Table of Contents

THE present number of the Year-book (the thirty-first) follows, generally, the same lines as its immediate predecessor, the 1921–22 issue, which marked the inauguration of several new departures in the presentation of the Year-book.

The size of the book has been increased somewhat, principally by the inclusion of new matter. A section has been added on the subject of. “Wage-rates” a branch of statistical inquiry only recently undertaken officially; the subsection of “Trade,” which deals with the purchase of supplies for the Imperial Government, and which was omitted from the 1921–22 issue, has been brought up to date and reinstated; and existing sections have been extended by the introduction of new matter, among which may be mentioned the articles on the following subjects:—-

Historical Outline of Primary Education (p. 163).

Tariff Reciprocity with Australia (p. 302).

Inland Fisheries (p. 404).

Rating-powers of Local Authorities (p. 486).

The Totalizator (p. 631).

In the “Miscellaneous” section will be found an interesting extract from the Hon. Sir John Salmond's report on the Washington Conference, together with a short summary of the principal enactments of the parliamentary sessions of 1921 and 1921–22. An appendix gives summaries of various population characteristics as shown by the 1921 census, in addition to the latest available statistical information on a variety of subjects. Another appendix revives the list of principal events which was formerly a feature of the Year-book.

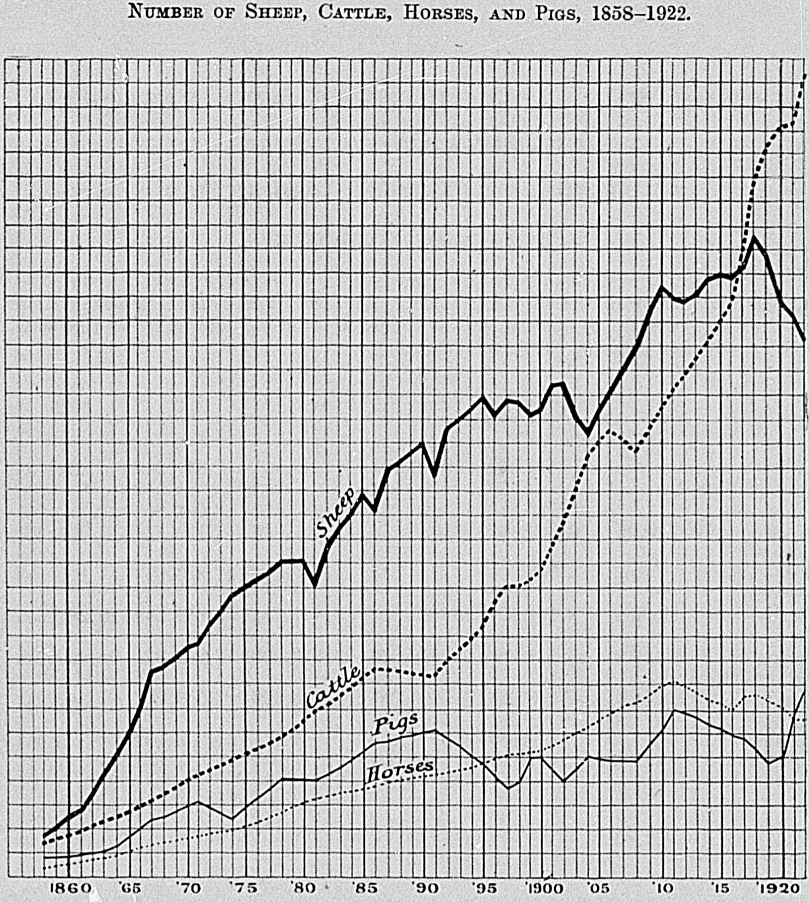

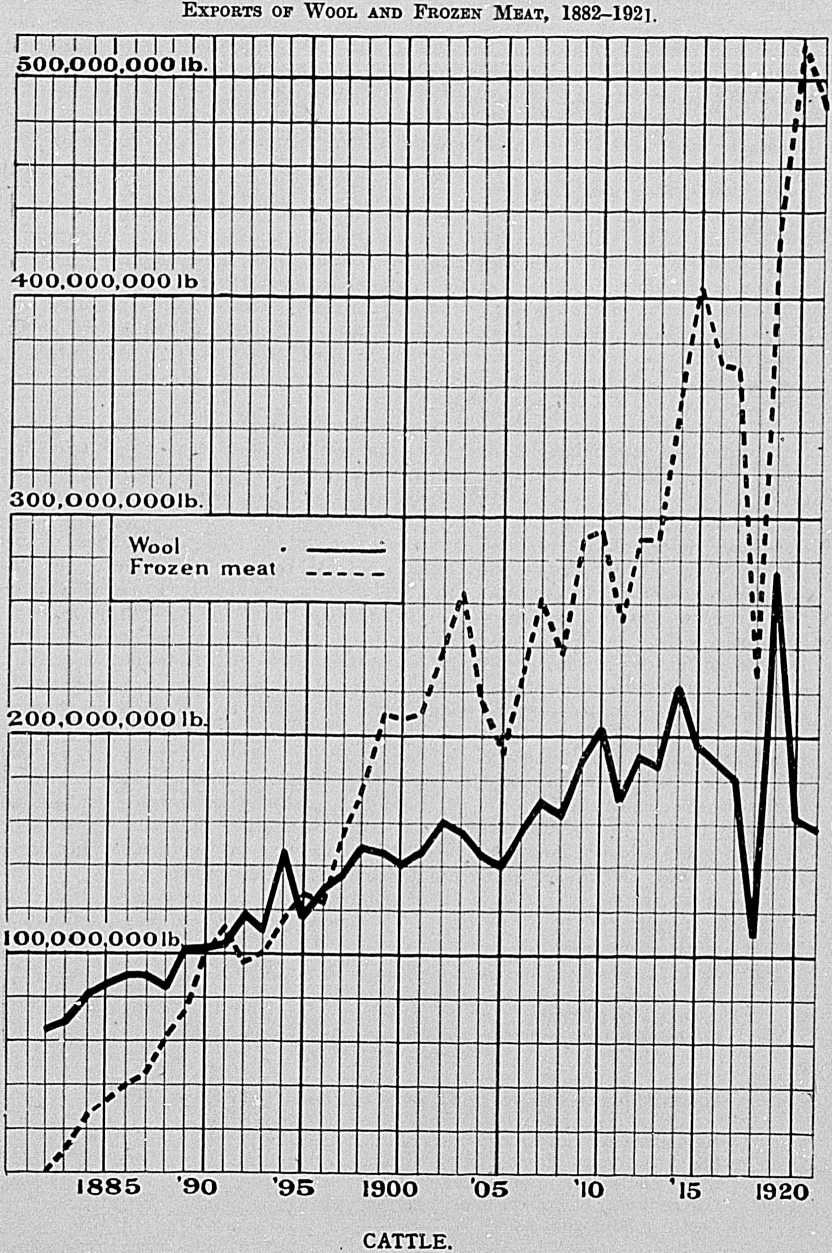

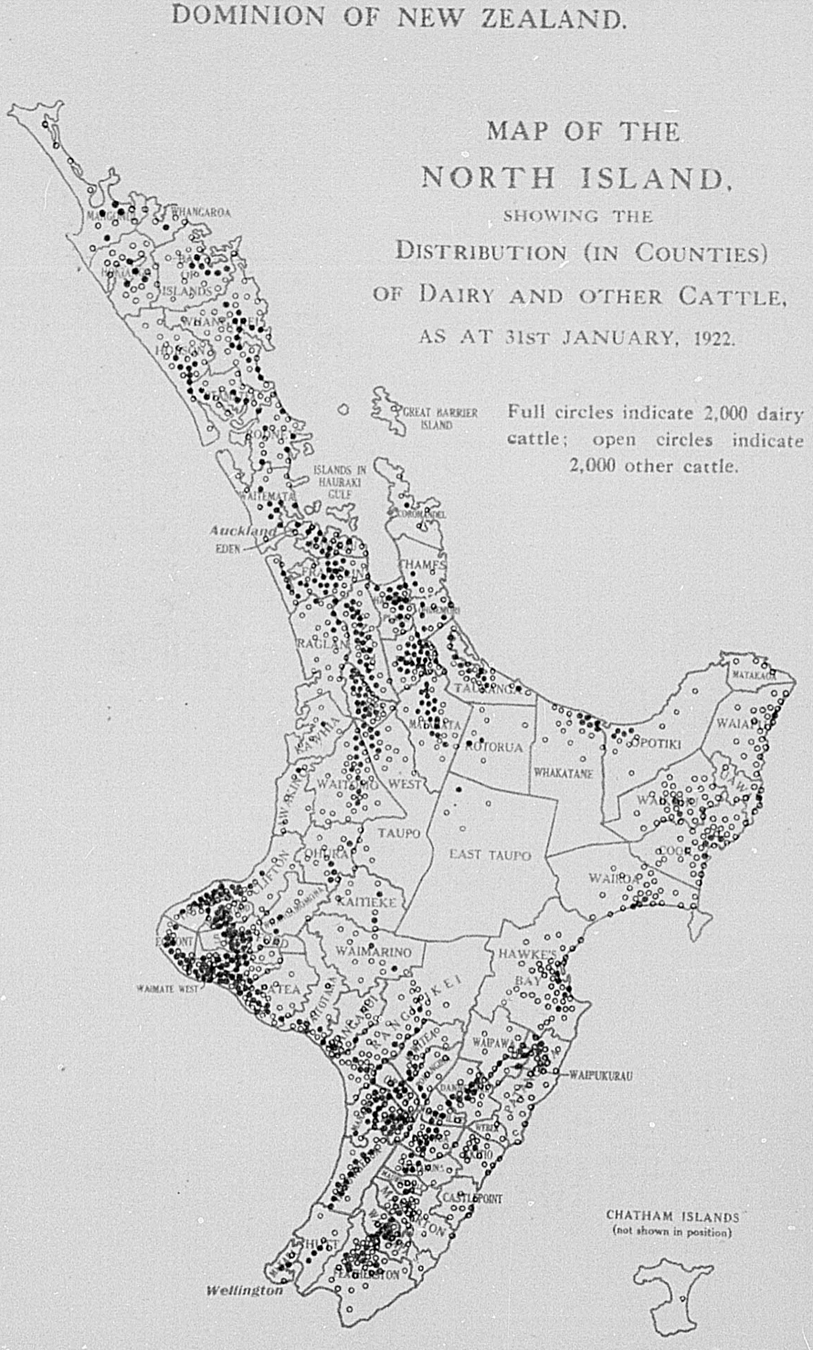

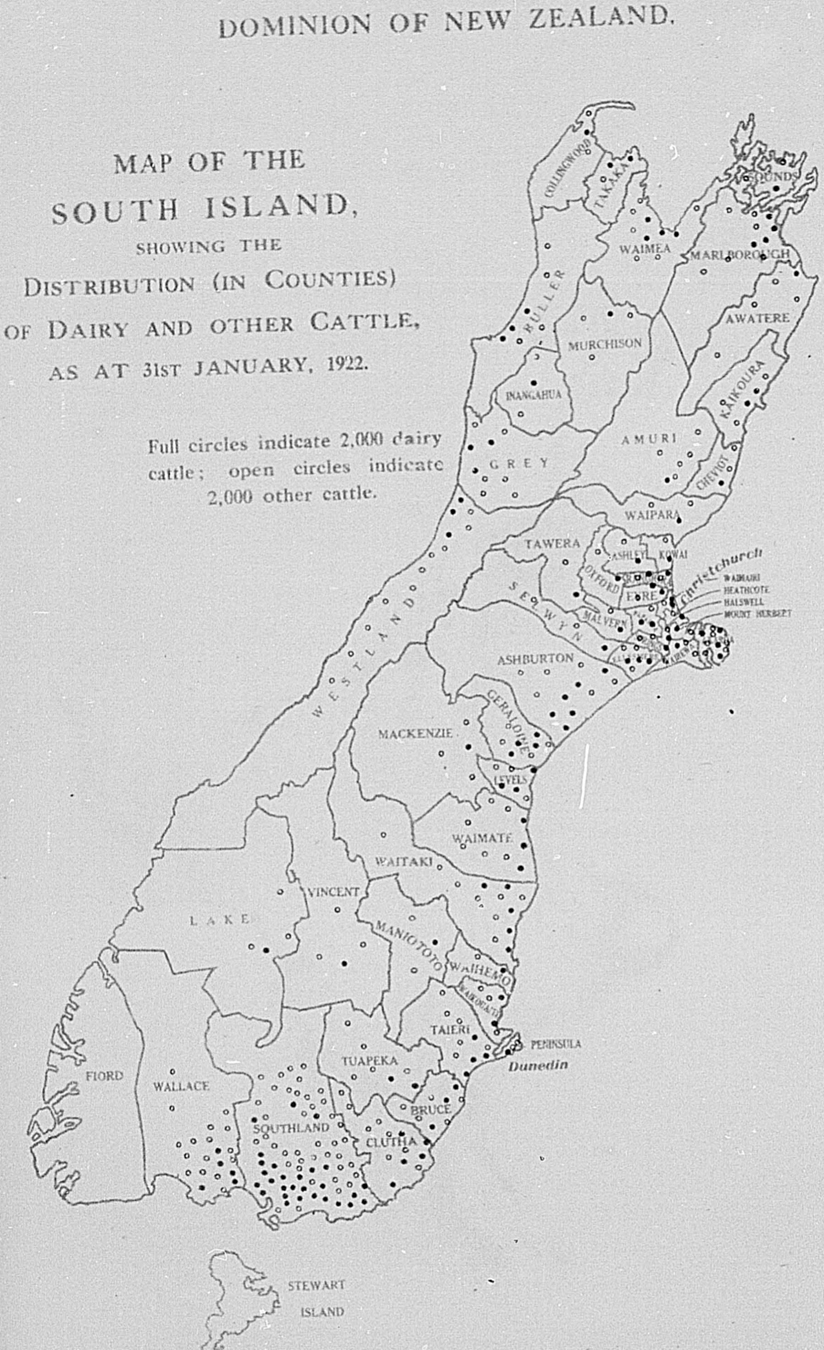

Several new diagrams have been added, and attention is drawn to the map (p. 384) showing the distribution of dairy and other cattle throughout the Dominion.

Consequent on a return to normal conditions in the Census and Statistics Office and the Printing Office, the Year-book appears on this occasion much earlier than has been found possible for some years past.

MALCOLM

FRASER,

Government

Statistician.

Census and Statistics Office,

Wellington,

N.Z., 15th December, 1922.

Table of Contents

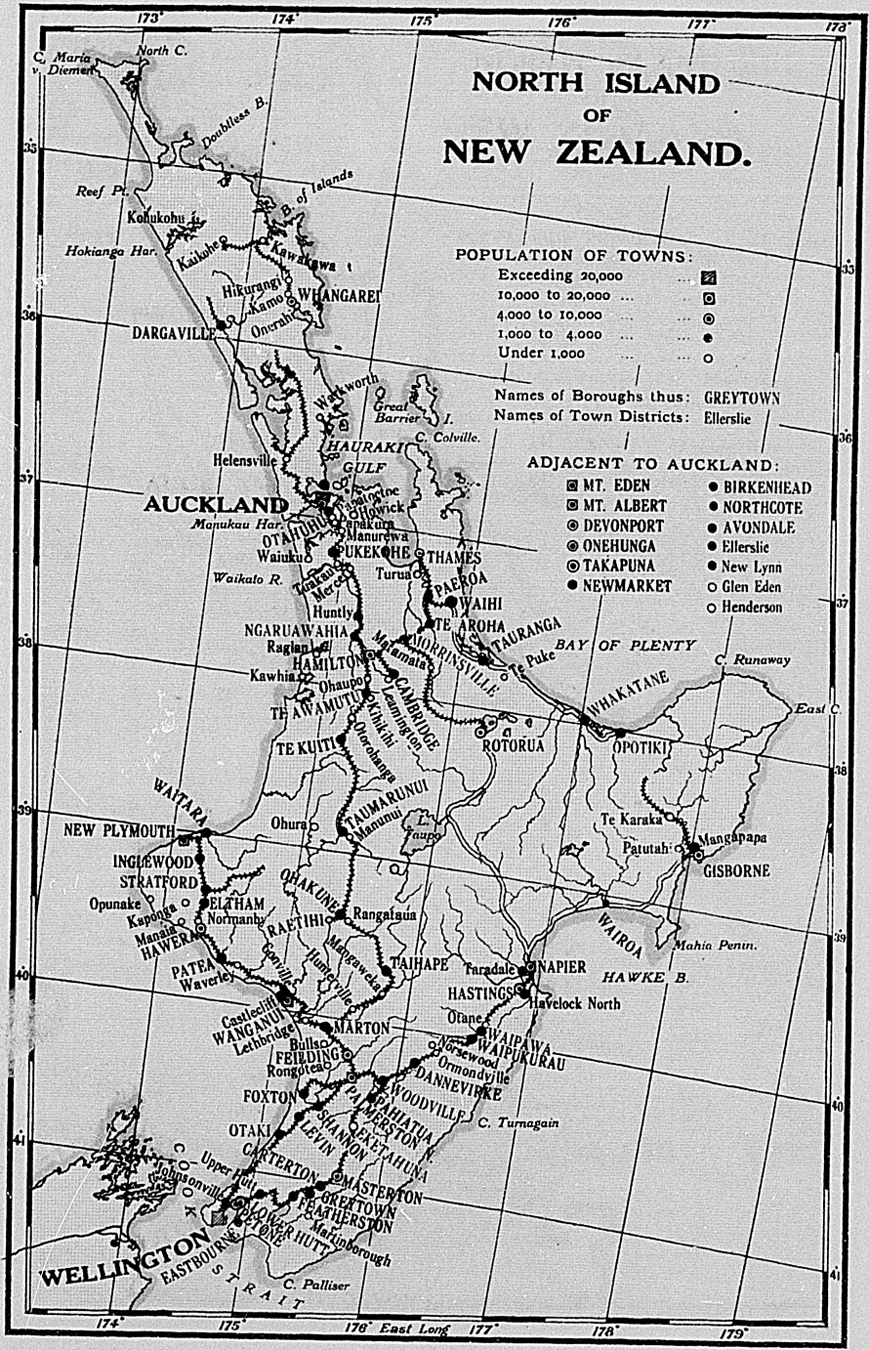

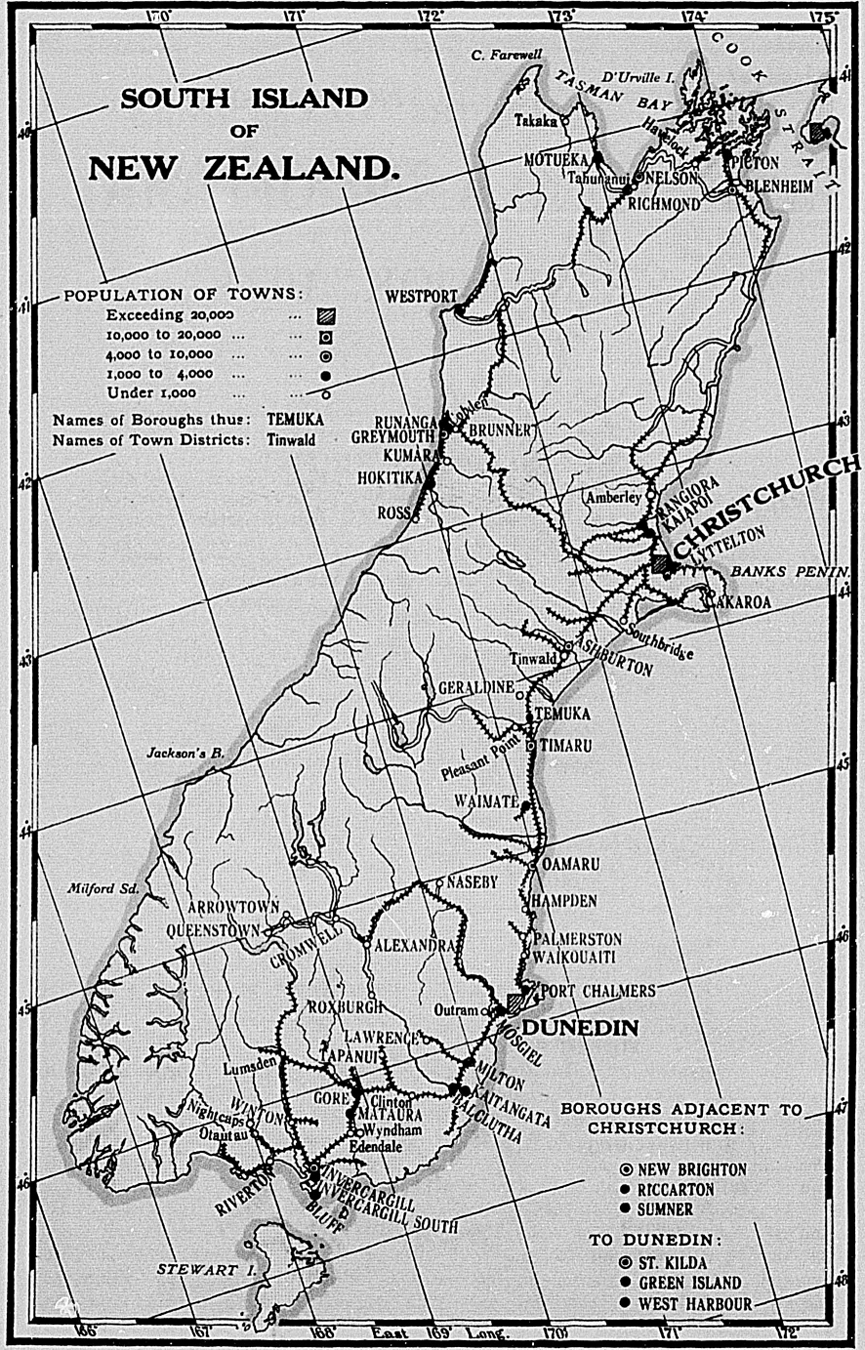

THE Dominion of New Zealand consists of two large and several small islands in the South Pacific. These may be classified as follows:—

Islands forming the Dominion proper, for statistical and general practical purposes:—

North Island and adjacent islets.

South Island and adjacent islets.

Stewart Island and adjacent islets.

Chatham Islands.

Outlying islands included within the geographical boundaries of New Zealand, as proclaimed in 1847:—

Three Kings Islands.

Auckland Islands.

Campbell Island.

Antipodes Islands.

Bounty Islands.

Snares Islands.

Islands annexed to New Zealand:—

Kermadec Islands.

Cook Islands.

Niue (or Savage) Island.

Palmerston Island.

Penrhyn (or Tongareva) Island.

Manahiki Island.

Rakaanga Island.

Pukapuka (or Danger) Island.

Suwarrow Island.

The Proclamation of British sovereignty over New Zealand, dated the 30th January, 1840, gave as the boundaries of what was then the colony the following degrees of latitude and longitude: On the north, 34° 30' S. lat.; on the south 47° 10' S. lat.; on the east, 179° 0' E. long.; on the west, 166° 5' E. long. These limits excluded small portions of the extreme north of the North Island and of the extreme south of Stewart Island.

In April, 1842, by Royal Letters Patent, and again by the Imperial Act 26 and 27 Vict., c. 23 (1863), the boundaries were altered so as to extend from 33° to 53° of south latitude and from 162° of east longitude to 173° of west longitude. By Proclamation bearing date the 21st July, 1887, the Kermadec Islands, lying between the 29th and 32nd degrees of south latitude and the 177th and 180th degrees of west longitude, were declared to be annexed to and to become part of the then Colony of New Zealand.

By Proclamation bearing date the 10th June, 1901, the Cook Group of islands, and all the other islands and territories situate within the boundary-lines mentioned in the following schedule, were included:—

A line commencing at a point at the intersection of the 23rd degree of south latitude and the 156th degree of longitude west of Greenwich, and proceeding due north to the point of intersection of the 8th degree of south latitude and the 156th degree of longitude west of Greenwich; thence due west to the point of intersection of the 8th degree of south latitude and the 167th degree of longitude west of Greenwich; thence due south to the point of intersection of the 17th degree of south latitude and the 167th degree of longitude west of Greenwich; thence due west to the point of intersection of the 17th degree of south latitude and the 170th degree of longitude west of Greenwich; thence due south to the point of intersection of the 23rd degree of south latitude and the 170th degree of longitude west of Greenwich; and thence due east to the point of intersection of the 23rd degree of south latitude and the 156th degree of longitude west of Greenwich.

By mandate of the League of Nations the New Zealand Government also now administers the former German possession of Western Samoa; and, jointly with the Imperial Government and the Government of Australia, holds the League's mandate over the Island of Nauru.

The total area of the Dominion of New Zealand, exclusive of the territories administered under mandate, is 103,861 square miles. The areas of the principal islands are as follows:—

| Square Miles. | |

| North Island and adjacent islets | 44,130 |

| South Island and adjacent islets | 58,120 |

| Stewart Island and adjacent islets | 662 |

| Chatham Islands | 372 |

| Total Dominion proper | 103,284 |

| “Outlying” islands | 284 |

| “Annexed” islands | 293 |

| Grand total | 103,861 |

The mountainous character of New Zealand is one of its most striking physical characteristics. In the North Island mountains occupy approximately one-tenth of the surface; but, with the exception of the four volcanic peaks of Egmont (8,260 ft.), Ruapehu (9,175 ft.), Ngauruhoe (7,515 ft.), and Tongariro (6,458 ft.), they do not exceed an altitude of 6,000 ft. Of these four volcanoes only the first-named can be classed as extinct. Other dormant volcanoes include Mount Tarawera and White Island, both of which have, in recent years, erupted with disastrous consequences. Closely connected with the volcanic system are the multitudinous hot springs and geysers.

The South Island contains much more mountainous country than is to be found in the North. Along almost its entire length runs the mighty chain known as the Southern Alps, rising to its culmination in Mount Cook (or Aorangi, “the Sky-piercer,” in Maori nomenclature). No fewer than six peaks of the Southern Alps attain a height of over 10,000 ft. Owing to the snow-line being low in New Zealand, many large and beautiful glaciers exist. The Tasman Glacier (Southern Alps), which has a total length of over eighteen miles and an average width of one mile and a quarter, is the largest. On the west coast the terminal face of the Franz Josef Glacier is but a few hundred feet above sea-level.

A list showing the altitude of all peaks over 7,000 ft., and also the mountain-range of which they form part, is appended:—

| Name. | Range. | Height, In Feet. |

|---|---|---|

| Cook | Southern Alps | 12,349 |

| Tasman | ″ | 11,467 |

| Malte Brun | ″ | 10,421 |

| Sefton | ″ | 10,390 |

| Haidinger | ″ | 10,178 |

| De la Beche | ″ | 10,058 |

| Aspiring | ″ | 9,960 |

| Tapuaenuku | Kaikoura | 9,467 |

| Elie de Beaumont | Southern Alps | 9,279 |

| Earnshaw | ″ | 9,200 |

| Ruapehu | 9,175 | |

| Arrowsmith | Southern Alps | 9,171 |

| Tutoko Peak | Darran | 9,042 |

| Burns | Southern Alps | 8,984 |

| The Nun's Veil | ″ | 8,975 |

| Hopkins | ″ | 8,800 |

| Brodrick's Peak | ″ | 8,777 |

| Kaitarau | Seaward Kaikoura | 8,7003 |

| Christina | Darran | 8,675 |

| Sealy | Southern Alps | 8,651 |

| Evans | ″ | 8,580 |

| Glenmary | ″ | 8,524 |

| Dechan | ″ | 8,500 |

| Whakari | Seaward Kaikoura | 8,500 |

| Edward | Southern Alps | 8,459 |

| Pollux | ″ | 8,341 |

| Thumbs | Two Thumbs | 8,338 |

| Jukes | Southern Alps | 8,289 |

| Tyndall | ″ | 8,282 |

| Alba | ″ | 8,268 |

| Brewster | ″ | 8,264 |

| Egmont | 8,260 | |

| Castor | Southern Alps | 8,256 |

| Percy Smith | ″ | 8,249 |

| Roberts | ″ | 8,239 |

| Huxley | ″ | 8,201 |

| Ansted | Southern Alps | 8,157 |

| Dun Fiunary | ″ | 8,147 |

| Tyndall | ″ | 8,116 |

| Humphries | ″ | 8,028 |

| Glacier Dome | ″ | 7,810 |

| Double Cone | Remarkables | 7,688 |

| Franklyn | Spenser | 7,671 |

| Edison | Southern Alps | 7,669 |

| Travers | St. Arnaud | 7,666 |

| St. Mary | Southern Alps | 7,656 |

| Ben Nevis | Remarkables | 7,650 |

| Taylor | Southern Alps | 7,641 |

| Fox | Two Thumbs | 7,604 |

| Una | Spenser | 7,540 |

| Ngauruhoe | 7,515 | |

| Rolleston | Southern Alps | 7,453 |

| Eros | ″ | 7,452 |

| Ella | Spenser | 7,438 |

| Somnus | Barrier | 7,424 |

| St. Bernard | Kaikoura | 7,416 |

| Musgrave | Two Thumbs | 7,379 |

| Neave | Southern Alps | 7,350 |

| Cosmos | Barrier | 7,340 |

| Faerie Queen | Spenser | 7,332 |

| Maitland | Southern Alps | 7,291 |

| Paske | Spenser | 7,260 |

| Humboldt | ″ | 7,240 |

| Jollie | Southern Alps | 7,232 |

| Enys | ″ | 7,202 |

| Potts | ″ | 7,197 |

| Ark | Barrier | 7,190 |

| Minaret Peaks | Southern Alps | 7,189 |

| Hutt | ″ | 7,180 |

| Dillon | Kaikoura | 7,132 |

| Marshman | Southern Alps | 7,116 |

| Dora | Spenser | 7,100 |

| Sinclair | Two Thumbs | 7,022 |

| Ballance | Southern Alps | 7,008 |

The hot springs of the North Island form one of the most remarkable features of New Zealand. They are found over a large area, extending from Tongariro, south of Lake Taupo, to Ohaeawai, in the extreme north-a distance of some three hundred miles; but the principal seat of hydrothermal action appears to be in the neighbourhood of Lake Rotorua, about forty miles north-north-east from Lake Taupo. By the destruction of the famed Pink and White Terraces at Lake Rotomahana during the eruption of Mount Tarawera on the 10th June, 1886, the neighbourhood was deprived of attractions unique in character and of unrivalled beauty; but the natural features of the country-the numerous lakes, geysers, and hot springs, some of which possess remarkable curative properties in certain complaints-are still very attractive to tourists and invalids. The vast importance of conserving this region as a sanatorium for all time has been recognized by the Government, and it is dedicated by Act of Parliament to that purpose.

There are also several small hot springs in the South Island, the best-known being those at Hanmer.

A full account of the springs in the Rotorua, Te Aroha, and Hanmer districts was given in the 1905 number of the Year-book, with analyses of the waters of some of the principal springs.

The rivers of New Zealand were discussed in the 1914 issue of this book in an article (pages 948 to 956) supplied by R. Speight, Esq., M.Sc, F.G.S., Curator of the Canterbury Museum. Considerations of space in the present book prevent more than a list of the more important rivers being given. These are as follows, the lengths shown being in most cases only approximate. Very few of these rivers are navigable by vessels of any size.

| NORTH ISLAND. | |

| Flowing into the Pacific Ocean— | Miles. |

| Piako | 60 |

| Waihou (or Thames) | 90 |

| Rangitaiki | 95 |

| Whakatane | 60 |

| Waiapu | 55 |

| Waipaoa | 50 |

| Wairoa | 50 |

| Mohaka | 80 |

| Ngaururoro | 85 |

| Tukituki | 65 |

| Flowing into Cook Strait— | |

| Ruamahanga | 70 |

| Hutt | 35 |

| Otaki | 30 |

| Manawatu (tributaries: Tiraumea and Pohangina) | 100 |

| Rangitikei | 115 |

| Turakina | 65 |

| Wangaehu | 85 |

| Wanganui (tributaries: Ohura, Tangarakau, and Maunganui-te-ao) | 140 |

| Waitotara | 50 |

| Patea | 65 |

| Flowing into Tasman Sea— | |

| Waitara (tributary: Maunganui) | 65 |

| Mokau | 75 |

| Waikato (tributary: Waipa) | 220 |

| Wairoa | 95 |

| Hokianga | 40 |

| SOUTH ISLAND. | |

| Flowing into Cook Strait— | Miles. |

| Aorere | 45 |

| Takaka | 45 |

| Motueka | 75 |

| Wai-iti | 30 |

| Pelorus | 40 |

| Wairau (tributary: Waihopai) | 105 |

| Awatere | 70 |

| Flowing into the Pacific Ocean— | |

| Clarence (tributary: Acheron) | 125 |

| Conway | 30 |

| Waiau (tributary: Hope) | 110 |

| Hurunui | 90 |

| Waipara | 40 |

| Ashley | 55 |

| Waimakariri (tributaries: Bealey, Poulter, Esk, and Broken River) | 93 |

| Selwyn | 55 |

| Rakaia (tributaries: Mathias. Wilberforce, Acheron, and Cameron) | 95 |

| Ashburton | 67 |

| Rangitata | 75 |

| Opihi | 50 |

| Pareora | 35 |

| Waihao | 45 |

| Waitaki (tributaries: Tasman, Tekapo, Ohau, Ahuriri, and Hakataramea) | 135 |

| Kakanui | 40 |

| Shag | 45 |

| Taieri | 125 |

| Clutha (tributaries: Kawarau, Makarora, Hunter, Manuherikia, and Pomahaka) | 210 |

| Flowing into Foveaux Strait— | Miles. |

| Mataura | 120 |

| Oreti | 105 |

| Aparima | 65 |

| Waiau (tributaries: Mararoa, Clinton, and Monowai) | 115 |

| Flowing into the Tasman Sea— | |

| Cleddau and Arthur | 20 |

| Hollyford | 50 |

| Cascade | 40 |

| Arawata | 45 |

| Haast (tributary: Landsborough) | 60 |

| Karangarua | 30 |

| Fox | 25 |

| Waiho | 20 |

| Wataroa | 35 |

| Wanganui | 35 |

| Waitaha | 25 |

| Hokitika (tributary: Kokatahi) | 40 |

| Arahura | 35 |

| Taramakau (tributaries: Otira and Taipo) | 45 |

| Grey (tributaries: Ahaura, Arnold, and Mawhera-iti) | 75 |

| Buller (tributaries: Matakitaki, Maruia, and Inangahua) | 105 |

| Mokihinui | 30 |

| Karamea | 45 |

| Heaphy | 25 |

In a further article in the 1915 issue of the Year-book Mr. Speight dealt at length with the lakes of the Dominion. A summary of the statistics of the chief lakes of New Zealand is here given.—

| Lake. | Length, In Miles. | Greatest Breadth, in Miles. | Area, in Square Miles. | Drainage Area, in Square Miles. | Approximate Volume of Discharge, in Cubic Feet per Second. | Height above Sea-level, in Feet. | Greatest Depth, in Feet. |

|---|---|---|---|---|---|---|---|

| North Island. | |||||||

| Taupo | 25 | 17 | 238 | 995 | 5,000 | 1,211 | 534 |

| Rotorua | 7 1/2 | 6 | 32 | 158 | 420 | 915 | 84 |

| Rotoiti | 10 3/4 | 2 1/4 | 14 | 26 | 500 | 913 | 230 |

| Tarawera | 6 1/2 | 6 1/2 | 15 | 75 | .. | 1,032 | 285 |

| Waikaremoana | 12 | 6 1/4 | 21 | 128 | 772 | 2,015 | 846 |

| Wairarapa | 10 | 4 | 27 | 1,250 | .. | .. | .. |

| South Island. | |||||||

| Rotoiti | 5 | 2 | 2 3/4 | 86 | .. | 1,997 | 228 |

| Rotorua | 7 | 2 1/2 | 8 | 146 | .. | 1,470 | .. |

| Brunner | 5 | 4 | 16 | 145 | .. | 280 | 357 |

| Kanieri | 5 | l 3/4 | 8 | 11 | .. | 422 | 646 |

| Coleridge | 11 | 3 | 18 | 70 | .. | 1,667 | 680 |

| Tekapo | 12 | 4 | 32 | 580 | 5,000 | 2,323 | .. |

| Pukaki | 10 | 5 | 31 | 515 | 6,000 | 1,588 | .. |

| Ohau | 10 | 3 | 23 | 424 | 5,000 | 1,720 | .. |

| Hawea | 20 | 5 | 48 | 518 | 5,700 | 1,062 | .. |

| Wanaka | 30 | 4 | 75 | 960 | .. | 922 | .. |

| Wakatipu | 52 | 3 | 112 | 1,162 | 13,000 | 1,016 | 1,242 |

| Te Anau | 33 | 6 | 132 | 1,320 | 12,660 | 694 | 906 |

| Manapouri | 12 | 6 | 56 | 416 | .. | 596 | 1,458 |

| Monowai | 12 | 1 | 12 | 51 | 700 | 600 | .. |

| Hauroko | 20 | 3 | 25 | 195 | 1,800 | 611 | .. |

| Poteriteri | 17 | 2 | 17 | 162 | .. | 96 | .. |

| Waihola | 4 1/2 | 1 1/8 | 3 1/3 | 2,200 | .. | (Tidal) | .. |

| Ellesmere | 16 | 10 | 107 1/2 | 745 | .. | (Tidal) | .. |

The geological structure of New Zealand, so far as it has yet been determined, is, owing to its complexity, difficult to summarize. For a fuller account than can be given here the reader is referred to the article in the 1914 Year-book, pages 943 to 947, and to the various works on geology mentioned therein.

The oldest fossiliferous rocks are the Ordovician argillites (“slates”) of north west Nelson and Preservation Inlet. At Baton River Silurian fossils, at Reefton Devonian fossils, and in the limestone near Nelson Carboniferous or Permo-Carboniferous fossils, show that these systems are all represented in the Palæozoic sequence. Included in it are marble, sandstone, shale, greywacke, quartzite, schist, and gneiss. The auriferous lodes of the South Island are almost always found cutting through rocks of Palæozoic age.

Rocks belonging to the Mesozoic periods occur over a large area in both Islands. The Trias-Jura system of greywacke and argillite forms the main mountain-range3, but contains few workable mineral deposits. It is fossiliferous in only a few localities, and cannot be easily subdivided.

While all these foregoing rocks were being deposited the New Zealand area was probably the foreshore of a great continent, but after the Trias-Jura sediments were deposited far-reaching changes, involving the breaking-up and disappearance of the continental land, took place. The New Zealand area was necessarily involved in these earth-movements, and as the result the existing strata were folded, broken, and raised above sea-level. After extensive denudation of its surface had taken place New Zealand was again, probably several times, depressed and elevated either in whole or in part. During the periods of subsidence Cretaceous and Tertiary strata were laid down. These contain all the workable coal-seams of the Dominion.

Pleistocene and Recent deposits are well represented by fluviatile, glacial, marine, and wind-blown material.

Plutonic rocks of various types, but mainly granitic, occupy a large area in the western parts of the South Island, and occur also in North Auckland. Volcanic rocks, chiefly of Tertiary age, are found in scattered areas throughout the eastern part of the South Island, and occur extensively in the North Island, where volcanic activity still continues on a small scale.

The following article by the former Government Seismologist, the late Mr. George Hogben, C.M.G., M.A., F.G.S., has been revised and brought up to date by Mr. C. E. Adams, D.Sc, F.R.A.S., Government Astronomer and Seismologist.

The Wellington earthquake of 23rd January, 1855, received a full notice in Sir Charles Lyell's classic work “The Principles of Geology,” and probably largely on that account the attention of the scientific world was attracted to this feature of the natural phenomena of New Zealand. But since that earthquake, during which the level of the land in the neighbourhood of Wellington Harbour was raised about 5 ft., there has been no shock in the New Zealand region proper which has at all approached the destructive phase. Indeed, of about 1,800 earthquakes recorded as having origins in or near New Zealand, that of 1848 is the only other earthquake comparable in intensity to that of 1855; and the average intensity of all the earthquakes thus recorded is between III and IV on the Rossi-Forel scale-or, in other words, just sufficient to make pictures hung on walls move a little, and to cause doors and windows to creak or rattle slightly. In about twelve or fifteen instances the force has been sufficient near the origin to overturn some chimneys (for the most part badly constructed ones), and in a very few buildings to crack walls or ceilings of faulty design. In about thirty other earthquakes such phenomena have been noted as the stopping of clocks, without any damage. The great majority of shocks have passed unperceived by the ordinary observer, and have been recorded only by means of instruments. In short, earthquakes in New Zealand are rather a matter of scientific interest than a subject for alarm. Their scientific interest is largely due to the light they throw upon questions connected with the movements taking place in the earth's crust. Most people know now that the crust of the earth is not the stable thing that the ancients supposed it to be, but is constantly rising here, and falling there, and wrinkling itself into folds that cause most of our mountains and valleys and other striking surface features. All the great movements that appear at the surface are due to the repacking of the rocks below, especially, as the earth quakes seem to show, at a depth of fifteen to twenty miles.

This repacking is caused by change of pressure, which makes the rocks either “creep” or fold, or, in most cases, both creep and fold. When a movement takes place suddenly an earthquake is experienced. Apparently the change of pressure arises generally in one or other of two ways:—

The enormous amount of earthy material carried by rivers into the sea lessens the pressure on the rocks below the land-surface, and increases the load on the sea-bed; this would tend to cause a side thrust and creep at a lower depth towards the direction of the rocks underlying the land-surface.

The unequal contraction of different layers of the crust is due to unevenness in their rate of cooling; this gives rise to crumpling or folding of the rocks.

Nearly all the earthquakes in New Zealand seem to be due to the second of these causes. Indeed, the facts of the earthquake of 1855 and several of the instrumental records of recent years give tolerably clear evidence of tilting of the surface that has taken place about lines that are parallel to the general direction of the main mountain-ranges and to the chief known geological faults.

The origins of the New Zealand seismic region will be seen to arrange themselves in groups as follows:—

Group I.—Earthquakes felt most strongly on south-east coast of North Island; epicentra form a strip 180 miles from the coast, parallel to the axis of New Zealand, and to axis of folding of older Cainozoic rocks in Hawke's Bay. Chief shocks: 17th August, 1868; 7th March, 1890; 23rd and 29th July, 1904; 9th August, 1904 (intensity IX on R.F. scale); 8th September, 1904; prob. 23rd February, 1863 (IX, R.-F.); &c.

According to Captain F. W. Hutton, F.R.S., the geological evidence shows that New Zealand rose considerably in the older Pliocene period, and was then probably joined to the Chatham Islands. At a later period subsidence occurred, followed again by elevation in the Pleistocene period, with oscillations of level since. The seismic origins of this group are at the foot of a sloping submarine plateau, about two hundred miles wide, which culminates to the east-south-east in the Chatham Islands. This elevation is separated from the New Zealand coast by a trough from 1,000 to 2,000 fathoms in depth, which is widest and deepest between these origins and the mainland.

Group II.—

South-east of Otago Peninsula. Shocks: 20th November, 1872, &c.

A strip south-east of Oamaru. Shocks: February, 1876; April, 1876, &c.

Many short and jerky, but generally harmless, quakes felt in Christchurch, Banks Peninsula, and mid Canterbury. Chief shocks: 31st August, 1870; 27th December, 1888 (VII, R.-F.); &c. Focus of 1888 shock, sixteen miles long, from west-south-west to east-north-east, twenty-four to twenty-five miles below surface, being deepest ascertained origin in New Zealand region.

These origins form a line parallel to the general axis of the land. It is quite possible that the loading of the sea-floor by the detritus brought down by the rivers of Canterbury and Otago is a contributing cause of the earthquakes of this group.

Group III.—Wellington earthquakes of January, 1855, and Cheviot earthquakes of November, 1901.

The origin of the earthquake of 1855 was probably the fault that forms the eastern boundary of the Rimutaka Range and the western boundary of the Wairarapa Valley.

The origin of the earthquake of 1901 was probably in or near the southern continuation of this fault.

The great earthquakes of October, 1848, probably came from the same region as those of January, 1855. The chief shocks of both series did extensive damage to property, and caused the formation of large rifts in the earth's surface; they are the only seismic disturbances since the settlement of the Dominion that can be assigned to degree X on the Rossi-Forel scale.

Group IV.—

Region about twenty-five to thirty miles in length, and, say, ten miles or less in width, running nearly north-north-east from middle of Lake Sumner, about twenty miles below the surface, whence proceed most of the severer shocks felt from Christchurch to the Amuri, and a large number of minor shocks Chief earthquakes: 1st February, 1868; 27th August to 1st September, 1871; 14th September and 21st October, 1878; 11th April, 1884; 5th December, 1881 (VIII, R.-F.), when Christchurch Cathedral spire was slightly injured; 1st September, 1888 (IX, R.-F.), when upper part of same spire fell, and still more severe damage was done in the Amuri district.

A small shallow origin not more than five to ten miles below the surface, a few miles south of Nelson. Earthquake: 12th February, 1893 (VIII to IX, R.-F.); chimneys thrown down and buildings injured.

Origin in Cook Strait, north-north-east of Stephen Island, about ten miles wide, and apparently traceable with few interruptions nearly to mouth of Wanganui River; depth, fifteen miles or more. More than half the earthquakes recorded in New Zealand belong to this region; earthquake of 8th December, 1897 (VIII to IX, R.-F.), and other severer ones come from south-south-west end. Probably the first recorded New Zealand earthquake, felt by Captain Furneaux on the 11th May, 1773, belonged to this region.

An origin near Mount Tarawera, with a large number of moderate or slight shocks, most, but not all, volcanic and local in character-e.g., those of September. 1866, and those of June, 1886, which accompanied and followed the well-known eruption of Mount Tarawera.

These origins of Group [V, (a), (b), (c), (d), are nearly in a straight line on the map; on or near the same line are the origins of earthquakes felt in the Southern Lake District (15th December, 1883, &c), the volcanoes Ruapehu, Ngauruhoe, Tongariro, Tarawera, and White Island. It is evident that this line, which, like the rest, is parallel or nearly so to the general axis, is a line of weakness or of unstable equilibrium. Hence the adjusting movements that have caused earthquakes may have, from time to time, relieved the pressure of the rocks that restrained overheated steam and other volcanic agents from bursting out, and so may have led to volcanic eruptions; just as the series of earthquakes in Guatemala and in the Caribbean Sea in April and May, 1902, were the signs of movements in the great folds of that part of the earth's crust, in the course of which, the pressure in the Antillean Ridge being relieved, the volcanic forces below Mount Pelée in Martinique, and Mount Souffière in St. Vincent, caused the disastrous eruptions of that year.

Group V.—Off the coast near Raglan and Kawhia. Chief shock: 24th June, 1891 (VII to VIII, R.-F.). The line joining this origin to that of the earthquake of 1st February, 1882, is parallel to the other lines of origins (Groups I to IV); but we have no data to establish any connection between them.

Since 1888 there has been established in New Zealand a system of observing local earthquakes as recorded by galvanometers at selected telegraph – stations- about eighty in number—distributed throughout the extent of the Dominion.

Whenever a shock occurs and is felt by an officer in charge of one of these stations he fills up a form giving the New Zealand mean time of the beginning of the shock, its apparent duration and direction, and the principal effects observed by him. Some of the officers exhibit considerable care and skill in making up these returns, and the data have been used to determine principal origins of earthquakes within the New Zealand region.

Two seismographs are installed in New Zealand; they are Milne horizontal pendulums with photographic registration. One is installed at the Hector Observatory, Kelburn, Wellington, under the charge of Mr. C. E. Adams, D.Sc, F.R.A.S., and the other at the Magnetic Observatory, Christchurch, under the charge of Mr. H. F. Skey, B.Sc.

An improved type of seismograph-the Milne-Shaw-was received at the Hector Observatory in September, 1921, but has not yet been installed. The instrument is magnetically damped, and is very much more sensitive than the ordinary type of Milne seismograph.

The records of the New Zealand stations are sent to the General Secretary of the Seismological Committee of the British Association, to the Station Centrale Sismologique, Strasbourg, France, and to the principal observatories of the world, and thus form part of the general system of earthquake-observation being conducted throughout the world for the last thirty-one years.

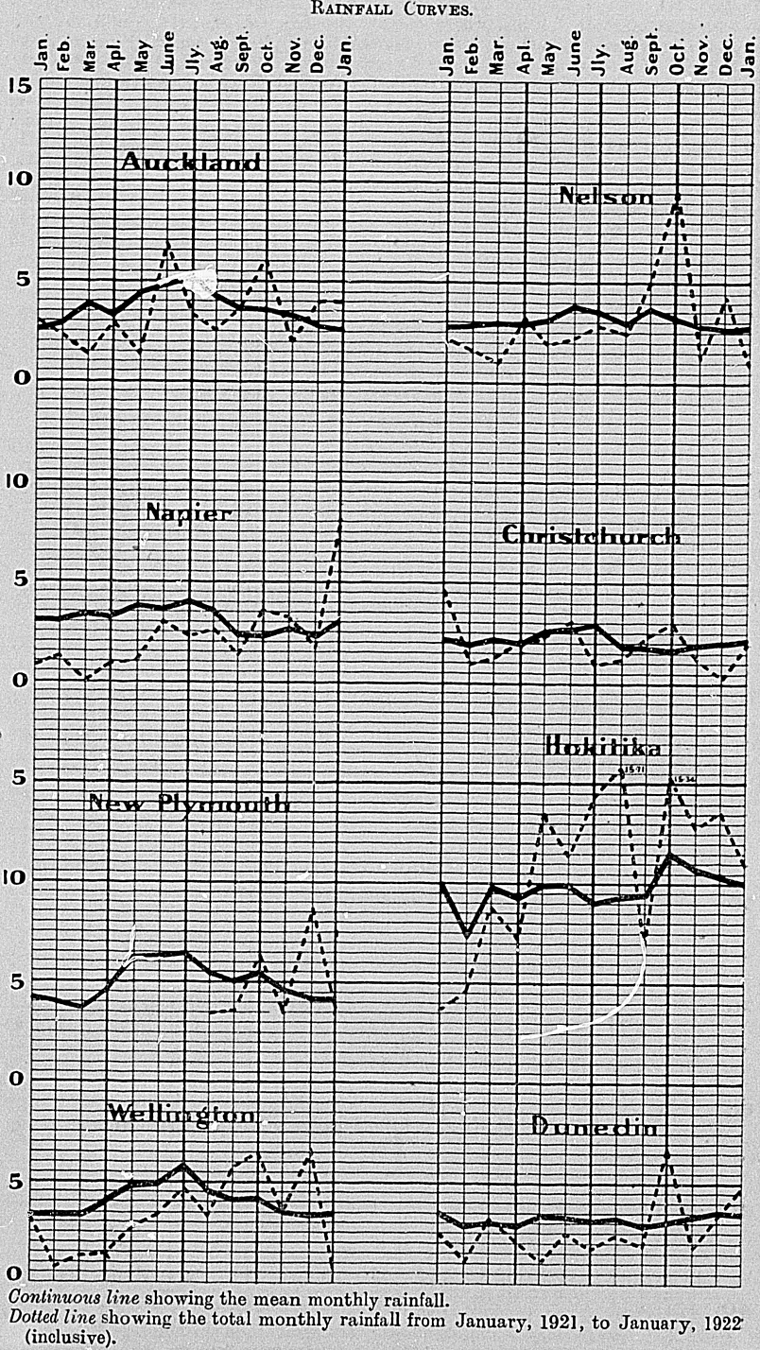

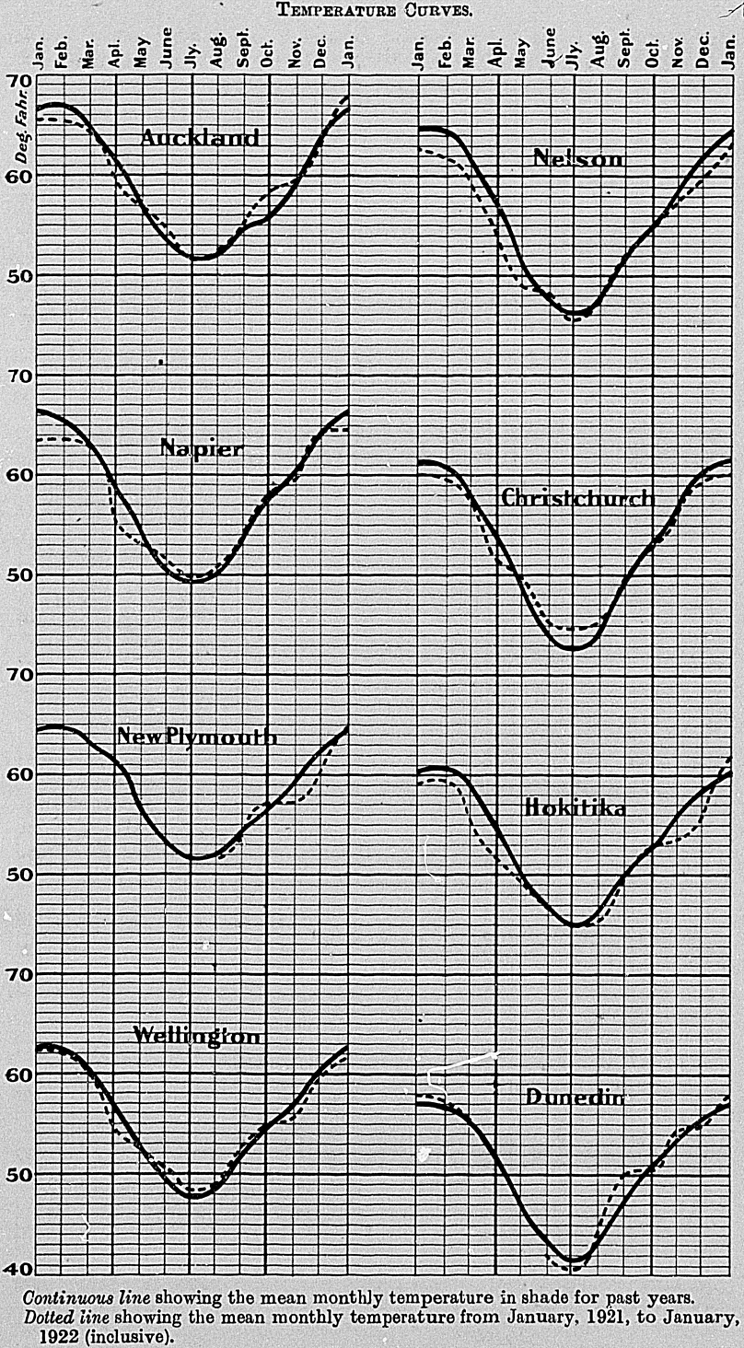

The following article on the climate of New Zealand has been prepared by Lieut. Colonel D. C. Bates, Dominion Meteorologist.

The climate of New Zealand is spoken of in popular and general terms as equable, mild, and salubrious; but such a summary does not convey an adequate idea of variations that exist in a country stretching, as it does, north and south for nearly a thousand miles, and distinctly differentiated by lofty mountain-chains. Another fact which must also be borne in mind is that the greater part of the North Island is controlled by a different system of circulation from that which dominates conditions in the parts about Cook Strait and the South Island. The former is subject to ex-tropical disturbances, and the latter more to westerly or antarctic “lows,” which travel along the latitudes of the “forties,” with their prevailing westerly winds.

The climate of the Auckland Province, speaking generally, combines degrees of warmth and humidity agreeable by day and comfortable by night. North of Auckland City conditions are almost subtropical, and in summer balmy easterly breezes prevail, and are responsible for delightful conditions. In winter the winds are more north and west, while changes to the south-west or south-east mostly account for the rainfall. Cumulus clouds are frequently formed in the afternoons, and, while tempering the heat of the day, also cut down sunshine records somewhat, but add considerably to the beauty of the land- and sea-scape. Southward of Auckland the climate is more varied, the west coast experiencing more rain, while the central parts are warmer in the day and considerably colder at night. In the winter months frosts, which are unknown farther north, now and then occur in the hours of darkness. Eastward from Rotorua (the great health resort and centre of the thermal region) is to be found one of the most genial climates in the world, and Tauranga and Opotiki have charms all their own, especially for their weather and the fruits which ripen to perfection in these regions.

The monthly and annual means of the temperature, rainfall, and sunshine of Auckland are shown in the following table:—

| Month. | Mean Temperatures for 56 Years. | Mean Rainfall for 08 Years. | Mean Sunshine for 11 Years. | ||||

|---|---|---|---|---|---|---|---|

| Maximum. | Minimum. | Mean. | |||||

| °F. | °F. | °F. | Inches. | Days. | Hr. | min. | |

| January | 73.7 | 58.9 | 66.5 | 2.57 | 10.3 | 213 | 58 |

| February | 74.3 | 59.6 | 67.1 | 2.98 | 9.6 | 175 | 7 |

| March | 72.0 | 57.7 | 65.0 | 3.04 | 11.1 | 170 | 41 |

| April | 67.8 | 54.6 | 61.2 | 3.34 | 13.9 | 137 | 53 |

| May | 62.7 | 505 | 56.7 | 4.46 | 18.4 | 128 | 50 |

| June | 59.2 | 47.8 | 53.5 | 4.79 | 19.4 | 115 | 50 |

| July | 57.6 | 46.0 | 51.8 | 5.13 | 20.9 | 118 | 2 |

| August | 58.2 | 46.0 | 52.2 | 4.27 | 19.5 | 136 | 4 |

| September | 60.7 | 48.4 | 54.7 | 3.63 | 17.6 | 139 | 10 |

| October | 63.5 | 50.7 | 57.3 | 3.59 | 16.4 | 161 | 29 |

| November | 67.0 | 53.3 | 60.2 | 3.28 | 14.6 | 186 | 13 |

| December | 70.9 | 56.7 | 63.9 | 2.80 | 11.5 | 214 | 8 |

| Year | 65.6 | 52.5 | 59.2 | 43.88 | 183.2 | 1,897 | 25 |

| ROTORUA. | |||||||

|---|---|---|---|---|---|---|---|

| Month. | Mean Temperatures for 32 Years. | Mean Rainfall for 35 Years. | Mean Sunshine for 9 Years. | ||||

| Maximum. | Minimum. | Mean. | |||||

| °F. | °F. | °F. | Inches. | Days. | Hr. | min. | |

| January | 75.5 | 52.3 | 63.9 | 3.99 | 9.6 | 249 | 53 |

| February | 74.9 | 52.2 | 63.4 | 3.97 | 8.8 | 188 | 18 |

| March | 71.8 | 49.4 | 60.6 | 3.68 | 9.6 | 191 | 0 |

| April | 66.0 | 45.4 | 55.6 | 4.35 | 10.8 | 157 | 16 |

| May | 60.0 | 40.7 | 50.3 | 5.45 | 12.4 | 143 | 19 |

| June | 55.6 | 38.2 | 46.8 | 5.03 | 12.8 | 119 | 16 |

| July | 54.2 | 37.0 | 45.5 | 5.18 | 13.9 | 129 | 10 |

| August | 56.1 | 37.5 | 46.7 | 5.03 | 13.4 | 139 | 35 |

| September | 59.6 | 40.8 | 50.2 | 5.19 | 14.4 | 156 | 35 |

| October | 63.9 | 44.0 | 54.0 | 4.85 | 13.9 | 185 | 28 |

| November | 68.3 | 46.7 | 57.5 | 4.07 | 12.7 | 215 | 7 |

| December | 72.8 | 49.6 | 61.1 | 3.61 | 9.7 | 228 | 47 |

| Year | 64.9 | 44.5 | 54.6 | 54.40 | 142.0 | 2,103 | 44 |

The Hawke's Bay Province is one of the richest in New Zealand, and is favoured with a pleasant climate, being sheltered from westerly winds, though occasionally they are of the warm and dry (Foehn) type. It is rather dry, but ex-tropical disturbances are occasionally responsible for heavy downpours. Though the number of days with rain is less than, and sunshine above that of other parts, the rainfall is still a good one, and fairly regular throughout the year, though some seasons have been notably dry. The meteorological records of Napier show reliable normal for the coastal districts. Inland the country is rather mountainous and less mild.

| NAPIER. | ||||||

|---|---|---|---|---|---|---|

| Month. | Mean Temperatures for 29 Years. | Mean Rainfall for 16 Years. | Mean Sunshine for 14 Years. | |||

| Maximum. | Minimum. | Mean. | ||||

| °F. | °F. | °F. | Inches. | Days. | Hr. min. | |

| January | 75.9 | 57.0 | 66.4 | 1.66 | 6.5 | 275 20 |

| February | 74.5 | 56.7 | 65.6 | 2.42 | 6.7 | 207 33 |

| March | 71.2 | 54.7 | 63.0 | 3.72 | 91 | 217 1 |

| April | 67.2 | 50.4 | 58.7 | 2.50 | 7.8 | 195 17 |

| May | 61.7 | 46.3 | 54.0 | 4.24 | 9.5 | 161 14 |

| June | 58.0 | 42.3 | 50.1 | 2.64 | 8.1 | 162 36 |

| July | 56.5 | 41.6 | 49.0 | 3.96 | 10.3 | 148 15 |

| August | 57.9 | 42.1 | 50.0 | 3.12 | 10.8 | 187 35 |

| September | 62.3 | 45.2 | 53.7 | 1.86 | 8.3 | 216 17 |

| October | 66.4 | 48.7 | 57.5 | 2.52 | 9.0 | 234 5 |

| November | 69.6 | 51.8 | 60.7 | 2.07 | 8.1 | 245 18 |

| December | 73.1 | 55.3 | 64.2 | 2.06 | 7.0 | 276 22 |

| Year | 66.2 | 49.3 | 57.7 | 32.77 | 101.2 | 2,526 53 |

Wellington, the capital city, as disclosed by its meteorological records, has a mean climate for the whole Dominion. Wellington occupies a central position, and is situated near Cook Strait, which divides the two main Islands. It has a somewhat changeable but temperate climate, and, though occasionally subject to disturbances from warmer regions, is usually controlled by the terrestrial wind-currents which have a westerly direction round the world in the latitude of the “forties.” It is popularly regarded as a rather windy spot, for high winds are frequently experienced, although they hardly ever roach hurricane force. Its windiness is largely owing to local configuration, for places quite near Wellington experience very little wind; and to compensate for this rather disagreeable element is a bountiful sunshine, averaging 2,027 hours per annum. There is a plentiful rainfall, amounting to nearly 50 in.

Between Wellington and Taranaki, following the Taranaki Bight, is probably one of the most fertile and agreeable regions in Australasia; but inland, though very productive, conditions are not so favourable.

Taranaki has a rather heavy rainfall, and in most parts of this region the grass is always green. Its climate is mild, and cattle winter in the open. Wanganui and Manawatu districts (which lie between Wellington and Taranaki) have loss rainfall than either Wellington or Taranaki.

| WELLINGTON. | ||||||

|---|---|---|---|---|---|---|

| Month. | Mean Temperatures for 56 Years. | Mean Rainfall for Years. | Mean Sunshine for 14 Years. | |||

| Maximum. | Minimum. | Mean. | ||||

| °F. | °F. | °F. | Inches. | Days. | Hr. min. | |

| January | 69.4 | 55.8 | 62.5 | 3.32 | 10.4 | 228 11 |

| February | 69.2 | 55.7 | 62.5 | 3.28 | 9.0 | 207 17 |

| March | 66.8 | 54.2 | 60.5 | 3.27 | 11.3 | 182 6 |

| April | 62.8 | 51.3 | 57.0 | 3.97 | 13.2 | 150 50 |

| May | 58.3 | 47.3 | 52.8 | 4.77 | 16.6 | 130 28 |

| June | 54.7 | 44.3 | 49.5 | 4.95 | 17.2 | 103 51 |

| July | 53.1 | 42.3 | 47.7 | 5.76 | 18.3 | 103 15 |

| August | 54.4 | 42.8 | 48.6 | 4.47 | 17.1 | 140 41 |

| September | 57.4 | 45.7 | 51.6 | 4.08 | 15.2 | 159 42 |

| October | 60.3 | 48.3 | 54.3 | 4.12 | 14.1 | 177 38 |

| November | 63.4 | 50.4 | 56.9 | 3.47 | 12.9 | 203 43 |

| December | 66.9 | 53.8 | 60.3 | 3.19 | 12.0 | 239 21 |

| Year | 61.4 | 49.3 | 55.3 | 48.65 | 167.3 | 2,027 3 |

It may be useful to make a comparison between the records of Wellington and those of Camden Square, London.

| CAMDEN SQUARE, LONDON. | |||

|---|---|---|---|

| Month. | Mean Temperatures for 35 Years. | ||

| Maximum. | Minimum. | Mean. | |

| °F. | °F. | °F. | |

| January | 43.5 | 34.0 | 38.8 |

| February | 45.6 | 34.4 | 40.0 |

| March | 50.1 | 35.6 | 42.9 |

| April | 57.4 | 39.4 | 48.4 |

| May | 64.9 | 45.2 | 55.1 |

| June | 70.9 | 51.0 | 61.0 |

| July | 74.1 | 54.4 | 64.3 |

| August | 72.6 | 53.7 | 63.2 |

| September | 67.4 | 49.8 | 58.6 |

| October | 57.5 | 43.9 | 50.7 |

| November | 49.7 | 38.9 | 44.3 |

| December | 45.1 | 35.8 | 40.5 |

| Year | 58.2 | 43.0 | 50.6 |

| MOUMAHAKI. | ||||||

|---|---|---|---|---|---|---|

| Month. | Mean Temperatures for 14 Years. | Mean Rainfall for 16 Years, | Mean Sunshine for 14 Years. | |||

| Maximum. | Minimum. | Mean. | ||||

| °F. | °F. | °F. | Inches. | Days. | Hr. min. | |

| January | 70.0 | 53.3 | 61.6 | 3.20 | 9.7 | 235 36 |

| February | 70.8 | 53.3 | 62.1 | 2.91 | 8.1 | 184 52 |

| March | 69.6 | 52.4 | 61.0 | 3.77 | 9.3 | 180 4 |

| April | 64.4 | 48.2 | 56.3 | 4.03 | 13.1 | 149 45 |

| May | 59.1 | 44.1 | 51.6 | 4.17 | 14.6 | 119 3 |

| June | 55.1 | 42.5 | 48.8 | 4.42 | 14.9 | 100 62 |

| July | 53.7 | 40.9 | 47.3 | 4.24 | 16.4 | 109 4 |

| August | 55.5 | 41.8 | 48.7 | 3.68 | 14.7 | 140 16 |

| September | 58.8 | 44.8 | 51.8 | 4.01 | 14.1 | 148 7 |

| October | 61.8 | 47.0 | 54.3 | 4.53 | 14.9 | 163 5 |

| November | 64.6 | 49.1 | 56.8 | 3.56 | 12.8 | 170 17 |

| December | 68.2 | 50.9 | 59.5 | 3.46 | 11.9 | 232 23 |

| Year | 62.6 | 47.4 | 55.0 | 45.98 | 154.5 | 1,933 24 |

Nelson and Marlborough are highly favoured regions with regard to sunshine and shelter from marine winds. Long ago Bishop Selwyn said, “NO one knows what the climate is till he has basked in the almost perpetual sunshine of Tasman's Gulf, with a frame braced and invigorated to the full enjoyment of heat by the wholesome frost or cool snowy breeze of the night before.”

Pastoral and agricultural industries are thriving, and the Province of Nelson is also famous for its fruit cultures-apples especially being celebrated for their variety, colour, and flavour. The rainfall about Nelson is very reliable, and averages from 35 in. to 45 in. per annum. Marlborough is also a sunny province, and its rainfall averages from 25 in. to 30 in.

| NELSON. | |||||

|---|---|---|---|---|---|

| Month. | Mean Temperatures for 31 Years. | Mean Rainfall for 38 Years. | |||

| Maximum. | Minimum. | Mean. | |||

| °F. | °F. | °F. | Inches. | Days. | |

| January | 75.5 | 53.8 | 64.6 | 2.78 | 8.1 |

| February | 74.6 | 53.9 | 64.1 | 2.81 | 9.5 |

| March | 71.4 | 51.4 | 61.3 | 2.99 | 8.8 |

| April | 66.5 | 47.4 | 57.0 | 2.97 | 9.7 |

| May | 60.3 | 42.5 | 51.3 | 3.16 | 10.0 |

| June | 56.2 | 38.9 | 47.5 | 3.82 | 10.1 |

| July | 54.7 | 37.7 | 46.2 | 3.56 | 11.1 |

| August | 56.7 | 38.6 | 47.6 | 3.07 | 10.5 |

| September | 60.8 | 42.4 | 51.5 | 3.72 | 12.2 |

| October | 64.9 | 45.0 | 55.0 | 3.25 | 11.8 |

| November | 69.0 | 48.4 | 58.7 | 2.89 | 11.3 |

| December | 72.0 | 51.4 | 61.8 | 2.66 | 8.8 |

| Year | 65.2 | 45.9 | 55.6 | 37.68 | 121.9 |

The climate of Westland is influenced by its position with regard to the prevailing westerly winds, its proximity to the sea from which these winds blow, and the mountainous character of its eastern half. The rainfall, as might be expected, is heavy, and ranges from about 70 in. per annum in the north on the coast to as much as 200 in. in the mountainous country. The weather-changes are chiefly due to atmospheric depressions, with lowest pressures passing south of the Dominion. Cyclones centred in the north, while bringing heavy rains to the North Island and the east coast portions of the south, do not, as a rule, affect Westland, as easterly winds, which then prevail, are not conducive to cloud-formation in this province. Sunshine at Hokitika averages 1,871 hours a year, and, though not so abundant as in east coast districts, is a good average amount considering the rainfall. Westland is noted for a clear, beautiful atmosphere during fair-weather periods.

| HOKITIKA. | ||||||

|---|---|---|---|---|---|---|

| Month. | Mean Temperatures for 34 Years. | Mean Rainfall for 42 Years. | Mean Sunshine for S Years. | |||

| Maximum. | Minimum. | Mean. | ||||

| °F. | °F. | °F. | Inches. | Days. | Hr. min. | |

| January | 67.9 | 53.7 | 60.8 | 9.99, | 12.6 | 192 24 |

| February | 68.4 | 53.3 | 60.8 | 7.35 | 11.0 | 177 26 |

| March | 66.2 | 51.3 | 58.7 | 9.67 | 13.7 | 177 27 |

| April | 62.7 | 47.2 | 54.9 | 9.25 | 15.0 | 130 37 |

| May | 58.3 | 42.5 | 50.4 | 9.82 | 15.4 | 141 55 |

| June | 54.9 | 39.1 | 47.0 | 9.80 | 15.5 | 101 44 |

| July | 52.9 | 36.7 | 41.8 | 9.08 | 16.3 | 109 20 |

| August | 54.6 | 38.1 | 46.3 | 9.23 | 15.8 | 153 32 |

| September | 57.8 | 42.4 | 50.1 | 9.30 | 16.6 | 135 26 |

| October | 59.8 | 45.7 | 52.7 | 11.66 | 18.8 | 162 6 |

| November | 62.3 | 48.4 | 55.3 | 10.63 | 17.4 | 171 45 |

| December | 66.3 | 52.2 | 59.2 | 10.44 | 15.8 | 217 41 |

| Year | 60.9 | 45.8 | 63.3 | 116.22 | 183.9 | 1,871 23 |

The chief health resort of the South Island, Hanmer Spa, is situated on a small plateau in the northern portion of the Canterbury Land District. On account of its altitude, 1,120 ft., it enjoys an invigorating climate, with a mean annual temperature of only about one degree below that of Christchurch. Owing to its elevated position and nearness to the mountains Hanmer is in some winter seasons subject to rather severe snowstorms, such as are never experienced on the Canterbury Plains. The mean annual rainfall is 38.15in., and the moan total sunshine 1,992 hours.

The district of Canterbury comprises a variety of topographical features. A plain stretches over a hundred miles from north-east to south-west, with a maximum width of about forty miles from the east coast to the foothills to the westward. The latter merge into the mountainous country culminating in the main range of the Southern Alps, which divide the provinces of Canterbury and Westland, and afford a protection from the heavily moisture-laden north-westerly winds. The rainfall of the Canterbury Plains is in consequence much restricted, the average being about 26 in. There is, however, a remarkable progressive increase from east to west, as is shown by the records. At Christchurch the moan is 25.13 in.; at Mount Torlesse Station (near Springfield), 39.86 in. The climate of Canterbury might almost be described as Continental in type, with large extremes of temperature between summer and winter and day and night. Except in the three summer months frosts are numerous, and even in the early spring and late autumn they are at times severe enough to damage vegetation of a tender nature. In summer, day temperatures of over 90° in the shade are sometimes experienced. With regard to both climate and soil, the Plains have proved most suitable for agricultural farming, and much of the district is capable of growing splendid cereal and root crops. The prevailing winds in Canterbury are north-east and south-west, while north-westerlies are not, as often supposed, of frequent occurrence. They are most common in the springtime, and, being dry and warm, they have a somewhat enervating effect, though in winter-time they come as a welcome change from the keen temperatures then generally ruling. The bright sunshine, as recorded at Lincoln, shows a daily average for the year of 5.8 hours.

| LINCOLN. | |||||

|---|---|---|---|---|---|

| Month. | Mean Temperatures for 23 Years. | Mean Rainfall for 40 Years. | |||

| Maximum. | Minimum. | Mean. | |||

| °F. | °F. | °F. | Inches. | Days. | |

| January | 70.7 | 52.6 | 61.6 | 2.18 | 9.3 |

| February | 69.3 | 52.6 | 60.9 | 1.72 | 7.8 |

| March | 66.4 | 50.0 | 58.2 | 2.37 | 10.0 |

| April | 61.8 | 45.1 | 53.4 | 2.01 | 9.5 |

| May | 56.1 | 40.1 | 48.1 | 2.30 | 11.2 |

| June | 50.9 | 36.0 | 43.4 | 2.41 | 11.7 |

| July | 49.9 | 34.9 | 42.4 | 2.90 | 13.5 |

| August | 52.2 | 36.2 | 44.2 | 2.01 | 11.5 |

| September | 57.2 | 40.5 | 48.8 | 1.98 | 10.0 |

| October | 62.2 | 43.6 | 52.9 | 1.64 | 9.2 |

| November | 66.0 | 47.4 | 56.7 | 1.97 | 10.6 |

| December | 69.8 | 51.4 | 60.6 | 2.13 | 10.3 |

| Year | 61.0 | 44.2 | 52.6 | 25.62 | 124.6 |

Otago, the southernmost part of New Zealand, is very diversified as regards both its physical features and its climate. Inland, in Central and North Otago, the climate is dry and clear—hot in summer and cold in winter. The rainfall for this district averages from 13 in. to 20 in. Near the coast, in the Dunedin district, the rainfall is more plentiful, averaging from 30 in. to 40 in. per annum, a good deal of which falls in light drizzling rains.

There are continuous rainfall records from various parts of Dunedin for sixty-nine years, of which the median rainfall is 33.5 in., and the mean in the table following may be regarded as too high.

| DUNEDIN. | |||||

|---|---|---|---|---|---|

| Month. | Mean Temperatures for 55 Years. | Mean Rainfall for 63 Years. | |||

| Maximum. | Minimum. | Mean. | |||

| °F. | °F. | °F. | Inches. | Days. | |

| January | 66.4 | 49.5 | 570 | 3.41 | 14.3 |

| February | 65.7 | 49.4 | 56.6 | 2.72 | 11.3 |

| March | 62.9 | 47.8 | 55.3 | 2.92 | 12.7 |

| April | 60.3 | 44.7 | 51.6 | 2.74 | 12.8 |

| May | 53.3 | 41.0 | 47.0 | 3.26 | 13.7 |

| June | 49.3 | 38.4 | 431 | 3.13 | 12.8 |

| July | 47.5 | 36.9 | 41.5 | 3.04 | 13.0 |

| August | 49.9 | 37.7 | 431 | 3.18 | 13.0 |

| September | 53.9 | 40.7 | 47.0 | 2.77 | 12.7 |

| October | 59.0 | 42.7 | 50.8 | 3.00 | 14.1 |

| November | 61.4 | 44.9 | 53.1 | 3.29 | 14.2 |

| December | 64.5 | 47.9 | 55.3 | 3.50 | 14.5 |

| Year | 57.8 | 43.5 | 50.1 | 36.96 | 159.1 |

Queenstown, on Lake Wakatipu, amongst the mountains, at an elevation of over 1,000 ft., furnishes the following averages:—

| Month. | Mean Temperatures for 9 Years. | Mean Rainfall for 31 Years. | |||

|---|---|---|---|---|---|

| Maximum. | Minimum. | Mean. | |||

| °F. | °F. | °F | Inches. | Days. | |

| January | 70.4 | 49.9 | 60.1 | 2.76 | 8.8 |

| February | 70.2 | 49.6 | 59.9 | 1.80 | 5.6 |

| March | 66.4 | 47.9 | 57.1 | 2.51 | 7.3 |

| April | 59.1 | 43.8 | 51.5 | 2.95 | 7.8 |

| May | 51.8 | 38.6 | 45.2 | 2.67 | 7.5 |

| June | 45.9 | 33.7 | 39.7 | 2.41 | 6.9 |

| July | 43.3 | 31.8 | 37.5 | 1.96 | 5.9 |

| August | 47.3 | 33.8 | 40.6 | 1.76 | 6.1 |

| September | 54.3 | 38.7 | 46.5 | 2.53 | 7.5 |

| October | 59.8 | 42.1 | 50.9 | 3.61 | 9.0 |

| November | 63.2 | 44.5 | 53.8 | 2.83 | 8.8 |

| December | 68.0 | 49.2 | 58.6 | 2.49 | 8.0 |

| Year | 58.3 | 42.0 | 50.1 | 30.28 | 89.2 |

At Invercargill, the chief town of Southland, the averages are as follow:—

| Month. | Mean Temperatures for 11 Years. | Mean Rainfall for 27 Years. | |||

|---|---|---|---|---|---|

| Maximum. | Minimum. | Mean. | |||

| °F. | °F. | °F. | Inches. | Days. | |

| January | 65.8 | 48.3 | 57.0 | 4.23 | 15.7 |

| February | 65.7 | 47.6 | 56.6 | 2.77 | 11.6 |

| March | 64.4 | 46 0 | 55.2 | 3.60 | 14.2 |

| April | 59.1 | 42.7 | 50.9 | 4.38 | 16.5 |

| May | 53.5 | 37.7 | 45.6 | 4.66 | 17.5 |

| June | 49.7 | 36.2 | 42.9 | 3.51 | 15.9 |

| July | 48.4 | 34.0 | 41.2 | 3.45 | 15.9 |

| August | 52.1 | 36.1 | 44.1 | 3.35 | 14.7 |

| September | 56.7 | 39.0 | 47.8 | 3.05 | 13.8 |

| October | 59.5 | 42.8 | 51.1 | 4.65 | 17.2 |

| November | 61.0 | 43.6 | 52.3 | 4.54 | 17.8 |

| December | 63.8 | 46.2 | 55.0 | 4.31 | 16.7 |

| Year | 58.3 | 41.7 | 50.0 | 46.50 | 186.5 |

The average rainfall of Southland is between 40 in. and 50 in., but towards Queenstown the rainfall is between 30 in. and 40 in. The rainfall is well distributed throughout the year, but there is loss wind in winter than in summer.

Stewart Island has a wonderfully mild and moist climate, especially on its eastern side, with an average rainfall of 65.18 in.

The total year's rainfall was above the average in the west coast and north-east districts of the South Island, but below in nearly all other parts of the Dominion, the greatest deficiency occurring in the North Island. Following is a short summary for each month of the weather and the chief atmospheric systems which were in evidence:—

January.—Anticyclonic influences were predominant during the first portion of the month, and fine and warm weather was experienced generally. The warmest day was the 3rd, when maximum shade temperatures of over 90° Fahr, were recorded in Canterbury. At Ashburton as high as 100° Fahr. was reported. A westerly low-pressure passed in the South on the 13th, and was followed by an ex-tropical cyclone. The centre of the latter reached Cape Maria van Diemen on the morning of the 15th, and apparently passed in the neighbourhood of Cook Strait the same night. Good general rains occurred at this time. The latter half of the month proved changeable, with frequent showers. On the night of the 29th a secondary “low” developed considerable intensity between the east coast of the South Island and Chatham Island, and accounted for south-west gales and heavy seas along the east coast south of East Cape. The total rainfall was much above the average in Canterbury and in parts of the Auckland peninsula, but elsewhere it was below.

February.—During February the weather was generally warm and very dry. The middle of the month was bright and sunny, except in the far North, whore some heavy rains were reported from the 12th to the 14th. From the 7th to the 9th considerable rain fell in the North and in some parts of the north-eastern coast of the South Island. At Hokitika, on the morning of the 7th, 312 in. of rain fell between 1.30 a.m. and 7.30 a.m. A strong south-westerly sprang up on the 22nd and brought rain to many parts of the country, especially the cast coast districts; it was accompanied by a cold snap, and the hills were lightly covered with snow in both Islands at this time. The rainfall in Poverty Bay was greater than in Hawke's Bay, and drought conditions set in in the latter district. Most parts of Marlborough also suffered from drought during February.

March.—The dry weather which characterized the previous month was generally maintained throughout March, the only portions of the Dominion recording above the average rainfall being the southernmost district of the South Island and parts of West-land. The greatest shortage occurred in the east coast districts of the North Island, where a few stations reported a total absence of rain. Fair weather ruled during the first half of the month, except between the 6th and 8th, when a westerly low-pressure area, in conjunction with a depression in the North, brought unsettled conditions and rain in many parts. The latter half of the month was dominated by frequent disturbances passing in the South, and strong and squally north-west to south-west winds prevailed with changeable weather. Between the 20th and 27th conditions were particularly boisterous and wet in districts with a westerly aspect and in Otago. During this period some severe thunderstorms occurred in various parts of the Dominion, and on the 20th the observer at waimate reported a heavy fall of hail, with hailstones up to 7/8 in. in diameter.

April.—Rainfall was again below the average, with the greatest deficiency in districts with an easterly aspect. Anticyclonic systems were dominant during the first week, between the 15th and 17th, and from the 22nd to the close of the month. The weather proved fair generally about these periods, with fine, clear days and frosty nights. From the 7th to the 14th a very intense westerly disturbance brought unsettled, and at times stormy, conditions. High north-west winds backed to southerlies on the latter date, but the weather then rapidly improved. Another but less intense westerly “low” was in evidence between the 18th and 21st, when squally conditions prevailed, and occasional rain fell. In the early morning hours of the 19th a severe electrical disturbance was experienced in the vicinity of Cook Strait, accompanied by heavy rain showers. The shade temperature for the month was generally about 2.5° Fahr. below the April mean.

May.—Dull and misty weather was much in evidence during May, but except in the west coast districts of the South Island the total rainfall was everywhere considerably less than the average. Westerly disturbances ruling between the 7th and 13th and from the 24th to the end of the month accounted for unsettled and squally conditions during these two periods, with rain in many parts, particularly in districts with a westerly aspect. Although anticyclonic pressure prevailed from the 12th to the 24th, the weather proved cold and dull, owing to the proximity of depressions eastward and southward of the Dominion.

June.—June proved a favourable winter month, with mild fair-to-cloudy weather ruling. There were, however, several days on which heavy rain fell in different parts of the Dominion, particularly about the 1st and 3rd, 12th and 13th, 15th, 16th, and between the 23rd and 26th. On the 15th and 18th very heavy rain caused floods in many of the rivers in the northern districts of the North Island on account of a cyclone, the centre of which passed down the west coast of the North Island and in the vicinity of Cook Strait on the night of the 17th. Several other disturbances of both tropical and antarctic origin were in evidence during the month, but were generally of only minor intensity, except one centred between the Chatham Islands and the east coast of the South Island from the 23rd to 26th. During this period snow fell on much of the high country in the South Island, with squally south-west winds. The aggregate month's rainfall was above the mean in the northernmost portion of the North Island and in most parts southward of Greymouth and Christchurch in the South Island, but elsewhere it was deficient.

July.—July was an unsettled month, though the weather was milder than usual, and in consequence vegetation made an appreciable growth. The total rain was above the average in the west coast districts of the South Island, and between New Plymouth and Wanganui in the North Island; elsewhere the amounts were below, the greatest deficiencies occurring in the Hawke's Bay and Canterbury districts. Some heavy rain fell on the 2nd and 3rd, with high westerly to southerly winds, when a disturbance in the South ruled in conjunction with one which passed in the vicinity of Cook Strait during the night of the 3rd. A very intense Antarctic storm prevailed between the 12th and 18th, and on the night of the 16th a north-west gale of exceptional severity was experienced, particularly in and southward of Cook Strait. From the 26th to the close of the month a cyclone centre persisted off the western coast, but, though the weather proved dull and misty during this period, the disturbance was responsible for very little rainfall.

August.—During the first week of August an intense and extensive Antarctic storm was responsible for high westerly winds and unsettled boisterous conditions. On the 4th and 5th atmospheric pressure as low as 28.60 in. occurred in southern parts of the South Island. Thunderstorms were frequent while the storm lasted, and on the night of the 4th a severe one was experienced at Wellington. With the change of wind to southerly, about the 6th, snow fell in many parts of the South Island and on high levels in the North. The middle and end of the month proved somewhat unsettled on account of small depressions to the southward of New Zealand, but, except during the first week, the weather generally was under anticyclonic control, and proved very favourable for a winter month. Rainfall, however, was deficient over most of the Dominion, above-average totals being recorded only in the west coast and southern districts of the South Island and at a few westerly stations in the North.

September.—The chief meteorological feature in September was the heavy rain on the 17th, 18th and 19th, which benefited nearly all parts of the Dominion. This rainstorm was caused by a cyclone centre passing from the north-westward and traversing Cook Strait early on the morning of the 18th. It was followed by an intense Antarctic depression. The latter ruled until the 23rd, and also accounted for rain in many districts and for severe thunderstorms in the northern portion of the North Island. Except about the period above mentioned—viz., 16th to 23rd—anticyclonic conditions dominated, and the weather generally proved fair and mild, with a low wind-force. The total rainfall was above the average in the vicinity of Cook Strait and in South Canterbury and South Westland, but deficiencies occurred elsewhere.

October.—The mild conditions of the previous month continued almost throughout October, but owing to the cyclonic type of atmospheric pressure generally ruling precipitation was considerably above normal everywhere, except in the south-west portion of Otago. Cold weather prevailed only on the 7th and 8th and between the 23rd and 25th, and during the latter period a strong southerly gale raged in many parts of the Dominion. The feature of the month, however, was, as before mentioned, the mild, wet weather, which was conducive to a vigorous growth of vegetation. The heavy rains were specially beneficial to the east coast districts after the lengthy period of low rainfall experienced in those parts. For the Dominion as a whole the general rainfall expressed as a percentage of the normal was 156, while for the North Island it was 146 and for the South Island 167.

November.—The weather during November proved changeable and showery, but between the 21st and 26th, while a “low” centre passed in the North, occasional heavy rain fell in various parts of the country. Four other disturbances occurred during the month with lowest pressure passing southward of the Dominion, the most severe being one which ruled between the 6th and 11th. Squally conditions prevailed during this period, with much rain in the west coast districts. The rainfall of the month was commonly below the average, but excessive in the east coast portions of the North Island and in the west coast and extreme south of the South Island.

December.—December was remarkable for very changeable weather. Except on the east coast of both Islands, where rainfall was deficient, showery conditions with occasional heavy rain accounted for an aggregate precipitation generally much above normal. The greatest difference above occurred about Cook Strait. when some places experienced over double the average; while the greatest deficiency was in Canterbury, Christchurch reporting the driest December for the past twenty years. Atmospheric pressure was very unstable, high and low alternating with unusual frequency. There were, however, few disturbances of any marked intensity. The most notable one in this respect was a westerly area of low pressure which passed in the South on the 17th. It brought boisterous westerly winds, especially in and southwards of Cook Strait, and heavy rain in districts with a westerly aspect. A secondary “low” passing through Cook Strait on the night of the 12th was responsible for a severe southerly gale in districts surrounding the Strait. In most parts of the Dominion an abundant growth of vegetation took place during the month.

The following tables show the difference, above or below the moan, for each month in the year:—

| NORTH ISLAND RAINFALL, 1921. | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Monthly Means compared with the Averages for Sixteen Previous years. | ||||||||||||

| Jan. | Feb. | March. | April. | May. | June. | July. | Aug. | Sept. | Oct. | Nov. | Dec. | |

| + | .. | .. | .. | .. | .. | 4.69 | .. | .. | .. | 6.51 | .. | 6.04 |

| Av. | 3.31 | 3.08 | 4.25 | 3.97 | 4.64 | 4.54 | 5.14 | 4.29 | 3.75 | 4.24 | 3.62 | 3.06 |

| – | 2.82 | 1.55 | 1.45 | 2.30 | 2.76 | .. | 4.27 | 3.67 | 2.94 | .. | 3.17 | .. |

| Mean Number of Days with Rain, compared with the Averages for Sixteen Previous Years. | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Jan. | Feb. | March. | April. | May. | June. | July. | Aug. | Sept. | Oct. | Nov. | Dec. | |

+ Above the average. − Below the average. | ||||||||||||

| + | .. | .. | .. | .. | .. | 15.3 | 16.6 | 14.8 | .. | 14.9 | 13.5 | 10.9 |

| Av. | 10.1 | 8.7 | 11.0 | 12.7 | 14.5 | 15.3 | 16.6 | 14.8 | 14.2 | 14.6 | 13.5 | 10.7 |

| − | 10.0 | 8.5 | 10.9 | 12.5 | 14.4 | .. | .. | .. | 14.0 | .. | .. | .. |

| SOUTH ISLAND RAINFALL, 1921. | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Monthly Means compared with the Averages for Sixteen Previous years.0 | ||||||||||||

| Jan. | Feb. | March. | April. | May. | June. | July. | Aug. | Sept. | Oct. | Nov. | Dec. | |

| + | .. | .. | .. | .. | .. | .. | .. | 3.52 | .. | 5.94 | .. | .. |

| Av. | 3.74 | 2.73 | 3.39 | 3.41 | 3.48 | 3.82 | 3.76 | 3.14 | 3.80 | 3.72 | 3.47 | 3.47 |

| − | 3.03 | 1.80 | 2.52 | 2.51 | 3.15 | 3.78 | 2.95 | .. | 3.40 | .. | 2.69 | 3.36 |

| Mean Number of Days with Rain, compared with the Average for Sixteen Previous Years. | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Jan. | Feb. | March. | April. | May. | June. | July. | Aug. | Sept. | Oct. | Nov. | Dec. | |

+ Above the average. − Below the average. | ||||||||||||

| + | 12.5 | .. | .. | .. | .. | 13.0 | .. | .. | .. | 19.3 | .. | .. |

| Av. | 12.3 | 9.1 | 11.2 | 12.1 | 12.2 | 13.0 | 13.2 | 12.6 | 13.4 | 13.9 | 13.9 | 12.3 |

| − | .. | 7.2 | 10.5 | 9. | 10.6 | .. | 11.1 | 11.8 | 9.5 | .. | 12.5 | 12.2 |

| The observations were taken at 9.a.m. | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Stations. | Months. | Temperature in Shade. | Rainfall. | Mean Height of Barometer. | Prevailing Winds. | |||||

| Highest. | Lowest. | Mean Max Temp. | Mean Min. Temp. | Mean Temp. for Month. | Wet Days. | Fall. | ||||

| * Incomplete. | ||||||||||

| °Fahr. | °Fahr. | °Fahr. | °Fahr. | °Fahr. | No. | Inches. | Inches. | |||

| Auckland (lat. 36° 50' S.; long. 174° 50' 4' E.; alt. 125 ft.)— | January | 78.5 | 50.0 | 71.4 | 59.4 | 65.4 | 9 | 3.07 | 30.01 | NE, SW. |

| February | 78.0 | 51.0 | 71.4 | 59.4 | 65.4 | 5 | 2.37 | 30.04 | E, SW. | |

| March | 77.5 | 52.0 | 70.3 | 58.2 | 64.2 | 12 | 1.37 | 30.05 | SW. | |

| April | 71.0 | 43.5 | 65.2 | 53.0 | 59.1 | 11 | 2.92 | 30.13 | SW. | |

| May | 66.0 | 43.0 | 61.4 | 50.9 | 56.9 | 11 | 1.35 | 30.13 | SW, NE. | |

| June | 64.0 | 39.0 | 59.9 | 49.8 | 54.8 | 17 | 6.85 | 30.08 | SW, W. | |

| July | 63.0 | 37.5 | 56.7 | 46.5 | 51.6 | 22 | 3.42 | 30.04 | W. | |

| August | 65.0 | 42.0 | 58.2 | 47.1 | 52.6 | 16 | 2.59 | 30.07 | W, NW, SE. | |

| September | 66.5 | 43.0 | 60.8 | 49.6 | 55.2 | 9 | 3.72 | 30.16 | SW, W. | |

| October | 67.5 | 47.5 | 63.4 | 53.3 | 58.3 | 18 | 6.05 | 29.94 | NE, SW. | |

| November | 71.0 | 49.0 | 65.3 | 54.0 | 59.6 | 13 | 2.00 | 29.96 | W, SW. | |

| December | 75.5 | 50.0 | 68.4 | 57.9 | 63.1 | 13 | 3.98 | 30.00 | NE, SW. | |

| Te Aroha (lat. 37° 32' S.; long. 175° 42' E.; alt. 46 ft.)— | January | 84.0 | 40.0 | 76.3 | 53.5 | 64.9 | 7 | 3.46 | .. | W, SW. |

| February | 80.0 | 30.0 | 76.0 | 54.2 | 65.1 | 4 | 0.44 | .. | W, SW. | |

| March | 80.0 | 40.0 | 73.8 | 55.2 | 64.5 | 12 | 1.50 | .. | N, NE, W. | |

| April | 71.0 | 40.0 | 67.1 | 49.6 | 58.3 | 8 | 2.16 | .. | S, NW. | |

| May | 69.0 | 28.0 | 63.3 | 41.7 | 52.5 | 7 | 3.10 | .. | N, S, SW, NW. | |

| June | 66.0 | 28.0 | 60.3 | 45.4 | 52.8 | 14 | 9.15 | .. | N, S. | |

| July | 64.0 | 28.0 | 57.0 | 39.5 | 48.2 | 15 | 3.63 | .. | S, NW. | |

| August | 60.0 | 35.0 | 57.0 | 43.5 | 50.2 | 16 | 2.68 | .. | NW, N. | |

| September | 69.0 | 30.0 | 61.9 | 45.7 | 53.8 | 9 | 2.19 | .. | N, W. | |

| October | 70.0 | 40.0 | 66.5 | 50.0 | 58.2 | 20 | 6.26 | .. | NW, W, N. | |

| November | 74.0 | 39.0 | 68.8 | 47.1 | 57.9 | 9 | 1.26 | .. | W, NW, S. | |

| December | 79.0 | 40.0 | 72.6 | 52.8 | 62.7 | 18 | 4.26 | .. | N, NW. | |

| Waihi (lat. 37° 28' S.; long. 175° 52' E.; alt. 340 ft.)— | January | 84.9 | 44.3 | 74.6 | 54.5 | 64.5 | 13 | 3.60 | 30.016 | E, W. |

| February | 81.3 | 37.1 | 73.3 | 53.3 | 63.3 | 9 | 3.30 | 30.070 | E, W. | |

| March | 81.8 | 33.2 | 72.6 | 50.6 | 61.6 | 13 | 1.50 | 30.054 | W, SW. | |

| April | 74.1 | 29.0 | 66.3 | 43.7 | 55.0 | 11 | 4.66 | 30.125 | W, E. | |

| May | 67.9 | 27.7 | 61.7 | 41.8 | 51.7 | 14 | 3.42 | 30.175 | W, NW. | |

| June | 65.4 | 26.5 | 58.6 | 43.0 | 50.8 | 17 | 9.32 | 30.100 | E, SW. | |

| July | 63.4 | 25.6 | 56.2 | 39.6 | 47.9 | 16 | 5.66 | 30.045 | W, SW. | |

| August | 66.1 | 27.9 | 58.2 | 41.3 | 49.7 | 18 | 3.56 | 30.077 | W, SW. | |

| September | 72.0 | 26.9 | 62.9 | 45.3 | 54.1 | 11 | 3.40 | 30.157 | W, NW, SW. | |

| October | 72.0 | 35.1 | 65.5 | 47.7 | 56.6 | 23 | 9.85 | 29.948 | W, SW. | |

| November | 76.1 | 35.9 | 69.1 | 51.1 | 60.1 | 11 | 2.40 | 29.924 | W, NW. | |

| December | 80.4 | 44.8 | 72.3 | 53.8 | 63.0 | 17 | 4.80 | 30.020 | W. | |

| Tauranga (lat. 37° 42' S.; long. 176° 22' E.; alt. 100ft.)— | January | 86.0 | 39.0 | 72.7 | 51.8 | 62.2 | 7 | 3.56 | .. | NE, SW. |

| February | 77.0 | 35.0 | 71.2 | 50.1 | 60.6 | 8 | 1.48 | .. | E, SW. | |

| March | 85.0 | 38.0 | 72.1 | 40.2 | 60.6 | 7 | 0.55 | .. | SW. | |

| April | 72.0 | 32.0 | 60.2 | 42.7 | 54.4 | 5 | 3.27 | .. | NE, W. | |

| May | 66.0 | 32.0 | 62.1 | 41.2 | 51.6 | 14 | 6.27 | .. | W, S. | |

| June | 65.0 | 29.0 | 59.4 | 42.3 | 50.8 | 17 | 6.91 | .. | SW, S. | |

| July | 64.0 | 28.0 | 57.5 | 38.8 | 48.1 | 14 | 3.35 | .. | SW, S, W. | |

| August | 65.0 | 29.0 | 58.9 | 39. | 49.3 | 11 | 1.53 | .. | SW, W. | |

| September | 68.0 | 30.0 | 63.5 | 43.2 | 53.3 | 6 | 1.81 | .. | SW, W, NE. | |

| October | 69.0 | 34.0 | 64.2 | 45.9 | 55.0 | 17 | 9.90 | .. | W, SW. | |

| November | 76.0 | 38.0 | 68.3 | 47.7 | 58.0 | 8 | 1.43 | .. | SW, W. | |

| December | 78.0 | 41.0 | 69.2 | 51.0 | 60.1 | 21 | 4.87 | .. | W, NE. | |

| Rotorua (lat. 38° 9' S.; long. 176° 15' E.; alt. 932 ft.)— | January | 86.3 | 36.4 | 73.9 | 50.9 | 62.4 | 7 | 4.06 | .. | W, SW |

| February | 78.6 | 35.4 | 71.2 | 51.0 | 61.1 | 6 | 1.72 | .. | W, SW. | |

| March | 85.2 | 36.2 | 70.7 | 49.0 | 59.8 | 6 | 1.14 | .. | W, NW. | |

| April | 70.1 | 31.4 | 63.6 | 41.6 | 52.6 | 7 | 1.85 | .. | W, SE. | |

| May | 66.4 | 30.0 | 59.9 | 40.2 | 50.0 | 12 | 3.19 | .. | SW, NE. | |

| June | 64.0 | 25.8 | 56.7 | 41.0 | 48.8 | 14 | 6.11 | .. | SW, W. | |

| July | 61.4 | 28.1 | 54.9 | 37.0 | 45.9 | 13 | 3.53 | .. | SW, W. | |

| August | 61.0 | 30.0 | 56.1 | 38.3 | 47.2 | 13 | 3.99 | .. | SW, NW. | |

| September | 67.6 | 30.6 | 61.2 | 42.0 | 51.6 | 7 | 3.10 | .. | SW, W. | |

| October | 70.2 | 33.6 | 63.0 | 46.3 | 54.7 | 21 | 9.79 | .. | W, NE. | |

| November | 81.0 | 36.0 | 68.7 | 47.5 | 58.1 | 18 | 3.15 | .. | W, SW. | |

| December | 77.0 | 41.0 | 69.1 | 52.0 | 60.5 | 19 | 16.00 | .. | N, W. | |

| Taihape (lat. 39° 40' S.; long. 175 49' E.; alt. 2,080 ft.)— | January | 83.6 | 39.2 | 69.8 | 49.4 | 59.6 | 10 | 2.19 | .. | W, NE. |

| February | 76.0 | 32.0 | 66.2 | 48.0 | 57.1 | 9 | 2.04 | .. | W, NW. | |

| March | 78.3 | 38.0 | 64.1 | 47.2 | 55.6 | 12 | 1.75 | .. | W, SW. | |

| April | 67.0 | 30.8 | 56.3 | 41.0 | 48.6 | 15 | 2.31 | .. | SW, NE. | |

| May | 64.3 | 32.0 | 52.0 | 40.3 | 46.1 | 16 | 2.44 | .. | W, NW. | |

| June | 62.0 | 30.0 | 50.8 | 39.1 | 44.8 | 21 | 3.75 | .. | W, NE. | |

| July | 55.0 | 28.3 | 47.7 | 36.4 | 42.0 | 21 | 4.84 | .. | NW, W, NE. | |

| August | 57.0 | 26.0 | 40.2 | 37.3 | 43.2 | 19 | 3.77 | .. | NE, W. | |

| September | 64.0 | 31.0 | 54.4 | 40.7 | 47.5 | 15 | 1.74 | .. | W, NW. | |

| October | 60.2 | 32.0 | 57.7 | 43.6 | 50.6 | 23 | 3.95 | .. | NW, NE. | |

| November | 68.0 | 37.8 | 57.7 | 43.7 | 50.7 | 18 | 3.54 | .. | NW, SW. | |

| December | 70.4 | 41.0 | 64.1 | 48.9 | 56.5 | 14 | 4.06 | .. | NW, W. | |

| Greenmeadows (Napier) (lat. 39° 32' S.; long. 176° 53' E.; alt. 70 ft.)— | January | 93.0 | 43.0 | 72.6 | 54.7 | 63.6 | * | 1.11 | 30.071 | SW. |

| February | 86.0 | 45.0 | 72.9 | 54.2 | 63.5 | 6 | 2.70 | 30.059 | NW, SW. | |

| March | 88.0 | 40.0 | 73.8 | 53.0 | 63.4 | 1 | 0.08 | 29.981 | NW, W. | |

| April | 73.0 | 31.5 | 64.9 | 45.4 | 55.1 | 4 | 0.70 | 30.073 | W, NW. | |

| May | 71.5 | 30.0 | 61.0 | 45.2 | 53.1 | 6 | 0.97 | 30.105 | SW, NW. | |

| June | 68.0 | 33.0 | 58.8 | 44.1 | 51.4 | 11 | 2.42 | 30.007 | SW, NW. | |

| July | 68.5 | 34.0 | 57.4 | 41.9 | 49.6 | 11 | 2.10 | 29.948 | NW, W. | |

| August | 68.0 | 34.0 | 58.8 | 43.1 | 50.9 | 15 | 2.71 | 30.005 | NW, SE. | |

| September | 72.0 | 35.5 | 63.2 | 44.8 | 54.0 | 5 | 0.81 | 30.070 | SW, NE, NW. | |

| October | 72.0 | 39.0 | 66.0 | 50.0 | 58.0 | 16 | 3.54 | 29.877 | NW, SW. | |

| November | 88.5 | 38.0 | 69.1 | 50.2 | 59.6 | 11 | 3.50 | 29.836 | NW, SW. | |

| December | 90.0 | 45.0 | 72.4 | 56.0 | 64.2 | 12 | 1.72 | 29.963 | NE, NW. | |

| Moumahakl (Taranaki) (lat. 39° 44' S.; long. 174° 40' E.; alt. 270 ft.)— | January | 85.0 | 42.0 | 73.0 | 53.3 | 63.1 | 6 | 2.69 | .. | NW, SW, NE. |

| February | 83.0 | 42.0 | 73.1 | 50.9 | 62.0 | 2 | 1.12 | .. | NW. | |

| March | 79.0 | 40.0 | 71.2 | 50.4 | 60.8 | 9 | 1.86 | .. | NW. | |

| April | 73.0 | 33.0 | 63.3 | 43.6 | 53.4 | 16 | 2.86. | .. | NW, NE. | |

| May | 66.0 | 32.0 | 59.3 | 44 2 | 51.7 | 12 | 3.35 | .. | NW, NE. | |

| June | 65.0 | 34.0 | 59.4 | 40.9 | 50.1 | 11 | 2.23 | .. | NW, NE. | |

| July | 62.0 | 30.0 | 53.8 | 39.6 | 46.7 | 17 | 5.28 | .. | NW, NE | |

| August | 63.0 | 33.0 | 56.2 | 39.3 | 47.7 | 16 | 6.20 | .. | SW. NW, NE. | |

| September | 670 | 33.0 | 600 | 42.8 | 51.4 | 12 | 2.53 | .. | NW. | |

| October | 71.0 | 38.0 | 63.6 | 47.4 | 55.5 | 24 | 5.90 | .. | NW. | |

| November | 72.0 | 40.0 | 63.7 | 46.8 | 55.2 | 17 | 2.92 | .. | NW. | |

| December | 73.0 | 41.0 | 65.2 | 47.2 | 56.2 | 11 | 1.85 | .. | NW. | |

| Masterton (lat. 40° 57' S.; long. 175° 40' E.; alt. 377 ft.)— | January | 92.6 | 39.4 | 75.5 | 50.0 | 62.7 | 11 | 2.32 | .. | SW, NE. |

| February | 82.8 | 97.4 | 73.8 | 48.8 | 61.3 | 7 | 1.64 | .. | S, N. | |

| March | 85.0 | 35.8 | 72.4 | 47.5 | 59.9 | 8 | 0.55 | .. | W, NW. | |

| April | 76.8 | 28.6 | 64.5 | 39.6 | 52.0 | 11 | 1.70 | .. | SW, NE. | |

| May | 70.8 | 29.4 | 60.1 | 40.0 | 50.0 | 13 | 1.90 | .. | NW, SW, s. | |

| June | 64.6 | 24.8 | 56.4 | 39.6 | 48.0 | 13 | 3.21 | .. | NW, SW, W. | |

| July | 65.6 | 27.8 | 54.9 | 38.0 | 46.4 | 18 | 3.60 | .. | SW, NW. | |

| August | 62.8 | 28.4 | 56.5 | 38.1 | 47.3 | 18 | 4.14 | .. | NW, SW, NE | |

| September | 69.8 | 28.8 | 62.8 | 39.7 | 51.2 | 11 | 1.53 | .. | SW. | |

| October | 72.2 | 31.6 | 64.0 | 46.0 | 55.0 | 17 | 6.83 | .. | NW, NE. | |

| November | 76.2 | 33.0 | 66.2 | 43.9 | 55.0 | 14 | 4.13 | .. | SW, W. | |

| December | 84.0 | 37.4 | 71.3 | 49.4 | 60.3 | 9 | 5.71 | .. | NE, NW. | |

| Palmerston North (lat. 40° 21' S.; long 175°37' E.; alt. 100 ft.)— | January | 83.5 | 41.0 | 7d.0 | 50.8 | 62.9 | 7 | 1.65 | .. | E, W. |

| February | 80.0 | 43.0 | 69.0 | 51.4 | 60.2 | 6 | 1.10 | .. | NW. | |

| March | 82.0 | 40.0 | 64.0 | 49.2 | 56.6 | 14 | 2.39 | .. | NW, W. | |

| April | 70.0 | 26.0 | 61.3 | 40.0 | 50.6 | 9 | 1.36 | .. | NW. | |

| May | 70.0 | 25.0 | 59.0 | 39.3 | 49.1 | 10 | 2.01 | .. | W, E. | |

| June | 65.0 | 23.0 | 56.6 | 39.8 | 48.2 | 15 | 2.94 | .. | NW, N. | |

| July | 60.0 | 28.0 | 54.1 | 40.6 | 47.3 | 16 | 5.21 | .. | NW, N. | |

| August | 60.0 | 28.0 | 56.0 | 40.7 | 48.3 | 16 | 5.09 | .. | NW, SE. | |

| September | 70.0 | 33.0 | 59.5 | 44.1 | 51.8 | 12 | 2.47 | .. | W, NW. | |

| October | 73.0 | 37.0 | 62.3 | 48.6 | 55.4 | 21 | 4.65 | .. | NW, W, SE. | |

| November | 68.0 | 360 | 63.0 | 49.0 | 56.0 | 17 | 2.83 | .. | W, NW. | |

| December | 79.5 | 42.0 | 69.0 | 52.4 | 60.7 | 15 | 6.11 | .. | W, E. | |

| Wellington (lat. 41° 16' S.; long. 174° 46' E.; alt. 10 ft.)— | January | 81.6 | 45.3 | 69.8 | 54.7 | 62.2 | 11 | 3.14 | 30.019 | S, N. |

| February | 76.8 | 42.3 | 69.5 | 54.5 | 62.0 | 4 | 0.72 | 30.041 | N, SE. | |

| March | 76.9 | 42.8 | 67.5 | 53.2 | 60.3 | 11 | 1.29 | 29.963 | NW, S. | |

| April | 69.5 | 37.4 | 62.0 | 47.1 | 54.5 | 7 | 1.41 | 30.055 | S, N. | |

| May | 64.1 | 37.3 | 57.4 | 4.7 | 52.5 | 20 | 2.62 | 30.001 | N, S. | |

| June | 62.0 | 30.9 | 55.6 | 45.6 | 50.6 | 17 | 3.36 | 30.001 | S, N, NE. | |

| July | 60.0 | 30.3 | 53.7 | 43.1 | 48.4 | 16 | 4.61 | 29.941 | N, S. | |

| August | 60.3 | 30.7 | 55.7 | 42.3 | 49.0 | 14 | 3.25 | 29.973 | N, NW, S. | |

| September | 68.2 | 31.0 | 58.5 | 46.0 | 52.2 | 10 | 5.76 | 30.063 | N, S. | |

| October | 66.4 | 42.0 | 59.6 | 50.2 | 54.9 | 18 | 6.48 | 29.871 | NW, S. | |

| November | 71.2 | 38.3 | 61.8 | 49.2 | 55.5 | 14 | 3.55 | 29.841 | NW, S. | |

| December | 79.6 | 42.2 | 66.2 | 53.2 | 59.7 | 15 | 6.67 | 29.942 | N, NW, S. | |

| Nelson (lat. 41° 16' 17' S.; long. 173° 18' 46' E.; alt. 13 ft.)— | January | 91.5 | 41.0 | 71.3 | 53.9 | 62.6 | 9 | 2.12 | .. | N, NE. |

| February | 79.0 | 45.0 | 70.4 | 52.9 | 61.6 | 5 | 1.72 | .. | N, NE. | |

| March | 77.0 | 37.0 | 68.1 | 50.0 | 59.0 | 7 | 0.92 | .. | N, SW. | |

| April | 69.5 | 35.5 | 62.4 | 45.5 | 53.9 | 8 | 3.22 | .. | N, SW. | |

| May | 63.0 | 33.0 | 56.2 | 41.7 | 48.9 | 12 | 1.81 | .. | SE. | |

| June | 64.0 | 30.0 | 56.0 | 40.0 | 48.0 | 12 | 2.26 | .. | SE, S, NE. | |

| July | 60.0 | 30.0 | 54.5 | 36.3 | 45.4 | 10 | 2.83 | .. | SE, NE. | |

| August | 61.0 | 27.5 | 56.4 | 38.6 | 47.5 | 12 | 2.47 | .. | SE, S. | |

| September | 71.6 | 34.0 | 61.3 | 42.9 | 52.1 | 8 | 5.06 | .. | SW, N. | |

| October | 70.2 | 36.4 | 61.9 | 47.9 | 54.9 | 15 | 9.53 | .. | N, NE. | |

| November | 75.0 | 38.7 | 66.2 | 48.6 | 57.4 | 10 | 1.17 | .. | SW, N. | |

| December | 76.1 | 42.7 | 67.7 | 51.8 | 59.7 | 11 | 4.31 | .. | N, SW. | |

| Brightwater (lat. 41° 23' S.; long. 173° 9' E.; alt. 89 ft.)— | January | 91.0 | 43.0 | 73.6 | 53.8 | 63.7 | 9 | 2.06 | .. | SW, N. |

| February | 82.0 | 41.0 | 73.2 | 50.4 | 61.8 | 5 | 1.92 | .. | N, SE, SW. | |

| March | 86.0 | 38.0 | 70.2 | 48.7 | 59.4 | 6 | 1.02 | .. | SW. | |

| April | 69.0 | 32.0 | 64.1 | 42.6 | 53.3 | 8 | 3.22 | .. | SW, SE. | |

| May | 68.0 | 30.0 | 59.0 | 38.7 | 48.8 | 12 | 2.40 | .. | SE, SW. | |

| June | 62.0 | 27.0 | 58.1 | 37.6 | 47.8 | 10 | 2.75 | .. | SW, SE. | |

| July | 58.0 | 28.0 | 54.9 | 33.9 | 44.4 | 13 | 2.02 | .. | SW, SE. | |

| August | 61.0 | 27.0 | 55.9 | 36.3 | 46.1 | 11 | 2.92 | .. | SW, SE. | |

| September | 71.0 | 28.0 | 61.0 | 42.2 | 51.6 | 8 | 4.77 | .. | SW. SE. | |

| October | 71.0 | 35.0 | 63.2 | 46.2 | 54.7 | 16 | 9.61 | .. | N, SW. | |

| November | 77.0 | 38.0 | 67.8 | 48.3 | 58.0 | 8 | 1.25 | .. | SW, N. | |

| December | 74.0 | 40.0 | 69.0 | 49.9 | 59.4 | 11 | 3.76 | .. | NW, SW. | |

| Hokitika (lat. 42° 41' 30' S.; long 170° 49' E.; alt, 12 ft.)— | January | 73.0 | 42.0 | 66.3 | 51.8 | 59.0 | 12 | 3.60 | 30.070 | SW. |

| February | 72.0 | 37.0 | 67.2 | 51.3 | 59.2 | 9 | 4.54 | 30.075 | SW, NE. | |

| March | 69.0 | 37.5 | 62.3 | 49.1 | 55.7 | 21 | 8.78 | 30.001 | NE, NW. | |

| April | 67.0 | 24.0 | 59.5 | 44.2 | 51.8 | 12 | 7.19 | 30.074 | NE, E. SW. | |

| May | 62.5 | 30.5 | 56.3 | 42.2 | 49.2 | 18 | 13.47 | 30.105 | NE, E. | |

| June | 51.5 | 31.0 | 54.7 | 38.8 | 46.7 | 19 | 11.27 | 30.039 | E. | |

| July | 62.5 | 30.5 | 53.1 | 37.1 | 45.1 | 18 | 14.32 | 29.913 | E. | |

| August | 59.5 | 28.0 | 52.8 | 37.9 | 45.3 | 22 | 15.71 | 29.964 | E, NE. | |

| September | 61.0 | 33.5 | 56.4 | 43.1 | 49.7 | 15 | 6.73 | 30.102 | E, SW, NW. | |