Acknowledgements

This publication was produced in the Information Services Division of the Department of Statistics.

Assistant Government Statistician: G. E. Dickinson.

Director: K. W. Eddy.

Senior Section Officer: L. J. Collins.

Editors: K. M. Carson, J. H. Macdonald.

Graphic Designer: P. J. McGrath.

Photograph Editor: J. R. Hames.

NEW ZEALAND OFFICIAL YEARBOOK

CAT. NO. 01.001

ISSN 0078-0170

Table of Contents

List of Tables

- 1.2. PRINCIPAL MOUNTAINS

- 1.3. PRINCIPAL RIVERS*

- 1.4. PRINCIPAL LAKES*

- 1.5. GEOLOGICAL TIMESCALE

- 3.4. PARLIAMENTARY REPRESENTATION

Percentage of women, and ages of members compared to voting population

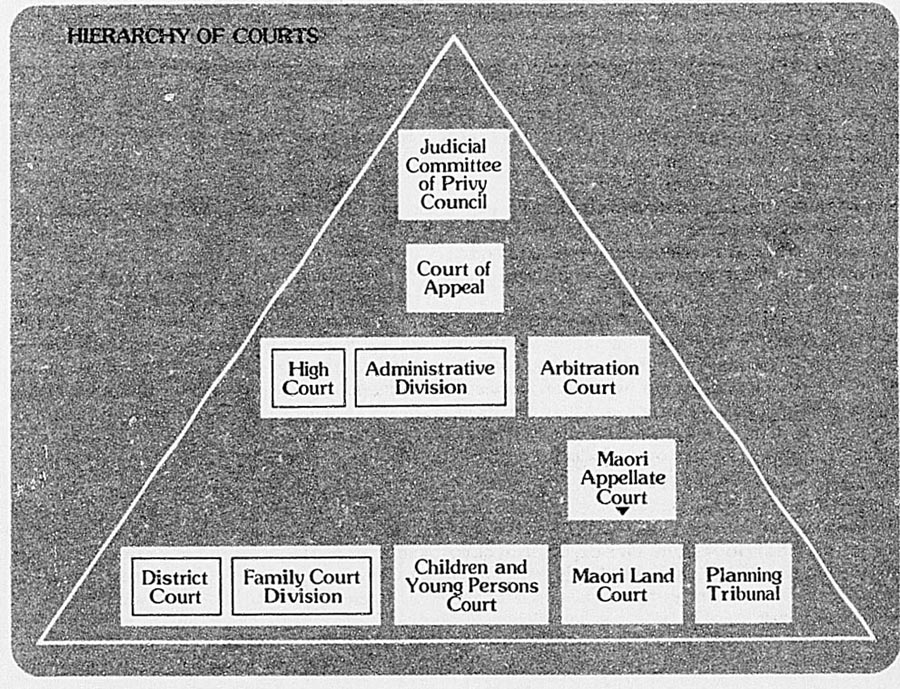

- 3.14. JUDICIARY*

- 4.4. DEFENCE EXPENDITURE

- 4.7. STRENGTH OF THE NAVY

- 4.8. STRENGTH OF THE ARMY

- 5.1. POPULATION CHANGE

- 5.11. ARRIVALS IN NEW ZEALAND

- 5.16. BIRTHS

- 5.17. SEX OF CHILDREN BORN

- 5.18. BIRTHS: AGES OF PARENTS

- 5.22. EX-NUPTIAL BIRTHS

- 5.24. ADOPTIONS

- 5.25. STILLBIRTHS

- 5.28. DEATH RATES

- 5.29. AVERAGE* AGE AT DEATH

- 5.30. LIFE EXPECTANCY

- 6.6. TYPES OF DWELLINGS

- 6.7. TENURE OF DWELLINGS

- 6.17. MARRIAGE RATES

- 6.18. MARITAL STATUS 1981

- 6.26. CUSTODY ORDERS 1984

- 6.28. RELIGIOUS PROFESSIONS

- 6.40. RESIDENT NEW ZEALAND POPULATION 1981: COMPARISON OF POLYNESIANS, NEW ZEALAND

MAORIS AND OTHERS

- 7.12. INFANT MORTALITY BY PRINCIPAL CAUSES: NUMBERS AND RATES FOR MAORI AND

NON-MAORI POPULATION, 1983

- 7.16. HOSPITAL BOARD LOANS

- 7.63. CHILDREN AND YOUNG PERSONS UNDER THE CONTROL OF THE SOCIAL WELFARE

DEPARTMENT, 30 NOVEMBER 1984

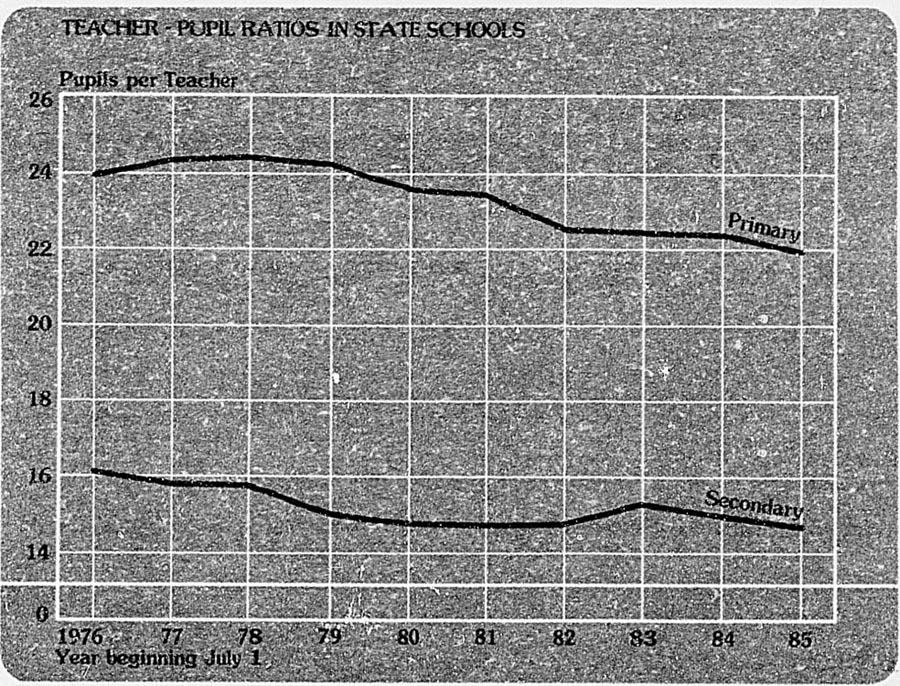

- 8.2. TEACHING STAFF

- 8.3. PROJECTED STUDENTS

- 8.8. PRIMARY SCHOOLS

- 8.11. SECONDARY SCHOOLS

- 8.18. UNIVERSITY STUDENTS

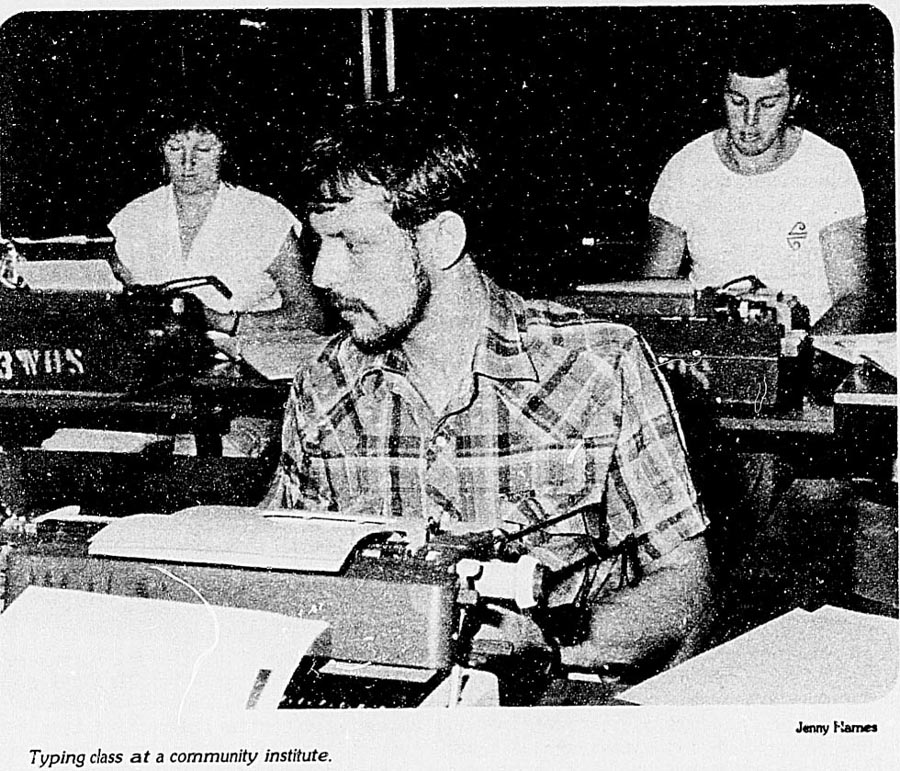

- 8.28. NUMBER OF FULL-YEAR FULL-TIME STUDENTS AT TECHNICAL INSTITUTES AND

COMMUNITY COLLEGES AT 1 JULY

- 9.19. PRISON POPULATION

- 10.11. ROAD ACCIDENTS BY TYPE, 1984

- 11.5. HORSE RACING

- 11.7. NEW ZEALAND LOTTERIES

- 11.13. ACCOMMODATION

INVENTORY*

- 12.1. GROWTH OF LABOUR FORCE

- 12.12. LABOUR FORCE PROJECTIONS

- 12.15. UNEMPLOYMENT BENEFITS*

- 12.22. TRAINING COURSES

- 12.23. SUMMARY OF EMPLOYMENT

- 12.32. WORKING LIFE EXPECTANCIES

- 27.33a. INCOMES OF SELF-EMPLOYED PERSONS

- 12.34. INCOME OF PERSONS

- 12.37. SOCIAL SECURITY INCOME

- 12.38. WEEKLY EARNINGS

- 12.39. AVERAGE HOURLY EARNINGS

- 12.46. PROFILE OF WORKERS' UNIONS

- 12.47. UNIONS OF WORKERS

- 12.49. PROFILE OF EMPLOYERS' UNIONS

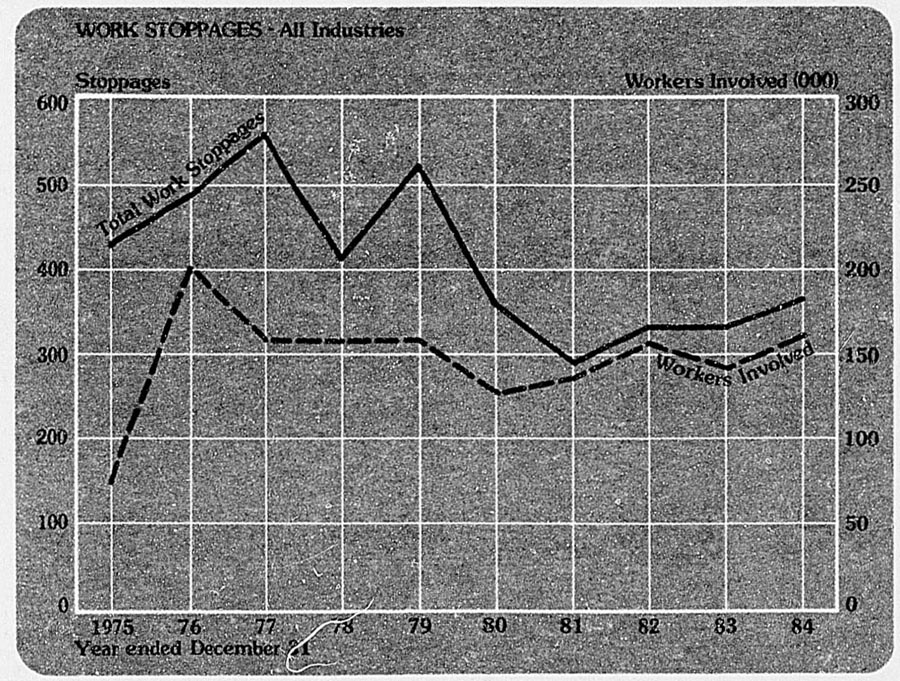

- 12.52. WORK STOPPAGES

- 12.53. NUMBER OF STOPPAGES

- 12.55. STOPPAGES BY DURATION 1984

- 12.56. CAUSE OF WORK STOPPAGES 1984

- 12.57. METHODS OF SETTLEMENT 1984

- 14.1. LAND USE

- 14.11. CROWN LAND ALLOCATED 1984-85

- 15.6. FARM MACHINERY

- 15.8. FERTILISER APPLICATION

- 15.15. SHEEP CATEGORIES

- 15.16. SHEEP: SIZE OF FLOCKS

- 15.17. CATTLE CATEGORIES

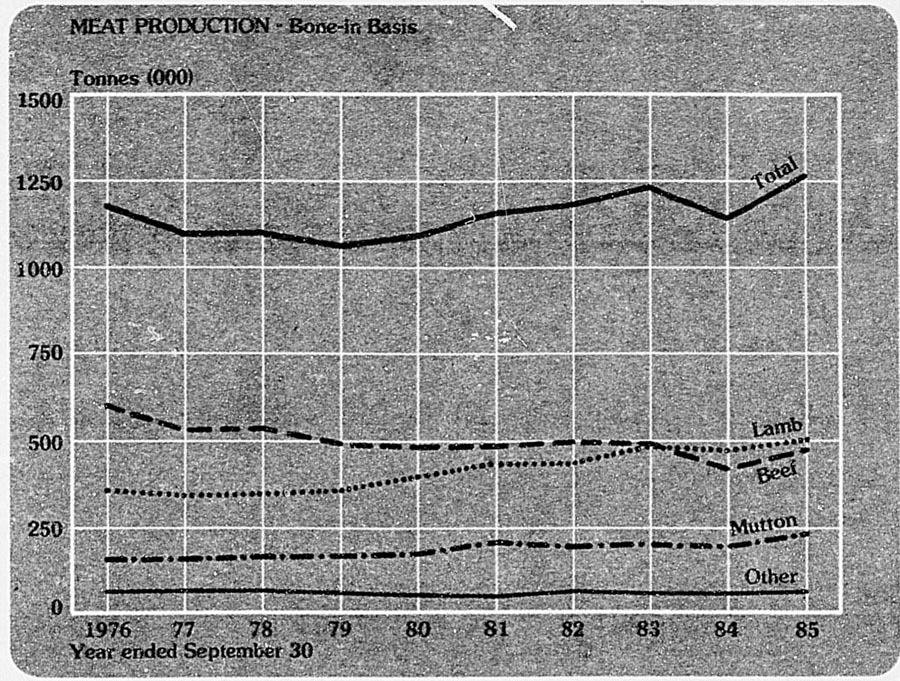

- 15.18. MEAT PRODUCTION

- 15.20. MEAT EXPORT PRODUCTION

- 15.21. MEAT BOARD LEVY RATES 1985

- 15.22. LAMB WHOLESALE LONDON PRICES

- 15.25. WOOL PRODUCTION*

- 15.30. WOOL SOLD AT AUCTION

- 15.31. MILK PRODUCTION

- 15.33. TOWN MILK

- 15.34. DAIRY FACTORY PRODUCTION

- 15.35. DAIRY EXPORT EARNINGS

- 15.38. PIGS

- 15.39. POULTRY PRODUCTION*

- 15.40. POULTRY FLOCKS*

- 15.46. POTATOES

- 15.47. ONIONS

- 15.48. SEED PRODUCTION

- 15.49. AREAS PLANTED IN FRUIT

- 15.50. WINE STOCKS

- 15.51. WINE PRODUCTION AND SALES

- 16.5. ROUNDWOOD PRODUCTION

- 16.13. VOLUME OF TIMBER EXPORTS*

- 17.4. FISHERIES EXPORTS

- 17.7. CENSUS OF FISHING 1984: GENERAL STATISTICS BY INDUSTRY MAJOR GROUP

(Including Joint Fishing Ventures)

- 19.3. CENSUS OF MANUFACTURING

- 20.5. RESIDENTIAL PRICES

- 20.15a. WORK PUT IN PLACE

- 20.15b. WORK PUT IN PLACE—continued

- 20.16. BUILDING MATERIAL PRODUCTION

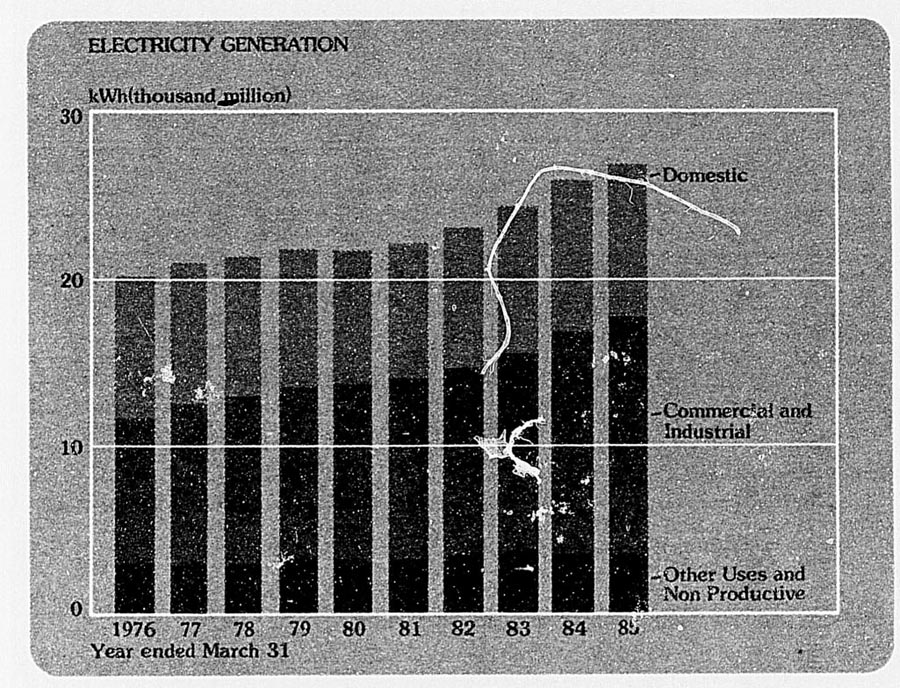

- 21.8. PUBLIC SUPPLY STATIONS

- 21.10. INCOME AND EXPENDITURE

- 21.12. GENERATION AND DISPOSAL

- 21.13. DISTRIBUTION OF POWER

- 21.14. CENSUS OF GAS

- 22.5. MOTOR SPIRITS USAGE

- 22.31. EXPENDITURE ON ROADING*

- 22.32. PUBLIC ROADING EXPENDITURE*

- 22.38. TRANSPORT TO WORK 1981

- 22.40. ARTICLES POSTED

- 22.41. OVERSEAS PARCEL POST

- 22.42. PHILATELIC SERVICES

- 22.45. POST OFFICE REVENUE 1984-85

- 22.47. POST OFFICE STAFF EMPLOYED

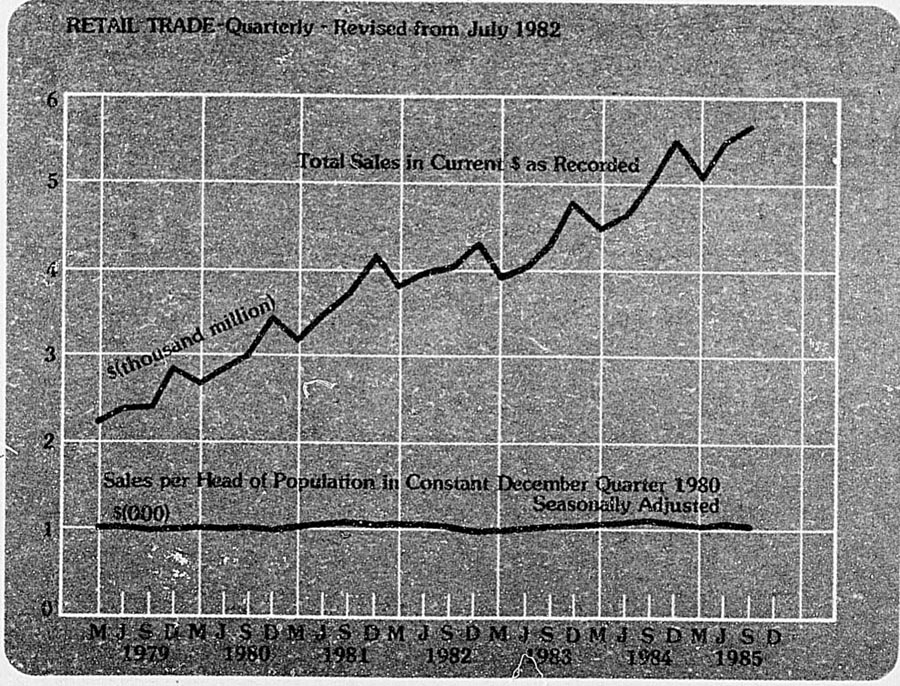

- 23.6. RETAIL TRADE SURVEY

- 23.12. HIRE PURCHASE

- 23.13. VALUE OF CREDIT CARD SALES

- 24.5. TRANS-TASMAN TRADE

- 25.3. AVERAGE RETAIL PRICES

- 26.13. PRIVATE SAVINGS BANKS

- 26.14. TRUSTEE SAVINGS BANKS

- 26.25. MONEY SUPPLY

- 26.27. OFFICIAL OVERSEAS RESERVES

- 26.35. SOURCES OF MORTGAGE FINANCE

- 26.36. RURAL BANK LOANS AUTHORISED

- 26.43. COMPANY REGISTRATIONS

- 26.45. SURVEYED COMPANY PROFITS

- 26.46. TRANSACTIONS IN BANKRUPTCY

- 26.47. BANKRUPTCY STATISTICS

- 26.53. LIFE ASSURANCE BUSINESS

- 27.13. RATES OF STAMP DUTY

- 27.14. RATES OF GIFT DUTY*

- 27.16. INCOME TAX REVENUE: SUMMARY*

- 27.17. RECEIPTS OF TAXATION

- 27.19. CUSTOMS AND EXCISE REVENUE

- 27.22. AVERAGE ESTATE DUTY ASSESSED

- 27.25. TOTALISATOR DUTY

- 27.27. INCOME OF COMPANIES

- 27.33b. INTEREST PAYMENTS

- 27.34. MATURITY YEARS OF DEBT

- 27.36a. PUBLIC DEBT TRANSACTIONS

- 28.4. INCOME TAX RATES

- 28.6. FAMILY SUPPORT

- 29.4. CAPITAL FINANCE

- 29.5. EXTERNAL TRANSACTIONS

- 29.9. INCREASE IN STOCKS

- 29.15. INDEX OF GROSS DOMESTIC PRODUCT AT CONSTANT PRICES PER LABOUR FORCE

MEMBER

(Base: 1977-78 = 100.0)

- 29.16. UNCOMMITTED EXPORTS

This 91st edition of the New Zealand Official Yearbook has been re-formatted and improved so as to increase its usefulness to readers. Several chapters have been rewritten and the layout has been altered to make items of information easier to find.

As a general reference work in the form of a printed book the Yearbook complements the other components in the integrated information service provided by the Department of Statistics. Ninety three years after the Yearbook was first published in 1893 the main objective is still the traditional one. The Yearbook still aims at giving an authoritative overview of New Zealand. It introduces general readers, both in New Zealand and overseas, to the social, economic, and cultural life, and the institutions, of New Zealand. For specialist users it contains relevant basic statistics and reference material, and also gives guidance to sources of further information. In preparing the latest edition there has been a concentration on enhancing the Yearbook's quality and effectiveness in reaching these objectives.

A great deal of detailed information about many aspects of New Zealand life is available today in addition to that in the New Zealand Official Yearbook. Information users in business, education, central and local government, special interest groups, and the public at large are now more sophisticated in their requirements. Changes in technology mean that up-to-date information is often available more quickly, and in more depth, through media other than the printed page. The Department of Statistics operates INFOS, an on-line computerised statistical information service, and produces information on microfiche and computer readable media, as well as producing a wide range of conventional printed publications which deal with specific topics in detail.

The New Zealand Official Yearbook is prepared and edited in the Department of Statistics mainly from contributions provided by other Government departments and official organisations. I would like to thank all copy contributors, departmental editorial staff, and the Government Printing Office for their excellent work in the preparation and production of the 91st edition.

S. Kuzmicich,GOVERNMENT STATISTICIAN

Wellington,September 1986.

| CML Centre | Private Bag |

| 159 Queen Street | Telephone (09) 31-055 |

| AUCKLAND | |

| Aorangi House | Private Bag |

| 85 Molesworth Street | Telephone (04) 729-119 |

| WELLINGTON | |

| MFL Building | Private Bag |

| 749 Colombo Street | Telephone (03) 793-700 |

| CHRISTCHURCH | |

| or | |

| Census of Population and Dwellings | Private Bag |

| Winchester House | Telephone (03) 793-700 |

| 64 Kilmore Street | |

| CHRISTCHURCH | |

| Norwhich Union Building | Private Bag |

| Corner Bond and Rattray Streets | Telephone (024) 777-511 |

| DUNEDIN |

The Department of Statistics has an enquiries desk at every office. In answer to a letter, visit, or telephone call, “Enquiries” can provide statistical information, or tell you more about the department's other services, including access to statistics on the INFOS computer database.

This edition of the New Zealand Official Yearbook gives the latest information available on 1 January 1986, although some items may be more recent. When the sources of data on topics outside the Department of Statistics, the Yearbook identifies them. Enquiries for more details, or later information about those topics should go to the sources mentioned.

Every chapter in the Yearbook finishes with a section which lists titles containing further information. At the back of the book there is a reading list “Books about New Zealand”. There is also a list of some publications issued by the Department of Statistics at the back of the book and the Department will send you its full Publications Catalogue free on request.

The following symbols are used throughout:

| x | revised figure or figures. |

| - | nil or zero. |

| . . | figures not available. |

| not yet available—space left blank. | |

| … | not applicable. |

| .. | amount too small to be expressed. |

| P | provisional |

Figures are often rounded off to the nearest thousand or some other convenient unit. Sometimes this rounding off results in tables with totals which disagree slightly with the total of the individual items shown.

The 1981 Census of Population and Dwellings statistics contained in this publication have been subject to a process of random rounding, whereby all cell values, including row and column totals, have been rounded. Individual figures will therefore not necessarily sum to give the stated totals.

Weights and measures, and a Glossary of statistical terms used, are given at the back of the book.

Table of Contents

New Zealand lies in the south-west Pacific Ocean and consists of 2 main, and a number of smaller islands, whose combined area of 268 000 square kilometres is similar to the size of Japan or the British Isles.

The main North and South Islands are separated by Cook Strait, which is relatively narrow. They lie on an axis running from north-east to south-west, except for the low-lying Northland peninsula. The administrative boundaries of New Zealand extend from 33 degrees to 53 degrees south latitude, and from 162 degrees east to 173 degrees west longitude. In addition to the main and nearby islands, New Zealand also includes the following small inhabited outlying islands: the Chatham Islands, 850 kilometres east of Christchurch; Raoul Island in the Kermadec Group, 930 kilometres north east of the Bay of Islands; and Campbell Island, 590 kilometres south of Stewart Island. New Zealand also has jurisdiction over the territories of Tokelau and the Ross Dependency, which are described in chapter 4.

Table 1.1. LAND AREA OF NEW ZEALAND*

| SquareKilometres | |

|---|---|

* As at 11 March 1986. Includes the islands comprising Great Barrier Island County and Waiheke County. Source: Department of Lands and Survey. | |

| North Island† | 114,669 |

| Nearby islands | 69 |

| South Island | 149,883 |

| Nearby islands | 4 |

| Stewart Island | 1,746 |

| Chatham Islands | 963 |

| Outlying islands | 778 |

| Total | 268 112 |

New Zealand is more than 1600 kilometres long and 450 kilometres wide at its widest part, and has a long coastline for its area. The coast is very indented in places, providing natural harbours.

New Zealand is also very mountainous, with less than a quarter of the land below 200 metres. In the North Island the main ranges run generally south-west, parallel to the coast, from East Cape to Cook Strait, with further ranges and 4 volcanic peaks to the north-west. The South Island is much more mountainous than the North Island. A massive mountain chain, the Southern Alps, runs almost the length of the island. There are many outlying ranges to the Southern Alps in the north, and the south-west of the South Island. There are at least 223 named peaks higher than 2300 metres. There are also 360 glaciers in the Southern Alps. The largest are, on the east, the Tasman (length 29 kilometres), Murchison (17 kilometres), Mueller (13 kilometres), Godley (13 kilometres) and the Hooker (11 kilometres), and, on the west, the Fox (15 kilometres) and the Franz Josef (13 kilometres).

Table 1.2. PRINCIPAL MOUNTAINS

| Mountain or Peak | Height (metres) |

|---|---|

* Since 1985 both the Maori and European names of this mountain have had official recognition. † Peaks over 3000 metres. Source: Department of Lands and Survey. | |

| North Island— | |

| Ruapehu | 2,797 |

| Taranaki, or Egmont* | 2,518 |

| Ngauruhoe | 2,290 |

| Tongariro | 1968 |

| South Island†— | |

| Southern Alps— | |

| Cook | 3,764 |

| Tasman | 3,497 |

| Dampier | 3,440 |

| Silberhorn | 3,279 |

| Lendenfeldt | 3,201 |

| Mt Hicks (St David's Dome) | 3,183 |

| Torres | 3,163 |

| Teicheimann | 3,160 |

| Sefton | 3,157 |

| Malte Brun | 3,155 |

| Haast | 3,138 |

| Elie de Beaumont | 3,117 |

| Douglas Peak | 3,085 |

| La Perouse | 3,079 |

| Heidinger | 3,066 |

| Minarets | 3,055 |

| Aspiring | 3,027 |

| Glacier Peak | 3,007 |

New Zealand's rivers are mainly swift and difficult to navigate. They are important as sources of hydro-electric power and many artificial lakes have been created as part of major hydro-electric schemes. New Zealand also has numerous natural lakes of great scenic beauty.

Table 1.3. PRINCIPAL RIVERS*

| River | Length (kilometres) |

|---|---|

* Over 150 kilometres in length from the mouth to the farthest point in the river system irrespective of name, including estimated courses through lakes. Source: Department of Lands and Survey. | |

| North Island— | |

| Flowing into the Pacific Ocean— | |

| Waihou | 175 |

| Rangitaiki | 193 |

| Mohaka | 172 |

| Ngaruroro | 154 |

| Flowing into the Tasman Sea— | |

| Manawatu | 182 |

| Rangitikei | 241 |

| Whangaehu | 161 |

| Wanganui | 290 |

| Mokau | 158 |

| Waikato | 425 |

| South Island— | |

| Flowing into Cook Strait— | |

| Wairau | 169 |

| Flowing into the Pacific Ocean— | |

| Clarence | 209 |

| Waiau-uha | 169 |

| Waimakariri | 161 |

| Waitaki | 209 |

| Taieri | 288 |

| Clutha | 322 |

| Flowing into Foveaux Strait— | |

| Mataura | 240 |

| Oreti | 203 |

| Waiau | 217 |

| Flowing into the Tasman Sea— | |

| Buller | 177 |

Table 1.4. PRINCIPAL LAKES*

| Lake | Area Square Kilometres |

|---|---|

* Over 20 square kilometres in area. Source: Department of Lands and Survey. | |

| North Island— | |

| Taupo | 606 |

| Rotorua | 80 |

| Rotoiti | 34 |

| Tarawera | 36 |

| Waikaremoana | 54 |

| Wairarapa | 80 |

| South Island— | |

| Rotoroa | 23 |

| Brunner | 39 |

| Coleridge | 36 |

| Tekapo | 88 |

| Pukaki | 169 |

| Ohau | 61 |

| Hawea | 141 |

| Wanaka | 193 |

| Wakatipu | 293 |

| Te Anau | 344 |

| Manapouri | 142 |

| Monowai | 31 |

| Hauroko | 71 |

| Poteriteri | 47 |

| Ellesmere | 181 |

| Aviemore (artificial) | 29 |

| Mahinerangi (artificial) | 21 |

| Benmore (artificial) | 75 |

New Zealand lies in an area of the world that is characterised by active volcanoes and frequent earthquakes. The ring of fire, as this area is known, forms a belt that surrounds the Pacific Ocean and is the surface expression of a series of boundaries between the plates that make up the surface of the earth. Plate tectonics is a theory that is used to explain the fundamental geological features of the earth. According to the theory the crust of the earth is made up of a series of plates, rather like a jigsaw puzzle. Although these surface plates are rigid, the rocks of the underlying layer of the earth, its upper mantle, are partially molten. This provides the convection mechanism for movement of the overlying plates. Over millions of years these plates have moved in relation to each other, colliding together, pulling apart, or sometimes sliding past each other. Because the boundary between the Indian-Australian plate and the Pacific plate runs through New Zealand, the processes resulting from their collision have had a profound effect on New Zealand's geology. When 2 plates collide, one is pushed beneath the other in a process known as subduction. The zones of subduction are defined by 2 deep sea trenches to the north and south of New Zealand, which are connected by the Alpine Fault. The size, shape and geology of New Zealand reflects the long process of construction and deformation along this plate boundary.

Rock types. The interplay of earth movements and erosion has created the sedimentary rocks that cover almost three-quarters of New Zealand. With erosion of the land, sand, mud, gravel and other debris was carried out to sea, where it accumulated in great thicknesses to form rocks such as sandstone, mudstone, greywacke and conglomerate. The shells and skeletons of sea creatures also accumulated and formed thick layers of limestone. Most sedimentary rocks are formed in near horizontal layers called strata. Earth movements later raised the rocks above the sea to form land, and the strata were in many places tilted and folded by pressure. Seas advanced and retreated over the New Zealand area many times and the sedimentary rocks represent almost every geological period since the Cambrian (see time scale). Their age is revealed by the fossils they contain as well as by various radioactive techniques.

As well as the sedimentary rocks of various ages, New Zealand incorporates in its complex structure metamorphic rocks, (schist, gneiss and marble) and intrusive igneous rocks, (granite, gabbro, diorite and serpentine). Many of these metamorphic and intrusive igneous rocks are hundreds of millions of years old. The metamorphic rocks were developed by the action of heat and pressure on the thick sediments (up to tens of thousands of metres) deposited in huge elongated sea basins (geoclines), which continued to sink as the deposits accumulated. When these sediments were slowly compressed during major mountain-building episodes the deeper sediments were subjected to great pressures and shearing stress, which caused new minerals and structures to develop, changing the sediments into metamorphic rocks. The granites and other intrusive rocks are characterised by large crystals, and have a course grained texture. They are usually considered to have intruded into the outer crust in a molten state during mountain-building; some, however, may result from intense metamorphism of sediments.

Volcanic rocks, (basalt, andesite, rhyolite and ignimbrite) are the products of many volcanic eruptions that have characterised New Zealand's geological history. The most recognisable volcanoes in New Zealand now occur in the North Island, where a number are active. They include those in Tongariro National Park, White Island and Mount Tarawera. Others such as Mount Taranaki (or Egmont), and Rangitoto may be considered dormant at present although they are still regarded as significant hazards. Sporadic episodes of volcanic activity have also occurred in the South Island with Timaru, Lyttelton, Oamaru and Dunedin ail having basaltic volcanoes less than 13 million years old.

Geological history. The oldest rocks in New Zealand are found in Nelson, Westland and Fiordland. They were formed in the Paleozoic era, most perhaps as long as 570 million years ago, but some in Westland may be older. They include thick, geoclinal sedimentary rocks which suggests that to yield the great volume of sediments a large landmass existed nearby at that time, but little has been deduced about its shape or position.

The history of the later part of the Paleozoic era, and the Mesozoic era, is rather better understood. For a vast span of time from the Carboniferous period, probably until the early Cretaceous period, an expensive geocline occupied the New Zealand region. At first, during much of the late Paleozoic, huge quantities of submarine lava and volcanic ash were included in the materials that accumulated in the geocline. In the later Permian and Mesozoic times the sediments were mainly sand and mud, probably derived from some landmass west of present New Zealand. These rocks have been compacted into hard greywacke (a type of sandstone), and argillite (hard, dark mudstone).

Table 1.5. GEOLOGICAL TIMESCALE

| Eras | Periods | Approximate Time Since Periods Began (Years) | |

|---|---|---|---|

| Source: DSIR. | |||

| Cenozoic | Holocene (Recent) | Quanternary | 10 thousand |

| Pleistocene | 2 million | ||

| Pliocene | Tertiary | 6 million | |

| Miocene | 24 million | ||

| Oligocene | 38 million | ||

| Eocene | 53 million | ||

| Paleocene | 65 million | ||

| Mesozoic | Cretaceous | 135 million | |

| Jurassic | 190 million | ||

| Triassic | 238 million | ||

| Paleozoic | Permian | 300 million | |

| Carboniferous | 350 million | ||

| Devonian | 405 million | ||

| Silurian | 435 million | ||

| Ordovician | 500 million | ||

| Cambrian | 570 million | ||

In the early Cretaceous period one of the main mountain-building episodes in New Zealand's history took place. Although geoclinal sedimentation continued through the Cretaceous period in eastern New Zealand, elsewhere the geocline was compressed, and the sediments were intensely crumpled, broken and raised above the sea, probably forming a large, mountainous landmass. Some of the geoclinal sediments, now exposed over much of Otago, alpine Westland, and parts of the Marlborough Sounds, were metamorphosed into schist and gneiss by high temperatures and the tremendous deforming pressures to which the geocline was subjected. This intense folding of the strata occurred approximately 100 million years ago in the mid-Cretaceous period. Slowly the mountains were eroded and gradually a land of low relief was produced. The sea gradually advanced over the worn down stumps of the Mesozoic mountains, beginning its transgression earlier in some areas than in others. In the early Cretaceous period it began to submerge the land in the region of present North Auckland and the eastern margins of the North and South Islands, and thick deposits of mudstone and sandstone accumulated in some of these areas. At the close of the Mesozoic era, and in the very early Tertiary era, the land became so reduced in size that little sediment was formed, and only comparatively thin deposits of bentonitic and sulphurous muds, and fine, white foraminiferal limestone accumulated. During this time, New Zealand's main coal deposits accumulated in swamps on the surface of the old land. These became buried by marine deposits as the sea continued its transgression in the Eocene period. By the Oligocene period most of the land was submerged, and in shallow waters free of land sediments, thick deposits of shell and foraminiferal limestone accumulated. Scattered remnants of this Oligocene limestone are used for most of New Zealand's cement and agricultural lime.

After the Oligocene submergence, earth movements became more vigorous; many ridges rose from the sea as islands, and sank or were worn down again; sea basins formed and were rapidly filled with sediments. New Zealand's late Tertiary environment has been described by Sir Charles Fleming (Tuatara, June 1962) as follows: “The pattern of folds, belts and troughs that developed was on a finer scale than in the Mesozoic ... the land moved up and down as a series of narrow, short, interfingering or branching folds. ... We can think of Tertiary New Zealand as an archipelago ... a kind of writhing of part of the mobile Pacific margin seems to have gone on.” The thick deposits of soft grey sandstone and mudstone that now make up large areas of the North Island and some parts of the South Island, are the deposits that accumulated in the many sea basins that developed in the later Tertiary.

Recent geological history. Late in the Cenozoic era, in the Pliocene and Pleistocene periods, another great episode of mountain-building took place. Earth movements became intense, and slowly pushed up the Southern Alps and New Zealand's other main mountain chains. It was during this period that the general size and shape of the present islands of New Zealand was determined. Much of the movement during this mountain-building period (the Kaikoura Orogeny) took the form of displacement of blocks of the Earth's crust along fractures called faults. The total movement of the Earth blocks adjacent to major faults amounted to thousands of metres. It must have been achieved very slowly, probably by innumerable small movements, each less than a few metres. The blocks adjacent to “transcurrent” faults moved both vertically and laterally along the faults. The New Zealand landscape today in some regions shows well preserved, tilted fault blocks bounded by fault scarps (steep faces hundreds or even thousands of metres high). From Milford Sound to Cook Strait, an almost unbroken depression, formed by river valleys, and low saddles on the intervening ridges marks the site of New Zealand's Alpine Fault. Contrasting rock types occur on either side of the fault. This is exemplified by the separation by 480 kilometres of a Permian ophiolite, an association of igneous rocks, which occurs in Nelson and Western Otago. Fault movements continue to the present day and have accompanied several major earthquakes of the past century. Many minor but revealing landscape features, such as scarplets or offset ridges, or streams, show where the movement has been occurring over recent centuries.

Erosion has eaten into the landscape forms during this time, carving detailed pattern's of peaks, ridges, valleys and gorges. The deposition of the debris has built up alluvial plains, shingle fans and other construction forms. At the coast, waves have driven back the headlands and built beaches, spits and bars. The late Pleistocene glaciers carved the fiords of Fiordland and the valleys occupied by most of the South Island lakes; there were small glaciers also on Ruaphehu, where remnants survive, on Mount Taranaki and the Tararua Range. Sea-level changes accompanied the formation and later melting of the glacial ice, affecting the erosion and deposition of the rivers and thus being responsible for the formation of many prominent river terraces.

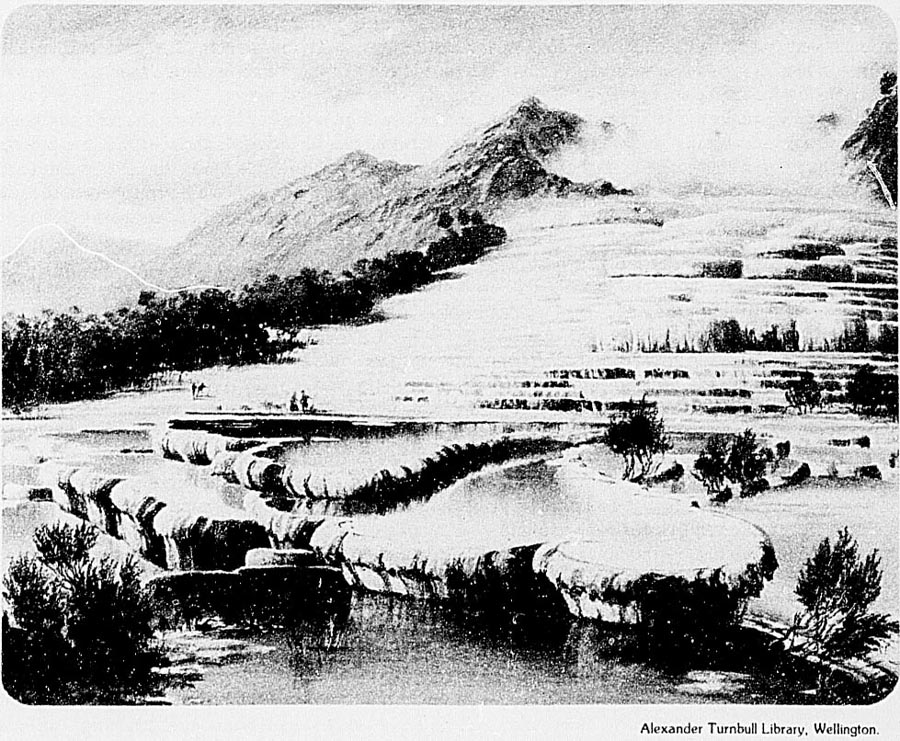

Volcanic activity of the past few million years has played an important part in shaping the landscape. “Banks Peninsula, a twin volcanic dome in Canterbury, also achieved much of its growth then. The largest volcanic outpourings of late geological times in New Zealand has been in the region between Tongariro National Park and the Bay of Plenty coast; andesite lava, scoria, and ash were erupted in the Pleistocene period and later, to build the volcanoes, Ruapehu, Tongariro, and Ngauruhoe. More than 8000 cubic kilometres of molten rhyolitic magma was erupted in the form of ignimbrite pumice and rhyolite lava, building up the Volcanic Plateau, which is one of the largest and youngest accumulations of acid volcanic rocks in the world. Mount Taranaki is an andesitic stratovolcano, with the remnants of 3 other volcanic cones nearby; all are of Pleistocene age. In the Waikato there are eroded Pleistocene cones of andesitic composition associated with a number of alkaline eruptive centres. The largest is Pirongia, a basaltic andesite cone some 900 metres high. Auckland city and the area just south has been the scene of many eruptions of basalt lava and scoria in Pleistocene and Holocene times, and many small scoria cones can be seen there. Late Tertiary and Quaternary basaltic eruptions in North Auckland have built lava plateaus and many young cones. From these volcanic outpourings some valuable mineral resources have been derived. The ironsands mined on the west coast of the North Island are concentrations of magnetite and ilmenite, which have been eroded out of the volcanic rocks.

Compared with some other parts of the almost continuous belt of earthquake activity around the rim of the Pacific such as Japan, Chile, and the Philippines, the level of seismic activity in New Zealand is moderate, although earthquakes are common. It may be roughly compared with that prevailing in California. A shock of Richter magnitude 6 or above occurs on the average about once a year, a shock of magnitude 7 or above once in 10 years, and a shock of about magnitude 8 perhaps once a century, but in historic times only 1 shock (the south-west Wairarapa earthquake in 1855) is known to have reached this magnitude.

Other natural disasters and accidents are together responsible for more casualties than earthquakes, the most serious seismic disasters in New Zealand having been the Hawke's Bay earthquake of 1931 in which 256 deaths occurred, and the Buller earthquake of 1929 in which there were 17 deaths. The total resulting from all other shocks since 1840 is less than 15 deaths. The last earthquake to cause deaths occurred at Inangahua in 1968, when 3 people died.

The process of earthquake occurrence is understood in terms of a large volume of the Earth's crust being subjected to strain by the relentless movement of the great plates of the Earth's surface against each other. The strain eventually exceeds the strength of the rock, which ruptures. Energy is radiated outwards in the form of elastic waves, which can be felt at places near the origin, and detected by sensitive instruments at greater distances. In large shallow earthquakes the rupture may appear at the surface, forming or renewing movement on a geological fault. In regions where the majority of earthquakes are very shallow, such as California, there is a tendency for the earthquake origins to cluster near geological fault traces, but in regions of deeper activity, such as New Zealand, this is not so. There is little activity near the Alpine Fault, which stretches for some 500 kilometres from Milford Sound to Lake Rotoiti, and is considered one of the world's largest and most active faults.

Within New Zealand at least 2 separate systems of seismic activity can be distinguished. The Main Seismic Region covers the whole of the North Island except the Northland peninsula, and the part of the South Island north of a line passing roughly between Banks Peninsula and Cape Foulwind. The Southern, or Fiordland, Seismic Region includes southern Westland, western Southland, and western Otago. Less clearly defined activity covers the remainder of the 2 main islands, and extends eastwards from Banks Peninsula to include the Chatham Islands.

Shallow earthquakes, which are the most numerous, originate within the Earth's crust, which in New Zealand has an average thickness of some 35 kilometres. These shocks are responsible for almost all damage to property, and are widely scattered throughout the country. In historically recent times, the Main and Fiordland Seismic Regions have been significantly more active than the rest of New Zealand, but neither the Central Seismic Region, which lies between them nor the Northern peninsula has been free from damaging shocks. The details of the present pattern are not necessarily unchanging, and could alter significantly after the occurrence of a major earthquake. Because of this, because of the broader geographical setting, and because of the distance to which the effects of a large earthquake extend, it would be highly imprudent to treat any part of New Zealand as completely free from the risk of serious earthquake damage.

Many active regions of the Earth have only shallow earthquakes, but in others shocks have been known to occur at depths as great as 700 kilometres below the surface. It is thought that these deep shocks originate within the edges of crustal plates that have been drawn down or thrust beneath their neighbours. Such deep events are common in both the Main and Fiordland Seismic Regions of New Zealand, but their relative positions with respect to the shallow activity and to other geophysical features are rough mirror images. This is believed to indicate that in the North Island, the edge of the Pacific Plate lies below that of the Indian Plate, while in the south of the South Island the Pacific Plate is uppermost and the Indian Plate has been thrust beneath it.

The most important system of deep shocks in New Zealand lies in a well-defined zone beneath the Main Seismic Region, stretching from the Bay of Plenty to Nelson and Marlborough. The maximum depth of occurrence is about 400 kilometres at the northern end, and decreases evenly to a depth of about 200 kilometres before the southern boundary of the region is reached. Along the whole of the system, there is also a regular decrease in depth from west to east. In northern Taranaki, near the western limit of this activity, a small isolated group of shocks at a depth of about 600 kilometres has also been recorded. In the Central Seismic Region only shallow shocks are known. The maximum depth of earthquakes appears to be less than 150 kilometres in the Fiordland Region where the deep activity is more concentrated than in the north, lying close to Lakes Te Anau and Manapouri.

Both earthquakes and volcanoes are found in geophysically disturbed regions, but large earthquakes are rare, although small earthquakes usually accompany volcanic eruptions. Regions of active volcanism are also subject to periodic outbreaks of small earthquakes, all of similar magnitude, and very numerous, known as “earthquake swarms”. Although the number of shocks may cause alarm, it is unusual for even minor damage to result. There is not often a simultaneous volcanic outbreak, but swarms are rare in non-volcanic regions. In New Zealand they have occurred in the volcanic zone that includes Mount Ruapehu and White Island, the Coromandel Peninsula, parts of Northland, and Taranaki.

Earthquakes are recorded by more than 30 seismographs in New Zealand, and others throughout the south-west Pacific as far north as Western Samoa and south as the Antarctic. The network records small earthquakes in New Zealand and large earthquakes anywhere in the world. After analysing the records obtained, seismologists can not only determine the epicentres and focal depths of local earthquakes, but also, in supplying data to international data centres, make a valuable contribution to worldwide studies of earthquake occurrence, earthquake mechanism, and the structure of the Earth. The passage of earthquake waves through the Earth is the prime means of sounding its deep interior.

Seismological research in New Zealand falls into the following areas: Studies of the earthquake source and the process of earthquake occurrence (Details of the records produced by seismographs are used to infer the character of the rupture process at the earthquake source. These studies use not only locally recorded seismograms but also others from greater distances. The possibility of earthquake prediction is also being investigated.); The use of earthquakes as a tool to determine the structure of the Earth (Detailed maps of earthquake epicentres and vertical cross-sections of earthquake regions are used to infer the structure of the New Zealand area. Accurate measurements of the velocity of seismic waves provide constraints on this structure.); Estimation of the severity of the hazard presented by earthquake activity (The history of earthquake occurrence provides estimates of likely future activity, when analysed together with geological evidence of faulting. This estimate of hazard is done on both a national scale and for specific sites.); The use of earthquake recording equipment to detect underground nuclear explosions (The seismograph station in Rarotonga is well placed to record underground explosions at Mururoa in the Tuamotu Archipelago. Larger tests are also recorded in New Zealand. Yields are estimated on the basis of experience with previous tests.).

New Zealand lies in the mid-latitude zone of westerly winds, in the path of an irregular succession of anticyclones, which migrate eastwards every 6 to 7 days. The centres of these anticyclones generally track across the North Island, more northerly paths being followed in spring, and southerly paths in autumn and winter. Anticyclones are areas of descending air, and settled weather, with little or no rain, which may bring clear skies, or low cloud and fog. Between the anticyclones are troughs of low pressure, which extend northwards from low pressure depressions moving eastwards far to the south of New Zealand. Within these troughs there are often cold fronts, oriented northwest to south-east, which produce one of the commonest types of weather sequence over the country: as the front approaches from the west, north-westerly winds become stronger and cloud increases, followed by a period of rain for several hours as the front passes over, and then a change to cold showery south-westerly winds.

The presence of an axial mountain chain extending the length of the country has a major effect on the climate of its various regions, and produces much sharper climatic contrasts from west to east, than from north to south. In some inland areas of the South Island, just east of the mountains, the climate is distinctly 'continental' in character, with large daily and seasonal temperature extremes, despite the fact that no part of the country is more than 130 kilometres from the sea. Ophir in Central Otago has the greatest temperature range of 55°C.

Winds. The prevailing wind direction is westerly, although in individual months easterlies may predominate, and north of Taranaki the general flow is south-westerly. In the North Island winds generally decrease for a period in the summer or early autumn, but in many parts of the South Island July and August are the least windy months. The blocking effect of the mountain ranges modifies the westerly wind pattern. Wind strength decreases on the western side, but increases through Cook Strait. Foveaux Strait, and about the Manawatu Gorge. Air is also forced upwards over the ranges, which results in a warm drying (föhn) wind in the lee areas to the east of both islands. Wellington averages 173 days a year with wind gusts greater than about 60 kilometres per hour, compared with 30 for Rotorua, 31 for Timaru, and 35 for Nelson. Sea breezes are the predominant winds in summer in many coastal places, such as Canterbury, where the north-easterlies are almost as frequent as the predominant south-westerlies.

Rainfall. The distribution of rainfall is mainly controlled by mountain features, and the highest rainfalls occur where the mountains are exposed to the direct sweep of the westerly and north-westerly winds. The mean annual rainfall ranges from as little as 300 millimetres in a small area of Central Otago to over 8000 millimetres in the Southern Alps. The average for the whole country is high, but for the greater part lies between 600 and 1500 millimetres. The only areas with average rainfalls under 600 millimetres are found in the South Island to the east of the main ranges, and include most of Central and North Otago, and South Canterbury. In the North Island, the driest areas are central and southern Hawke's Bay, Wairarapa, and Manawatu, where the average rainfall is 700-1000 millimetres a year. Of the remainder, much valuable farm land, chiefly in northern Taranaki and Northland, has upwards of 1500 millimetres. Over a considerable area of both islands rainfall exceeds 2500 millimetres a year. For a large part of the country the rainfall is spread evenly through the year. The greatest contrast is found in the north, where winter has almost twice as much rain as summer. However, predominance of winter rainfall diminishes southwards: it is still discernible over the northern part of the South Island, but over the southern half, winter is the season with least rainfall, and a definite summer maximum is found inland due to the effect of convectional showers. Rainfall is also influenced by seasonal variations in the strength of the westerly winds. Spring rainfall is increased west of, and in, the ranges as the westerlies rise to their maximum about October, with a complementary decrease of rainfall in the lee of the ranges. Areas which are exposed to the west and south-west experience much showery weather, and rain falls on roughly half the days of the year. Over most of the North Island there are at least 130 rain days a year (days with at least 1.0 millimetre of rain)—except to the east of the ranges where in places there are fewer than 110 rain days. Those areas of the South Island with annual rainfall under 600 millimetres generally have about 80 rain days a year. In the far south the frequency of rain increases sharply, rain days exceeding 200 a year in Stewart Island and Fiordland. On the whole the seasonal rainfall does not vary greatly from year to year, its reliability in spring being particularly advantageous for agriculture. It is least reliable in late summer and autumn, when very dry conditions may develop east of the ranges, particularly in Hawke's Bay. The highest daily rainfall on record is 582 millimetres, which occurred at Rapid Creek (Hokitika), where the mean annual rainfall exceeds 6000 millimetres.

Areas with a marked lower annual rainfall can be subject to very heavy daily falls: such areas are found in northern Hawke's Bay and north-eastern districts in the Auckland province. By contrast, in the Manawatu district, Otago, and Southland, daily falls reaching 80 millimetres are very rare.

Temperature. Mean temperatures at sea level decrease steadily southwards from 15°C in the far north to 12°C in the south of the South Island. Temperatures also drop, by about 2°C per 300 metres, with altitude. January and February, with approximately the same mean temperature, are the warmest months of the year, and July is the coldest. Highest temperatures are recorded east of the main ranges, where they exceed 30°C on a few afternoons in most summers. The extremes for New Zealand are 42°C. which has been recorded in 3 places, at Awatere Valley (Marlborough), Christchurch, and Rangiora (Canterbury); and —19°C at Ophir (Central Otago). The annual range of mean temperature (the difference between the mean temperature of the warmest and coldest months) is small. In Northland and in western districts of both islands it is about 8°C and for the remainder of the North Island and east coast districts of the South Island it is 9° to 10°C. Further inland the annual range exceeds 11°C in places, reaching a maximum of 14°C in Central Otago, where there is an approach to a 'continental' type of climate.

Sunshine. The sunniest places are near Blenheim, the Nelson-Motueka area, and Whakatane, where the average duration of bright sunshine exceeds 2350 hours a year. The rest of the Bay of Plenty and Napier are only slightly less sunny. A large portion of the country has at least 2000 hours, and even Westland, despite its high rainfall, has 1800 hours. Southland and coastal Otago, where sunshine drops sharply to about 1700 hours a year, lie on the northern fringe of a broad zone of increasing cloudiness. A pleasant feature of the New Zealand climate is the high proportion of sunshine during the winter months, although there is a marked increase in cloudiness in the North Island in winter, but little seasonal change in the South Island, except in Southland.

Hail, thunderstorms, and tornadoes. The number of severe hailstorms reported annually over the whole country averages 9, but this figure varies yearly from 4 to 20. Severe hailstorms occur widely throughout the country, but the areas most affected are Canterbury, the low country of central Hawke's Bay, and a small area south and west of Nelson. Most of the hailstones are small, but occasionally larger stones cause local damage to glasshouses and orchards. Thunderstorms are not numerous. Their frequency is greatest in the north and western side of the country where thunder is heard on 15 to 20 days a year. On the east coast of the South Island the average is commonly less than 5. Tornadoes show a similar pattern to thunderstorms except maximum frequency occurs in the Waikato and Bay of Plenty. An average of about 20 tornadoes and waterspouts is reported each year, but most of these are small.

Frost and snow. Local variations in frostiness are considerable, even within quite small areas. For example, at Albert Park, Auckland, the screen minimum thermometer has registered below 0°C only once in 65 years, while further up the harbour at Whenuapai aerodrome there are on average 8 screen frosts per annum. Favourable sites in coastal areas of Northland are free of frost, although further inland light frosts occur frequently in the winter months. Excluding the uninhabited mountainous areas, the coldest winter conditions are experienced in Central Otago, the Mackenzie Plains of inland Canterbury, and on the central plateau of the North Island, but even in these areas night temperatures as low as −12°C are rarely recorded. Elsewhere over the North Island the winters are very mild, and in both Islands sheep and cattle remain in the open all year round.

The North Island has a small permanent snow field above 2500 metres on the central plateau, but the snow line rarely descends below 600 metres even for brief periods in winter. In the South Island snow falls on a few days a year in eastern coastal districts, where in some years it may lie for a day or two even at sea level, but in Westland it does not lie at sea level. The snow line on the Southern Alps is about 2000 metres in summer, being slightly lower on the western side where the Franz Josef and Fox Glaciers descend through heavy bush to within 300 metres of sea level. In inland Canterbury and Otago, where there are considerable areas of grazing lands above 300 metres, snowfalls are heavier and more persistent, and have caused serious sheep losses during severe winters. In that area, however, it is rare for the winter snow line to remain below 1000 metres for extended periods.

Relative humidity. Humidity is commonly between 70 and 80 percent in coastal areas and about 10 percent lower inland. The daily variation is greater than the difference between summer and winter. Very low humidity (from 30 percent down to 5 percent) occurs at times in the lee of the Southern Alps, where the föhn wind (the Canterbury nor-wester) is often very marked. Cool south-westerlies are also at times very dry when they reach eastern districts. In Northland the humid mid-summer conditions are inclined to be oppressive, although temperatures rarely reach 30°C. Dull, humid spells are generally not prolonged anywhere, but their frequency shows a marked increase in the south.

Table 1.6. SUMMARY OF CLIMATE OBSERVATIONS TO 1980, RAINFALL, FROST AND SUNSHINE

| Station | Height | Rainfall | Screen Frost† | Ground Frost‡ | Bright Sunshine | |

|---|---|---|---|---|---|---|

| Annual | Rain Days* | |||||

* A rain day is one when 1.0 mm or more of rain was recorded in the screen (at 1.3 metres above ground) falls below 0°C. thermometer (25 mm above short grass) reads −1.0°C or lower. † A screen (or air) frost occurs when the temperature ‡ A ground frost occurs when the grass minimum Source: New Zealand Meteorological Service. | ||||||

| (metres) | (mm) | (no. days) | (no. days) | (hours) | ||

| Kaitaia Airport | 80 | 1,418 | 138 | 0 | 1.7 | 2,113 |

| Kerikeri | 73 | 1,682 | 135 | 1.0 | 24.9 | 2,004 |

| Dargaville | 20 | 1,248 | 149 | 5.0 | 16.8 | 1,956 |

| Auckland (Albert Park) | 49 | 1,185 | 140 | 0 | 4.2 | 2,102 |

| Tauranga Airport | 4 | 1,349 | 118 | 5.3 | 56.9 | 2,277 |

| Hamilton (Ruakura) | 40 | 1,201 | 131 | 25.5 | 71.8 | 2,006 |

| Rotorua Airport | 287 | 1,491 | 123 | 21.2 | 56.9 | .. |

| Gisborne Airport | 4 | 1,058 | 113 | 6.8 | 40.7 | 2,204 |

| Taupo | 376 | 1,178 | 122 | 37.1 | 71.4 | 2,021 |

| Taumarunui | 171 | 1,443 | 140 | 34.7 | 64.7 | 1,704 |

| New Plymouth Airport | 27 | 1,529 | 144 | 2.0 | 12.8 | 2,165 |

| Waiouru | 823 | 1,048 | 137 | 65.1 | 100.6 | .. |

| Napier | 2 | 824 | 95 | 8.8 | 38.6 | 2,245 |

| Wanganui | 22 | 906 | 115 | 3.5 | 10.7 | 2,087 |

| Palmerston North (DSIR) | 34 | 995 | 126 | 13.5 | 54.4 | 1,794 |

| Masterton (Waingawa) | 114 | 971 | 124 | 31.4 | 89.1 | 2,004 |

| Wellington (Kelburn) | 126 | 1,240 | 125 | 0 | 15.0 | 2,019 |

| Nelson Airport | 2 | 986 | 99 | 37.7 | 89.7 | 2,397 |

| Blenheim | 4 | 642 | 81 | 38.5 | 86.1 | 2,447 |

| Westport Airport | 2 | 2,192 | 168 | 1.0 | 39.3 | 1,925 |

| Hanmer Forest | 387 | 1,163 | 114 | 81.7 | 139.5 | 1,898 |

| Christchurch | 7 | 666 | 87 | 35.7 | 88.7 | 1,974 |

| Hokitika Airport | 39 | 2,783 | 168 | 16.0 | 56.4 | 1,846 |

| Lake Tekapo | 683 | 597 | 72 | 100.1 | 175.8 | 2,217 |

| Timaru | 17 | 587 | 81 | 37.9 | 87.8 | 1,869 |

| Queenstown | 329 | 805 | 92 | 50.3 | 140.7 | 1,921 |

| Alexandra | 141 | 343 | 65 | 86.2 | 154.0 | 2,064 |

| Dunedin (Musselburgh) | 2 | 784 | 120 | 9.7 | 77.7 | 1,676 |

| Gore | 72 | 836 | 136 | 43.7 | 100.2 | 1,698 |

| Invercargill Airport | 0 | 1037 | 157 | 46.3 | 111.1 | 1,621 |

| Milford Sound | 3 | 6,267 | 182 | 28.5 | 56.1 | .. |

Table 1.7. SUMMARY OF CLIMATE OBSERVATIONS TO 1980, AIR TEMPERATURE

| Mean Daily* | Daily Maximum | Daily Minimum | Extremes (annual) | |||||

|---|---|---|---|---|---|---|---|---|

| January | July | January | July | January | July | max. | min. | |

* The mean daily temperature is the average of the maximum and minimum temperature for a given day. Source: New Zealand Meteorological Service. | ||||||||

| Degrees Celsius | ||||||||

| Kaitaia Airport | 19.3 | 11.7 | 23.8 | 15.2 | 14.8 | 8.1 | 30.5 | -0.5 |

| Kerikeri | 18.9 | 10.8 | 24.5 | 15.5 | 13.3 | 6.1 | 34.3 | -2.0 |

| Dargaville | 18.6 | 10.7 | 23.4 | 14.9 | 13.7 | 6.5 | 32.1 | -5.0 |

| Auckland (Albert Park) | 19.4 | 10.9 | 23.1 | 14.1 | 15.7 | 7.8 | 32.4 | -0.1 |

| Tauranga Airport | 18.5 | 9.3 | 23.6 | 14.1 | 13.3 | 4.5 | 33.3 | -5.3 |

| Hamilton (Ruakura) | 17.8 | 8.3 | 23.9 | 13.5 | 11.6 | 3.1 | 34.7 | -9.9 |

| Rotorua Airport | 17.6 | 7.5 | 22.8 | 11.9 | 12.4 | 3.0 | 29.8 | -5.7 |

| Gisborne Airport | 18.7 | 9.1 | 24.4 | 13.8 | 13.0 | 4.4 | 38.1 | -3.4 |

| Taupo | 17.3 | 6,5 | 23.5 | 11.0 | 11.0 | 1.9 | 33.0 | -6.3 |

| Taumarunui | 18.3 | 7.3 | 24.8 | 12.5 | 11.8 | 2.1 | 33.9 | -6.4 |

| New Plymouth Airport | 17.1 | 9.1 | 21.4 | 13.0 | 12.7 | 5.3 | 30.3 | -2.4 |

| Waiouru | 13.8 | 4.0 | 19.2 | 7.6 | 8.2 | 0.3 | 28.5 | -9.0 |

| Napier | 18.9 | 9.0 | 23.8 | 13.4 | 14.1 | 4.6 | 35.8 | -3.9 |

| Wanganui | 17.8 | 8.7 | 21.9 | 12.5 | 13.7 | 4.9 | 31.2 | -2.3 |

| Palmerston North (DSIR) | 17.3 | 8.0 | 21.9 | 11.9 | 12.8 | 4.0 | 31,7 | -6.0 |

| Masterton (Waingawa) | 17.3 | 7.1 | 23.7 | 11.8 | 10.8 | 2.4 | 35.2 | -6.9 |

| Wellington (Kelburn) | 16.4 | 8.2 | 20.0 | 10.9 | 12.8 | 5.5 | 31.1 | -1.9 |

| Nelson Airport | 17.2 | 6.5 | 21.9 | 11.9 | 12.5 | 1.1 | 36.3 | -6.6 |

| Blenheim | 17.8 | 7.0 | 23.6 | 12.4 | 12.0 | 1.5 | 36.0 | -8.8 |

| Westport Airport | 15.8 | 8.2 | 19.5 | 12.0 | 12.0 | 4.3 | 28.6 | −3.5 |

| Hanmer Forest | 13.2 | 10.5 | 22.2 | 9.2 | 9.0 | −1.3 | 37.1 | -13.2 |

| Christchurch | 16.6 | 5.9 | 21.5 | 10.3 | 11.6 | 1.4 | 41.6 | -7.1 |

| Hokitika Airport | 15.3 | 7.2 | 19.2 | 11.7 | 11.4 | 2.7 | 27.5 | -3.2 |

| Lake Tekapo | 14.8 | 1.6 | 21.3 | 6.0 | 8.3 | -2.8 | 33.3 | -15.6 |

| Timaru | 16.2 | 5.3 | 21.4 | 9.8 | 11.0 | 0.7 | 37.2 | -6.8 |

| Queenstown | 15.8 | 3.7 | 21.7 | 7.7 | 9.9 | -0.4 | 34.1 | -7.8 |

| Alexandra | 17.0 | 2.6 | 23.2 | 7.3 | 10.7 | -2.2 | 37.2 | -11.7 |

| Dunedin (Musselburgh) | 15.0 | 6.4 | 19.0 | 9.9 | 11.1 | 2.9 | 34.5 | -8.0 |

| Gore | 15.0 | 4.6 | 20.9 | 9.1 | 9.2 | 0.2 | 35.0 | -8.9 |

| Invercargill Airport | 13.7 | 5.1 | 18.4 | 9.4 | 8.9 | 0.8 | 32.2 | -7.4 |

| Milford Sound | 14.4 | 5.4 | 18.5 | 9.3 | 10.3 | 1.5 | 28.3 | -4.9 |

The vegetation and wildlife of New Zealand are the product of not only natural factors during tens of millions of years, but also human factors over the last 1000 years. The New Zealand landmass is a fragment of the ancient southern continent of Gondwanaland, which has been isolated for over 100 million years, allowing many ancient plants and animals to survive. Although New Zealand has undergone many physical and climatic changes, such as mountain building, volcanic activity, and glaciation, parts of the landmass have remained in continuous existence with part of their original complement of plants and animals.

New Zealand is now a very diverse land and changes from being almost subtropical (“winterless”) in the north, to cool temperate, even subantarctic in the south, with a very wet, mild climate in the west, and a much drier, sometimes almost continental climate, in the east. A long exceptionally diverse coastline with many islands, produces habitats for coastal and lowland plants and animals, and there are extensive montane and alpine habitats as well. Geological variation has allowed species to adapt to soils derived from limestone, volcanic rock, serpentine, alluvial gravels, and peat. Such diversity has led to New Zealand being classified into over 260 ecological districts, each with a distinct blend of topography, climate, vegetation, and wildlife. Superimposed on natural diversity has been 1000 years of human activity; harvesting of naturally occurring species, introduction of species from elsewhere, and transformation of natural vegetation into farmland by fire, logging, and drainage. While 80 percent was forested before humans arrived, only 23 percent of the land remains forested, mainly in the mountainous hinterland.

Bio-geographicelements. The vegetation and wildlife is made up of different bio-geographic elements. The Gondwanaland element, consists of ancient plants and animals: conifers such as kauri (Agathis australis), frogs (Leiopelma), reptiles like tuatara (Sphenodon punctatus), large ground snails (Powelliphanta), and birds such as the kiwi and the now extinct moa. A tropical element includes the nikau palm, kie kie (Freycenetia), tree ferns, many northern forest trees, tropical snails (Placostylis), and earthworms. An Australian element includes many ferns, orchids, small seeded tree species like manuka (Leptospermum scoparium), insects, and birds (such as the nectar-feeding tui, parakeets, and many wetland birds). A Pacific element includes trees like pohutukawa (Metrosideros excelsa), numerous ferns, and migratory birds like the shining cuckoo. A subantarctic or circumpolar element includes beech (Nothofagus), which occurs also in South America and Southern Australia and was once present on Antarctica, and several characteristically southern bird groups such as penguins, albatrosses, and petrels. A South American element includes Fuchsia. A cosmopolitan mountain element entered New Zealand along the mountain and island chain from South East Asia and includes plants such as buttercups, daisies, veronicas and gentians. A cultural element of recent human origin comes from all parts of the world particularly Europe, North America and Australia, and consists of trees, horticultural plants, weeds, mammals, birds, and many other groups.

Northern (subtropical), central (temperate), and southern (subantarctic) marine areas can also be recognised, each with characteristic species; for instance rock oyster, blue mussel and dredge oyster, respectively. Bull kelp is a notable southern species. Some very unusual marine animals occur, including black coral and ancient brachiopods in the southern fiords, and recently discovered sea daisies—starfish relatives which live on sunken wood at 1000 metres depth. The complex sea floor means that shore, continental shelf, and deep water species occur close together, resulting in diverse marine life.

Characteristics of vegetation and wildlife. Uniqueness is a feature of the natural life of New Zealand. Foremost is the absence, apart from 2 species of bat, of land mammals, which had not evolved at the time New Zealand became separate. Many flightless birds and insects have evolved. The most remarkable birds were some 12 species of moa, forest and shrub browsers, that took the place of large herbivores in other parts of the world. Moa became extinct during Maori times, but other flightless birds remain including kiwi, kakapo (a nocturnal parrot—the largest in the world), and weka (a scavenging rail). Flightless insects are numerous, including many large beetles and cricket-like weta. The absence of mammals also meant that birds became important as seed-dispersing agents, so that most forest plants bear small berries, including the giant conifers (Podocarps), the smaller canopy trees, and even some forest-floor herbs. Some alpine plants produce berries, dispersed by the New Zealand pipit and the kea (mountain parrot). As a consequence of the great physical and climatic upheavals which New Zealand has undergone the forest has been influenced by extinction. Coconut palms once occurred in New Zealand, and fossil remains of kauri, now limited to the northern North Island, have been found south to Canterbury. Some tropical plant groups are represented by a single species, surviving only on protected islands, or in the far north. Some, like Tecomanthe are known from only a single plant. Similarly, the range of bird species is very limited in comparison with other temperate land masses of similar size. The unique family of wattle birds contains only 4 species, one of these, the huia, is now extinct and considerable natural extinction seems likely. On the other hand, there has been great diversification among smaller life-forms, such as tiny forest-floor snails, spiders, aquatic caddis flies, lichens, mosses and liverworts. Of note is the diversity of alpine plants such as daisies (Celmisia, Senecio), veronica (Hebe), native carrot (Aciphylla) and buttercups. Many of these plants produce rosettes of large leaves, which seem to adapt the plants to cold, windy, subantarctic conditions in the relatively recently-formed high mountains. A second group of plants adapted to cold, windy conditions are cushion plants, some of which form remarkable mounds called “vegetable sheep”.

In the forest and along its margins divaricating shrubs occur with tangled and criss-crossed branches bearing tiny leaves. They sometimes represent the juvenile form of a typical adult tree, but more often are the adult itself. Nowhere else in the world is this peculiar growth form so abundant. It may be an adaptation to browsing by the now extinct moa, or it may help plants to adapt to cold or dry conditions.

Although many New Zealand plants and animals occupy very specialised habitats, frequent droughts, high winds, floods, and erosion mean that many species need to be highly adaptable. Many insects, such as native bees, gather food from a wide variety of sources, and some forest species, like beech, regenerate best after the parent forest has been destroyed. However, the overwhelming character of the wildlife is its dependence on forest, and its vulnerability to introduced predators such as rats. The forests and natural grasslands have been severely modified by introduced browsers such as possums, deer and goats. Some introduced plants, like marram grass, have taken over the places where native species would normally grow.

A vast proportion of the native animals and plant species are endemic and found only in New Zealand. Virtually all insects, spiders, snails and all earthworms are restricted to New Zealand, as are most birds and plants, most freshwater fish (27 species), and all reptiles (38 species).

Table 1.8. SELECTED GROUPS OF NATIVE AND INTRODUCED SPECIES

| Group | Number of species | Percentage Endemic* | |

|---|---|---|---|

| Introduced | Native | ||

* Native species not found anywhere else. † Estimated. Source: Commission for the Environment. | |||

| Marine Algae (Seaweeds) | 3 | 900† | 43 |

| Bryophytes— | |||

| Mosses | 15 | 485 | 28 |

| Liverworts | .. | 500 | .. |

| Ferns and Allies | 20 | 163 | 41 |

| Conifers | 30 | 20 | 100 |

| Flowering Plants | 1 700 | 1 813 | 84 |

| Earthworms | 40 | 178 | 100 |

| Landsnails/Slugs | 12 | 520† | 99 |

| Spiders/Harvestmen | 60 | 2 500† | 90 |

| Insects | 1 100 | 9 460 | 90 |

| Freshwater Fish | 23† | 27 | 85 |

| Amphibia | 2 | 3 | 100 |

| Reptiles | 1 | 38 | 100 |

| Birds— | |||

| Land/Freshwater | 33 | 65 | 57 |

| Mammals— | |||

| Marine | 0 | 34 | 6 |

| Land | 33 | 2 | 100 |

Many figures in Table 1.8 are approximate and may change after future scientific investigation.

Forests. Apart from mountains above bush-line, swamps, coastal dunes, and some dry inland basins, 80 percent of New Zealand was orginally forest-covered. The forests were reduced by a third by Maori clearance before European settlement, and a further third by European clearance over the last 150 years, so that now only 23 percent of New Zealand remains in forest. Much occurs in mountainous areas, and most is now protected.

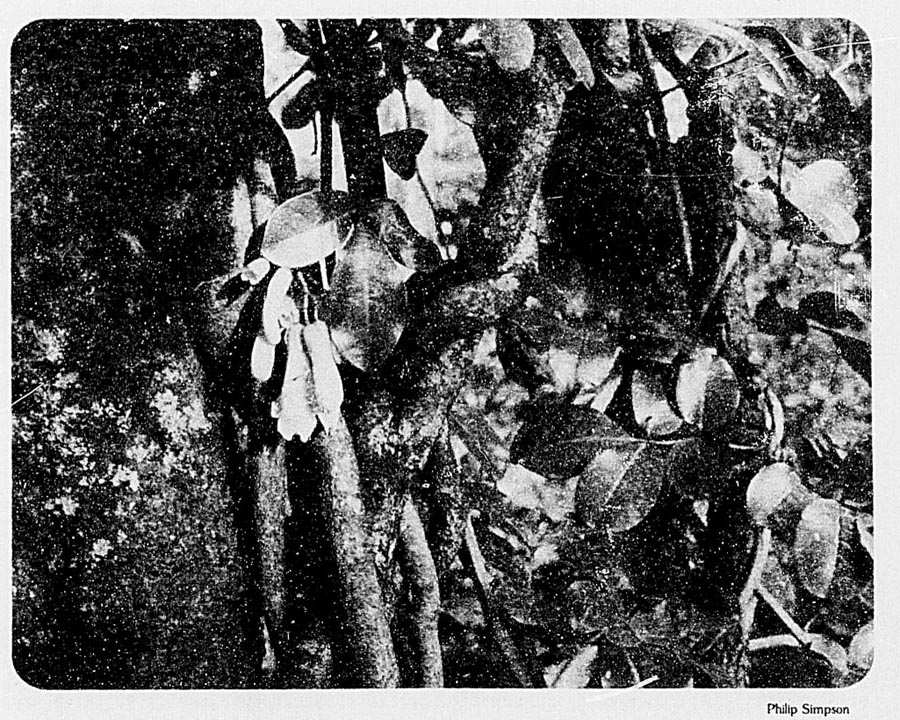

There is a wide range of natural forest types. Around the coast is a fragmented narrow band of salt tolerant plants including mangroves, nikau palm and mostly tropical pacific species, such as karaka and pohutukawa. Coastal forests are particularly important wildlife habitats for marine birds (for example various petrels and penguins), and offshore islands form refuges for tuatara, flightless insects and snails. The characteristic New Zealand forest type is warm temperate evergreen rain forest, in the far north this is dominated by kauri (Agathis australis) and various hardwoods though little forest remains. Swamp forest dominated by the podocarp kahikatea (Dacrycarpus dacrydioides) was once extensive, and remains prominent in western South Island. Elsewhere the podocarps (rimu, totara, matai, and miro) are associated with a diverse range of broad-leaved evergreen hardwoods, ferns, vines and epiphytes, forming dense and complex multi-storied communities. The species diversity gradually diminishes both with increasing altitude and increasing latitude. Evergreen beech forest is characteristic of the South Island generally above 300 metres altitude. These montane forests have fewer species than lowland forests, and extensive areas may be dominated by a single tree species. Bushline, usually of beech, is located generally between 1350 and 1500 metres.

A wide range of secondary forest types have developed since human arrival, notably kanuka forests east of the main divide, manuka and kanuka forests in northern New Zealand, and a range of broad-leaved hardwood and tree fern forest types on abandoned farmland.

Cool moist climates produce an abundance of ferns in New Zealand forests, not only giant tree ferns, but also filmy ferns which clothe tree trunks, and ground ferns.

Shrublands. Natural shrublands are rare and usually occur where soil or water factors restrict forest development, such as the margins of coastal estuaries and other wetlands, and rocky bluffs. Immediately above the bushline, a narrow band of diverse shrubland often occurs dominated by the heath Dracophyllum, shrub daisies, hebes, and alpine podocarps. The most extensive shrublands occur in once forested dryland of eastern New Zealand, where small-leaved sometimes spiny shrubs occur, notably matagouri (Discaria), tauhinu (Cassinia), and divaricating coprosmas. These shrublands are stages in the re-establishment of forest. Fernland, particularly bracken fern (Pteridium esculentum), once a staple Maori food, is very widespread throughout deforested New Zealand hill country. Like shrubland it serves as a nurse-bed for forest.

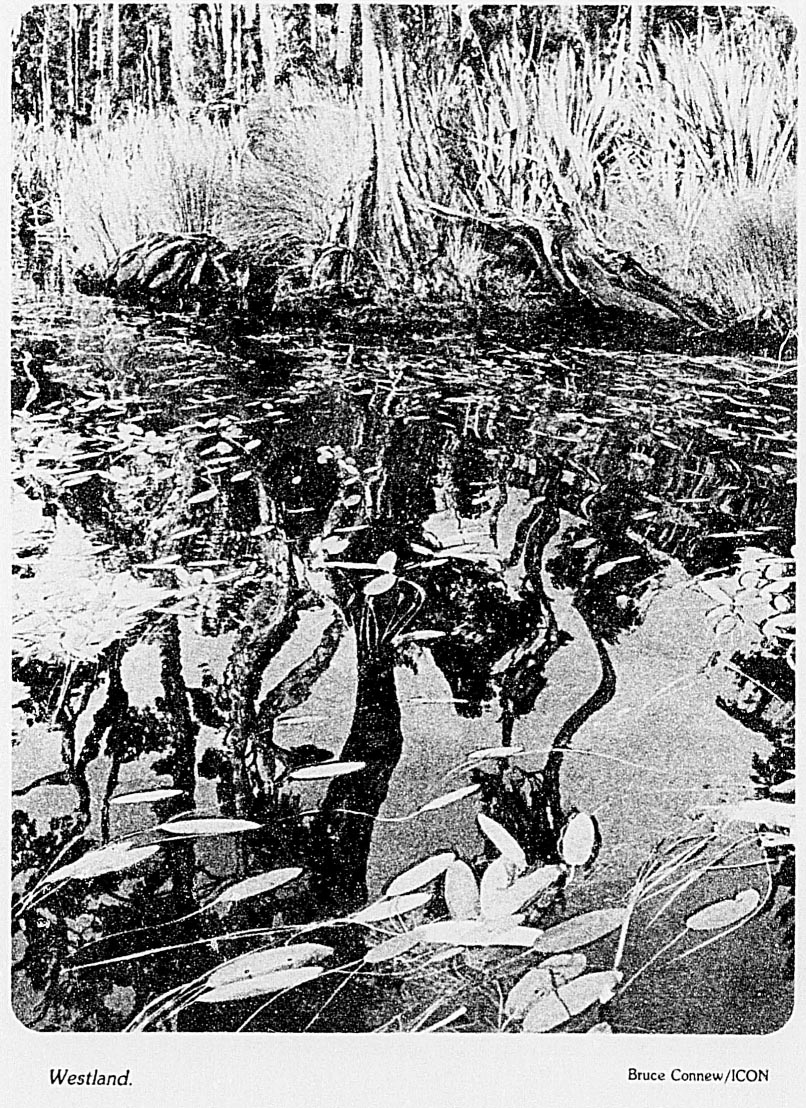

Wetlands. A rise in sea-level inundated coastal valleys formed during the ice-age. This created extensive estuaries, rich in worms, molluscs and eelgrass, which are important habitats for marine birds such as oyster-catchers. In the north the estuaries support dense groves of low mangroves, while elsewhere there are extensive rush, jointed-rush and sedge wetlands which are spawning grounds for whitebait or inanga (Galaxias species). The numerous rivers of New Zealand created extensive freshwater wetlands dominated by harakeke or flax (Phormium), raupo (Typha) and sedges. These have mostly been drained but are extensive in western South Island. Numerous small swamps and lakes have been formed to the lee of sand dunes deposited along western coasts by prevailing westerly winds. Lakes, swamps and bogs made by glaciers are features of the South Island high country.

Dune lands. Active erosion of the land has created extensive coastal sand deposits, which have mainly been stabilised by marram grass, pines and lupins, and few remain in their natural state. One threatened dune species is pingao, a sedge used for traditional Maori weaving.

Grasslands. When Europeans arrived in the nineteenth century much of the eastern South Island was covered by short tussock grassland or silver tussock and fescue, which had become established after Maori fires removed forests. Before the Maori the only naturally occurring lowland tussock was in the dry interior of Central Otago. Pastoral farming and introduced grasses have now largely destroyed short tussock grassland. However at higher altitudes, especially above the bushline, extensive areas of tall snow tussock (Chionochloa) occur.

Alpine vegetation. Large-leaved herbs, mat plants, and cushion plants occur throughout the tall tussocks, and in places dominate and form herb fields of great beauty in flower. Scree supports a range of specialised, often fleshy, drought-resistant plants. Alpine bluffs support a scattered cover of shrubs, herbs and cushion plants, adapted to extreme climate and sometimes possessing very strange form such as the coral shrub (Helichrysum) and the vegetable sheep (Raoulia).

Introduced vegetation and wildlife. The New Zealand landscape is now dominated by introduced animals and plants. Over 1500 exotic plants grow wild, some (like rye-grass, browntop, gorse and sweet briar), over large areas. Although introduced plants have seldom colonised extensive areas of native vegetation, wild animals (deer, pigs, goats, possums, stoats and rats) are widespread, and some introduced birds, such as blackbirds, occur everywhere. Urban vegetation is largely exotic and domestic stock dominate agricultural areas throughout the lowlands.

Introduced plants and animals have greatly increased the diversity of species in New Zealand. However their increase has been associated with a decrease in the area dominated by native species. Today a large number of native species are very rare and seldom seen. Some of these are ancient and stamp uniqueness on New Zealand as a living museum. Urgent measures are needed to ensure the healthy survival of this unique heritage of international importance.

One uniform time is kept throughout New Zealand. This is the time 12 hours ahead of Co-ordinated Universal Time, and is named New Zealand Standard Time (N.Z.S.T.). It is an atomic standard, and is maintained by the New Zealand Time Service, DSIR. One hour of daylight saving, named New Zealand Daylight Time, which is 13 hours ahead of Universal Time, is generally introduced from 2 a.m. (N.Z.S.T.) on the last Sunday in October, until 2 a.m. (N.Z.S.T.) on the first Sunday in March next year. Time kept in the Chatham Islands is 45 minutes ahead of that kept in New Zealand.

New Zealand Atlas, ed. I. Ward. Government Printer 1976.

The Department of Lands and Survey produces and publishes a wide range of maps and charts, which are listed in its Catalogue of maps.

Searle, E. J. City of Volcanoes. 2nd edition Longman Paul, 1981.

Smith, I. E. M. (ed.) Late Cenozoic Volcanism In New Zealand. Bulletin 23, Royal Society of New Zealand. 1986.

Soons. J.; Selby. M. (eds.) Landforms of New Zealand. Longman Paul, 1982.

Speden, I. G.; Keyes, I. W. Illustrations of New Zealand Fossils. DSIR Information Series 150.

Stevens, G. R. Lands in Collision—Discovering New Zealand's Geography. DSIR Information Series 161.

Stevens, G. R. New Zealand Adrift: the theory of continental drift in a New Zealand setting. A. H. and A. W. Reed, 1980.

Stevens, G. R. Rugged Landscape. A. H. and A. W. Reed, 1974.

Suggate, R. P.; Stevens, G. R.; Te Punga, M. T.; (eds.) The Geology of New Zealand 2 vols. Government Printer, 1978.

Thornton, J. Field Guide to New Zealand Geology. Reed Methuen, 1985.

Volcanoes and the Earth's Interior—Readings from Scientific American. W. H. Freeman and Company, 1982.

Williams, G. J. Economic Geology of New Zealand. AusIMM Monograph Series 4, 1974.

Williams, K. Volcanoes of the South Wind—a field guide to the volcanoes and landscape of Tongariro National Park. Tongariro Natural History Society, 1985.

New Zealand Atlas, ed. I. Ward. Government Printer 1976.

An Encyclopedia of New Zealand, vol. 1, ed. A. H. McLintock, Government Printer 1966.

The New Zealand Gazette, Government Printer. (These list current monthly summaries of temperature, rainfall and sunshine for all climate stations, as the data comes to hand.)

Bibliography of New Zealand Meteorological Service Publications 1892-1985. Kathleen F. Johnson. N.Z. Met. Serv., 1986.

The Meteorological Service publishes monthly summaries of:

Climate Observations (Misc. Pub. 109) and Rainfall Observations (Misc. Pub. 110) annually; Climate Observations which are updated every 10 years, e.g. 1980 (Misc. Pub. 177); Rainfall Normals (averages) for 30-year periods, e.g. 1951-1980 (Misc. Pub. 185); Sunshine Normals (averages) for 30-year periods, e.g. 1951-1980 (Misc. Pub. 186); and Temperature Normals (averages) for 30-year periods, e.g. 1951-1980 (Misc. Pub. 183). The service also produces regional climatologies (Misc. Pub. 115), maps and many other publications.

Enting, Brian and. Molloy, Les. The Ancient Islands. Port Nicholson Press 1982.

Kuschel, G. (ed.): Biogeography and ecology in New Zealand. W. Junk. 1975.

Salmon, J. J. 1980: The Native Trees of New Zealand. Reed Methuen. 1980.

Stevens, Graeme. Lands in collision—discovering New Zealand's past geography. DSIR. 1985.

The early history of the people of New Zealand and the coming of the Maoris is shrouded in myth and based on orally-transmitted traditions. It is difficult to establish the period when the voyages of the Polynesian people to New Zealand began. Tradition has it that the first voyager to visit New Zealand was Kupe in about 950 A.D., and according to some Maori tribes it was he who named the land Aotearoa (“land of the long white cloud”). Finding no other inhabitants Kupe returned to Hawaiki, the legendary homeland of the Maori. Following his return there were various waves of migration to New Zealand, and the names of the canoes and of their captains and crews are still remembered by the Maoris and are important features of their history and genealogy.

Linguistic and other evidence indicates that Hawaiki was situated in Eastern Polynesia, which makes their voyages impressive and bears testimony to the sophistication of their vessels and navigation.

From the people of each canoe arose tribal groupings claiming common descent and symbolic unity. About 10 major tribes evolved, divided into many subtribes. All tribes can claim their ancestry back to members of one or more of the canoes, and many of the more familiar canoes such as Aotea, Te Arawa, Tainui, and Takitimu have become synonymous today with tribal groupings and territories.

The Maoris mainly confined themselves to the warmer North Island and the population was organised into descent groups of different scale—iwi (tribes), hapu (subtribes), and whanau (extended families). The main themes in this society were mana (prestige), tapu (sacredness) and utu (the principle of equal return, often expressed in revenge).

The bases of Maori society have changed profoundly from the original subsistence economy in pre-European contact times.

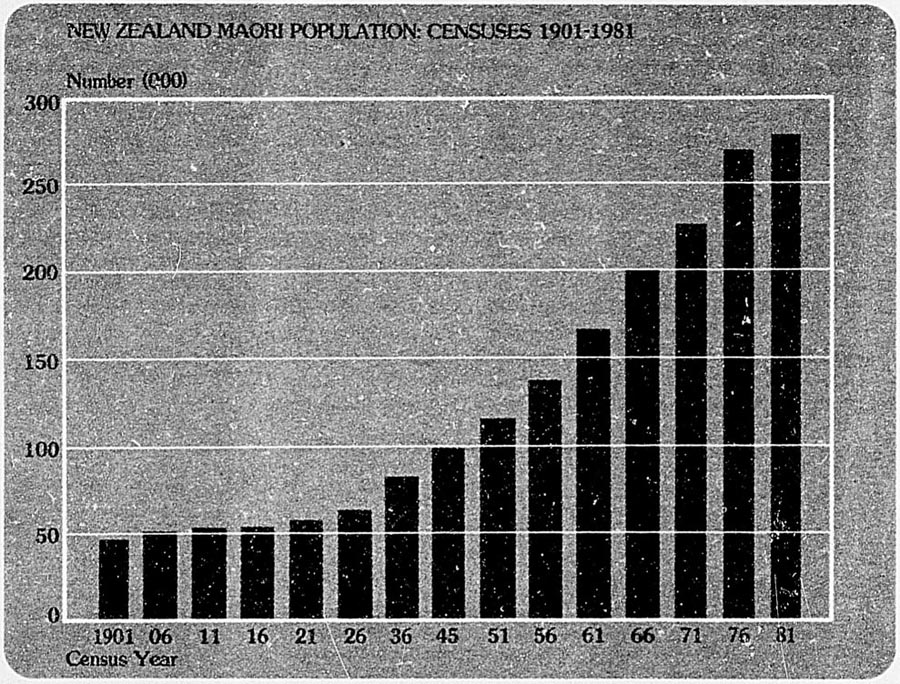

The introduction of European disease and firearms, and the impact of European civilisation on the traditional way of life and customs of the Maoris, had such an adverse effect that their numbers must have been reduced by over half during the nineteenth century. However, from the beginning of the twentieth century the Maori population has been rapidly increasing, and now forms 9 percent of the New Zealand population.

Discovery by Europeans. On 13 December 1642, Abel Janszoon Tasman, a navigator of the Dutch East India Company, discovered the country to which he gave the name of Staten Land, and which later became known as “Nieuw Zeeland”. Tasman had left Batavia on 14 August 1642, and after having discovered Tasmania, he steered eastward and sighted the west coast of the South Island, described by him as a high mountainous country. Sailing north he came into conflict with the Maoris at Golden Bay, on the north coast of the South Island, so that, though he continued his northward journey until he reached the northern tip of the country, he did not again attempt to land.

There is no record of any European visit to New Zealand after Tasman's departure until Captain (then Lieutenant) James Cook sighted land on 7 October 1769 near Gisborne. Cook and a party of men from HMS Endeavour landed at Gisborne on 9 October 1769. On his first voyage Cook spent 6 months exploring the New Zealand coastline, and he completely circumnavigated the North and South Islands. His activities can best be described by saying “he found New Zealand a line on a map, and left it an archipelago”. Not only was Cook's ability shown by his cartographical accuracy, but also in his peaceful dealings with the Maoris. He returned to New Zealand again in 1773, 1774, and in 1777. His careful observations made New Zealand known to the western world; the accounts of his voyages were translated into a dozen languages.

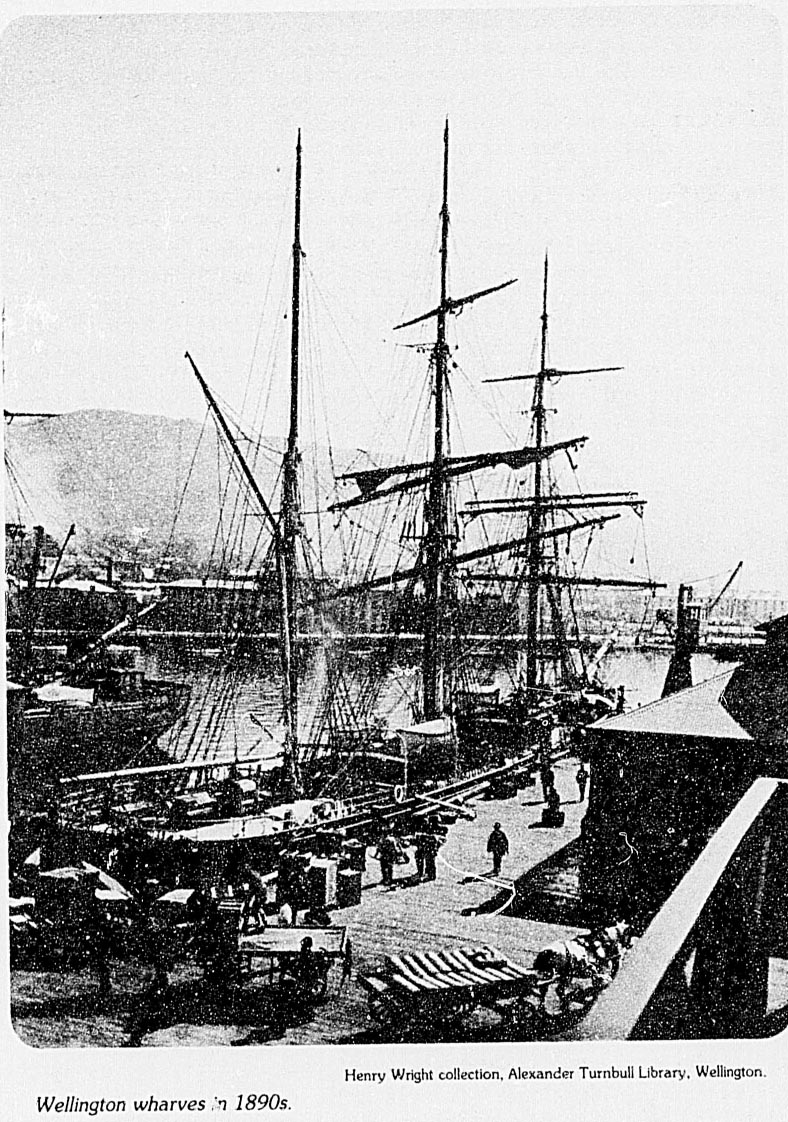

First European settlements. Whaling stations sprang up along the New Zealand coast from 1792 onwards and a trade with New South Wales began not only in whale oil and seal skins, but also in flax and timber. In 1814 Samuel Marsden, chaplain to the Governor of New South Wales, was responsible for the establishment of the first mission station in the Bay of Islands.

The growing white population in the Bay of Islands, and the lawlessness of crews of visiting ships led to the appointment by the British Government of James Busby as British Resident at Waitangi in 1833. The Governor of New South Wales in 1837 sent Captain William Hobson, in command of HMS Rattlesnake, from Sydney to the Bay of Islands to report on New Zealand. Among other things, Hobson suggested a treaty with the Maori chiefs and the placing of British subjects under British law. On 29 January 1840 Hobson arrived at the Bay of Islands as Governor to proclaim British sovereignty.

By 1840 numerous mission stations had spread through the northern half of the North Island. Conversion of Maori tribes to Christianity was accompanied by the introduction of new crops and methods of cultivation and the pacification of warring tribes.

Early constitutional developments. On 29 January 1840 Captain William Hobson arrived in the Bay of Islands. His instructions from the British Government required him to take possession of the country with the consent of the Maori chiefs. Hobson read his commission at Kororareka on 30 January and on 6 February 46 chiefs signed the Treaty of Waitangi, a compact whereby all rights and powers of sovereignty were ceded to the Queen, all territorial rights were secured to the chiefs and their tribes (with the Crown having the sole right of purchase) and in return the Queen extended her protection and all the rights and privileges of British subjects. Other chiefs throughout both islands later adhered to this Treaty. On 21 May 1840 Governor Hobson proclaimed British sovereignty over the North Island by virtue of the Treaty of Waitangi, and over the South Island and Stewart Island by right of discovery.

The history of the present constitution dates back to the declaration of British sovereignty in 1840. The constitution is wholly Anglo-Saxon in its origin and takes no account of Maori custom and usage.

Since its signing the Treaty has remained a contentious issue. Maori grievances focus on the following points: the full implications of the Treaty were not explained at the time; the Maori translation of the Treaty was in parts misleading; and its promises have not been honoured.

The capital was at first transferred from Russell to Auckland, but in 1865 it was again transferred, on this occasion to Wellington, where the seat of Government has since remained.

From 1840 until the grant of responsible government in 1856 the colony was subject to rule by the Governor. New Zealand remained a dependency of New South Wales until 3 May 1841, when it was created a separate colony by Royal Charter dated 16 November 1840.