Table of Contents

WITH this the twenty-ninth number of the Year-book it had been hoped to mark a return to the pre-war standard of early publication. That this hope was not realized was attributable firstly to the drastic reduction in size necessitated by the prevailing paper-shortage, and, secondly, to the late availability of much of the material included in the volume, this latter in itself being largely an indirect result of the paper-shortage also.

This number is the smallest ever issued under the title of “New Zealand Official Year-book,” and limitations of space have precluded the introduction of new features to any great extent. It was found a difficult task in the time available to retain with some degree of coherency all features of outstanding interest. In all cases the matter presented is of necessity treated with the utmost brevity, and other portions have had to be entirely omitted.

For more recent statistics than are contained herein the reader is referred to the “Monthly Abstract of Statistics” issued from this Office, while in many instances more detailed particulars can be obtained from the annual volumes of “Statistics of New Zealand.”

MALCOLM FRASER

Government Statistician.

Census and Statistics Office, Wellington, N.Z., 25th February, 1921.

Table of Contents

THE estimated population of the Dominion on 31st December, 1919, was 1,164,405 persons. This total does not include Maoris nor residents of the Cook and other Pacific islands annexed in 1901. The Maori population at the census of 1916 was 49,776, that of the annexed islands, 12,797.

| — | Males. | Females. | Total. |

|---|---|---|---|

* Excluding Maoris and residents of Cook and other Pacific Islands. † Including members of Expeditionary Forces. | |||

| Estimated population at end of 1918* | 542,046 | 566,327 | 1,108,373 |

| Increase during 1919— | |||

| By excess of births over deaths | 6,380 | 7,295 | 13,675 |

| By excess of immigration over emigration† | 40,462 | 1,895 | 42,357 |

| Estimated population at end of 1919* | 588,888 | 575,517 | 1,164,405 |

| Maori population, census 1916 | 25,933 | 23,843 | 49,776 |

| Population of Cook and other Pacific islands, census 1916 | 6,552 | 6,245 | 12,797 |

| Total estimated population of the Dominion on 31st December, 1919 | 621,373 | 605,605 | 1,226,978 |

The population, exclusive of Maoris and residents of the annexed islands, at each census since 1874 is given in the following statement, together with the numerical and centesimal increase between the successive enumerations:—

| Date of Enumeration. | Population. | Numerical Increase. | Centesimal Increase. | |

|---|---|---|---|---|

| March, | 1874 | 299,514 | 114,898 | 38.36 |

| March, | 1878 | 414,412 | 75,521 | 18.22 |

| April, | 1881 | 489,933 | 88,549 | 18.07 |

| March, | 1886 | 578,482 | 48,176 | 8.33 |

| April, | 1891 | 626,658 | 76,702 | 12.24 |

| 1896 | 703,360 | 69,359 | 9.86 | |

| March, | 1901 | 772,719 | 115,859 | 14.99 |

| April, | 1906 | 888,578 | 119,890 | 13.49 |

| April, | 1911 | 1,008,468 | 90,981 | 9.02 |

| October, | 1916 | 1,099,449 |

The Cook Islands are not included in any of the statistics of New Zealand quoted throughout this book. Figures re Maoris are included in the general details in a few cases only—i.e., imports and exports, savings-bank deposits, &. Where Maoris are included they swell totals to a much less extent per head than does the European population. The figures given below, therefore, do not include Maoris and residents of Cook Islands.

| Year. | Estimated Population at End of Year. | Increase during Year. | Mean Population for Year. | |||

|---|---|---|---|---|---|---|

| Males. | Females. | Totals. | Numerical. | Per Cent. | ||

* Decrease. † Census population. | ||||||

| 1910 | 529,998 | 474,388 | 1,004,386 | 21,460 | 2.18 | 992,802 |

| 1911 | 539,729 | 485,677 | 1,025,406 | 21,020 | 2.09 | 1,014,896 |

| 1912 | 553,212 | 499,415 | 1,052,627 | 27,221 | 2.65 | 1,039,016 |

| 1913 | 569,109 | 515,553 | 1,084,662 | 32,035 | 3.04 | 1,068,644 |

| 1914 | 568,161 | 527,833 | 1,095,994 | 11,332 | 1.04 | 1,090,328 |

| 1915 | 563,963 | 538,831 | 1,102,794 | 6,800 | 0.62 | 1,099,394 |

| 1916 | 549,895 | 550,668 | 1,100,563 | -2,231 | -0.20* | 1,099,449† |

| 1917 | 537,360 | 560,312 | 1,097,672 | -2,891* | -0.26* | 1,099,117 |

| 1918 | 542,046 | 566,327 | 1,108,373 | 10,701 | 0.97 | 1,103,022 |

| 1919 | 588,888 | 575,517 | 1,164,405 | 56,032 | 5.06 | 1,136,389 |

The departure of the Expeditionary Force and Reinforcements effected a heavy drain upon the small margin of numerical superiority of males. By the end of 1916 there were more females than males in New Zealand, and this position was maintained until July, 1919, when the male preponderance was again established.

At 30th June, 1914, there were 52,175 more males than females; at 30th June, 1920, only 15,404. (Maoris have not been included.)

Should the pre-war trend of events be continued, the male surplus would permanently disappear in a few years’ time.

The average rate of natural increase for the ten years preceding 1919 was 15.88 per 1,000. It may be remarked that the rates for 1918 and 1919 are much the lowest on record. Further discussion of natural increase will be found in the Vital Statistics section of this book.

| Year. | Excess of Births over Deaths. | Natural Increase per 1,000 of Mean Population. | ||

|---|---|---|---|---|

| Males. | Females. | Total. | ||

| 1910 | 7,838 | 8,507 | 16,345 | 16.46 |

| 1911 | 7,937 | 8,883 | 16,820 | 16.58 |

| 1912 | 8,622 | 9,672 | 18,294 | 17.61 |

| 1913 | 8,566 | 9,250 | 17,816 | 16.67 |

| 1914 | 8,549 | 9,641 | 18,190 | 16.68 |

| 1915 | 8,649 | 9,236 | 17,885 | 16.27 |

| 1916 | 8,523 | 9,390 | 17,913 | 16.29 |

| 1917 | 8,298 | 9,413 | 17,711 | 16.11 |

| 1918 | 3,391 | 6,105 | 9,496 | 8.61 |

| 1919 | 6,380 | 7,295 | 13,675 | 12.03 |

The total number of arrivals and departures during the past ten years, distinguishing the sexes and the number of those under and over twelve years of age, is given in the table following. The figures for the last five years do not include members of Expeditionary Forces.

| Arrivals and Departures, 1910–19. | |||||

|---|---|---|---|---|---|

| Year. | Over 12 Years of Age. | Under 12 Years of Age. | Total. | ||

| Males. | Females. | Males. | Females. | ||

| ARRIVALS. | |||||

| 1910 | 20,161 | 11,832 | 1,974 | 1,802 | 35,769 |

| 1911 | 22,881 | 13,953 | 2,452 | 2,103 | 41,389 |

| 1912 | 24,026 | 15,442 | 2,749 | 2,443 | 44,660 |

| 1913 | 22,872 | 15,801 | 3,019 | 2,896 | 44,588 |

| 1914 | 20,360 | 13,020 | 2,166 | 2,100 | 37,646 |

| 1915 | 12,993 | 9,589 | 1,494 | 1,475 | 25,551 |

| 1916 | 10,657 | 8,406 | 1,302 | 1,434 | 21,799 |

| 1917 | 8,334 | 5,583 | 825 | 907 | 15,649 |

| 1918 | 5,685 | 4,842 | 671 | 708 | 11,906 |

| 1919 | 9,341 | 8,822 | 1,431 | 1,337 | 20,931 |

| DEPARTURES. | |||||

| 1910 | 19,032 | 10,629 | 1,419 | 1,281 | 32,361 |

| 1911 | 21,730 | 12,190 | 1,809 | 1,460 | 37,189 |

| 1912 | 20,151 | 12,278 | 1,763 | 1,541 | 35,733 |

| 1913 | 17,188 | 10,518 | 1,372 | 1,291 | 30,369 |

| 1914 | 18,460 | 11,227 | 1,565 | 1,254 | 32,506 |

| 1915 | 12,228 | 8,251 | 1,090 | 907 | 22,476 |

| 1916 | 10,717 | 8,273 | 1,215 | 958 | 21,163 |

| 1917 | 6,896 | 5,672 | 701 | 600 | 13,869 |

| 1918 | 5,477 | 5,029 | 620 | 534 | 11,660 |

| 1919 | 10,086 | 7,440 | 1,291 | 1,060 | 19,877 |

The monthly figures for 1919 are as follows:—

| Month. | Arrivals. | Departures. | Excess of Arrivals. | Excess of Departures. |

|---|---|---|---|---|

| January | 1,139 | 706 | 433 | |

| February | 1,394 | 833 | 561 | |

| March | 1,545 | 1,761 | 216 | |

| April | 1,112 | 1,743 | 631 | |

| May | 1,514 | 2,018 | 504 | |

| June | 270 | 1,992 | 1,722 | |

| July | 1,765 | 995 | 770 | |

| August | 886 | 1,285 | 399 | |

| September | 2,444 | 1,845 | 599 | |

| October | 2,662 | 1,943 | 719 | |

| November | 2,735 | 2,314 | 421 | |

| December | 3,465 | 2,442 | 1,023 | |

| Totals | 20,931 | 19,877 | 1,054 |

Some two-thirds of the oversea arrivals come from Australia, while five-sixths of the departures are booked for the Commonwealth. The numbers of departures for Australian ports are, however, inflated by the inclusion of many persons who sail from New Zealand for Australia to make that country a starting-point for further travel, and who may or may not return by the same route. The real destination and original place of departure when returning are not ascertained in these cases.

| ARRIVALS FROM AND DEPARTURES TO VARIOUS COUNTRIES, 1910–19. | ||||||

|---|---|---|---|---|---|---|

| Year. | Arrivals. | |||||

| From | Total Arrivals. | |||||

| United Kingdom. | Australian Commonwealth. | Fiji. | Other British Possessions. | Foreign Countries. | ||

| 1910 | 9,367 | 24,502 | 581 | 351 | 968 | 35,769 |

| 1911 | 11,379 | 26,909 | 624 | 996 | 1,481 | 41,389 |

| 1912 | 12,912 | 28,522 | 767 | 1,305 | 1,154 | 44,660 |

| 1913 | 14,707 | 26,764 | 548 | 1,420 | 1,149 | 44,588 |

| 1914 | 8,579 | 25,967 | 648 | 1,267 | 1,185 | 37,646 |

| 1915 | 3,531 | 19,499 | 655 | 862 | 1,004 | 25,551 |

| 1916 | 3,394 | 15,321 | 697 | 626 | 1,761 | 21,799 |

| 1917 | 2,931 | 10,146 | 617 | 935 | 1,020 | 15,649 |

| 1918 | 1,176 | 8,282 | 574 | 1,130 | 744 | 11,906 |

| 1919 | 4,668 | 11,568 | 882 | 2,412 | 1,401 | 20,931 |

| Year. | Departures. | |||||

|---|---|---|---|---|---|---|

| To | Total Departures. | |||||

| United Kingdom. | Australian Commonwealth. | Fiji. | Other British Possessions. | Foreign Countries. | ||

| 1910 | 2,509 | 27,100 | 702 | 694 | 1,356 | 32,361 |

| 1911 | 2,755 | 30,918 | 696 | 844 | 1,976 | 37,189 |

| 1912 | 2,605 | 30,141 | 580 | 846 | 1,561 | 35,733 |

| 1913 | 2,649 | 24,961 | 479 | 1,017 | 1,263 | 30,369 |

| 1914 | 2,574 | 26,693 | 939 | 871 | 1,429 | 32,506 |

| 1915 | 2,063 | 17,793 | 658 | 821 | 1,140 | 22,476 |

| 1916 | 2,608 | 16,390 | 420 | 712 | 1,033 | 21,163 |

| 1917 | 1,501 | 10,499 | 503 | 588 | 778 | 13,869 |

| 1918 | 445 | 9,477 | 434 | 615 | 689 | 11,660 |

| 1919 | 3,559 | 12,722 | 675 | 1 546 | 1,375 | 19,877 |

The War Regulations of the 15th November, 1915, as amended from time to time, prescribe that no person over the age of fifteen years shall leave New Zealand for any place beyond the seas save in pursuance of a written permit issued to him by the Minister or Under-Secretary of Internal Affairs, or some other authorized person.

The only persons exempted from the necessity for obtaining permits are those who—

Leave New Zealand on the King's Service:

Leave New Zealand as bona fide members of the crew of any ship:

Arrive in and leave New Zealand in the course of the same voyage of any ship other than a ship arriving from a port in the Commonwealth of Australia.

The amendments made in November, 1915, to the Defence of the Realm Regulations of the Imperial Government, providing that no person shall enter or leave the United Kingdom without a passport, have led to a greatly increased number being issued in New Zealand.

A person leaving New Zealand for the United Kingdom or other country (with the exception of British possessions in the Pacific, for which permits suffice) must therefore have in his possession (1) a permit under the War Regulations to enable him to depart from the Dominion, (2) a passport to enable him to land at the end of his journey. If foreign countries are being visited the passport must be viséd by the Consular representative of such country in New Zealand.

Between the 1st November, 1915, and the 31st March, 1918, passports were issued to the number of 3,112, for the year ended 31st March, 1919, 1,346, and for the year ended 31st March, 1920, 4,620.

Under the War Regulations of the 21st August, 1916, no person over the age of fifteen years may land in New Zealand unless in possession of a passport or some other document satisfactorily establishing his or her nationality or identity.

In the case of a person coming from a foreign country the passport must have been issued or viséd by the British Ambassador or a British Consul in that country, and in the case of a person coming from any part of the British dominions the issue or visé must have been by some public official duly authorized in that behalf.

Certain exceptions are made with respect to persons coming to New Zealand from Australia, the Cook Islands, and Samoa. In their case the only requirement is the possession of a permit. The regulations further do not apply to a British subject arriving in New Zealand as the master or a member of the crew of the vessel in which he arrives.

The Minister of Internal Affairs or any person authorized by him is given power to grant exemptions from the requirements of the regulation.

Residents in the Dominion may, by application on the proper form, secure a passage at assisted rates for any person residing in the United Kingdom.

The payments required are—second class, £52; third class (two-berth cabin), £30; third class (four-berth cabin), £26. The passage-money, which must be paid in full before passages are booked, can be paid to the Immigration Department in Wellington or to the High Commissioner for New Zealand in London. The Department will cable any nomination, together with a remittance, if so desired, for the extra charge of £1.

Domestic servants and farm labourers granted assisted passages as such are required to follow in New Zealand their respective occupations of domestic and farm work for a period of one year after their arrival in the Dominion. If it is found that some occupation other than domestic or farm work is entered into by any such assisted immigrant before the expiration of one year after arrival in New Zealand, the immigrant will be called upon to pay the Government the difference between the assisted rate and the full fare.

Children between three and twelve years of age travelling with their parents are charged half rates. One child under three years of age in each family is taken free. A quarter-fare is charged for each additional child under three years of age.

Passages are granted on vessels belonging to the Shaw, Savill, and Albion Company, the New Zealand Shipping Company, and the Federal Steam Navigation Company.

Unhealthy persons should not be nominated, as passages at reduced rates will not be granted to them. When cases of lung, chest, or other like complaints are discovered in any member of a family by the Medical Officer at London or Liverpool, the whole family will be prevented from sailing.

The foregoing applies to persons of not more than fifty years of age in the case of nominated persons and farmers or farm labourers, and not more than forty years of age in the case of domestic servants.

In the case of immigrants under twenty-one years of age, special arrangements have to be entered into for their protection on the voyage where deemed necessary or advisable.

The High Commissioner is authorized to grant to suitable and healthy farmers, farm labourers, and domestic servants, who apply to him in London, a passage to New Zealand at the following rates:—

| Farmers. | Farm Labourers. | Domestic Servants. | |||||

|---|---|---|---|---|---|---|---|

| £ | s. | d. | £ | s. | d. | Free.Grant £2.— | |

| Third class: 6-berth cabin | 24 | 0 | 0 | 10 | 0 | 0 | |

| Third class: 4-berth cabin | 26 | 0 | 0 | 12 | 0 | 0 | |

| Third class: 2-berth cabin | 30 | 0 | 0 | 16 | 0 | 0 | |

The following table illustrates the progress of the last decade:—

| Year ended 31st March. | Immigrants assisted. | Capital possessed by Assisted Immigrants. | Net Government Expenditure on Immigration. |

|---|---|---|---|

| * Not available. | |||

| £ | £ | ||

| 1911 | 2,624 | 37,735 | 9,441 |

| 1912 | 3,300 | 24,088 | 11,681 |

| 1913 | 3,928 | 32,006 | 14,694 |

| 1914 | 5,064 | 39,701 | 33,914 |

| 1915 | 2,986 | 16,313 | 33,220 |

| 1916 | 1,103 | 2,564 | 10,010 |

| 1917 | 638 | 1,407 | 6,533 |

| 1918 | 171 | * | 3,877 |

| 1919 | 906 | * | 8,000 |

| 1920 | 3,811 | * | 40,516 |

On arrival in New Zealand the immigrants are met on board by officers of the Immigration Department who accompany the Port Health Officer to the ship. While the ship is in the stream it is the special duty of such officers to afford to the assisted immigrants all necessary information as regards transhipment, &. Arrangements are made for safety and transhipment of luggage.

Each immigrant is seen as he passes towards the doctor for examination, and is handed an official letter containing information as to where his ticket will be arranged for, and the place and time of departure of his connecting train or boat (if any). The immigrant is also requested to see the Immigration Officer on board, or to come to the office, which is near the wharf in Wellington (Union Steamship Company's building), if he requires information or advice beyond what is given in the letter. The addresses of the district agencies of the Labour Department in the larger centres of the Dominion are also supplied to male assisted immigrants. It is the practice of the Department to send out advices, by wire if necessary, to friends and relatives of immigrants about to arrive, and to get back information as to where the newcomers will be met. These messages, often together with private letters, &., are given out on board to those to whom they are addressed. Information of this nature is much appreciated, especially by wives joining their husbands.

Assisted immigrants requiring work are referred to the office of the Immigration Department, and their cases are there dealt with.

As regards the female assisted domestic workers, who are chosen after application at Home to the High Commissioner, and who are sent to New Zealand under the supervision of one or more responsible matrons, the following applies:—

The Government advertises the fact that the books of the Department are open to record the names of those people in the Dominion desirous of securing the services of an assisted girl. Such advertisements bring into the office many applications, especially pending the arrival of the ship.

Each matron in charge on board is instructed to classify the girls under two heads: (a) those with work already arranged or friends to go to; (b) those without either friends or work. On arrival they are met by the Girls’ Superintendent of the Immigration Department. Arrangements are made for sending to their destinations those girls who are going to friends or to definite positions. Those requiring accommodation are directed to homes or hostels approved by the Minister of Immigration for this purpose. The Superintendent then separately considers the case of each girl, and arranges to place her with an applicant for a Government assisted girl. In placing these girls at present, considerable reliance has necessarily to be placed on the statements made by them. The Department is, however, taking steps to get full and independent details of the work that the girl was actually engaged in before she left the Mother-country. After a girl has been placed, the Department endeavours to keep in touch with her by correspondence.

The legislation respecting the restriction of immigration into New Zealand is contained in the Immigration Restriction Act, 1908, and its amendments, and the Undesirable Immigrants Exclusion Act, 1919.

The following persons or classes of persons are prohibited from landing in New Zealand:—

Persons not of British birth and parentage who are unable to write out and sign in any European language a prescribed form of application;

Idiots or insane persons;

Persons suffering from contagious diseases which are loathsome or dangerous;

Persons arriving in New Zealand within two years after the termination of a period of imprisonment for a serious offence.

The above provisions do not apply to (a) His Majesty's land and sea forces, (b) the officers and crew of any ship of war of any Government, (c) persons duly accredited to the Government of New Zealand by the Imperial or any other Government, (d) shipwrecked persons, (e) the officers and crew of any mercantile vessel who leave New Zealand with that vessel, (f) persons exempted by the Governor-General in Council or by the Minister of Internal Affairs.

Chinese (not naturalized in New Zealand), unless they pay a poll-tax of £100 and are able to read a printed passage of not less than 100 words of the English language selected by the Collector of Customs.

The officers and crews of any ship of war of the Chinese Government, and members of the crew of any mercantile vessel who leave New Zealand by that vessel, are exempted from these provisions. There is power to exempt any other persons or classes of persons under such conditions as the Minister of Customs may prescribe.

Persons who have at any time been subjects of the State of Germany or of Austria-Hungary as those States existed on the 4th August, 1914, except under a license issued by the Attorney-General.

Persons not permanently resident in New Zealand who are disaffected or disloyal and of such a character that their presence in New Zealand would be injurious to the peace, order, and good government of the Dominion, and whom the Attorney-General on that account prohibits from landing.

When persons arrive in New Zealand who are lunatic, idiotic, deaf, dumb, blind, or infirm, and are likely to become a charge upon the public or upon any public or charitable institution, the master, owner, or charterer of the ship by which such persons come to New Zealand must enter into a bond for £100 for each such person, guaranteeing his support and maintenance for five years.

His Majesty's land and sea forces, persons brought to New Zealand either wholly or partly at the expense of the Government, shipwrecked mariners brought to New Zealand by another vessel without charge, and persons domiciled in New Zealand are exempted from these provisions. General power is given to exempt other persons in special cases and under such conditions as the Minister of Customs may prescribe.

Every person of and over the age of fifteen years who lands in New Zealand must, unless exempted by the Attorney-General, make and deliver to an officer of Customs a declaration giving his or her name, occupation, and residence, and also the following particulars if the immigrant is not a permanent resident in New Zealand returning thereto after not more than twelve months’ absence: Country of birth; age; names and places of birth of his parents; particulars as to his nationality, his intention as to permanent residence in or departure from New Zealand, and his purpose in coming thereto.

Persons of other than European descent are classified in the immigration returns as “race aliens.” Immigrants of this class have since 1908 been required to pass an education test before admission to the Dominion.

| Birthplace. | Year. | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 1910. | 1911. | 1912. | 1913. | 1914. | 1915. | 1916. | 1917. | 1918. | 1919. | |

| British Possessions— | ||||||||||

| India | 80 | 190 | 325 | 133 | 257 | 13 | 92 | 92 | 138 | 193 |

| Pacific islands | 9 | 24 | 51 | 48 | 8 | 10 | 28 | 44 | 278 | 25 |

| Other | 43 | 1 | 4 | 34 | 7 | 8 | 1 | 5 | ||

| Total, British possessions | 132 | 215 | 380 | 215 | 272 | 31 | 120 | 136 | 417 | 223 |

| Foreign Countries— | ||||||||||

| China | 209 | 546 | 348 | 325 | 511 | 265 | 327 | 272 | 256 | 418 |

| Syria | 12 | 9 | 20 | 19 | 9 | 3 | 1 | 2 | 1 | |

| Asia Minor | 4 | 4 | 8 | 2 | 2 | 2 | ||||

| Japan | 1 | 4 | 9 | 17 | 13 | 13 | 26 | 11 | 30 | 10 |

| Pacific islands | 7 | 25 | 24 | 4 | 6 | 6 | 537 | 295 | 211 | 57 |

| Other | 2 | 1 | 14 | 7 | 12 | 4 | 8 | |||

| Total, foreign countries | 235 | 589 | 423 | 374 | 551 | 291 | 893 | 588 | 500 | 485 |

| Total, “race aliens” | 367 | 804 | 803 | 589 | 823 | 322 | 1,013 | 724 | 917 | 708 |

Of the race aliens arriving in New Zealand a large proportion are Chinese, some of whom, however, have been formerly resident in the Dominion. Hindus and other natives of India are also of late years arriving in considerable numbers. A number of soldiers from the French Pacific islands are included in the figures for 1916, 1917, and 1918.

Since July, 1914, records of departures of race aliens have been kept, and these show that a total of 321 race aliens left the Dominion during 1919, including natives of the following countries: China, 237; India, 18; Japan, 4; British Pacific islands, 36; foreign Pacific islands, 22.

The census returns of 1916 showed that there were 3,204 race aliens resident in the Dominion, not including 3,221 Maori half-castes living as Europeans. Of these, 2,857 were described as being of full-blood and 347 as of half-blood.

More than 45 per cent, of the race aliens reside in Auckland Province. Wellington, however, claims the largest share (over one-third) of the Chinese.

At the census of 1881, the year in which taxation was first imposed on Chinese landing in New Zealand, the Chinese population numbered 5,004 persons. In 1896 an Act was passed raising the poll-tax on Chinese immigrants from £10 to £100 per head, and limiting the number of Chinese passengers that may be carried by vessels to New Zealand to one for every 200 tons burthen. According to the census of 1901, the Chinese population was 2,857, in 1906 it was 2,570, in 1911, 2,630, and in 1916 2,147, of whom 135 were half-castes. During recent years departures are about equal to arrivals. For the first nine months of 1920, however, arrivals exceeded departures by the large total of 905.

When any alien residing in New Zealand desires to be naturalized he may present to the Governor-General a memorial signed and verified by a statutory declaration setting forth—

His name, age, birthplace, residence, and occupation;

The length of his residence in New Zealand, and his desire to settle therein;

A request that letters of naturalization may be granted to him.

Every memorial must have written upon it or attached to it a certificate signed by some Magistrate or Justice to the effect that the applicant is known to the person certifying and is of good repute. On taking the oath of allegiance he shall enjoy within New Zealand all the rights and capacities that a natural-born subject of the United Kingdom can enjoy or transmit, excepting such rights (if any) as are specially excepted in the letters of naturalization granted to him.

Any person who has been previously naturalized in the United Kingdom or any British possession may obtain letters of naturalization in New Zealand upon presentation of his certificate or letters to the Governor-General, with satisfactory evidence of his bona fides.

An alien woman married to a natural-born or naturalized British subject shall be deemed to be herself naturalized. Where the father (or the mother, being a widow) has become naturalized in New Zealand, every child of such father or mother who during minority resides with such parent shall also be deemed to be naturalized.

No fee is payable for naturalization except in the case of Chinese, who are charged £1.

The issue of letters of naturalization, which was suspended during the war, was resumed during November, 1919, in regard to aliens from countries which, in the recent war, were either neutral or allied with Great Britain.

The Revocation of Naturalization Act of 1917 provided that the Governor-General may, by Order in Council, revoke the naturalization of any person when such revocation is considered desirable on grounds of public policy.

The number of natives of each country naturalized during the twenty years 1895–1914 is shown in the next table.

| Natives of— | Persons. |

|---|---|

| Austria-Hungary | 1,529 |

| Germany | 1,159 |

| Denmark | 676 |

| Sweden | 671 |

| Norway | 455 |

| Russia | 346 |

| Italy | 231 |

| Switzerland | 186 |

| France | 159 |

| Syria | 147 |

| China | 146 |

| United States of America | 144 |

| Netherlands | 61 |

| Greece | 61 |

| Portugal and possessions | 60 |

| Belgium | 40 |

| Spain | 16 |

| Japan | 11 |

| Turkey | 11 |

| Other countries | 52 |

| Total | 6,161 |

The Registration of Aliens Act passed in 1917 provided for the registration of all persons of the age of fifteen or over who are not British subjects either by birth or by naturalization in New Zealand. The Government Statistician is charged with the duty of compiling and keeping the register, but the actual registration is effected by Registration Officers (mostly police officers) throughout the Dominion. Every alien not less than fifteen years of age is required to make application for registration to a Registration Officer, and is required to supply the following particulars concerning himself or herself:—

Name in full:

Nationality (and if nationality is not the nationality of origin, nationality of origin):

Place of birth:

Age, and date of birth:

Whether married, single, widower, widow, or divorced:

If married, the name, age, nationality of origin, and place of abode of wife or husband:

If married, a widower, a widow, or divorced, number, names, and ages of children (if any):

Occupation:

Date of arrival in New Zealand:

Place of abode and postal address:

Whether permanently resident in New Zealand:

If not permanently resident in New Zealand, place of permanent residence, and date of projected departure from New Zealand:

Such other particulars as may from time to time be prescribed by regulations under the Act.

Upon receipt of an application for registration the Registration Officer issues a certificate of registration, and forwards the application in duplicate to the Superintendent of Police for the district, who files one copy and sends the other on to the Commissioner of Police for transmission to the Government Statistician. Registered aliens are required to notify change of address on pain of a penalty not exceeding £20. Failure to register involves a fine on conviction not exceeding £50.

The number of aliens on the Dominion register in April, 1920, was 8,581. The birthplaces of these are as follows:—

| Birthplace. | Males. | Females. | Total. |

|---|---|---|---|

| France | 89 | 46 | 135 |

| Spain | 17 | 4 | 21 |

| Portugal | 14 | 1 | 15 |

| Italy | 177 | 23 | 200 |

| Switzerland | 178 | 64 | 242 |

| Belgium | 48 | 19 | 67 |

| Netherlands | 66 | 2 | 68 |

| Germany | 587 | 167 | 754 |

| Schleswig-Holstein | 18 | 4 | 22 |

| Denmark | 452 | 92 | 544 |

| Norway | 359 | 26 | 385 |

| Sweden | 165 | 8 | 173 |

| Poland | 112 | 34 | 146 |

| Late Russian Empire | 227 | 57 | 284 |

| Austria-Hungary | 72 | 6 | 78 |

| Balkan States | 1,080 | 34 | 1,114 |

| Palestine and Syria | 85 | 39 | 124 |

| China | 2,349 | 27 | 2,376 |

| Japan | 9 | 9 | |

| U.S. America | 430 | 115 | 545 |

| South Sea islands | 69 | 28 | 97 |

| Other countries | 474 | 38 | 512 |

| At sea | 9 | 4 | 13 |

| British - born, but aliens by naturalization, marriage, &. | 50 | 607 | 657 |

| Totals | 7,136 | 1,445 | 8,581 |

A table published in Volume iv of “Statistics of New Zealand,” 1919, gives fairly detailed information as to birthplaces in conjunction with ages. A summary giving information as to ages follows:—

| Age-group. | Males. | Females. | Total. |

|---|---|---|---|

| 15 and under 20 | 158 | 21 | 179 |

| 20 and under 25 | 633 | 100 | 733 |

| 25 and under 30 | 994 | 174 | 1,168 |

| 30 and under 35 | 990 | 183 | 1,173 |

| 35 and under 40 | 867 | 168 | 1,035 |

| 40 and under 45 | 751 | 173 | 924 |

| 45 and under 50 | 615 | 160 | 775 |

| 50 and under 55 | 551 | 129 | 680 |

| 55 and under 60 | 468 | 118 | 586 |

| 60 and over | 1,109 | 219 | 1,328 |

| Totals | 7,136 | 1,445 | 8,581 |

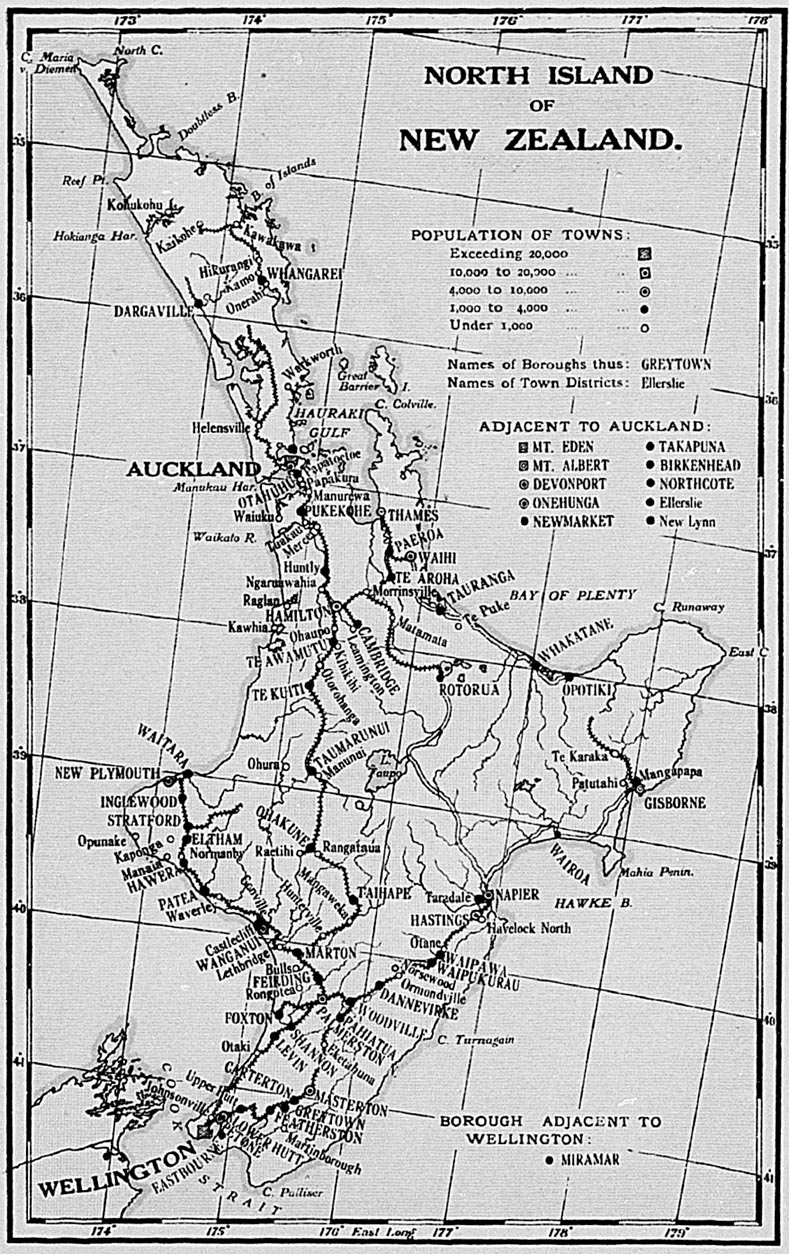

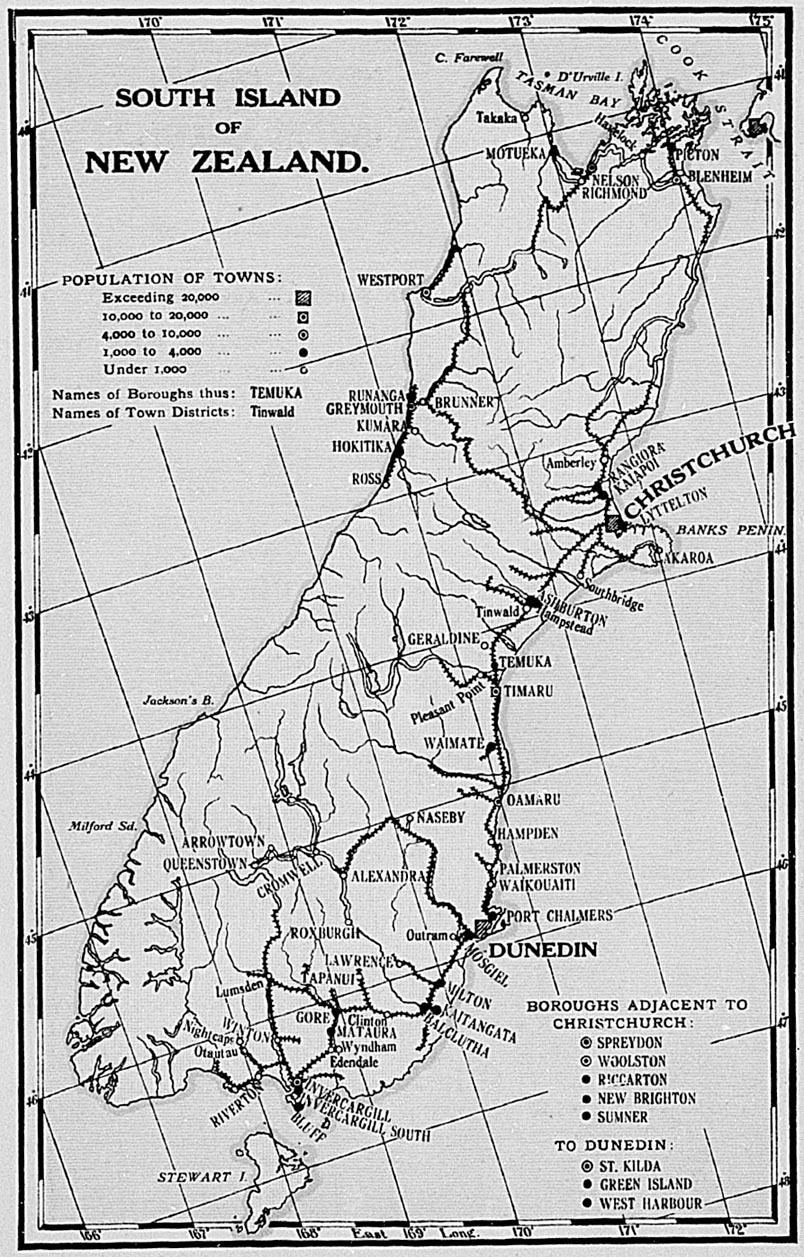

The number of persons (excluding Maoris) to a square mile in each provincial district at the last eight censuses is as follows:—

| Provincial District. | Area in Square Miles. | Persons to a Square Mile. | |||||||

|---|---|---|---|---|---|---|---|---|---|

| 1881. | 1886. | 1891. | 1896. | 1901. | 1906. | 1911. | 1916. | ||

| Auckland | 25,364 | 3.92 | 5.14 | 5.25 | 6.05 | 6.94 | 8.33 | 10.43 | 12.17 |

| Taranaki | 3,732 | 3.98 | 4.82 | 5.91 | 8.35 | 10.14 | 11.63 | 13.82 | 14.99 |

| Hawke's Bay | 4,241 | 4.10 | 5.79 | 6.72 | 8.03 | 8.35 | 9.96 | 11.45 | 12.80 |

| Wellington | 10,807 | 5.68 | 7.17 | 9.04 | 11.28 | 13.08 | 16.64 | 18.42 | 21.48 |

| Marlborough | 4,225 | 2.20 | 2.63 | 3.02 | 2.95 | 3.15 | 3.40 | 3.78 | 3.93 |

| Nelson | 10,875 | 2.40 | 2.78 | 3.20 | 3.29 | 3.49 | 3.91 | 4.46 | 3.98 |

| Westland | 4,881 | 3.08 | 3.26 | 3.25 | 2.96 | 2.97 | 3.01 | 3.22 | 3.18 |

| Canterbury | 13,858 | 8.11 | 8.77 | 9.28 | 9.82 | 10.34 | 11.50 | 12.52 | 13.12 |

| Otago— | |||||||||

| Otago portion | 13,957 | 7.70 | 8.15 | 8.32 | 8.60 | 8.98 | 9.16 | 9.52 | 9.42 |

| Southland portion | 11,358 | 2.34 | 3.12 | 3.26 | 3.87 | 4.21 | 4.67 | 5.17 | 5.25 |

| Totals | 103,298 | 4.74 | 5.60 | 6.07 | 6.81 | 7.48 | 8.60 | 9.76 | 10.64 |

The principal natural divisions in New Zealand are the North, South, and Stewart Islands. These contain approximately the whole population of European descent, the Cook and other annexed islands being inhabited almost solely by coloured Natives.

The population of the two Islands at successive censuses is given in the table following, together with the percentage that each Island bears to the total:—

| Population of the North and South Islands, 1858–1916. | |||||

|---|---|---|---|---|---|

| Census Year. | Population (excluding Maoris). | Proportions per Cent. | |||

| North Island. | South Island.* | Total. | North Island. | South Island.* | |

| * Including Stewart Island and Chatham Islands. | |||||

| 1858 | 34,094 | 25,319 | 59,418 | 57.88 | 42.62 |

| 1861 | 41,641 | 57,380 | 99,021 | 42.05 | 57.95 |

| 1864 | 65,263 | 106,895 | 172,158 | 37.91 | 62.09 |

| 1867 | 79,913 | 138,755 | 218,668 | 36.55 | 63.45 |

| 1871 | 96,875 | 159,518 | 256,393 | 37.78 | 62.22 |

| 1874 | 111,934 | 187,580 | 299,514 | 37.37 | 62.63 |

| 1878 | 158,208 | 256,204 | 414,412 | 38.18 | 61.82 |

| 1881 | 193,047 | 296,886 | 489,933 | 39.40 | 60.60 |

| 1886 | 250,482 | 328,000 | 578,482 | 43.30 | 56.70 |

| 1891 | 281,474 | 345,184 | 626,658 | 44.92 | 55.08 |

| 1896 | 340,638 | 362,722 | 703,360 | 48.43 | 51.57 |

| 1901 | 390,579 | 382,140 | 772,719 | 50.54 | 49.45 |

| 1906 | 476,737 | 411,841 | 888,578 | 53.65 | 46.35 |

| 1911 | 563,733 | 444,735 | 1,008,468 | 55.90 | 44.10 |

| 1916 | 651,072 | 448,377 | 1,099,449 | 59.22 | 40.78 |

The figures for 1916 are not quite fair to the South Island. All the military and internment camps were in the North Island, and many of the soldiers, &., in these on census night belonged to the South Island. The presence of the camps in the North Island had the further effect of temporarily attracting people from the other Island for business purposes, or to be near soldier friends and relatives. The troops abroad on census night (42,666 in number) may be regarded as having come from the two Islands in proportions approximately relative to population.

The populations of the various provincial districts as estimated at the 31st December, 1919, are as follows:—

| Provincial District. | Totals. |

|---|---|

| Auckland | 333,424 |

| Taranaki | 58,301 |

| Hawke's Bay | 60,246 |

| Wellington | 239,962 |

| Marlborough | 16,970 |

| Nelson | 49,050 |

| Westland | 14,801 |

| Canterbury | 191,282 |

| Otago— | |

| Otago portion | 137,995 |

| Southland portion | 62,374 |

| Totals for the Dominion | 1,164,405 |

The counties contain what is understood to be the rural population, but this is not strictly correct, as some of the towns not municipalized and forming part of counties have considerable populations. On the other hand, the population of a few of the smaller boroughs might be classed as rural, as will be noticed further on.

The estimated distribution of population at 31st December, 1919 (exclusive of Maoris), was as follows:—

| Counties | 484,195 |

|---|---|

| Boroughs | 641,100 |

| Independent town districts | 35,328 |

| Adjacent islands | 697 |

| Persons on shipboard | 3,085 |

| Total population of Dominion | 1,164,405 |

A list is given below showing counties and their population (exclusive of interior boroughs and independent town districts) as estimated at the 31st December, 1919, with amendments where necessary on account of subsequent alterations of boundaries. Maoris are not, unless expressly stated to the contrary, included in any population figures quoted in this section.

| Population of Counties. | |

|---|---|

| County. | Population. |

| Akaroa | 2,062 |

| Akitio | 1,503 |

| Amuri | 1,895 |

| Ashburton | 11,216 |

| Ashley | 757 |

| Awakino | 801 |

| Awatere | 1,578 |

| Bay of Islands | 3,838 |

| Bruce | 4,924 |

| Buller | 5,809 |

| Castlepoint | 659 |

| Chatham Islands | 228 |

| Cheviot | 1,263 |

| Clifton | 2,150 |

| Clutha | 7,106 |

| Collingwood | 1,293 |

| Cook | 6,060 |

| Coromandel | 2,362 |

| Dannevirke | 4,831 |

| East Taupo | 551 |

| Eden | 14,196 |

| Egmont | 3,340 |

| Eketahuna | 2,454 |

| Ellesmere | 3,629 |

| Eltham | 3,711 |

| Eyre | 1,879 |

| Featherston | 3,434 |

| Fiord | 18 |

| Franklin | 8,795 |

| Geraldine | 5,403 |

| Great Barrier | 262 |

| Grey | 5,684 |

| Halswell | 1,693 |

| Hauraki Plains | 2,168 |

| Hawera | 5,080 |

| Hawke's Bay | 10,080 |

| Heathcote | 3,509 |

| Hobson | 5,055 |

| Hokianga | 2,915 |

| Horowhenua | 5,401 |

| Hutt | 5,405 |

| Inangahua | 4,263 |

| Inglewood | 3,234 |

| Kaikoura | 1,948 |

| Kairanga | 4,377 |

| Kaitieke | 2,955 |

| Kawhia | 1,185 |

| Kiwitea | 2,744 |

| Kowai | 1,991 |

| Lake | 1,784 |

| Levels | 4,808 |

| Mackenzie | 3,033 |

| Makara | 3,156 |

| Malvern | 2,818 |

| Manawatu | 4,798 |

| Maniototo | 2,585 |

| Manukau | 5,130 |

| Marlborough | 7,014 |

| Masterton | 3,976 |

| Matakaoa | 474 |

| Matamata | 3,633 |

| Mauriceville | 818 |

| Mongonui | 3,998 |

| Mount Herbert | 421 |

| Murchison | 1,343 |

| Ohinemuri | 3,523 |

| Ohura | 2,605 |

| Opotiki | 2,011 |

| Oroua | 3,507 |

| Otamatea | 3,924 |

| Oxford | 1,827 |

| Pahiatua | 3,290 |

| Paparua | 4,905 |

| Patangata | 2,192 |

| Patea | 3,396 |

| Peninsula | 1,880 |

| Piako | 4,264 |

| Pohangina | 1,678 |

| Raglan | 4,305 |

| Rangiora | 2,857 |

| Rangitikei | 9,204 |

| Rodney | 3,630 |

| Rotorua | 1,522 |

| Selwyn | 1,480 |

| Sounds | 1,227 |

| Southland | 25,754 |

| Springs | 1,857 |

| Stewart Island | 367 |

| Stratford | 5,562 |

| Taieri | 5,801 |

| Takaka | 1,938 |

| Taranaki | 4,912 |

| Tauranga | 3,616 |

| Tawera | 881 |

| Thames | 1,764 |

| Tuapeka | 5,301 |

| Uawa | 876 |

| Vincent | 3,945 |

| Waiapu | 1,723 |

| Waihemo | 1,506 |

| Waikato | 6,918 |

| Waikohu | 3,243 |

| Waikouaiti | 4,272 |

| Waimairi | 12,394 |

| Waimarino | 2,783 |

| Waimate | 7,164 |

| Waimate West | 2,499 |

| Waimea | 9,633 |

| Waipa | 6,452 |

| Waipara | 2,133 |

| Waipawa | 3,250 |

| Waipukurau | 708 |

| Wairarapa South | 2,912 |

| Wairewa | 1,078 |

| Wairoa | 2,469 |

| Waitaki | 10,077 |

| Waitemata | 7,943 |

| Waitomo | 5,539 |

| Waitotara | 2,636 |

| Wallace | 8,542 |

| Wanganui | 2,540 |

| Weber | 443 |

| Westland | 4,257 |

| West Taupo | 2,514 |

| Whakatane | 2,197 |

| Whangamomona | 1,519 |

| Whangarei | 8,808 |

| Whangaroa | 852 |

| Woodville | 1,917 |

The next table shows the distribution of the population in counties and boroughs at each quinquennial census since 1881:—

| Census Year. | Counties. | Boroughs. | Percentage. | ||

|---|---|---|---|---|---|

| Counties. | Boroughs. | Shipboard, &. | |||

| 1881 | 291,238 | 194,981 | 59.44 | 39.80 | 0.76 |

| 1886 | 327,328 | 245,612 | 56.58 | 42.46 | 0.96 |

| 1891 | 352,097 | 270,343 | 56.18 | 43.14 | 0.68 |

| 1896 | 391,735 | 307,294 | 55.69 | 43.69 | 0.62 |

| 1901 | 417,596 | 350,202 | 54.04 | 45.32 | 0.64 |

| 1906 | 458,797 | 424,614 | 51.63 | 47.79 | 0.58 |

| 1911 | 496,779 | 505,598 | 49.26 | 50.14 | 0.60 |

| 1916 | 501,259 | 585,306 | 45.59 | 53.24 | 1.17 |

Prior to the year 1900 there was no statutory limitation to the number of inhabitants necessary to constitute a borough, and consequently many small centres, the residents being mainly engaged in rural occupations, became municipalities. The Municipal Corporations Act now imposes a limit as to area, and provides that no new borough may be constituted unless the proposed area contains at least 1,000 inhabitants.

The following table shows the estimated population of boroughs (excluding Maoris) as at 31st December, 1919, with amendments where necessary on account of subsequent alteration of boundaries:—

| Population of Boroughs. | |

|---|---|

| Borough. | Population. |

| *Town constituted under special Act. | |

| Akaroa | 562 |

| Alexandra | 737 |

| Arrowtown | 322 |

| Ashburton | 3,334 |

| Auckland (City) | 73,852 |

| Balclutha | 1,671 |

| Birkenhead | 2,262 |

| Blenheim | 4,005 |

| Bluff | 1,926 |

| Brunner | 606 |

| Cambridge | 1,711 |

| Carterton | 1,713 |

| Christchurch (City) | 61,104 |

| Cromwell | 576 |

| Dannevirke | 3,515 |

| Dargaville | 1,899 |

| Devonport | 8,140 |

| Dunedin (City) | 57,935 |

| Eastbourne | 1,310 |

| Eketahuna | 850 |

| Eltham | 1,871 |

| Featherston | 1,230 |

| Feilding | 4,949 |

| Foxton | 1,831 |

| Geraldine | 929 |

| Gisborne | 11,022 |

| Gore | 3,735 |

| Green Island | 1,996 |

| Greymouth | 4,960 |

| Greytown | 1,259 |

| Hamilton | 8,059 |

| Hampden | 412 |

| Hastings | 8,543 |

| Hawera | 3,891 |

| Hokitika | 2,241 |

| Inglewood | 1,311 |

| Invercargill | 14,867 |

| Invercargill South | 1,766 |

| Kaiapoi | 1,627 |

| Kaitangata | 1,762 |

| Kumara | 553 |

| Lawrence | 878 |

| Levin | 1,730 |

| Lower Hutt | 5,093 |

| Lyttelton | 3,817 |

| Marton | 1,801 |

| Masterton | 6,256 |

| Mataura | 1,197 |

| Milton | 1,531 |

| Miramar | 2,390 |

| Mosgiel | 1,802 |

| Motueka | 1,513 |

| Mount Albert | 10,422 |

| Mount Eden | 13,023 |

| Napier | 13,785 |

| Naseby | 299 |

| Nelson (City) | 9,107 |

| New Brighton | 3,003 |

| Newmarket | 3,061 |

| New Plymouth | 9,820 |

| Northcote | 1,765 |

| Oamaru | 5,389 |

| Ohakune | 1,455 |

| Onehunga | 6,422 |

| Opotiki | 1,167 |

| Otahuhu | 2,539 |

| Paeroa | 1,471 |

| Pahiatua | 1,650 |

| Palmerston | 788 |

| Palmerston North | 13,617 |

| Patea | 1,155 |

| Petone | 7,652 |

| Picton | 1,195 |

| Port Chalmers | 2,742 |

| Pukekohe | 1,589 |

| Queenstown | 739 |

| Rangiora | 2,081 |

| Riccarton | 3,106 |

| Richmond | 942 |

| Riverton | 980 |

| Ross | 507 |

| Rotorua* | 3,042 |

| Roxburgh | 446 |

| Runanga | 1,406 |

| Shannon | 1,044 |

| Spreydon | 4,961 |

| St. Kilda | 5,788 |

| Stratford | 3,067 |

| Sumner | 2,579 |

| Taihape | 2,045 |

| Takapuna | 3,895 |

| Tapanui | 363 |

| Taumarunui | 1,955 |

| Tauranga | 2,302 |

| Te Aroha | 1,877 |

| Te Awamutu | 1,138 |

Population of Boroughs—continued.

| Borough. | Population. |

|---|---|

| Te Kuiti | 2,119 |

| Temuka | 1,724 |

| Thames | 5,714 |

| Timaru | 13,230 |

| Waihi | 4,804 |

| Waikouaiti | 741 |

| Waimate | 1,942 |

| Waipawa | 1,159 |

| Waipukurau | 1,230 |

| Wairoa | 1,612 |

| Waitara | 1,505 |

| Wanganui | 15,363 |

| Wellington (City) | 81,301 |

| West Harbour | 1,711 |

| Westport | 4,248 |

| Whakatane | 1,082 |

| Whangarei | 3,522 |

| Winton | 576 |

| Woodville | 1,136 |

| Woolston | 4,150 |

For various purposes (vital statistics, &.) metropolitan areas have been created at each of the four chief centres, and suburban areas at nine of the more important secondary centres. Each area includes, in addition to the central borough and suburban boroughs, a considerable non-municipalized area adjacent to and contingent on the centre.

The population figures as estimated at the 31st December, 1919, with necessary subsequent internal amendments due to alteration of boundaries, are as follows:—

| Metropolitan Areas. | |

|---|---|

| Auckland | 144,646 |

| Wellington | 100,898 |

| Christchurch | 101,747 |

| Dunedin | 72,048 |

| Suburban Areas. | |

| Gisborne | 14,366 |

| Napier | 16,383 |

| New Plymouth | 11,051 |

| Wanganui | 21,778 |

| Palmerston North | 14,866 |

| Nelson | 10,340 |

| Grey Valley Boroughs | 8,495 |

| Timaru | 15,028 |

| Invercargill | 18,726 |

The several stages in the growth of a New Zealand town may be marked thus: The village, taxed by the parent county, and dependent upon the latter for all public works; then the legally constituted town district, still subordinate to the county in some matters, its affairs administered by a Board presided over by a Chairman. When its population exceeds 500 the town district may become independent of the county and control the whole of its revenues. When the population reaches 1,000 full municipal powers may be obtained, with the dignity of a Council presided over by a Mayor; and finally, if the number of inhabitants should reach 20,000 or over, the title of “city” may be assumed, although the constitution remains unaltered. The name of each town district and its population as estimated on the 31st December, 1919, including alterations due to subsequent changes in boundaries, are as follows:—

| (a.) Town Districts not forming Parts of Counties. | |

|---|---|

| Town District. | Population. |

| Bull's | 513 |

| Castlecliff | 1,557 |

| Ellerslie | 1,457 |

| Gonville | 2,950 |

| Hampstead | 1,323 |

| Havelock North | 917 |

| Helensville | 895 |

| Hikurangi | 829 |

| Hunterville | 639 |

| Huntly | 1,541 |

| Johnsonville | 940 |

| Lumsden | 537 |

| Manaia | 663 |

| Mangapapa | 1,169 |

| Mangaweka | 413 |

| Manunui | 863 |

| Manurewa | 440 |

| Martinborough | 800 |

| Matamata | 610 |

| Morrinsville | 999 |

| New Lynn | 1,613 |

| Ngaruawahia | 807 |

| Nightcaps | 641 |

| Otaki | 855 |

| Otautau | 712 |

| Papakurạ̣ | 953 |

| Papatoetoe | 801 |

| Pleasant Point | 601 |

| Raetihi | 807 |

| Rangataua | 435 |

| Taradale | 1,066 |

| Te Puke | 664 |

| Tinwald | 818 |

| Tuakau | 417 |

| Upper Hutt | 1,485 |

| Waiuku | 610 |

| Warkworth | 667 |

| Waverley | 661 |

| Wyndham | 660 |

| (b.) Town Districts forming Parts of Counties. | |

|---|---|

| Town District. | Population. |

| Amberley | 338 |

| Clinton | 433 |

| Cobden | 1,080 |

| Edendale | 391 |

| Havelock | 296 |

| Kaikohe | 381 |

| Kamo | 428 |

| Kaponga | 434 |

| Kawakawa ̣̣ ̣̣ | 350 |

| Kawhia | 206 |

| Kihikihi | 296 |

| Kohukohu | 411 |

| Leamington | 469 |

| Lethbridge | 270 |

| Mercer | 352 |

| Normanby | 402 |

| Norsewood | 274 |

| Ohaupo | 277 |

| Ohura | 224 |

| Onerahi | 347 |

| Opunake | 552 |

| Ormondville | 334 |

| Otane | 351 |

| Otorohanga | 392 |

| Outram | 365 |

| Patutahi | 272 |

| Raglan | 282 |

| Rongotea | 283 |

| Southbridge | 434 |

| Takaka | 402 |

| Te Karaka | 356 |

No fewer than nine of the “independent” town districts have sufficient population to enable them to be constituted boroughs, while on the other hand four have fallen below the 500 mark.

At the present time there is being exhibited in many countries a tendency for an increasing proportion of their inhabitants to accumulate in towns. This gradual desertion of the rural life for that of the city is usually referred to as “urban drift.” That this movement is reflected in New Zealand life is certain, but to provide an exact measure of its growth would be an excessively laborious task. The following method, while imperfect, may be taken as indicating approximately the changing of the population: The total population of towns of over 1,000 inhabitants in 1878 is contrasted with the total population of that day. Similar calculations have been made for 1886, 1896, 1906, and 1916. To make allowance for normal expansion, the minimum size of towns dealt with has been raised from 1,000 in 1878 to 1,500 in 1886, 2,000 in 1896, 2,500 in 1906, and 3,000 in 1916, a rate roughly commensurate with the growth of the country. The result was:—

| Year. | Urban Population. | Total Population. | Urban Population expressed as a Percentage of Total Population. |

|---|---|---|---|

| 1878 | 130,407 | 414,412 | 31.47 |

| 1886 | 213,286 | 578,482 | 36.87 |

| 1896 | 250,498 | 703,360 | 35.61 |

| 1906 | 344,308 | 888,578 | 38.75 |

| 1916 | 464,835 | 1,099,449 | 42.28 |

According to this calculation, urban residents formed in 1916 over 42 per cent. of the people, whereas in 1878 they were only 31 1/2 per cent.

Adjacent to the main Islands are many smaller islands, some of which are of considerable area, and are under cultivation; others are but islets used as sites for lighthouses, while others again are barren and unfitted for human habitation. The Chatham Islands and Great Barrier Island have been constituted counties, and their populations are shown in the list of counties already given. The name and population of each of the other inhabited islands as at the census of 1916 are shown in the following table:—

| Islands. | Population. |

|---|---|

| * Excluding internment camp. | |

| Mokohinau | 8 |

| Kawau | 23 |

| Motuketekete | 2 |

| Moturekareka | 1 |

| Little Barrier | 3 |

| Motuhora | 5 |

| Waiheke | 193 |

| Pakihi | 2 |

| Ponui | 21 |

| Rakino | 6 |

| Motutapu | 20 |

| Motuihi* | 6 |

| Rangitoto | 6 |

| Brown's | 5 |

| Rotoroa | 125 |

| Pakatoa | 43 |

| Tiritiri | 13 |

| Slipper | 2 |

| Cuvier | 7 |

| Mercury | 4 |

| Matakana | 7 |

| Motiti | 6 |

| Somes * | 7 |

| Mana | 1 |

| Kapiti | 3 |

| The Brothers | 3 |

| D'Urville | 87 |

| Stephen | 11 |

| Quarantine | 56 |

| Dog | 12 |

| Centre | 9 |

| Total | 697 |

In 1901 the boundaries of New Zealand were extended to include the Cook and certain other Pacific islands, the population of which is given on the next page.

A census of the Maori population is taken every five years, the information being obtained by the collectors either directly or through the chief or head of the tribe or hapu. The name, sex, and age, so far as can be ascertained, of each Maori are entered; but, owing to the nomadic habits of the race and lack of definite knowledge in some particulars, it has been a difficult task in the past. The results of the past six enumerations are as follows:—

| Census Year. | Males. | Females. | Total. |

|---|---|---|---|

| 1891 | 22,861 | 19,132 | 41,993 |

| 1896 | 21,673 | 18,181 | 39,854 |

| 1901 | 23,112 | 20,031 | 43,143 |

| 1906 | 25,538 | 22,193 | 47,731 |

| 1911 | 26,475 | 23,369 | 49,844 |

| 1916 | 25,933 | 23,843 | 49,776 |

The slight decrease in 1916 as compared with 1911 is more than compensated for by the number of Maoris at the front.

The number of half-castes living as members of Maori tribes is given in the next table for six census periods. Those under the first heading are already included among Maoris in the preceding table, the others being classed among the European population.

During the year 1901 the boundaries of the Dominion were extended to include the Cook Group and certain other of the South Pacific islands. No record of the population of these islands was then obtainable, but at each subsequent census an account of the number and birthplaces was taken. The figures for the censuses of 1906, 1911, and 1916 are as follows:—

| Census Year. | Males. | Females. | Total. |

|---|---|---|---|

| 1906 | 6,224 | 6,116 | 12,340 |

| 1911 | 6,449 | 6,149 | 12,598 |

| 1916 | 6,553 | 6,244 | 12,797 |

The islands of Western Samoa are now within the governing authority of the Dominion. An account of the group will be found in the section dealing with Outlying Islands.

Table of Contents

THE number of births registered during 1919 was 24,483 or 21.54 per 1,000 of mean population. This birth-rate of only 21.54 per 1,000, the lowest point ever reached in New Zealand, is somewhat startling. A considerable improvement for 1920 is anticipated if the numbers already recorded in the first part of the year are maintained.

The number of male children born during 1919 was 12,587, and of female children 11,896.

| BIRTHS: NUMBERS AND RATES. | |||

|---|---|---|---|

| Year. | Total Number of Births registered. | Birth-rate. | |

| Per 1,000 of Population. | Compared with Rate in 1882-86, taken as 100. | ||

| * Average of five years. | |||

| 1882-86 | 19,410* | 35.40 | 100 |

| 1890 | 18,278 | 29.44 | 83 |

| 1895 | 18,546 | 26.78 | 76 |

| 1900 | 19,546 | 25.60 | 72 |

| 1905 | 23,682 | 27.22 | 77 |

| 1910 | 25,984 | 26.17 | 74 |

| 1915 | 27,850 | 25.33 | 72 |

| 1916 | 28,509 | 25.94 | 73 |

| 1917 | 28,239 | 25.69 | 73 |

| 1918 | 25.860 | 23.44 | 66 |

| 1919 | 24,483 | 21.54 | 61 |

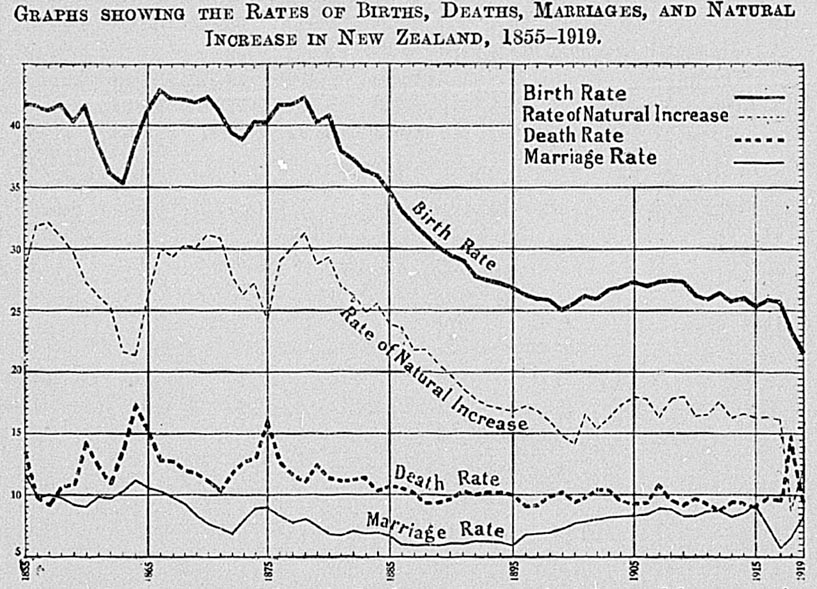

The decline of the birth-rate in New Zealand has been partially compensated for by a decrease in the death-rate. Nevertheless, the rate of natural increase of population h & s fallen from 31.19 per 1,000 of mean population in 1870 to 12.03 in 1919.

| Period. | Annual Rates per 1,000 living. | ||

|---|---|---|---|

| Births. | Deaths. | Natural Increase. | |

| 1871–1875 | 39.88 | 12.67 | 27.21 |

| 1876–1880 | 41.21 | 11.80 | 29.41 |

| 1881–1885 | 36.36 | 10.95 | 25.41 |

| 1886–1890 | 31.15 | 9.85 | 21.30 |

| 1891–1895 | 27.68 | 10.15 | 17.53 |

| 1896–1900 | 25.75 | 9.55 | 16.20 |

| 1901–1905 | 26.60 | 9.91 | 16.69 |

| 1906–1910 | 27.06 | 9.75 | 17.31 |

| 1911–1915 | 25.98 | 9.22 | 16.76 |

| 1919 | 21.54 | 9.51 | 12.03 |

In spite of the fact that the birth-rate in New Zealand is low compared with other countries, yet so low is the Dominion's death-rate that New Zealand has one of the highest rates of natural increase among countries keeping records of births and deaths.

The diagram which follows shows the rates of births and deaths and of natural increase per 1,000 of mean population each year from 1855 to 1919. The marriage-rate is also shown.

GRAPHS SHOWING THE RATES OF BIRTHS, DEATHS, MARRIAGES, AND NATURAL INCREASE IN NEW ZEALAND, 1855–1919.

The well-known fact that the birth-rate is strongly influenced by economic factors finds illustration in the position revealed by this graph, falls in the curve occurring during periods of economic depression. Recent declines are, of course, largely, if not wholly, due to war influences. At the present time birth-rates show a world-wide tendency to decline.

BIRTH-RATES (LEGITIMATE) PER 1,000 MARRIED WOMEN AT CHILD-BEARING AGES FOR EACH CENSUS YEAR, 1878 TO 1916.

| Year (Census). | Number of Married Women between 15 and 45 Years of Age. | Proportion per Cent. of Married Women in the Female Population aged 15 to 45 Years. | Number of Legitimate Births (Confinements). | Birth-rate per 1,000 Married Women of from 15 to 45 Years of Age. |

|---|---|---|---|---|

| 1878 | 50,995 | 63.50 | 17,196 | 337.2 |

| 1881 | 57,458 | 59.76 | 18,003 | 313.3 |

| 1886 | 62,704 | 53.19 | 18,532 | 295.5 |

| 1891 | 63,165 | 48.12 | 17,455 | 276.3 |

| 1896 | 69,807 | 44.12 | 17,596 | 252.1 |

| 1901 | 79,406 | 43.30 | 19,355 | 243.8 |

| 1906 | 98,211 | 46.15 | 22,352 | 227.6 |

| 1911 | 119,355 | 49.59 | 24,972 | 209.2 |

| 1916 | 141,322 | 52.97 | 26,786 | 189.5 |

Taking the whole of the four metropolitan areas into consideration the birth-rate for 1919 was 19.67 per 1,000. Each individual metropolitan area has a lower rate than the Dominion as a whole (21.54 per 1,000), a position which always obtains. Tho rates for five years, 1915 to 1919, are given below:—

| Births per 1,000 of Population. | |||||

|---|---|---|---|---|---|

| 1915. | 1916. | 1917. | 1918. | 1919. | |

| * Metropolitan areas in 1917. | |||||

| Auckland (including suburbs)* | 23.13 | 23.35 | 22.33 | 21.77 | 19.47 |

| Wellington (including suburbs) | 24.19 | 24.30 | 25.25 | 23.15 | 21.13 |

| Christchurch (including suburbs) | 22.19 | 23.54 | 22.96 | 20.22 | 19.79 |

| Dunedin (including suburbs) | 20.73 | 23.32 | 22.47 | 18.69 | 17.94 |

The fact is well illustrated above that, of tho four centres, Wellington usually has the highest rate and Dunedin the lowest. Explanation of this lies in the difference in age-constitution between the cities. In any year the ages of tho parents of the great majority of children born in that year range from 25 to 50 years. Considering this group (i.e., married people of ages 25 to 49 inclusive) it is found that it forms to the total population a proportion of 41.48 per cent, in Auckland, in Wellington 46.19 per cent., in Christchurch 40.66 per cent., in Dunedin only 36.58 per cent. These proportions are clearly reflected in the birth-rates.

Of recent years the Australian birth-rate has been higher than that of New Zealand.

The movement over the last ten years is as follows:—

BIRTH-RATES PER 1,000 OF POPULATION.

| State. | 1910. | 1911. | 1912. | 1913. | 1914. | 1915. | 1916. | 1917. | 1918. | 1919. |

|---|---|---|---|---|---|---|---|---|---|---|

| Queensland | 27.33 | 27.65 | 29.67 | 30.24 | 29.46 | 29.35 | 27.91 | 29.09 | 28.37 | 26.23 |

| New South Wales | 27.83 | 28.75 | 29.86 | 28.86 | 28.96 | 28.33 | 27.89 | 28.06 | 26.53 | 24.68 |

| Victoria | 24.51 | 24.84 | 26.39 | 25.82 | 25.45 | 24.55 | 24.30 | 23.50 | 22.29 | 21.56 |

| South Australia | 26.50 | 26.89 | 28.65 | 29.08 | 29.33 | 26.81 | 27.37 | 26.21 | 25.80 | 24.27 |

| Western Australia | 27.99 | 28.21 | 28.83 | 29.36 | 28.45 | 27.97 | 27.21 | 25.54 | 22.84 | 21.44 |

| Tasmania | 29.25 | 28.57 | 30.53 | 30.03 | 30.33 | 29.32 | 28.47 | 27.03 | 25.91 | 25.12 |

| Aust. Commonwealth | 26.73 | 27.21 | 28.65 | 28.25 | 28.05 | 27.25 | 26.78 | 26.51 | 25.25 | 23.78 |

| New Zealand | 26.17 | 25.97 | 26.48 | 26.14 | 25.99 | 25.33 | 25.94 | 25.69 | 23.44 | 21.54 |

The birth-rates for ten years in Great Britain and Ireland and certain countries of tho European Continent are also given. The decline is steady and continuous, except in the cases of Roumania and Hungary, where the rates are very high.

| Number of Births per 1,000 of Mean Population. | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Country. | 1905. | 1906. | 1907. | 1908. | 1909. | 1910. | 1911. | 1912. | 1913. | 1914. |

| Roumania | 38.3 | 39.9 | 41.1 | 40.3 | 41.1 | 39.2 | 42.3 | 43.4 | 42.1 | 42.5 |

| Hungary | 36.3 | 36.5 | 36.7 | 36.9 | 37.7 | 35.7 | 35.0 | 36.3 | ||

| Spain | 35.2 | 34.0 | 33.6 | 34.0 | 33.5 | 33.1 | 31.2 | 32.6 | 30.4 | 29.8 |

| Italy | 32.7 | 32.1 | 31.7 | 33.7 | 32.7 | 33.3 | 31.5 | 32.4 | 31.7 | 31.1 |

| Austria | 33.9 | 35.0 | 34.0 | 33.7 | 33.4 | 32.5 | 31.4 | 31.3 | ||

| German Empire | 32.9 | 33.1 | 32.3 | 32.1 | 31.0 | 29.8 | 28.6 | 28.3 | 27.5 | |

| Netherlands | 30.8 | 30.4 | 30.0 | 29.7 | 29.1 | 28.6 | 27.8 | 28.1 | 28.1 | 28.2 |

| Denmark | 28.4 | 28.5 | 28.2 | 28.5 | 28.2 | 27.5 | 26.7 | 26.7 | 25.6 | 25.6 |

| Scotland | 28.6 | 28.6 | 27.7 | 28.1 | 27.3 | 26.2 | 25.6 | 25.9 | 25.5 | 26.1 |

| Norway | 27.4 | 26.7 | 26.4 | 26.3 | 26.3 | 26.1 | 25.9 | 25.6 | 25.3 | 25.2 |

| Switzerland | 26.9 | 26.9 | 26.2 | 26.4 | 25.5 | 25.0 | 24.2 | 24.1 | 23.1 | |

| England and Wales | 27.3 | 27.2 | 26.5 | 26.7 | 25.8 | 25.1 | 24.3 | 23.9 | 24.1 | 23.8 |

| Sweden | 25.7 | 25.7 | 25.5 | 25.7 | 25.6 | 24.7 | 24.0 | 23.8 | 23.1 | 22.9 |

| Ireland | 23.4 | 23.5 | 23.2 | 23.3 | 23.4 | 23.3 | 23.2 | 23.0 | 22.8 | 22.6 |

| Belgium | 26.1 | 25.7 | 25.3 | 24.9 | 23.7 | 23.7 | 22.9 | 22.6 | ||

| France | 20.6 | 20.6 | 19.7 | 20.1 | 19.5 | 19.6 | 18.7 | 19.0 | 19.0 | 18.0 |

An examination of the figures shows that, with the exception of one year, there has always been a preponderance of males in the number of children born in New Zealand. The proportions are usually shown by stating the number of births of male children to every 1,000 female births. This number has been as high as 1,113 (in 1859), and as low as 991 (in 1860). Little significance can be attached to any figures prior to 1870, on account of the comparatively small number of births. The period preceding 1870 exhibits violent fluctuations in the proportion of males, which tend to disappear as the total of births grows larger. The extreme range since 1870 has been from 1,016 male to 1,000 female births in 1878, to 1,078 in 1875 and 1,073 in 1915.

| Year. | Number of Births of | Proportion of Births of Males to every 1,000 Females. | |

|---|---|---|---|

| Males. | Females. | ||

| 1910 | 13,442 | 12,542 | 1,072 |

| 1911 | 13,532 | 12,822 | 1,055 |

| 1912 | 13,996 | 13,512 | 1,036 |

| 1913 | 14,433 | 13,502 | 1,069 |

| 1914 | 14,535 | 13,803 | 1,053 |

| 1915 | 14,415 | 13,435 | 1,073 |

| 1916 | 14,669 | 13,840 | 1,060 |

| 1917 | 14,329 | 13,910 | 1,030 |

| 1918 | 13,124 | 12,736 | 1,030 |

| 1919 | 12,587 | 11,896 | 1,058 |

There were 270 eases of twin births (540 children), two cases of triplets and one of quadruplets registered in 1919. The number of children born was 24,483; the number of mothers was 24,206: thus, on an average, one mother in every 89 gave birth to twins or triplets.

The number of cases of plural births and the proportion per 1,000 of the total cases of births during the past five years was,—

| Year. | Total Births. | Total Cases. | Cases of Twins. | Cases of Triplets. | Plural Cases per 1,000 of Total Cases |

|---|---|---|---|---|---|

| * Including one case of quadruplets. | |||||

| 1915 | 27,850 | 27,546 | 302 | 1 | 11.00 |

| 1916 | 28,509 | 28,184 | 323 | 1 | 11.50 |

| 1917 | 28,239 | 27,927 | 312 | 11.17 | |

| 1918 | 25,860 | 25,560 | 294 | 3 | 11.62 |

| 1919 | 24,483 | 24,206 | 270 | 3* | 11.15 |

The following table shows the sexes in individual cases of twin births for the last eight years:—

| Year. | Total Cases. | Both Males. | Both Females. | Opposite Sexes. |

|---|---|---|---|---|

| 1912 | 329 | 114 | 106 | 109 |

| 1913 | 314 | 108 | 86 | 120 |

| 1914 | 350 | 105 | 116 | 129 |

| 1915 | 302 | 93 | 88 | 121 |

| 1916 | 323 | 99 | 98 | 126 |

| 1917 | 312 | 90 | 105 | 117 |

| 1918 | 294 | 87 | 95 | 112 |

| 1919 | 270 | 81 | 79 | 110 |

During the eight years 1912–19 there were seventeen cases of triplets. In three cases all the children were males, in four cases all were females, in three cases there were two males and one female, and in each of the remaining seven cases two of the three children were females.

There occurred in 1919 one case of quadruplets, all male children.

An examination of the total still-births recorded during 1915–19 shows that of 3,447 cases 188 (5.45 per cent.) were found in cases of plural births, either one or both of the children being still-born. Since, for living births in the same period, plural cases were only 1.13 per cent. of total cases, it appears that still-births occur proportionately almost five times as often in plural births as in cases of single births.

| Age of Mother, in Years. | Illegitimate Births. | Duration of Marriage, in Months. | Total Legitimate First Births within One Year after Marriage. | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Under 3. | 3 and under 6. | 6 and under 7. | 7 and under 8. | 8 and under 9. | 9 and under 10. | 10 and 11. | 11 and under 12. | |||

| Under 21 | 348 | 82 | 159 | 71 | 55 | 35 | 47 | 35 | 27 | 511 |

| 21 and under 25 | 362 | 99 | 207 | 116 | 98 | 101 | 198 | 169 | 123 | 1,111 |

| 25 and under 30 | 197 | 48 | 82 | 56 | 41 | 70 | 143 | 124 | 92 | 656 |

| 30 and under 35 | 108 | 12 | 20 | 9 | 23 | 21 | 55 | 48 | 48 | 236 |

| 35 and under 40 | 79 | 6 | 16 | 5 | 5 | 8 | 24 | 17 | 23 | 104 |

| 40 and under 45 | 38 | 4 | 4 | 1 | 3 | 2 | 4 | 1 | 19 | |

| 45 and over | ||||||||||

| Totals | 1,132 | 251 | 488 | 258 | 222 | 238 | 469 | 397 | 314 | 2,637 |

A compilation of births registered in 1919 gives 5,485 children (23 per cent, of all legitimate births) as first issue of the existing marriage. Of these 2,851 were males and 2,634 females; the sex proportion being thus 1,082 males to 1,000 females—somewhat higher than for all births. Plural cases numbered 46, or 0.85 per cent, of the total, as compared with 1.12 per cent. for all births.

The birth statistics for 1918 contained one feature which was by way of a novelty in New Zealand statistics. This consisted of a series of tables showing the period that elapsed between successive births, in conjunction with the total number of children born. One table is repeated in this issue.

| Average Interval (In Years) between | Cases in which the Number of Children In the Family was | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2. | 3. | 4. | 5. | 6. | 7. | 8. | 9. | 10 | Over 10. | All Families. | |

| First and second child | 2.96 | 2.75 | 2.55 | 2.35 | 2.27 | 2.27 | 2.24 | 2.14 | 2.15 | 2.01 | 2.67 |

| Second and third child | 3.33 | 2.98 | 2.69 | 2.48 | 2.41 | 2.27 | 2.24 | 2.36 | 1.92 | 2.94 | |

| Third and fourth child | 3.33 | 2.96 | 2.72 | 2.63 | 2.39 | 2.42 | 2.25 | 2.21 | 2.98 | ||

| Fourth and fifth child | 3.30 | 2.92 | 2.65 | 2.61 | 2.50 | 2.49 | 2.27 | 2.97 | |||

| Fifth and sixth child | 3.20 | 2.80 | 2.65 | 2.54 | 2.43 | 2.19 | 2.88 | ||||

The births of 1,138 children (581 males, 557 females) were illegitimate: thus 46 in every 1,000 children registered were born out of wedlock.

| Age. | Single Cases. | Plural Cases. |

|---|---|---|

| Years. | ||

| 14 | 1 | |

| 15 | 10 | |

| 16 | 32 | |

| 17 | 41 | |

| 18 | 75 | 1 |

| 19 | 79 | |

| 20 | 109 | |

| 21 | 116 | 1 |

| 22 | 98 | |

| 23 | 87 | |

| 24 | 60 | |

| 25 | 59 | 1 |

| 26 | 44 | |

| 27 | 33 | |

| 28 | 28 | |

| 29 | 32 | |

| 30 | 33 | 1 |

| 31 | 17 | |

| 32 | 14 | 1 |

| 33 | 25 | |

| 34 | 17 | |

| 35 | 20 | |

| 36 | 17 | |

| 37 | 12 | |

| 38 | 16 | |

| 39 | 13 | 1 |

| 40 | 12 | |

| 41 | 6 | |

| 42 | 6 | |

| 43 | 5 | |

| 44 | 9 | |

| Total | 1,126 | 6 |

The proportion of illegitimate births per 1,000 unmarried women —i.e., spinsters and widows—at the reproductive ages, covering a period of twenty-five years, is shown in the following table.

| Year. | Unmarried Women aged 15-45 Years. | Illegitimate Births. | Illegitimate-birth Rate per 1,000 Unmarried Women. |

|---|---|---|---|

| 1891 | 68,990 | 638 | 9.25 |

| 1896 | 89,722 | 834 | 9.30 |

| 1901 | 105,420 | 937 | 8.89 |

| 1906 | 116,506 | 1,132 | 9.72 |

| 1911 | 116,726 | 1,078 | 9.24 |

| 1916 | 125,461 | 1,159 | 9.24 |

The rates of illegitimacy in Australasia are quoted. The average rate for New Zealand for the ten years (4.37 per 100 of all births) compares favourably with that of the Commonwealth (5.39 per 100).

| Year. | Queensland. | New South Wales. | Victoria. | South Australia. | Western Australia. | Tasmania. | Commonwealth. | New Zealand. |

|---|---|---|---|---|---|---|---|---|

| 1909 | 7.05 | 6.44 | 5.94 | 4.18 | 3.95 | 5.45 | 6.01 | 4.61 |

| 1910 | 6.39 | 6.28 | 5.60 | 4.32 | 4.13 | 5.33 | 5.75 | 4.47 |

| 1911 | 6.22 | 6.14 | 5.96 | 4.21 | 4.47 | 5.33 | 5.79 | 4.09 |

| 1912 | 6.14 | 5.64 | 5.72 | 4.71 | 4.39 | 4.78 | 5.53 | 4.28 |

| 1913 | 6.22 | 5.35 | 6.03 | 4.18 | 4.40 | 5.18 | 5.48 | 4.23 |

| 1914 | 5.77 | 5.29 | 5.56 | 3.87 | 4.22 | 5.90 | 5.26 | 4.59 |

| 1915 | 5.36 | 4.97 | 5.74 | 4.00 | 4.24 | 5.32 | 5.12 | 4.14 |

| 1916 | 5.11 | 4.73 | 5.15 | 3.80 | 3.75 | 5.05 | 4.77 | 4.10 |

| 1917 | 5.01 | 4.74 | 5.53 | 3.96 | 4.15 | 5.28 | 4.91 | 4.56 |

| 1918 | 5.46 | 5.18 | 5.85 | 4.02 | 4.02 | 5.28 | 5.23 | 4.65 |

The Legitimation Act makes provision for the legitimation of children born before marriage on the subsequent intermarriage of their parents. For legitimation purposes Registrars must register a birth when called upon to do so by any person claiming to be the father of an illegitimate child; but such person is required to make a solemn declaration that he is the father, and that at the time of the birth there existed no legal impediment to his marriage with the mother of the child. He has also to produce the evidence of his marriage. The following is the number of legitimations in the past ten years, and the total since the Act came into force:—

| Number of Children legitimized. | |||

|---|---|---|---|

| Year. | Previously registered. | Not Previously registered. | Total. |

| 1910 | 75 | 46 | 121 |

| 1911 | 76 | 46 | 122 |

| 1912 | 86 | 51 | 137 |

| 1913 | 89 | 72 | 161 |

| 1914 | 99 | 66 | 165 |

| 1915 | 100 | 67 | 167 |

| 1916 | 190 | 91 | 281 |

| 1917 | 213 | 96 | 309 |

| 1918 | 128 | 76 | 420 |

| 1919 | 100 | 66 | 166 |

| Totals. | 1,904 | 1,140 | 3,044 |

The registration of still-births has been made compulsory in New Zealand as from the 1st March, 1913. Still–births are not included either as births or as deaths in the various numbers and rates shown in this subsection and in that relating to deaths.

In the 680 still-births registered in 1919 are included eight cases of twins, and thirty-four cases where one child of twins was still-born.

The sexes recorded in cases of still-births during each of the last five years are as follows:—

| Year. | Male. | Female. | Not stated. | Total. |

|---|---|---|---|---|

| 1915 | 382 | 340 | 6 | 728 |

| 1916 | 383 | 295 | 4 | 682 |

| 1917 | 375 | 305 | 14 | 694 |

| 1918 | 396 | 300 | 5 | 701 |

| 1919 | 377 | 288 | 15 | 680 |

The number of births of Maoris registered during 1919 under the provisions of section 20 of the Births and Deaths Registration Amendment Act, 1912, was 995. Only 14 Maori births were registered under the main Act.

Regulations under the Cook Islands Act, 1915, providing for compulsory registration of births and deaths in the Cook Islands and Niue from the 1st July, 1916, were gazetted on the 29th June, 1916.

| Islands. | Number of Births. |

|---|---|

| Rarotonga | 160 |

| Aitutaki | 60 |

| Mangaia | 63 |

| Manihiki | |

| Rakahanga | 14 |

| Atiu | 46 |

| Mauke | 19 |

| Mitiaro | 5 |

| Penrhyn | 4 |

| Niue | 110 |

| Total | 481 |

NOTE.—In some cases the above figures are for the calendar year 1919, others for year ending March, 1920, others again for different periods.

IN the following table are shown the numbers and rates for a series of years. A column is added showing the index number for the year as compared with the average of the five years 1882-86, taken as 100.

The marriage-rate for the period under review—war years 1915–18 excepted — shows a general upward tendency, having been above 8 per 1,000 in each year since and including 1902. Reference to the diagram on page 22 will show that the marriage-rate was at its lowest in the period 1885 to 1895, and that the rate in the early years of registration was considerably in excess of that in even the best of recent years.

| Year | Total Number of Marriages registered. | Marriage-rate. | |

|---|---|---|---|

| Per 1,000 of Population. | Compared with Rate in 1882-86, taken as 100. | ||

| * Average for five years. | |||

| 1882-86 | 3,663* | 6.68 | 100 |

| 1890 | 3,797 | 6.12 | 92 |

| 1895 | 4,110 | 5.94 | 89 |

| 1900 | 5,860 | 7.67 | 115 |

| 1905 | 7,200 | 8.28 | 124 |

| 1910 | 8,236 | 8.30 | 124 |

| 1915 | 10,028 | 9.12 | 137 |

| 1916 | 8,213 | 7.47 | 112 |

| 1917 | 6,417 | 5.84 | 87 |

| 1918 | 6,227 | 5.65 | 85 |

| 1919 | 9,519 | 8.38 | 125 |

The cessation of hostilities at the end of 1918 and the repatriation during 1919 of the great bulk of the Expeditionary Force has led to a healthy increase in marriages. Though not quite reaching the normal level of pre-war years, the progress made is satisfactory in view of two rate-depressing influences: first, the loss to the Dominion of many thousands of lives; and, secondly, the marriage abroad of no inconsiderable body of soldiers, the majority of whom would otherwise have married in this country.

| Year. | March Quarter. | June Quarter. | September Quarter. | December Quarter. |

|---|---|---|---|---|

| 1915 | 1,984 | 2,728 | 2,247 | 3,069 |

| 1916 | 2,214 | 2,393 | 1,773 | 1,833 |

| 1917 | 1,511 | 1.805 | 1,505 | 1,596 |

| 1918 | 1,457 | 1,756 | 1,593 | 1,421 |

| 1919 | 1,631 | 2,432 | 2,450 | 3,006 |

| Quinquennial average | 1,759 | 2,223 | 1,914 | 2,185 |

It will be seen that the June quarter is apparently considered the most propitious for the solemnization of marriage. The two years exceptional in this respect are 1915 and 1919. In the first year the December quarter was swelled by the influence of the National Registration Act of October, 1915; and the second may be explained by the celebration of many marriages postponed until the return of soldiers abroad.

An additional investigation of marriages contracted in 1919 reveals the pre-eminence which December has attained as a suitable month for entering the matrimonial state. The marriages contracted in each month were as follows:—

| January | 558 |

| February | 501 |

| March | 572 |

| April | 932 |

| May | 590 |

| June | 910 |

| July | 833 |

| August | 798 |

| September | 819 |

| October | 923 |

| November | 801 |

| December | 1,282 |

| Total | 9,519 |

Wednesday claims almost half of the total marriages—

| Sunday | 54 |

| Monday | 1,109 |

| Tuesday | 1,645 |

| Wednesday | 4,109 |

| Thursday | 1,279 |

| Friday | 476 |

| Saturday | 847 |

| Total | 9,519 |

The days of the year on which an exceptionally large number of marriages were performed were,—

| 23rd April | 137 |

| 26th November | 120 |

| 25th June | 117 |

| 30th April | 110 |

| 15th October | 107 |

| 31st December | 106 |

All these days were, it may be remarked, Wednesdays. Easter Monday, usually considered a most suitable day, ranked only thirteenth in favour.

A comparison of the marriage-rate of each Australian State with New Zealand for ten years is given. The Commonwealth rate has for some years been higher than that of this country.

| Year. | Queensland. | New South Wales. | Victoria. | South Australia (Proper). | Western Australia. | Tasmania. | Commonwealth. | New Zealand. |

|---|---|---|---|---|---|---|---|---|

| 1910 | 8.06 | 8.76 | 7.98 | 9.17 | 7.77 | 7.82 | 8.37 | 8.30 |

| 1911 | 8.41 | 9.24 | 8.34 | 9.81 | 8.44 | 7.76 | 8.79 | 8.70 |

| 1912 | 8.91 | 9.60 | 8.65 | 9.62 | 8.37 | 7.86 | 9.07 | 8.81 |

| 1913 | 8.67 | 9.02 | 8.13 | 9.40 | 8.19 | 8.27 | 8.66 | 8.25 |

| 1914 | 8.73 | 9.37 | 8.31 | 9.11 | 8.22 | 7.78 | 8.80 | 8.51 |

| 1915 | 8.93 | 9.68 | 9.00 | 9.02 | 8.01 | 8.02 | 9.14 | 9.12 |

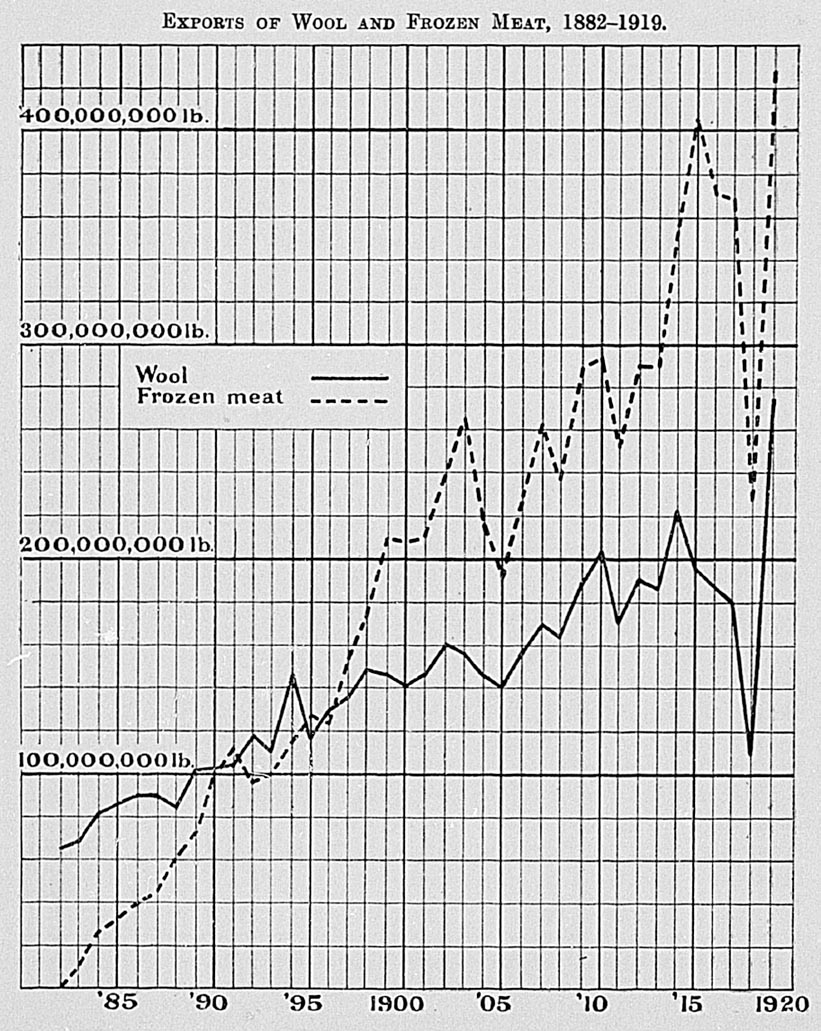

| 1916 | 7.69 | 8.74 | 8.05 | 8.31 | 7.51 | 7.23 | 8.21 | 7.47 |