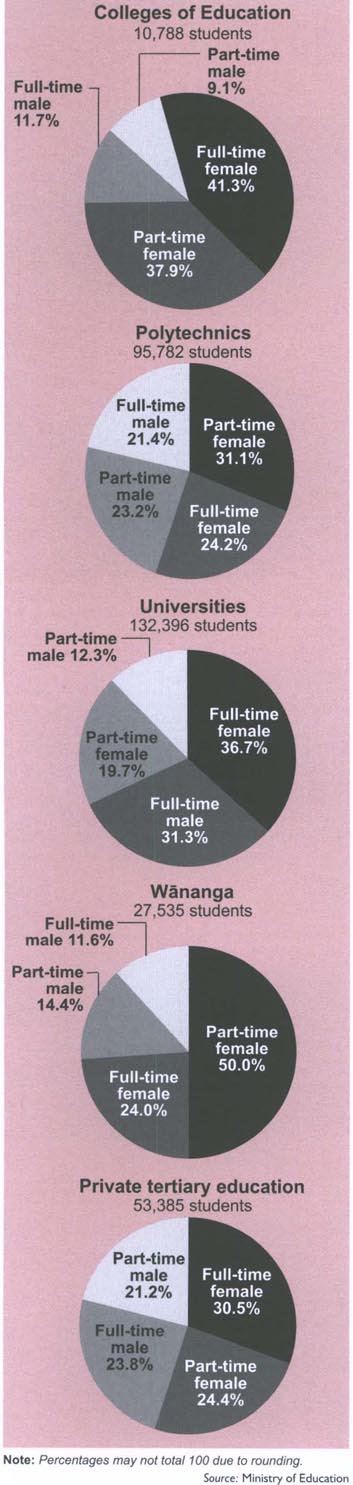

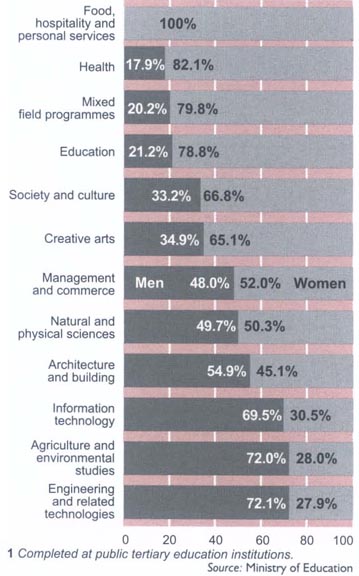

- 9.02. Tertiary attendance 2002

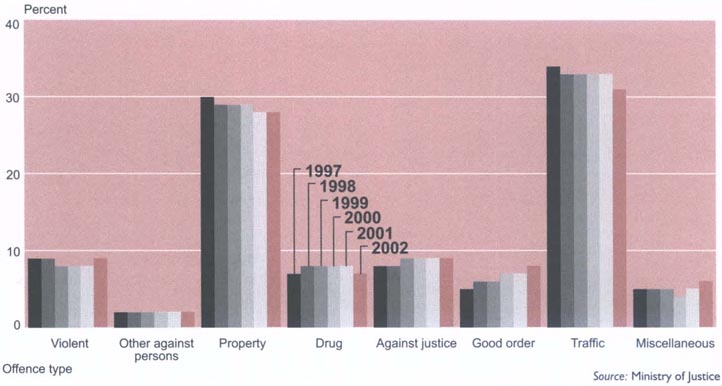

- 10.01. Convictions by offence type

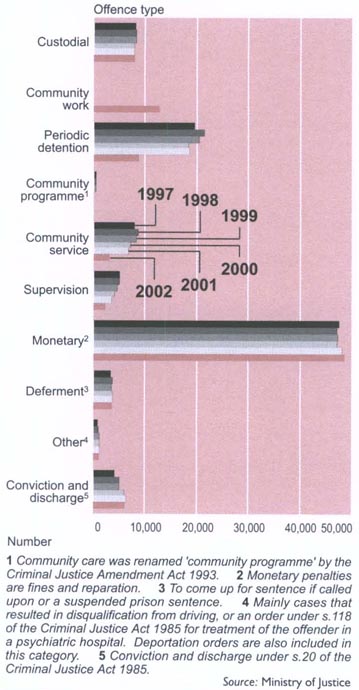

- 10.02. Sentences for all offences

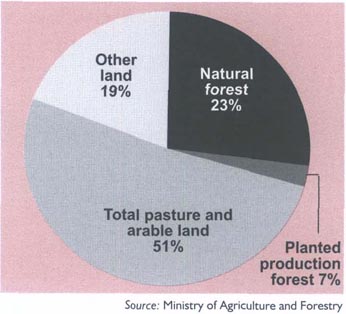

- 16.01. Land use

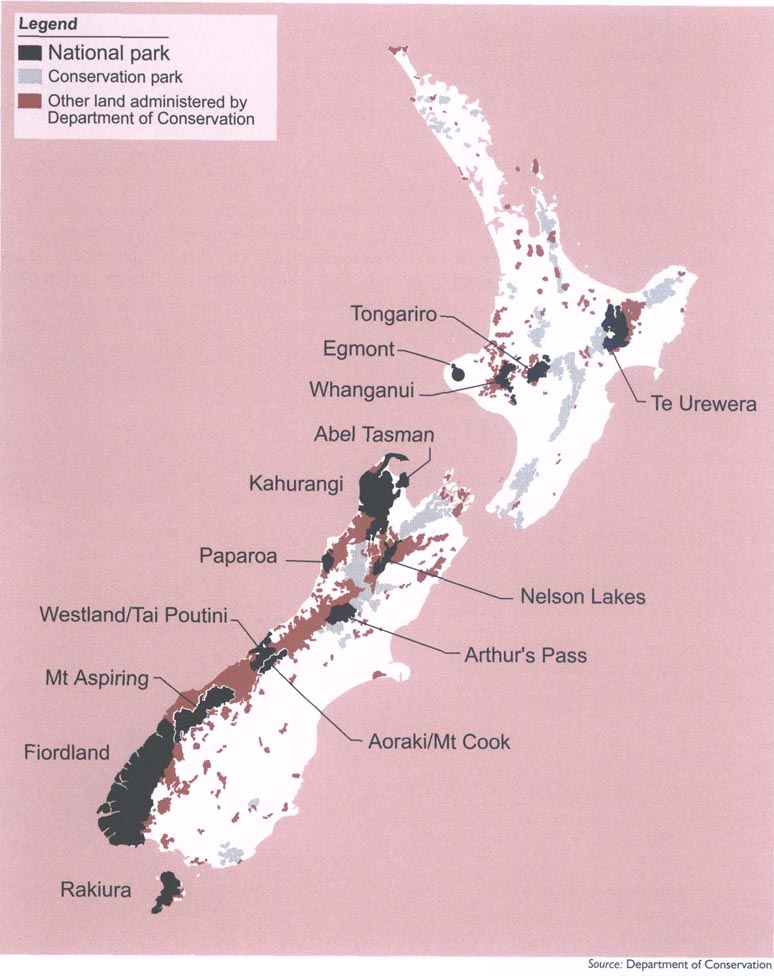

- 16.05. Parks of New Zealand

- 16.06. Whale sanctuaries

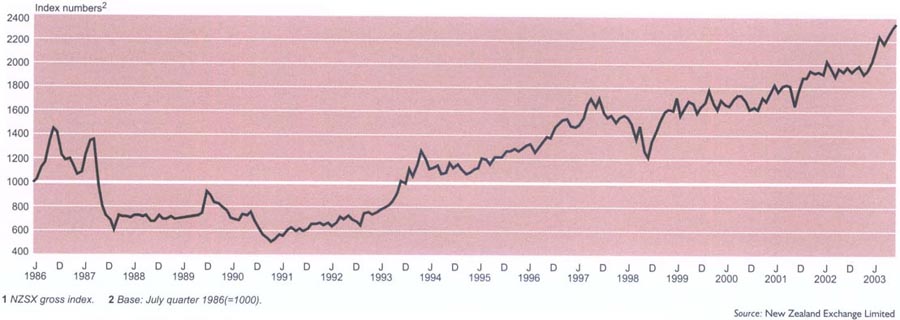

- 24.01. Share price

index1

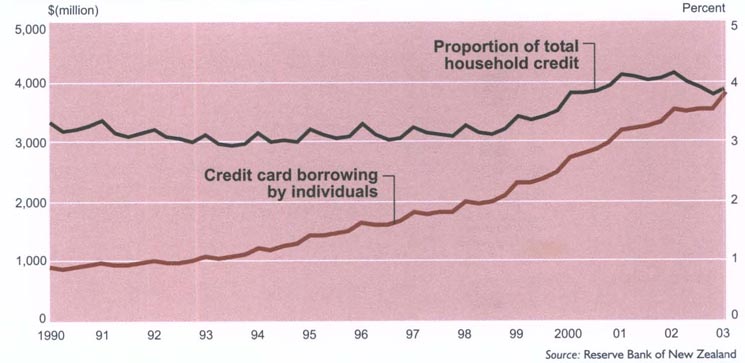

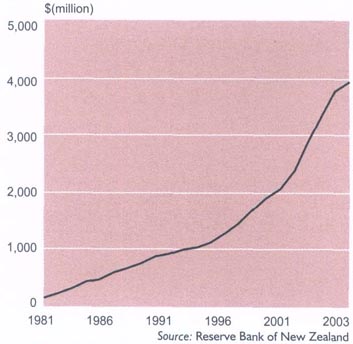

- 26.01. Credit card debt

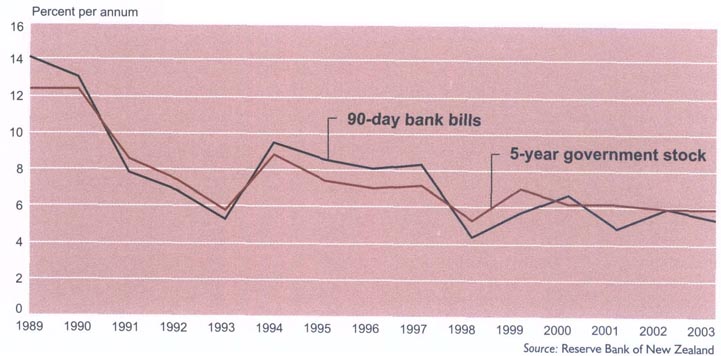

- 26.02. Key market rates

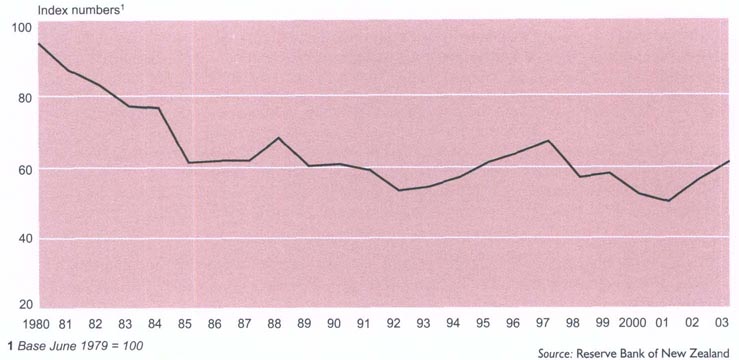

- 26.03. Trade-weighted index

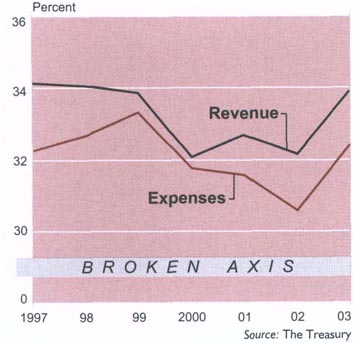

- 27.01. Revenue and expenses

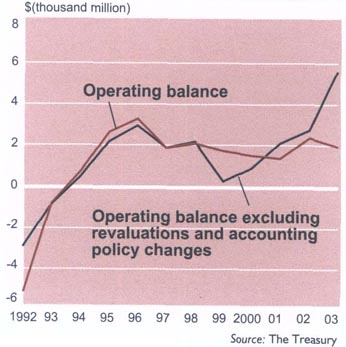

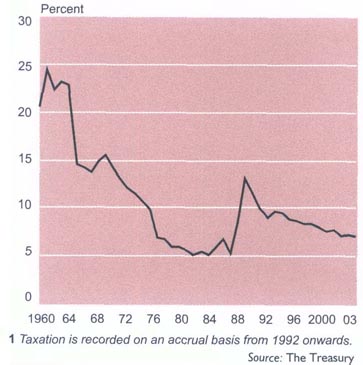

- 27.02. Operating balance

- 27.03. Customs and excise receipts

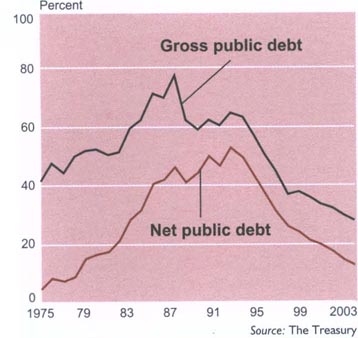

- 27.04. Public debt

List of Tables

- 1.02. Principal mountains

- 1.03. Principal rivers1

- 1.04. Principal lakes1

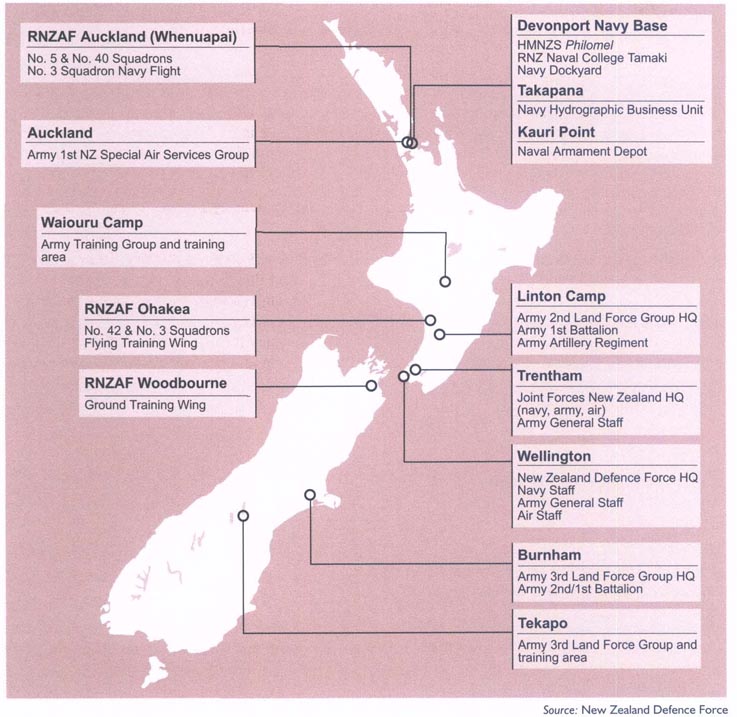

- 4.05. State of the navy

- 4.07. State of the army

- 4.09. State of the air force

- 6.04. Religious affiliation1

- 9.05. Secondary school leavers in 2002 By level of highest attainment,

gender and ethnic identification

- 9.13. Education 1875-2002

- 10.11. Sentencing for all offences1

- 10.13. Community-based sentences1

- 11.04. Magazine circulation1

- 11.08. Articles posted

- 11.1. 2001-2003 Stamp issues

- 13.1. Gaming statistics

Non-inflation adjusted for years ending 30 June1 rounded to the nearest million

- 14.01. Movable public holidays

- 14.16. Median weekly earnings

Full-time wage and salary workers

By age and sex

Quarter ending 30 June 2003

- 16.01. Land

use1

- 18.03. Sheep categories

At 30 June

- 18.04. Cattle categories

At 30 June

- 18.06. Average net schedule prices

- 18.16. Pigs

At 30 June

- 23.04. Formed roads and streets

- 24.06. Credit card usage1

By value

- 27.09. Refinancing/repricing risk

Table of Contents

This 104th edition of the New Zealand Official Yearbook continues the tradition of providing a comprehensive picture of New Zealand society based on the most recent and accurate information available.

Any chronicle with a publishing history of more than 100 years needs to evolve to ensure that it continues to meet the needs and expectations of its users. In the case of the 2004 edition of the Yearbook, the result is a more concise, easy-to-read format, in some cases replacing the more technical content of the past.

At the same time, care has been taken to retain and build upon the statistical tables, graphs and historical time series which have been the hallmark of previous Yearbooks. These and sidebar stories and photographs highlight the changes that have occurred in many aspects of New Zealand life since production of the 2002 Yearbook.

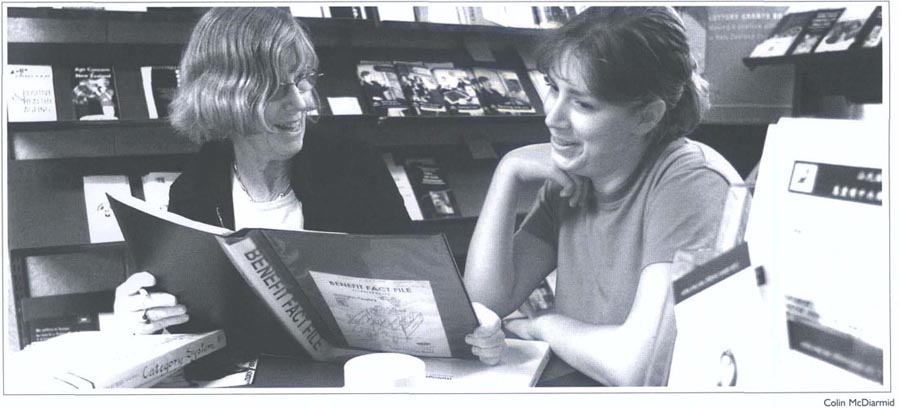

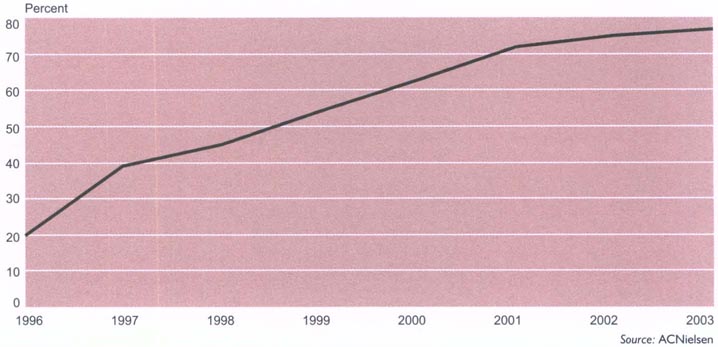

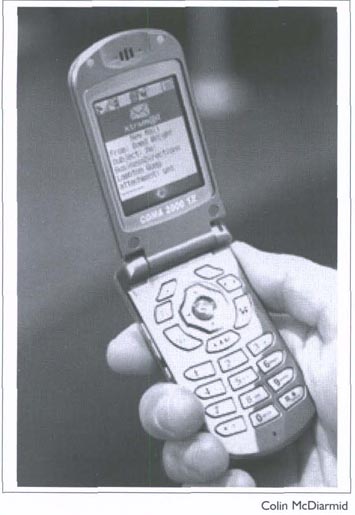

Statistics New Zealand is aware that more and more people are turning to the internet for their informational needs, and each chapter of Yearbook 2004 provides a comprehensive list of website links to contributors and organisations mentioned. Further information on much of the statistical information included in the Yearbook can be found on Statistics New Zealand's comprehensive website, www.stats.govt.nz. However, for the more than 60 percent of New Zealand households in private dwellings which the 2001 Census showed did not have internet access, the Yearbook remains an invaluable reference tool.

I would like to offer special thanks to the New Zealand Official Yearbook 2004 team for the high standards they have achieved and to publisher David Bateman Ltd for providing a high-quality finished product.

On behalf of Statistics New Zealand, I would also like to thank the 400 businesses, government departments, non-government organisations, academic institutions and individuals for their time, effort and goodwill in providing and updating contributions to the Yearbook. Their high level of cooperation, not only with the Yearbook but with all our surveys, ensures the continuing high quality of our official statistics.

Brian Pink

Government Statistician

The New Zealand Official Yearbook 2004 was produced by the Information and Publishing Services Division of Statistics New Zealand, with the assistance of the many individuals and organisations listed in the ‘Contributors’ section at the end of each chapter, or below the sidebars. The department thanks them and the following:

Divisional Manager: Kevin Eddy

Publishing Services Manager: David Town

Editor: Paul Cavanagh

Production Editor: Marie Smith

Editorial support: Teresa Schischka

Illustrations research: Margaret Low

Typesetting: Horiana Honotapu

Graphics: Maureen Metcalfe, Sandra Mackenzie

Technical assistance: Kevin Tompson

As a new reader of the New Zealand Official Yearbook, you may be surprised at the range of the information within its pages. The following notes are to help familiarise you with the book.

The New Zealand Official Yearbook is published as a compendium of facts and figures on New Zealand and describes major changes in New Zealand's administrative, economic and financial framework in the two years since the preceding publication.

There are two likely ways you will look for information.

If your question is general, for example ‘How is New Zealand governed?’, then you will probably refer firstly to the Contents (overleaf), which lists chapter headings and major sections within chapters. In approaching the book this way, it is worth bearing in mind that the 27 chapters follow a ‘logical’ progression. The first few chapters describe the physical setting of New Zealand, as well as its history, its system of government and its international relations. A description of its people comes next, followed by its social framework and its institutions. Later chapters, beginning with an overview of the New Zealand workforce, describe the activities of the economy's constituent sectors.

If, on the other hand, your question is more specific, for example ‘How many casinos are there in New Zealand, and where are they located?’, then the book is thoroughly indexed. A brief note on the system used can be found at the beginning of the index.

Statistics New Zealand has made every effort to obtain, analyse and edit the information and statistics used in the New Zealand Official Yearbook 2004. However, Statistics New Zealand gives no warranty that the information or data supplied contains no errors, and will not be liable for any loss or damage caused by the use, directly or indirectly, of material contained in the Yearbook.

Table of Contents

Just after dawn in Wanaka.

New Zealand lies in the south-west Pacific Ocean and comprises two main and a number of smaller islands. Their combined area of 267,707 square kilometres is similar in size to Japan or the British Isles. Table 1.01 gives more details of the size of the islands.

The main North and South Islands are separated by Cook Strait, which, at its narrowest point, is 20 kilometres wide.

The North and South Islands lie on an axis running from north-east to south-west, except for the low-lying Northland peninsula.

The administrative boundaries of New Zealand extend from 33° to 53° south latitude, and from 160° east to 173° west longitude.

In addition to the main and nearby islands, New Zealand also includes the small inhabited outlying islands of the Chathams, 850 kilometres east of Christchurch; Raoul Island, in the Kermadec Group, 930 kilometres north-east of the Bay of Islands; and Campbell Island, 590 kilometres south of Stewart Island.

New Zealand also has jurisdiction over the territories of Tokelau and the Ross Dependency.

Table 1.01. Land area of New Zealand1

| Land area | Size (sq km) |

|---|---|

1Includes all internal waterways (lakes and rivers). 2Includes all offshore islands 20 square kilometres or larger, except those listed separately. Source: Land Information New Zealand | |

| North Island | 114,154 |

| South Island | 150,416 |

| Stewart Island/Rakiura | 1,681 |

| Chatham Islands | 963 |

| Raoul Island | 34 |

| Campbell Island/Motu Ihupuku | 113 |

| Offshore islands2 | 346 |

New Zealand is more than 1,600 kilometres long and 450 kilometres wide at its widest part, and has a long coastline (more than 18,000 kilometres) for its area. The coast is very indented in places, providing many natural harbours.

The country is also very mountainous, with about three-quarters of the land 200 metres or more above sea level.

In the North Island, the main ranges run generally north-east to south-west, parallel to the coast, from East Cape to Cook Strait, with further ranges and four volcanic peaks to the north-west.

The South Island is much more mountainous than the North Island, with the Southern Alps, a massive mountain chain, running nearly the length of the island. There are many outlying ranges to the Southern Alps in the north and the south-west of the South Island. New Zealand has at least 223 named peaks higher than 2,300 metres. Table 1.02 lists the highest mountains in both the North and South Islands.

Table 1.02. Principal mountains

| Mountain or peak | Elevation (metres) |

|---|---|

| North Island | |

1Taranaki or Egmont is the correct format for the dual name as prescribed in the 1986 Gazette. 2The Institute of Geological and Nuclear Sciences photogrametrically confirmed the height of Aoraki/Mt Cook as 3,754m after the 1991 slip from the peak. Source: Land Information New Zealand | |

| Ruapehu | 2,797 |

| Taranaki or Egmont1 | 2,518 |

| Ngauruhoe | 2,287 |

| Tongariro | 1,967 |

| South Island | |

| Aoraki/Mt Cook2 | 3,754 |

| Tasman | 3,497 |

| Dampier | 3,440 |

| Silberhorn | 3,300 |

| Hicks (St David's Dome) | 3,198 |

| Lendenfeldt | 3,194 |

| Torres | 3,163 |

| Teichelmann | 3,160 |

| Sefton | 3,157 |

| Malte Brun | 3,155 |

| Haast | 3,138 |

| Elie de Beaumont | 3,117 |

| Douglas | 3,085 |

| La Perouse | 3,079 |

| Heidinger | 3,066 |

| Minarets | 3,055 |

| Aspiring/Tititea | 3,033 |

| Glacier Peak | 3,007 |

There are 360 glaciers in the Southern Alps. The largest are, on the east, the Tasman (29 kilometres in length), Murchison (13 kilometres), Mueller (13 kilometres), Godley (13 kilometres) and Hooker (11 kilometres), and, on the west, the Fox (15 kilometres) and the Franz Josef (13 kilometres).

New Zealand's rivers (see Table 1.03) are mainly swift and difficult to navigate. They are important as sources of hydro-electric power, and artificial lakes have been created as part of major hydro-electric schemes.

Table 1.03. Principal rivers1

| River | Length (kms) |

|---|---|

1More than 150km in length from the mouth to the farthest point in the river system, irrespective of name, including estimated courses through lakes. Source: Land Information New Zealand | |

| North Island | |

| Flowing into the Pacific Ocean - | |

| Rangitaiki | 193 |

| Waihou | 175 |

| Mohaka | 172 |

| Ngaruroro | 154 |

| Flowing into the Tasman Sea - | |

| Waikato | 425 |

| Whanganui | 290 |

| Rangitikei | 241 |

| Manawatu | 182 |

| Whangaehu | 161 |

| Mokau | 158 |

| South Island | |

| Flowing into Cook Strait - | |

| Wairau | 169 |

| Flowing into the Pacific Ocean - | |

| Clutha/Matau | 322 |

| Taieri | 288 |

| Clarence | 209 |

| Waitaki | 209 |

| Waiau | 169 |

| Waimakariri | 161 |

| Flowing into Foveaux Strait - | |

| Mataura | 240 |

| Waiau | 217 |

| Oreti | 203 |

| Flowing into the Tasman Sea - | |

| Buller | 177 |

New Zealand's artificial lakes created by the South Island's hydro-electric schemes are identified in Table 1.04, which describes the country's principal lakes.

Table 1.04. Principal lakes1

| Lake | Maximum depth (metres) | Area (kms2) |

|---|---|---|

1Only lakes greater than 20 square kilometres in area are listed. Source: National Institute of Water and Atmospheric Research (depths) Land Information New Zealand (areas) | ||

| North Island | ||

| Taupo | 163 | 613 |

| Rotorua | 45 | 81 |

| Wairarapa | 3 | 77 |

| Waikaremoana | 248 | 50 |

| Tarawera | 87 | 41 |

| Rotoiti | 94 | 34 |

| Waikari | 2 | 34 |

| South Island | ||

| Te Anau | 417 | 344 |

| Wakatipu | 380 | 295 |

| Wanaka | 311 | 201 |

| Ellesmere | 2 | 197 |

| Pukaki | 99 | 172 |

| Manapouri | 444 | 139 |

| Hawea | 384 | 152 |

| Tekapo | 120 | 96 |

| Benmore (artificial) | 120 | 75 |

| Hauroko | 462 | 71 |

| Ohau | 129 | 59 |

| Poteriteri | uncharted | 44 |

| Brunner | 109 | 41 |

| Coleridge | 200 | 37 |

| Monowai | 161 | 32 |

| Aviemore (artificial) | 62 | 28 |

| Dunstan (artificial) | 70 | 27 |

| Rotoroa | 152 | 24 |

| McKerrow | 121 | 23 |

New Zealand is in an area of the world characterised by active volcanoes and frequent earthquakes. The ‘ring of fire’, as this area is known, forms a belt that surrounds the Pacific Ocean and is the surface expression of a series of boundaries between the plates that make up the earth's crust. The boundary between the Indo-Australian plate and the Pacific plate runs through New Zealand, and the processes from their collisions have had a profound effect on New Zealand's size, shape and geology.

Renewed mountain building in New Zealand between about six million years ago and the present is primarily responsible for the landscape of today.

Mountain chains have been built by folding and displacement of the earth's crust along faults or by flexing of the crustal plates due to sediment loading and unloading. Due to this activity, well-preserved tilted blocks bounded by fault scarps (steep faces hundreds or even thousands of metres high) are visible in the landscape of some regions.

Ongoing movement of the Pacific and Indo-Australian plates is responsible for continued earth strain in New Zealand, and this results in periodic rupture of faults, several of which caused major earthquakes during the past century.

Erosion, enhanced by climate, has transformed the landscape during this time, carving detailed patterns of peaks, ridges, valleys and gorges. The deposition of debris has built up alluvial plains, shingle fans and other construction forms.

At the coast, waves have eaten back headlands and built beaches, spits and bars. Glaciers have carved the sea-filled valleys of Fiordland and have occupied most valleys of the South Island, many of which now have lakes held in by terminal moraines. Sea level changes accompanied formation, and later melting, of global glacial ice. These changes affected the erosion and deposition of rivers and were responsible for the formation of many prominent river terraces.

Volcanic activity during the past few million years has played an important part in shaping the landscape of the central North Island. The largest volcanic outpourings of late geological times were in the region between Tongariro National Park and the Bay of Plenty coast.

The most recognisable volcanoes in New Zealand, all of which are active, include Ruapehu, Tongariro, Ngauruhoe, White Island, and Taranaki or Egmont. Other major volcanoes are less obvious but have even more dramatic impacts on the landscape. These are the caldera-forming volcanoes that are now occupied by large central North Island lakes. Lakes Taupo, Rotorua, and Tarawera can be thought of as upside down volcanoes.

Small volcanic cones, such as One Tree Hill, Mt Eden and Rangitoto, are an important part of the Auckland landscape. These are dormant, but the volcanic field is still regarded as posing a significant hazard.

The magnitude 6.6 Edgecumbe earthquake in the Bay of Plenty in 1987 severely twisted railway lines, causing this locomotive to disrail.

Living in New Zealand means living with earthquakes. There is an almost continuous belt of earthquake activity around the edge of the Pacific Ocean that affects the geological stability of many countries on the Pacific Rim, particularly New Zealand, the west coast of the United States, Chile, Peru, Japan and the Philippines. New Zealand's level of activity is similar to that of California, but slightly lower than that of Japan. A magnitude eight earthquake occurs in New Zealand about once a century, a magnitude seven earthquake averages out at once a decade and there is an average rate of one magnitude six earthquake a year.

New Zealand has many earthquakes because it straddles the boundary between two of the earth's great tectonic plates - the Pacific plate in the east and the Indo-Australian plate in the west, illustrated in figure 1.01. These two plates are converging obliquely at about 30 millimetres a year in Fiordland, increasing to about 50 millimetres a year at East Cape. The plates converge in different ways. In the North Island and the northern South Island, the Pacific plate sinks below the Indo-Australian plate.

Earthquakes originating within the subducting Pacific plate are less than 30 kilometres deep along the eastern coast, and become deeper westward.

In Fiordland and the region to the south, the Indo-Australian plate subducts beneath the Pacific plate, so the earthquake sources are shallow in the west and deeper in the east under Fiordland.

Between these two subduction zones, the crust of both plates is too buoyant to subduct, so the convergence is accommodated by uplift, which created the Southern Alps, and horizontal movement along the Alpine Fault. This results in parts of Nelson and western Otago, adjacent five million years ago, now being 450 kilometres apart.

The forces driving this sideways and upward movement create shallow earthquakes.

About two-thirds of New Zealand's earthquakes are deep, while shallow earthquakes originate within the earth's crust, which has an average thickness of 35 kilometres in New Zealand. Crustal earthquakes are responsible for almost all damage to property, and are widely scattered throughout New Zealand. In the Taupo volcanic zone, from White Island to Ruapehu, swarms of small earthquakes of similar magnitude are associated with the area's active volcanism. Although the number of shocks is alarming, they rarely cause damage.

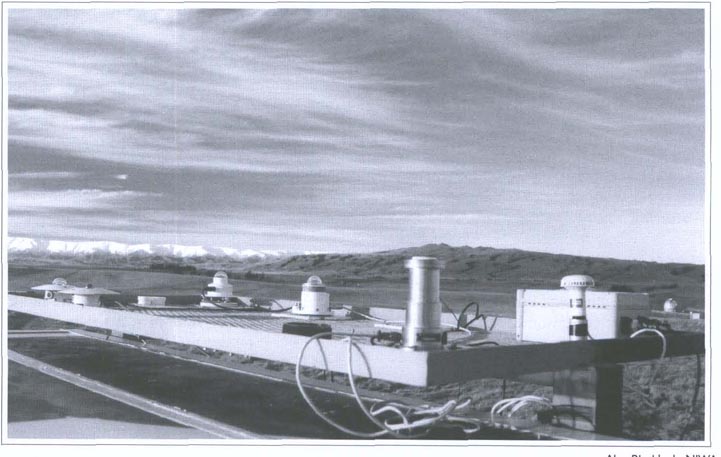

Earthquake risk. The worst disaster that can reasonably be expected within a generation is a 7.5 magnitude earthquake on the segment of the Wellington fault within the city. It has a 12 percent probability of occurring within the next 30 years, and would affect 200,000 residential properties from Palmerston North to Nelson, as well as roads, bridges and dams, and services such as electricity, water and sewerage. The Institute of Geological and Nuclear Sciences (GNS) runs national and regional earthquake and volcano monitoring networks. A major upgrade of monitoring equipment commenced in 2001 with the Earthquake Commission providing core funding of $5 million a year over 10 years.

The new equipment is linked to GNS data centres via satellite and cellular and radio networks, permitting more rapid and reliable determinations of the location and magnitude of all significant earthquakes and volcanic activity within the New Zealand region. Such information underpins current and emerging research on geological hazards and is also available to civil defence and emergency management authorities and international earthquake centres worldwide.

New Zealand scientists undertake a large body of research aimed at improving understanding of, and ways to mitigate, seismic and volcanic risk in New Zealand. Mitigation measures include improved engineering design of buildings and infrastructure, better prepared communities and better regional planning.

The New Zealand region is characterised by both a high density of active volcanoes and a high frequency of eruptions. Volcanic activity in New Zealand occurs within the North Island and offshore to the north-east in the Kermadec Islands. In the past 150 years, volcanoes have killed more people than earthquakes (see Table 1.05), yet the scale and style of historically recorded volcanic activity is dwarfed by events known to have occurred in the past 2,000 to 5,000 years.

Volcanism. New Zealand volcanism is confined to five areas in the North Island - the Bay of Islands, Whangarei, Auckland, a zone extending from White Island to Ruapehu, and Taranaki or Egmont. The area from White Island to Ruapehu is known as the Taupo Volcanic Zone and is by far the most frequently active. There are three major types of volcano in New Zealand:

Volcanic fields such as Auckland, where each eruption builds a single small volcano (eg Mt Eden), which does not erupt again. The next eruption in the field occurs at a different place, the site of which cannot be predicted until the eruption is imminent.

Cone volcanoes such as Taranaki or Egmont and Ruapehu, where a succession of small eruptions occurs from roughly the same point on the earth's surface. The products of successive eruptions accumulate close to the vent to form a large cone, which is the volcano itself. The site of future eruptions can generally be predicted.

Caldera volcanoes such as Taupo and Rotorua. Eruptions at these volcanoes are occasionally so large that the ground surface collapses into the ‘hole’ left behind. For example, Lake Taupo infills a caldera formed in two episodes about 1,800 and 26,000 years ago.

The Taupo Volcanic Zone contains three frequently active cone volcanoes (Ruapehu, Tongariro/Ngauruhoe and White Island) and two of the most productive caldera volcanoes (Taupo and Okataina) in the world.

Casualties. Deaths due directly or indirectly to volcanism (and associated hydrothermal explosions) represent the biggest single source of fatalities from natural disasters in New Zealand since 1846. Economic loss due to volcanism, however, has been low compared with that from earthquakes or flooding. The cost of the 1995 and 1996 eruptions of Ruapehu has been estimated at $130 million. However, an assessment of the size and style of volcanic eruptions in the geologically recent past, coupled with consideration of the economic development of New Zealand, especially in the central North Island, shows that the record since 1846 represents only a fraction of the type and size of hazard posed by New Zealand volcanism.

Table 1.05. Deaths in volcanic areas since 1846

| Year | Location (eruption) | Cause - hazard | Fatalities |

|---|---|---|---|

| Source: Institute of Geological and Nuclear Sciences | |||

| 1846 | Waihi (Lake Taupo) | Debris avalanche/mudflow from thermal area | c60 |

| 1886 | Tarawera Rift | Large volcanic eruption | >108 |

| 1903 | Waimangu (Tarawera) | Hydrothermal explosion | 4 |

| 1910 | Waihi (Lake Taupo) | Debris avalanche/mudflow from thermal area | 1 |

| 1914 | White Island | Debris avalanche from crater wall | 11 |

| 1917 | Waimangu (Tarawera) | Hydrothermal explosion | 2 |

| 1953 | Tangiwai (Ruapehu) | Lahar and flood from crater lake | 151 |

| Total | >337 | ||

Surveillance. Volcanologists use three primary techniques to establish the ‘health’ of an active volcano:

Monitoring of volcanic earthquakes. This is done using closely-spaced networks of seismometers, designed to detect movement of magma (molten rock) below the surface and allow assessment of the possible onset and timing of eruptive activity. There are five volcano-seismic networks in New Zealand (Auckland, Bay of Plenty-Rotorua, Taranaki, Tongariro and Taupo).

Monitoring of ground deformation. This is done using precise geodetic surveys. The concept is that if magma is moving upwards before an eruption, it will cause the volcano to swell (ie the ground surface to rise), and this swelling can be detected. A novel version of this technique uses lakes at Taupo and Okataina as giant spirit levels.

Monitoring of volcanic gases. Magma at depth in the earth contains gases (carbon dioxide, together with various compounds of sulphur, chlorine and fluorine) dissolved in it. As the magma rises to shallow levels before an eruption, these gases are released and come to the surface via fumaroles. The temperatures and the abundance of the gases and their relative proportions give information on the state of the magma and how close to the surface it is.

In a volcanic crisis, practical steps can be taken to mitigate risk and lessen the threat to life, but this requires accurate perception of the onset of a crisis. This perception in turn depends on a knowledge of the ‘background’ or ‘normal’ levels of seismicity, ground movement and gas flux at the volcano, coupled with ‘real-time’ determination of any significant changes from this background. New Zealand has an active volcano surveillance programme to define these background levels.

New Zealand is surrounded by a large expanse of ocean, with Australia the nearest major land mass, about 1,600km to the west.

The climate of New Zealand is largely influenced by:

Its location in a latitude zone where the prevailing wind flow is westerly.

Its surrounding oceanic environment.

Its mountains, especially the main mountain chain, which modify weather systems as they pass eastwards, and which also provide a sheltering effect on the leeward side.

Day-to-day weather is mostly determined by a series of anticyclones and troughs of low pressure in the westerlies. Consequently. New Zealand's weather is changeable, typically with short periods of settled or unsettled weather. At times, the westerly regime breaks down and there are cold, southerly outbreaks, with snow in winter and sometimes spring; or northerly intrusions of warm, moist air when tropical depressions move southwards into New Zealand latitudes in the summer. The main mountain chain is a major barrier to weather systems approaching from the west. Consequently, there is a marked contrast between the climates of regions west and east of the mountains. This contrast is much greater than north-south climatic differences. Surrounding oceans have a moderating effect on temperatures in most northern and western regions. However, inland and eastern areas can experience large temperature variations. High temperatures usually occur in the east in warm, north-westerly wind conditions. These high temperatures are often followed by sudden falls in temperature, as cold fronts move up the east coast of both islands. Many parts of New Zealand are subject to extremes of wind and rain, occasionally causing wind damage to buildings and forests, and flooding as depressions with their fronts pass close to or over the country. The rugged terrain is an important factor in enhancement of wind strength and/or rainfall.

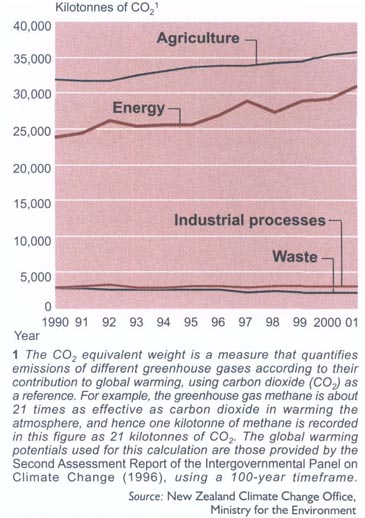

International climate change research reached a major milestone in January 2001 when the Intergovernmental Panel on Climate Change (IPCC) concluded there was comprehensive evidence of climate change during the 20th century caused by human activities. Key points raised in the IPCC report:

The global average surface temperature increased by about 0.6°C during the 20th century and sea levels in the tropical Pacific rose by about 2mm/year.

There was strong evidence that most of the warming was attributable to human activities (emissions of greenhouse gases and aerosols), and that anthropogenic (human-induced) climate change would persist for many centuries.

Projected increases in global mean temperatures from 1990 to 2100 for a range of plausible emission scenarios lie between 1.4 and 5.8°C. Global mean sea level changes lie between 9 and 88cm. Changes were expected in some extreme weather and climate events, including higher maximum temperatures and more hot days, more heavy rainfall events, and, in some areas, an increase in peak wind intensities.

What the warming climate will mean in detail for the South Pacific is still the subject of investigation by scientific researchers, with key emerging issues being changes in rainfall patterns and associated shifts in water resources and agricultural growing conditions.

Following is a summary of knowledge gained in the past decade about the effect of climate change on New Zealand.

Projected climate changes - Temperatures in New Zealand are likely to increase faster in the North Island than in the South Island, but generally less than global average temperatures. Rainfall is projected to increase in the west of the country and to decrease in many eastern regions. In the long term, rising seas are expected to increase erosion of vulnerable beaches and breach coastal protection structures more often.

Agriculture - The agricultural sector could benefit under climate change, but also faces risks. The key benefit to agriculture is likely to be from increased carbon dioxide concentrations, which could lead to greatly increased growth rates and water-use efficiency. In addition, warmer conditions and lengthened growing seasons could allow the long-term southward shift of climate-limited activities, and new crops and related industries could be introduced. The most significant risks include more droughts and floods in some areas, particularly in the east of New Zealand. Warmer temperatures could also make the growing of some current fruit crops in some northern areas uneconomical.

Native ecosystems - Climate change may add to pressure on ecosystems already under threat. Fragmented native forests of drier lowland environments in Northland, Waikato and Manawatu, and in the east from East Cape to Southland, are probably the most vulnerable to climate change.

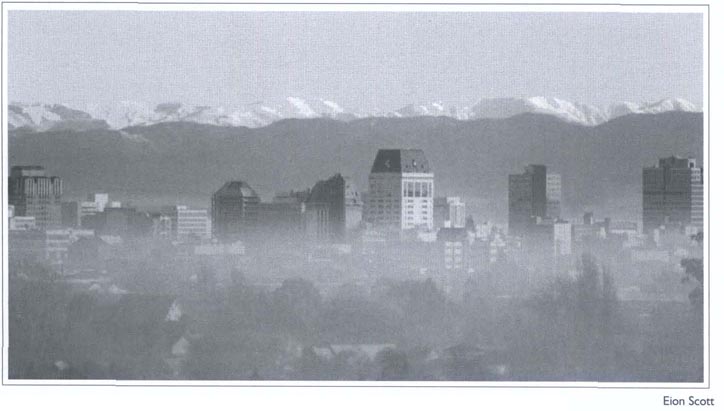

Urban environment, transport and energy - The main threat to the urban environment comes from possible increases in heavy rainfall, which would put pressure on drainage and stormwater systems and increase the risk of flooding in some areas. Warmer conditions will substantially reduce home heating costs, leading to reduced electricity demand during the peak winter season, but possibly increased demand for air conditioning during summer.

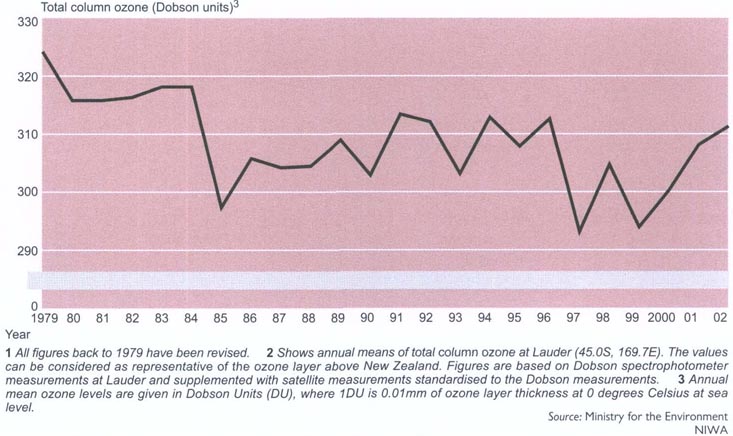

Health - Higher temperatures are expected to reduce winter illnesses, but could lead to higher death rates during summer. A warmer climate could also allow the spread of mosquitoes capable of transmitting diseases such as Ross River virus and dengue fever. Recent research has also found that climate change could lead to a delay in the recovery of the ozone layer. This would increase the period during which New Zealanders are exposed to high levels of ultraviolet radiation, which is known to lead to skin cancers. However, the possible effects of greenhouse gases on the ozone layer are still highly uncertain.

Table 1.06 lists predicted temperature and rainfall changes.

Table 1.06. Predicted changes in annual mean temperature and precipitation

Between 1970-1999 and

2070-2099

| Region | Temperature | Precipitation |

|---|---|---|

| Source: Ministry of Research, Science and Technology | ||

| Northland, Auckland | + 1.0° to +2.8°C | -10% to 0% |

| Western North Island from Waikato to Wellington | +0.8° to +2.7°C | 0% to +20% |

| Eastern North Island from Bay of Plenty to Wairarapa | +0.9° to +2.7°C | -20% to 0% |

| Nelson, Marlborough, to coastal Canterbury and Otago | +0.8° to +2.5°C | -20% to +5% |

| West Coast and Canterbury foothills | +0.6° to +2.5°C | +5% to +25% |

| Southland and inland Otago | +0.6° to +2.2°C | 0% to +30% |

Climate extremes. The National Institute of Water and Atmospheric Research's annual climate summaries (available on its website www.niwa.cri.nz) contain detailed descriptions of extreme weather events for the year. These include extremes of temperatures and sunshine hours, and notable occurrences of snowfalls and frosts, droughts, floods and high rainfall, tornadoes, gales and high winds, and severe hailstorms. New Zealand's climate extremes as at 31 December 2003 are shown in Table 1.07 on page 10.

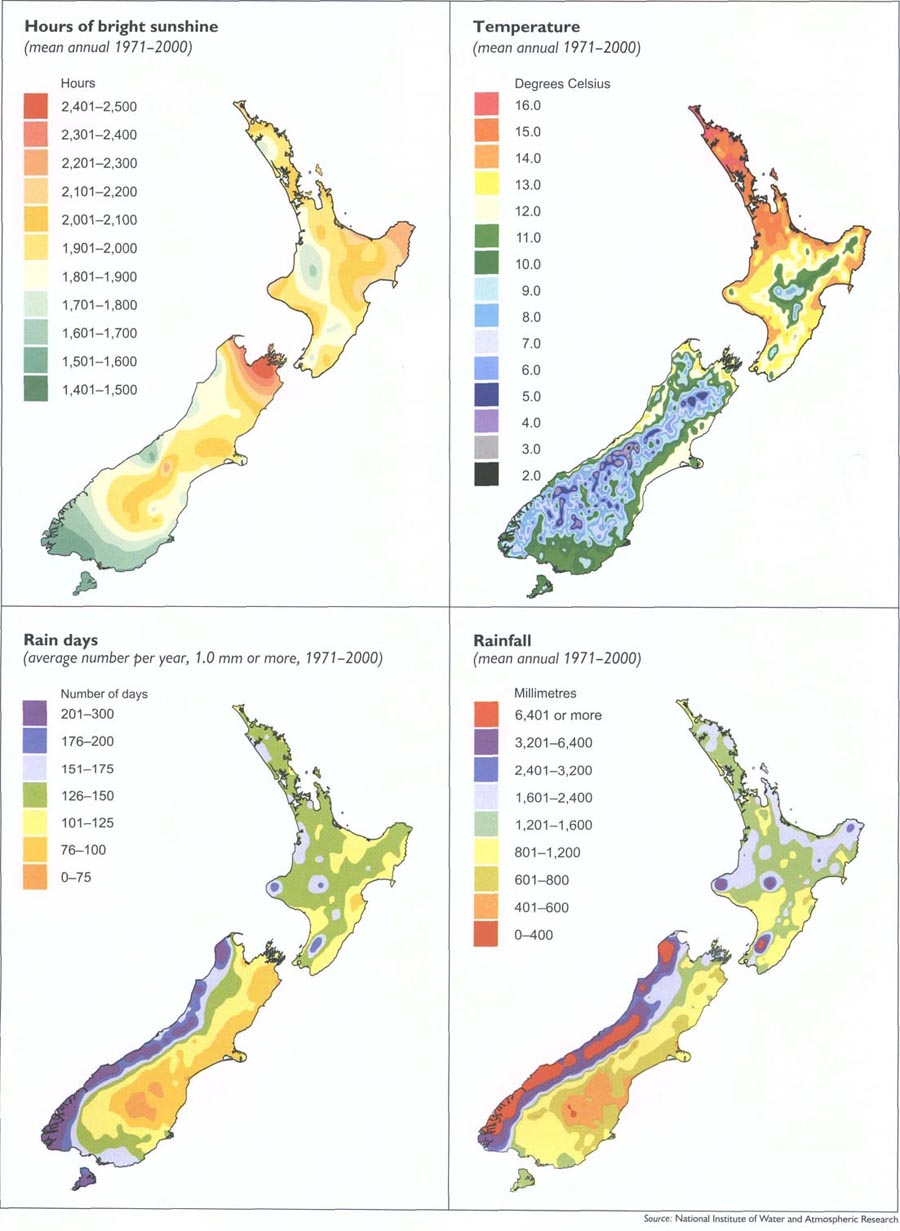

Figure 1.02 shows mean annual sunshine, temperature, rain days and rainfall for various parts of New Zealand. The maps are prepared by the National Institute of Water and Atmospheric Research (NIWA), and the mean annual figures are struck over a 30-year period to create what are referred to as ‘climate norms.’ The next ‘normal’ period for calculating mean annual figures will be 1981 to 2010.

2002. This year will be remembered for its high number of severe weather events and climate extremes. New records were set in many areas for rainfall, temperature and other climate extremes.

It was very dry in the Bay of Plenty, Nelson, Marlborough and North Otago, with above average sunshine hours in the eastern North Island, Westland and Southland.

One of the most notable severe weather events was the worst snowfall for many years in mid-Canterbury and inland Otago during June, leaving hundreds of travellers stranded, and thousands of homes without power.

A few days later, the ‘weather bomb’ brought high winds, intense rainfall and flooding in many northern and western areas, being especially severe over the Coromandel Peninsula.

Severe property damage was caused when slips sent an avalanche of water, mud and rocks into the township of Paekakariki, north of Wellington, in October 2003.

There were a dozen high-rainfall/flood-producing events and a high number of gale-force southerly wind episodes. Severe hailstorms hit throughout the country, and five tornadoes were reported. Lower than average pressures occurred south-east of the Chatham Islands with many more lows there than usual, bringing frequent stronger changeable westerly and south-westerly winds over the North Island, and southerlies and south-westerlies over the South Island. Seas around New Zealand were warmer than normal until October.

Analysis of month-by-month records for 2002 show:

The year's national average temperature was 12.5°C (the same as the 1961-1990 normal).

The highest recorded extreme air temperature for the year was 36.5°C, recorded at Darfield on 31 December, and the lowest -19.1°C (a new record low for June) at Tara Hills on the morning of 20 June.

The driest recorded centre was Alexandra, in Central Otago, with 371mm of rain for the year. Dunedin was the driest of the four main centres, with 647mm, and Wellington the wettest, with 1,250mm. Auckland received 1,075mm and Christchurch 785mm.

Christchurch was the sunniest of the three largest centres, with 2,166 sunshine hours, followed by Wellington (2,107 hours) and Auckland (2,034 hours). Nelson was the sunniest centre in 2002, with 2,580 hours, followed by Blenheim, with 2,534 hours. Tauranga recorded 2501 hours, well above average.

Table 1.07. Summary of New Zealand climate extremes

At 31 December 2003

| Source: National Institute of Water and Atmospheric Research | |||

|---|---|---|---|

| Rainfall Period | Amount (mm) | Location | Date |

| Highest | |||

| 10 minutes | 34 | Tauranga | 17 April 1948 |

| 1 hour | 109 | Leigh | 30 May 2001 |

| 12 hours | 473 | Colliers Creek (Hokitika Catchment) | 22 January 1994 |

| 24 hours | 682 | Colliers Creek (Hokitika Catchment) | 21-22 January 1994 |

| 48 hours | 1,049 | Waterfall, Cropp River (Hokitika Catchment) | 12-13 December 1995 |

| 1 calendar month | 2,927 | Waterfall, Cropp River (Hokitika Catchment) | December 1995 |

| 1 calendar year | 16,617 | Waterfall, Cropp River (Hokitika Catchment) | January-December 1998 |

| 365 days | 18,442 | Waterfall, Cropp River (Hokitika Catchment) | 29 October 1997-29 October 1998 |

| Lowest | |||

| 3 months | 9 | Cape Campbell | January-March 2001 |

| 6 months | 52 | Cape Campbell | Nov 2000-April 2001 |

| 12 months | 167 | Alexandra | Nov 1963-Oct 1964 |

| Longest rainless period | |||

| 71 days | 0 | Wai-iti, Marlborough | From 8 Feb 1939 |

| Temperature

extremes Location | Temperature (°C) | Date | |

| Highest air temperature | |||

| North Island | 39.2 | Ruatoria | 7 February 1973 |

| South Island | 42.4 | Rangiora | 7 February 1973 |

| Lowest air temperature | |||

| North Island | -13.6 | Chateau Tongariro | 7 July 1937 |

| South Island | -21.6 | Ophir | 3 July 1995 |

| Lowest grass minimum | -21.6 | Lake Tekapo | 4 August 1938 |

| Sunshine Location | Total (hours) | Date | |

| Highest in one year | |||

| North Island | 2,588 | Napier | 1994 |

| South Island | 2,711 | Nelson | 1931 |

| Highest in one month | |||

| North Island | 335 | Taupo | January 1950 |

| South Island | 336 | Nelson | December 1934 |

| Lowest in one year | |||

| North Island | 1,357 | Palmerston North | 1992 |

| South Island | 1,333 | Invercargill | 1983 |

| Lowest in one month | |||

| North Island | 27 | Taumarunui | June 2002 |

| South Island | 35 | Invercargill | June 1935 |

| Wind gusts Location | Speed (km/h) | Date | |

| North Island | 248 | Hawkins Hill, Wellington | 6 November 1959 and 4 July 1962 |

| South Island | 250 | Mt John, Canterbury | 18 April 1970 |

2003. This was a year of severe weather events and climate extremes involving very dry autumn conditions in many areas, extensive flooding and late snow storms. Overall, the year featured many new climate records and weather extremes. Analysis showed new records set in many months for rainfall, temperature and sunshine.

A very dry period from January through early May hit the southwest of the North Island and eastern regions of both islands, re-appearing in many eastern regions at the end of the year. There was a remarkably mild start to winter with the warmest June on record, followed by a very frosty July, and late frosts in October.

Five snowfall events occurred to low levels, and in October snowfall to the South Island hill country meant farmers lost thousands of newborn lambs to exposure.

There were at least 20 heavy rainfall events, of which nine produced floods, mainly in the North Island. The event producing the Paekakariki landslides in early October caused $2.5 million of damage.

NIWA analyses of month-by-month records for 2003 show:

The year's national average temperature was 12.7°C (0.1°C above the 1971-2000 normal).

The highest recorded extreme air temperature for the year was 36.0°C recorded at Middlemarch on 31 December. A late-summer heat wave occurred over the lower North Island, with new record maximum temperatures for any time of the year being recorded of 29.6°C at Paraparaumu on 28 February and 31.0°C at Levin on 2 March. June 2003 was the warmest in more than 150 years of measurement for New Zealand overall, with temperatures 2°C above average.

The lowest air temperature for the year was -14.8°C recorded at Tekapo on 13 July.

The driest rainfall recording locations were Alexandra, with 264.0mm, followed closely by Lauder, in Central Otago, with a record low 264.2mm of rain for the year. Christchurch was the driest of the four main centres, with 459mm, and Auckland the wettest, with 1,345mm. Of the regularly reporting gauges, the Cropp River gauge in Westland, inland in the headwaters of the Hokitika River, recorded the highest rainfall, with an annual total of 9,301mm.

Christchurch was the sunniest of the four main centres, with 2,362 sunshine hours, followed by Wellington (2,271 hours) and Auckland (2,047 hours). Dunedin recorded 1,971 hours. Nelson was the sunniest centre in 2003, with 2,707 hours, followed by Blenheim, with 2,663 hours.

The highest recorded wind gust for the year was 183 km/h at South West Cape (Stewart Island) on 16 November, with hurricane force northerlies and mean speeds as high as 132 km/h.

The islands of New Zealand separated from their nearest neighbours more than 80 million years ago.

Some of the original inhabitants endured times of turbulent change and violent upheaval, evolving and adapting to become part of a unique natural biota (or region). Other species died out (either nationally or regionally), unable to compete or survive environmental disturbances such as ice ages. For example, coconut palms were once found in New Zealand, and kauri, now confined to the north of the North Island, used to grow as far south as Canterbury. Over the years, the earliest inhabitants were joined by other plants and animals carried across the oceans by wind and current.

The pre-human community was notable for the absence of snakes, land mammals (apart from three species of bat) and many of the flowering plant families.

Whole orders and families were found only in New Zealand, including tuatara, moa and kiwi, all of the native lizards, and nearly 200 species of native earthworms.

Many remarkable plants, insects and birds evolved to fill ecological niches normally occupied by mammals. Others diversified to fill new territories created by sea-level fluctuations and land uplift.

With no mammalian predators on the ground, but avian predators everywhere, flightlessness was not a handicap, nor was size. Moa (11 species, some up to 3m tall) became extinct in pre-European times, but many other large flightless birds still remain, including kiwi, the nocturnal kākāpō (the only flightless parrot in the world) and weka (of the rail family).

Flightless insects are numerous, including many large beetles and 70 or so species of the cricket-like weta, found only in New Zealand.

New Zealand, with 84 species, has the most diverse seabird fauna of any country. Nearly half of all native bird species depend on the ocean for food, the feeding zones of some extending as far south as the Antarctic continent. New Zealand's extensive coastline and many islands offer a huge range of habitat, from estuary and mud-flat, to rocky cliffs and boulder bank.

The ocean itself is marvellously rich. There are about 400 different marine fish in the waters around New Zealand, as well as various species of seals, dolphins and porpoises. Twenty-nine species of whale have been recorded, and three of the largest (sperm, humpback and right) regularly migrate to New Zealand waters in spring and autumn.

The most widespread and complex type of forest in New Zealand is a podocarp (conifer) broadleaf association. It is generally found at lower altitudes and is characterised by a variety of species, a stratified canopy and an abundance of vines and epiphytic plants. Beech and kauri forests, by contrast, are much simpler in structure. New Zealand's beech species have close relatives in Australia and South America and the five different types of species in New Zealand have exploited habitats from valley floor to mountain tops. Kauri, true forest giants, dominate only in the warmer climes to the north.

Some of the most specialised plants are those occupying the alpine zone. A remarkable 25 percent of all New Zealand's plants can be found above the treeline. Ninety-three percent of all alpine plants are found only in New Zealand, compared with 80 percent for the rest of the higher plant species. Snow tussock herbfields are one of the most distinctive elements in this cold, windswept environment. Remarkably long-lived, some larger specimens may be several centuries old. Like beech trees, they seed infrequently, but in profusion.

A definitive feature of New Zealand's land-based plants and animals is their degree of specialisation and narrow habitat requirements (eg takahē/tussock grasslands; blue duck/fast flowing rivers and streams) and their evolution in the absence of mammalian predators (birds) or browsers (plants). This specialisation, and the adaptations which make New Zealand's wildlife so unique, render them extremely vulnerable to introduced predators, such as rats and cats; competitors, such as deer and possums; and loss of habitat.

The arrival of people in New Zealand heralded times of rapid change. Introduction (intentionally or accidentally) of exotic plants and animals, and the modification of habitat, radically affected native species populations. In the pre-1800 period, following the arrival and expansion of Māori, forest cover was reduced and 34 species became extinct, including moa, the adzebill and the flightless goose. In the much shorter post-1800 period of European settlement, the forest area was further reduced to around 25 percent of the land, nine more bird species became extinct and many more were threatened. Since 1840, more than 80 new species of mammals, birds and fish, and more than 1,800 plant species have been introduced, in many places totally changing the landscape and ecology.

One uniform time is kept throughout mainland New Zealand. This time is 12 hours ahead of Coordinated Universal Time (UTC) and is called New Zealand Standard Time (NZST). It is an atomic standard maintained by the Measurement Standards Laboratory, part of Industrial Research Ltd, Lower Hutt. One hour of daylight saving, called New Zealand Daylight Time (NZDT), which is 13 hours ahead of UTC, is observed from 2am (NZST) on the first Sunday in October, until 2am (NZST) on the third Sunday in March. Time kept in the Chatham Islands is 45 minutes ahead of that kept in New Zealand.

1.1 Land Information New Zealand (LINZ); Department of Geology, University of Canterbury; New Zealand Speleogical Soceity.

1.2 Institute of Geological and Nuclear Sciences Ltd; Department of Conservation.

1.3 National Institute of Water and Atmospheric Research Ltd (NIWA); Ministry of Research, Science and Technology.

1.4 Department of Conservation.

1.5 Industrial Research Ltd.

www.doc.govt.nz - Department of Conservation

www.gns.cri.nz - Institute of Geological and Nuclear Sciences Ltd

www.linz.govt.nz - Land Information New Zealand

www.weather.co.nz - Metservice

www.niwa.cri.nz - National Institute of Water and Atmospheric Research Ltd

www.terralinkinternational.com - Terralink International Ltd

Table of Contents

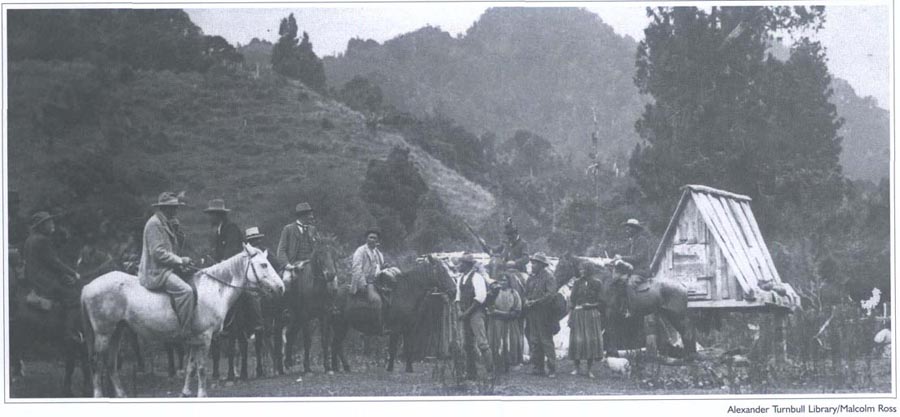

The Earl of Ranfurly (on grey horse), Governor of New Zealand from 1897 to 1904, rests with his party at a kainga on the Huia-rau Trail from Waikaremoana to Ruatoki in 1904.

The Polynesian ancestors of the Māori (meaning ‘ordinary’) people settled the main New Zealand islands (Aotearoa) about 800 years ago. They arrived - whether initially by accident or design is unclear - in waka (canoes) blown across the subtropics by prevailing north-east winds.

The settlers soon lost contact with their home islands and were forced to adapt to Aotearoa's more challenging physical environment. Annual cultivation of kumara (sweet potatoes) - a perennial crop in the tropics - was possible in the north through the underground winter storage of tubers. Birds, fish and small animals were caught and the resources of forests and oceans gathered. Large moa (flightless birds similar to emu), numerous in Te Wai Pounamu (the South Island), were eventually hunted to extinction. Fires lit to flush them out removed much of the forest east of the Southern Alps, and climatic changes made horticulture more difficult. Southern Māori increasingly lived in small hunter/gatherer groups and migrated seasonally to harvest resources.

Māori lived in groups of varying size that traced their descent from a common ancestor. Whānau (extended families of 10 to 30 people) were linked in hapū (subtribes), several of which made up an iwi. These distinctions were fluid: large whānau became hapū, and large hapū came to be seen as iwi, while other groups declined in status. iwi said to have arrived on the same migratory canoe were linked in loose confederations.

All aspects of Māori life were interrelated, with economic and social activities carried out on behalf of the whole community. While land belonged to large groups, smaller groups had rights to use specific areas and resources. Families were headed by kaumātua (elders) and communities by rangatira (chiefs), whose persons and possessions were tapu (spiritually protected). Tapu also safeguarded cultivations and urupā (burial grounds) and helped maintain social order. Tapu was regulated by tohunga (experts), who mediated spiritual forces, retained tribal history and knowledge, and had expertise in carving, tattooing and canoe building.

Tribal groups interacted through both trade and warfare. Regional products such as pounamu (jade or greenstone) and tītī (shearwaters or petrels, known as ‘muttonbirds’) were often transported long distances for bartering. Information was also exchanged among tribes. Travel was by waka, or on foot along beaches, riverbeds and ridges. There were footpaths in more densely populated areas, and tracks through forests.

One consequence of the slowness of travel was that even large iwi were unable to permanently conquer extensive areas. Instead, low-level warfare became endemic. Competition for mana (status) was complemented by competition for increasingly scarce land and resources. The concept of utu (reciprocity) generally ensured that at least one party to a dispute felt justified in maintaining it. Fighting usually occurred seasonally to fit in with cycles of subsistence. Most taua (raiding parties) made small-scale attacks, which caused few casualties. Sometimes, however, iwi were displaced into less desirable areas by military defeat or economic pressures. But many regions were occupied by the same descent group for long periods.

By the late 18th century, the Māori population may have been about 100,000. Most lived in the north of Te Ika a Māui (the North Island), where pressure for land and other resources had become intense. Here communities became larger, with many pā (fortified settlements) sited on hilltops and protected by ditches and palisades. Hunting and trapping had declined as population density increased; fish and shellfish now complemented crops. Some iwi now numbered many thousands, but Te Wai Pounamu remained sparsely populated.

Māori were generally relatively tall and sturdy, free from infectious diseases, adequately fed, and unlikely to die violently. Because of the dangers of childbirth, infant mortality and diet-related dental problems, Māori life expectancy was about 30 years. This was similar to that of Europeans in the 17th century.

The first Europeans to reach Aotearoa were probably Abel Tasman's Dutch East India Company expedition in 1642. After four men were killed by local Māori when a landing was attempted in Golden Bay, Tasman sailed up the west coast of Te Ika a Māui without finding the ‘treasures or matters of great profit’ he sought. While this experience discouraged other Europeans from following in his wake, the name of a Dutch province (Zeeland) was given to a jagged line on maps of the Pacific.

In 1769, two European expeditions visited Aotearoa. That of Frenchman Jean de Surville ill-treated Māori, provoking retaliation against later visitors. The arrival two months earlier of the English explorer James Cook, on a voyage with both scientific and economic goals, had enduring consequences. Cook's mostly peaceful interactions with ‘noble savages’ excited imaginations in Europe, and his discovery of Aotearoa's natural resources ensured it would not again be forgotten there. Cook led two further expeditions which visited Aotearoa in the course of systematic exploration of the South Pacific.

Following establishment of a penal colony at Sydney in 1788, New Zealand became an economic offshoot of New South Wales. Whaling and shore-based sealing began in the 1790s. Flax, timber, potatoes and pigs were being traded with visiting ships by the 1800s and Māori soon found they could barter this produce for firearms.

Muskets revolutionised Māori warfare. Fired in sufficient numbers, they generated enough terror to enable enemies who lacked them to be routed by traditional means. Unprecedentedly large and wide-ranging Ngā Puhi taua settled old scores and generated new grievances across Te Ika a Māui during the 1820s. Other iwi exploited temporary leads in local arms races, in some cases using sailing ships to launch surprise attacks. Thousands were killed or enslaved, and tens of thousands displaced, provoking enduring disputes about land rights. By 1840, the ‘Musket Wars’ had subsided into an uneasy balance of terror.

Regular contact with Europeans had other negative consequences. Desired products could be purchased only through debilitating labour, often in unhealthy environments. Māori were vulnerable to infectious diseases, from which many died from the 1790s. The Māori population probably fell by half during the 19th century.

Māori social structures were also disrupted. Mana became linked to the acquisition of European goods and the Pākehā (Europeans) who provided access to them. In the early 19th century, these were mostly whalers in the South Island - where communities soon included ‘half-caste’ children - and missionaries in the North Island. Māori initially resisted Christianity, but embraced the skills through which it was communicated - reading and writing. Literate slaves acquired status, while the mana of illiterate chiefs fell. Knowledge, previously held in common or tied to specific roles, could now be possessed and communicated by anyone.

Contact with the outside world also benefited Māori. Introduced animals and crops enabled improved diets. Knowledge gained through social interaction and literacy was supplemented by Māori who travelled the world as ships' crew. Māori gradually developed some resistance to European diseases, and Pākehā settlers remained relatively few - 1,000 to 2,000 by 1839.

From 1840, however, when the British sovereignty first proclaimed by Cook was reasserted, Māori control over Aotearoa was threatened. Humanitarian concerns in Britain were eased by the signing of an agreement with some 500 chiefs. The differing and contested meanings in Māori and English of this Treaty of Waitangi clouded subsequent inter-racial relations. Māori ceded kāwanatanga (a word derived from ‘governorship’, but rendered as ‘sovereignty’ in the English text) to the British Crown, in exchange for rights as British subjects. They retained their taonga (‘treasured possessions’, including land, forests and fisheries) and could sell land only to the Crown. Māori accepted that the Crown's local representatives would have jurisdiction over immigrants who were arriving in increasing numbers, but the extent of their authority over Māori remained unclear.

Three main waves of settlers arrived in the next half-century. In the first, five separate ‘colonies’ were planted around the coast by 1850 under the auspices of the privately-owned New Zealand Company. A sixth was the most important: Auckland became the seat of government in 1841. These ‘mere encampments on the fringes of Polynesia’ existed on Māori terms. Several were saved from starvation in their first years by food grown by Māori. Communication among them was by ship, and irregular - most had more frequent contact with Sydney than with each other.

Racial tolerance was soon strained. The New Zealand Company had purchased land hastily and with scant regard for actual ownership. Māori increasingly resisted further sales - especially at the low prices offered - of land which immigrants arrived expecting to occupy. Rumoured and actual wars in the 1840s were followed by a largely effective boycott of land sales from 1854. Māori remained a majority for whom the decisions of the newly-elected General Assembly were largely irrelevant.

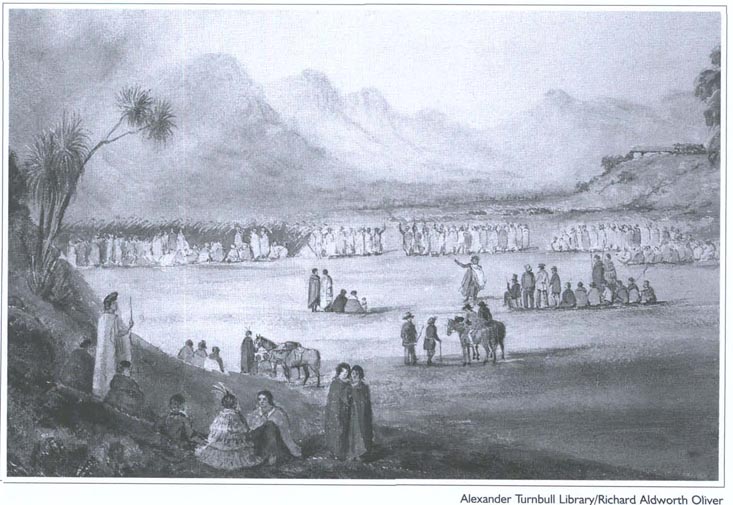

Artist's impression of Māori chief Te Rangihaeata (with arm outstretched) addressing Governor-in-Chief Sir George Grey (sitting) at Waikanae in 1851.

Governor George Grey had bought land and created institutions to assimilate Māori into British ways during his first term (1845-53). On his return in 1861, he employed more direct methods of establishing control. A war over land in Taranaki in 1860 had ended in stalemate. Grey decided to challenge the Kīngitanga (Māori sovereignty) movement in its Waikato heartland. A 14,000-strong army fought its way up the Waikato River in 1863-64 against strong resistance. War spread to Tauranga and both coasts of the North Island as messianic Pai Marire and Ringatū movements, which promised to expel the Pākehā, flourished. The strongest threat was posed by Titokowaru, who won several battles in southern Taranaki in 1868 before internal dissension lost him his army. With the flight of guerrilla leader Te Kooti to the ‘King's country’ in 1872, armed Māori resistance to British authority ended. The land of ‘rebels’ was confiscated, and much land belonging to ‘loyal’ Māori was also soon lost under a Native Land Court system which imposed individualised titles.

The second wave of immigration had begun in 1861 after the discovery of gold in Central Otago. Thousands of miners poured into Otago and Westland, swamping the ‘old identities’ of the carefully planned Otago and Canterbury settlements. From 1865, Chinese miners - the colony's first significant non-European immigrants - were brought in to rework the tailings.

The third influx of migrants, in the 1870s, was instigated by New Zealand's first ‘Think Big’ government, which provided assisted passages. Land opened for settlement by the wars required deforestation and conversion to farmland. The process was aided by railways which linked the main South Island towns in the 1870s, and those of the southern North Island by the early 1880s. Improved communications encouraged the abolition of separate provincial governments in 1876.

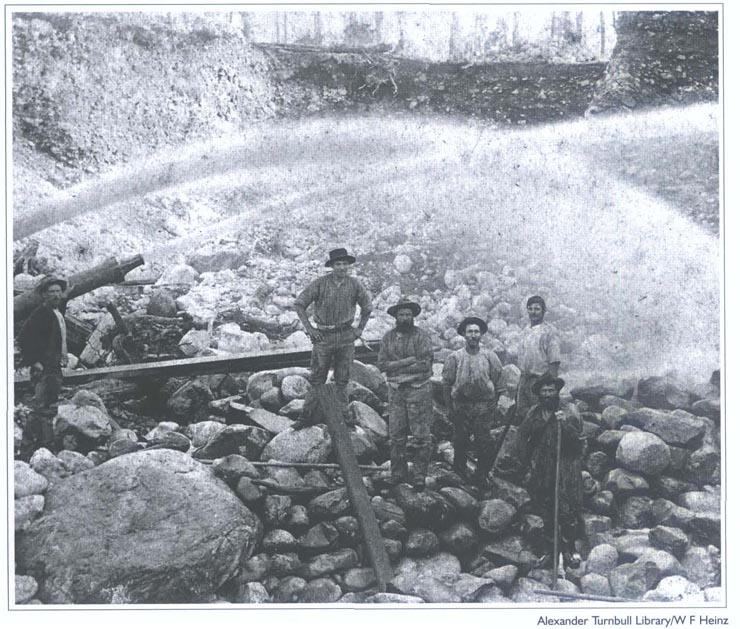

Recovering gold by sluicing on the West Coast in the 1880s.

The end of Māori autonomy was symbolised by the advance of a railway through the King Country in the 1880s. Because of difficult terrain, the Auckland-Wellington line was not completed until 1908. Dunedin and Auckland were now two days travel apart, compared with two weeks 40 years earlier. As use of telephones also increased - there were 33,000 by 1910 -New Zealand became more meaningfully a single country. From 1876, information that took up to 10 weeks to convey by letter could be transmitted to Britain instantaneously by undersea telegraph cable.

From the 1890s, refrigeration transformed New Zealand farming. Much of Waikato and Taranaki was soon covered by small, family-run dairy farms producing milk, and butter and cheese for export to Britain. Large runs in drier eastern areas had been growing wool for export since the 1850s; sheepmeat now also became a major export commodity. Coal steadily supplanted gold as the most important extracted mineral.

Politics, too, was transformed in the 1890s, when the ‘Continuous Ministry’ of run-holders and businessmen was replaced by a Liberal government supported by small farmers and the skilled workers of the growing and increasingly industrialised towns. New Zealand became the first country to grant women the vote in 1893. By 1900, when the Maori population had fallen to 46,000, the 750,000 Pākehā were evenly divided between the North and South islands.

The Liberals placed ‘ordinary working men’ and their families on farms - which promised them physical and mental health, and prosperity - by buying and subdividing large estates, and by acquiring much of the remaining Maori-owned land. Concern for the welfare of ageing ‘pioneers’ encouraged the introduction of old-age pensions for the ‘deserving poor’ in 1898; they were to be joined in the next 40 years by other worthy but narrowly defined groups, including war veterans and widows. Job security of urban workers was improved by provisions for the compulsory arbitration of employment disputes and regulation of wages.

Around 1900, Pakehā New Zealanders underlined their new sense of identity by rejecting an offer to join the new Australian federation, and accepting a change of status from ‘colony’ to ‘dominion’. They also seized a chance to prove themselves ‘better Britons’ by fighting Boers in South Africa. Living far from centres of culture and knowledge, ‘Maori-landers’ were proud of their adaptability and resourcefulness. Most of their innovations, such as mechanising the separation of cream from milk, were motivated by pragmatism. The imagination of the South Canterbury farmer Richard Pearse, who got off the ground before the Wright brothers, was exceptional.

The Liberal coalition began to unravel in the 1900s as the interests of small farmers and urban workers diverged. Farmers joined forces with urban employers in a Reform Party, while militant workers withdrew from the arbitration system and the ‘Liberal-Labour’ alliance. Social tensions came to a head in 1912-13, when Reform replaced the Liberals in power and crushed strikes led by a ‘red’ Federation of Labour. As in other settler societies, class war seemed imminent. But the threat had subsided by the time World War I broke out in mid-1914.

One hundred thousand New Zealanders served in the Great War alongside British forces. One in six were killed, many more came home as invalids, and another 8,000 to 9,000 New Zealanders died at the end of the war in the ‘Spanish flu’ pandemic. As their soldiers fought with distinction at Gallipoli, in Palestine and on the Western Front, New Zealanders' sense of identity within the Empire grew.

Still tied to Britain economically, New Zealand was buffeted by volatile commodity prices in the 1920s. Working-class aspirations now found political expression in the Labour Party, while Reform continued the tradition of activist government by creating producer boards to coordinate exports, and building a countrywide hydroelectric system. A conservative coalition failed to cope effectively with the Great Depression, and Labour won office in 1935.

Labour introduced a minimum wage, a 40-hour working week, compulsory unionism, a substantial state housing programme, and a comprehensive system of social security, which provided a safety net ‘from the cradle to the grave’. Labour also articulated an independent foreign policy. But this had limits: a balance of payments crisis in 1938 necessitated import and financial controls, which had the advantage of stimulating local industries.

New Zealand casualties in World War II were similar to those in World War I. While New Zealanders fought in North Africa and Europe, the country was garrisoned by United States forces training for the Pacific war. They made a substantial impression, especially on women. Aided by radio, the cinema and, later, television, the American invasion broadened New Zealanders' cultural horizons.

During World War II, Labour ‘manpowered’ both sexes and took control of the country's resources. Maori supported the war with unparalleled unanimity. A Maori Battalion was raised on tribal lines and a Maori War Effort Organisation coordinated civilian contributions. For the first time, Maori migrated to the cities in significant numbers, a trend which was to continue until the 1980s when manufacturing employment plummeted and rural life seemed more attractive. Successive governments worked to assimilate Maori into mainstream New Zealand life.

Young people made up a higher proportion of the population in the ‘baby-boom’ years after 1945. Growing up with British and American music, fashions and television programmes, they chafed at the modest expectations of their parents. There were jobs, homes, education and health care for all, although some consumer goods remained scarce. Family life in the suburbs, which transformed areas such as West Auckland and Wellington's Hutt Valley, was both satisfying and stultifying. Wider choices did become available: the contraceptive pill and recreational drugs brought new freedoms, experiences and dangers in the 1960s. The need to enlarge the paid workforce widened opportunities for women, and low-cost tertiary education expanded those of many working-class teenagers.

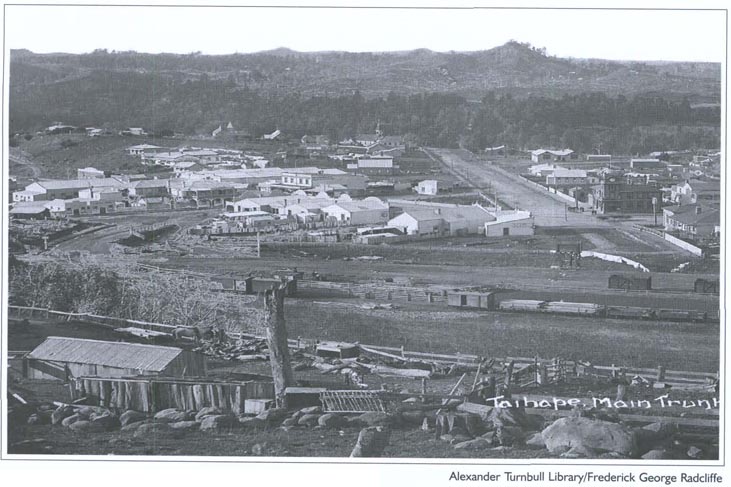

Taihape and the main trunk railway line in 1909.

The conservative National Party held power for most of the second half of the century. Until 1975, the terms of trade for New Zealand's primary exports (wool, meat, dairy products, timber) were high and so was the standard of living. Local manufacturing industries protected from foreign competition expanded further.

After energy crises in the 1970s, the terms of trade turned against most primary products and full employment disappeared. From the late 1970s, National attempted to increase New Zealand's energy self-sufficiency while subsidising farming incomes. Both policies were expensive failures.

The 1984-90 Labour government, and its National successor, challenged much that New Zealanders took for granted. Many government activities were corporatised and then privatised. Some fared poorly in private ownership - in 2001, the national airline and part of the railway system reverted to public ownership. Public education and health care, the social welfare system, and employees' rights were all constrained. The removal of most restrictions on economic activity encouraged both entrepreneurship and cultural diversity; the physical environment was more strongly protected; and New Zealand remained nuclear-free and robustly independent in foreign policy. Urban culture thrived as society was deregulated, and an influx of Pacific and East Asian immigrants increased New Zealand's ethnic diversity.

A Labour-led coalition government took office in 1999 and was re-elected in a slightly different form in 2002. Labour aimed to maintain the benefits of deregulation while reasserting a role for the state when markets failed. In a period of prosperity, its greatest challenge lay in Māori-Pākehā relations. After suffering disproportionately when full employment ended, Māori continued to lag in education, health and other social indicators.

Māori confronted the dominant culture directly from 1975 when a march reiterating land grievances generated much support. A statutory tribunal was established in the same year to investigate breaches of the Treaty of Waitangi. Others saw cultural renaissance as the key to empowerment, and schools in which only Māori was spoken, and Māori language radio stations, sprang up from 1981.

In the 1990s, the National government negotiated settlements of up to $170 million with individual iwi, and Māori entrepreneurship flourished. But many Māori feel entitled to a bigger share of national wealth. There have been several occupations of land whose ownership is disputed, and sales of artefacts have been disrupted. Māori increasingly assert rights to intellectual property under international law, and to the coastal foreshore and seabed under the Treaty of Waitangi. Indeed, many argue that the treaty requires the equal sharing of power between Māori and Pākehā; some that Māori sovereignty over Aotearoa has never been extinguished. Most New Zealanders, however, assume that all citizens have equal legal and political rights, an attitude that was reinforced in the 1990s by the introduction of an electoral system based on proportional representation. These debates seem likely to continue.

David Green, History Group, Ministry for Culture and Heritage

| c1300 | Archaeological evidence indicates Polynesian settlement established by this date. |

| 1642 | Dutch explorer Abel Janszoon Tasman discovers a land he calls Staten Landt, later named Nieuw Zeeland. |

| 1769 | British explorer James Cook makes first of three visits to New Zealand, taking possession of the country in the name of King George III. |

| 1790s | Sealing, deep-sea whaling, flax and timber trading begins, with some small temporary settlements. First severe introduced epidemic among Māori population. |

| 1791 | First visit by a whaling vessel, the William and Ann, to Doubtless Bay. |

| 1806 | First Pākehā women arrive in New Zealand. |

| 1814 | British missionary Samuel Marsden makes first visit to New Zealand. Anglican mission station established. Sheep, cattle, horses and poultry introduced. |

| 1815 | First Pākehā child, Thomas Holloway King, born in New Zealand. |

| 1819 | Raids on Taranaki and Te Whanganui-a-Tara regions by Ngā Puhi and Ngāti Toa people led by chiefs Patuone, Nene, Moetara, Tuwhare and Te Rauparaha. |

| 1820 | Ngā Puhi chief Hongi Hika visits England, meets King George IV and secures supply of muskets. |

| 1821 | Musket wars begin with raids by Hongi Hika and Te Morenga on southern iwi and continue throughout the decade. |

| 1822 | Ngāti Toa migration south to Cook Strait region, led by Te Rauparaha, begins. |

| 1823 | Wesleyan Missionary Society mission established. First Church of England marriage between Pākehā and Māori: Phillip Tapsell and Maria Ringa. |

| 1824 | Te Heke Niho-Puta migration of Taranaki iwi to the Kapiti Coast. Rawiri Taiwhanga in Bay of Islands sells dairy produce and other food supplies to visiting ships. |

| 1827 | Te Rauparaha's invasion of the South Island from Kapiti begins. |

| 1830 | First acorn planted at Waimate North where agricultural mission and school established. |

| 1831 | Whaling stations established at Tory Channel and Preservation Inlet. |

| 1833 | James Busby arrives in the Bay of Islands to take up appointment as British Resident in New Zealand. |

| 1834 | United Tribes' flag adopted by some 25 northern chiefs at Busby's suggestion. |

| 1835 | Declaration of Independence by the ‘United Tribes of New Zealand’ signed by 34 northern chiefs. |

| 1837 | New Zealand Association formed in London, becoming the New Zealand Colonisation Society in 1838 and the New Zealand Company in 1839, under the inspiration of Edward Gibbon Wakefield. William Colenso completes printing the New Testament in Māori, the first book printed in New Zealand. |

| 1838 | Bishop Pompallier founds Roman Catholic mission at Hokianga. |

| 1839 | William Hobson instructed to establish British rule in New Zealand, as a dependency of New South Wales. Colonel William Wakefield, of the New Zealand Company, arrives on the Tory to purchase land for a settlement. |

| 1840 | Treaty of Waitangi signed at Bay of Islands and later over most of the country. British sovereignty proclaimed. Hobson becomes first governor and sets up executive and legislative councils. New Zealand Company settlers arrive at Port Nicholson, Wellington. French settlers land at Akaroa. Local Māori initially provide food for these and later settlements. |

| 1841 | European settlements established at New Plymouth and Wanganui. Capital shifted from Russell to Auckland. |

| 1842 | Main body of settlers arrive at Nelson. |

| 1843 | Twenty-two European settlers and four Māori killed at a confrontation at Tua Marina, near Wairau, in Marlborough. Robert FitzRoy becomes governor. |

| 1844 | New Zealand Company suspends colonising operations due to financial difficulties. |

| 1845 | Hone Heke begins war in the north. George Grey becomes governor. Half of all adult Māori are at least partly literate. |

| 1846 | War in the north ends with capture of Ruapekapeka. Fighting between Māori and Pākehā around Wellington. Te Rauparaha captured by Grey. First New Zealand Constitution Act passed. Heaphy, Fox and Brunner begin exploring the West Coast. First steam vessel, HMS Driver, arrives in New Zealand. |

| 1848 | Settlement founded by Scottish Otago Association. Provinces of New Ulster and New Munster established. Coal discovered at Brunner on the West Coast. Earthquake centred in Marlborough damages most Wellington buildings. |

| 1850 | Canterbury settlement founded. |

| 1852 | Second New Zealand Constitution Act passed creating general assembly and six provinces with representative government. |

| 1853 | Idea of a Māori King canvassed by Tamihana Te Rauparaha and Matene Te Whiwhi. Many Māori agree not to sell any more land: 32 million acres have been bought by the government in the past five years. |

| 1854 | First session of general assembly opens in Auckland. |

| 1855 | Governor Thomas Gore Browne, appointed in 1854, arrives. Severe earthquake on both sides of Cook Strait. |

| 1856 | Henry Sewell forms first ministry under responsible government and becomes first premier. Edward Stafford forms first stable ministry. |

| 1858 | New Provinces Act passed. Te Wherowhero installed as first Māori King, taking name Potatau I. |

| 1859 | First session of new Hawke's Bay and Marlborough provincial councils. Gold discovered in Buller River. |

| 1860 | Waitara dispute develops into general warfare in Taranaki. Te Wherowhero dies and is replaced as Māori King by his son, Tawhiao. Kohimaramara Conference of Chiefs. |

| 1861 | Grey begins second governorship. Gold discovered at Gabriel's Gully and Otago goldrushes begin. First session of Southland provincial council. Bank of New Zealand incorporated at Auckland. |

| 1862 | First electric telegraph line opens - from Christchurch to Lyttelton. First gold shipment from Dunedin to London. |

| 1863 | War resumes in Taranaki and begins in Waikato when General Cameron crosses the Mangatawhiri stream. New Zealand Settlements Act passed to effect land confiscation. First steam railway in New Zealand opened. |

| 1864 | War in the Waikato ends after battle of Orakau. Māori defeat British at Gate Pa, Tauranga. Land in Waikato, Taranaki, Bay of Plenty and Hawke's Bay confiscated. Gold discovered in Marlborough and Westland. Arthur, George and Edward Dobson are the first Pākehā to cross what becomes known as Arthur's Pass. |

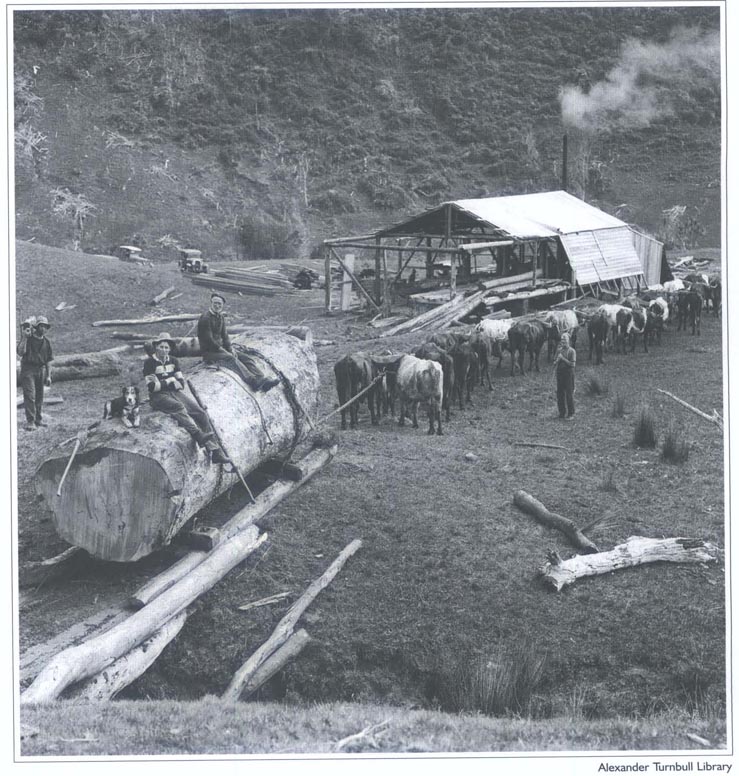

Bushmen take a break after hauling a kauri log with a team of bullocks to a sawmill in North Auckland around 1918. | |

| 1865 | Seat of government transferred from Auckland to Wellington. Native Land Court established. Māori resistance continues. Auckland streets lit by gas for first time. |

| 1866 | Cook Strait submarine telegraph cable laid. Cobb and Co coaches start running from Canterbury to the West Coast. |

| 1867 | Thames goldfield opens. Four Māori seats established in parliament. Lyttelton railway tunnel completed. Armed constabulary established. |

| 1868 | Māori resistance continues through campaigns of Te Kooti Arikirangi and Titokowaru. New Zealand's first sheep breed, the Corriedale, developed. |

| 1869 | New Zealand's first university, the University of Otago, established. |