Table of Contents

This, the twenty-second issue of the “New Zealand Official Yearbook,” while mainly following the arrangement of the 1912 book, contains some new features and additions. The whole of the book has been carefully revised. With the exception of the statistics relating to local governing bodies and life insurance and those not obtained annually the figures are up to the end of the calendar year 1912, or the financial year 1912-13, and in all cases the information published is the latest obtainable.

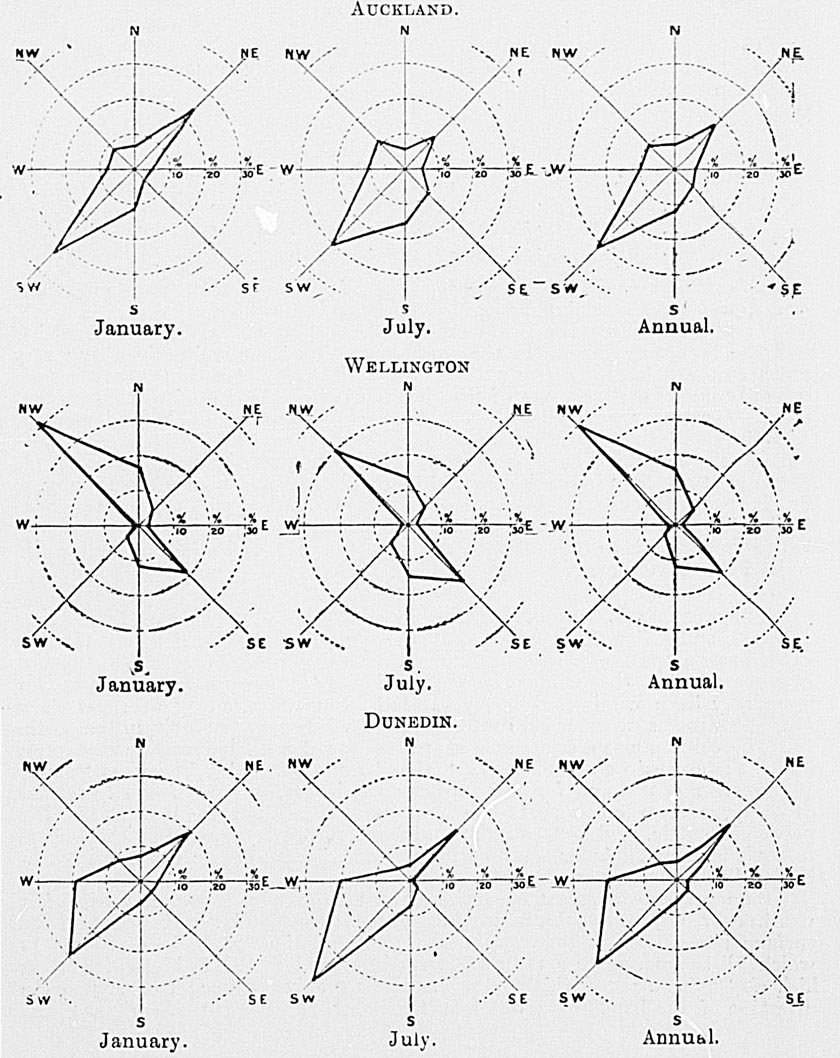

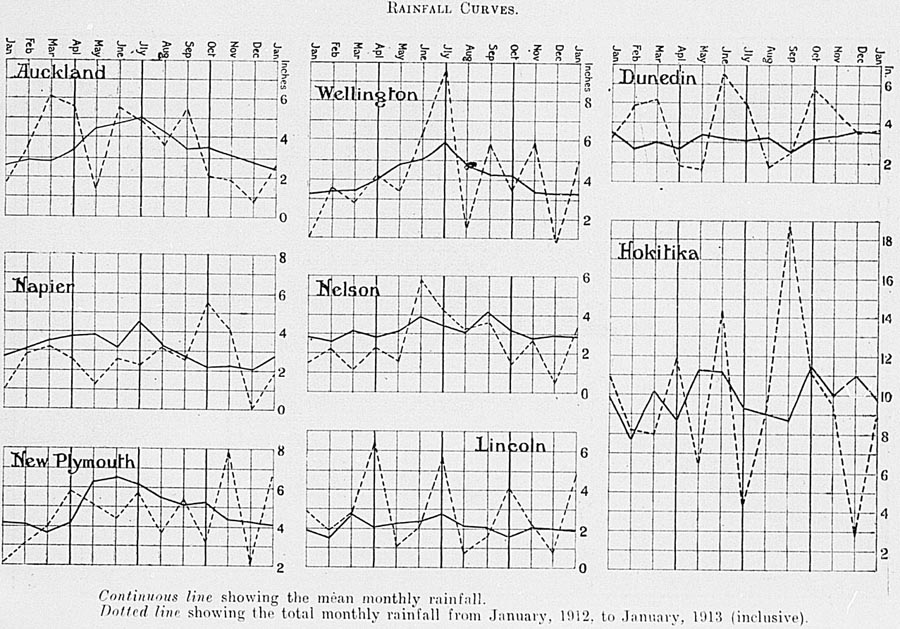

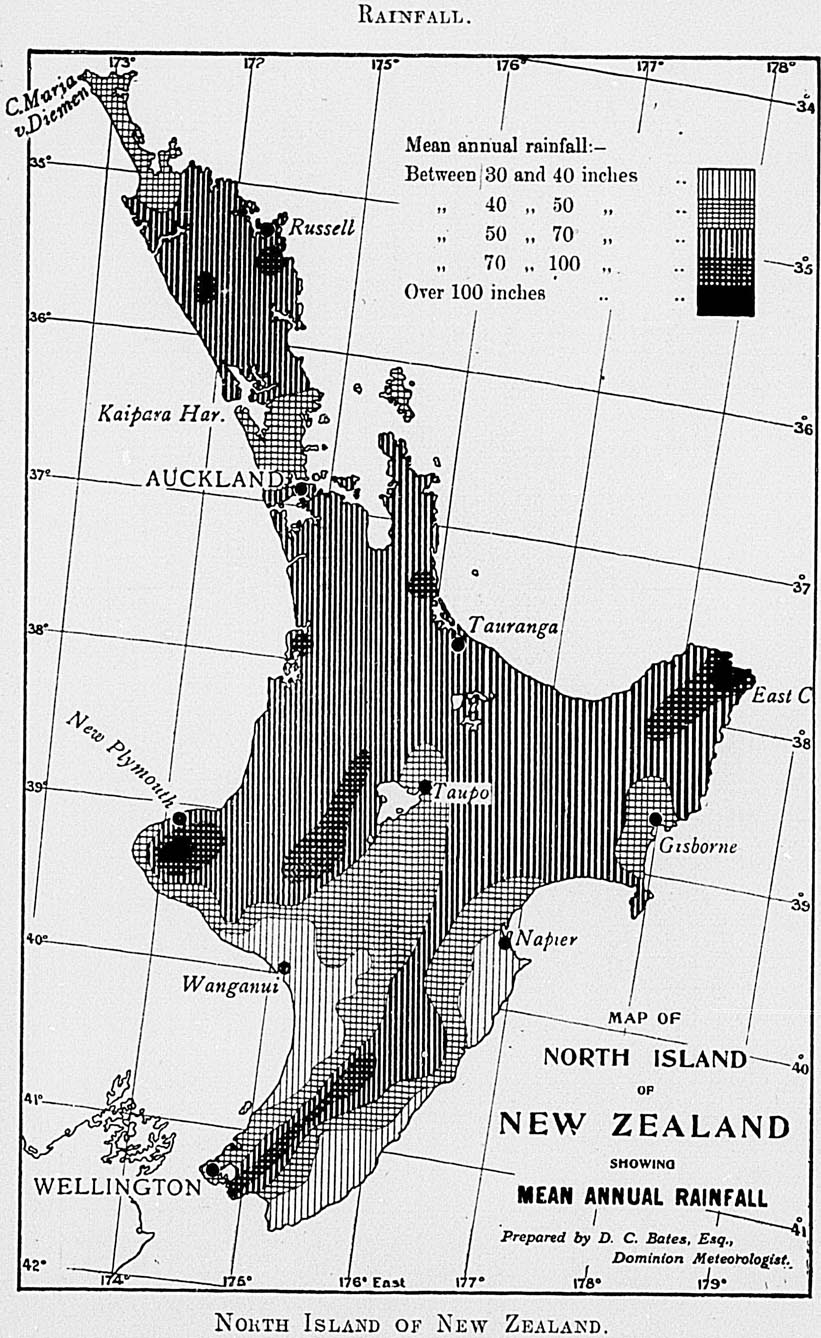

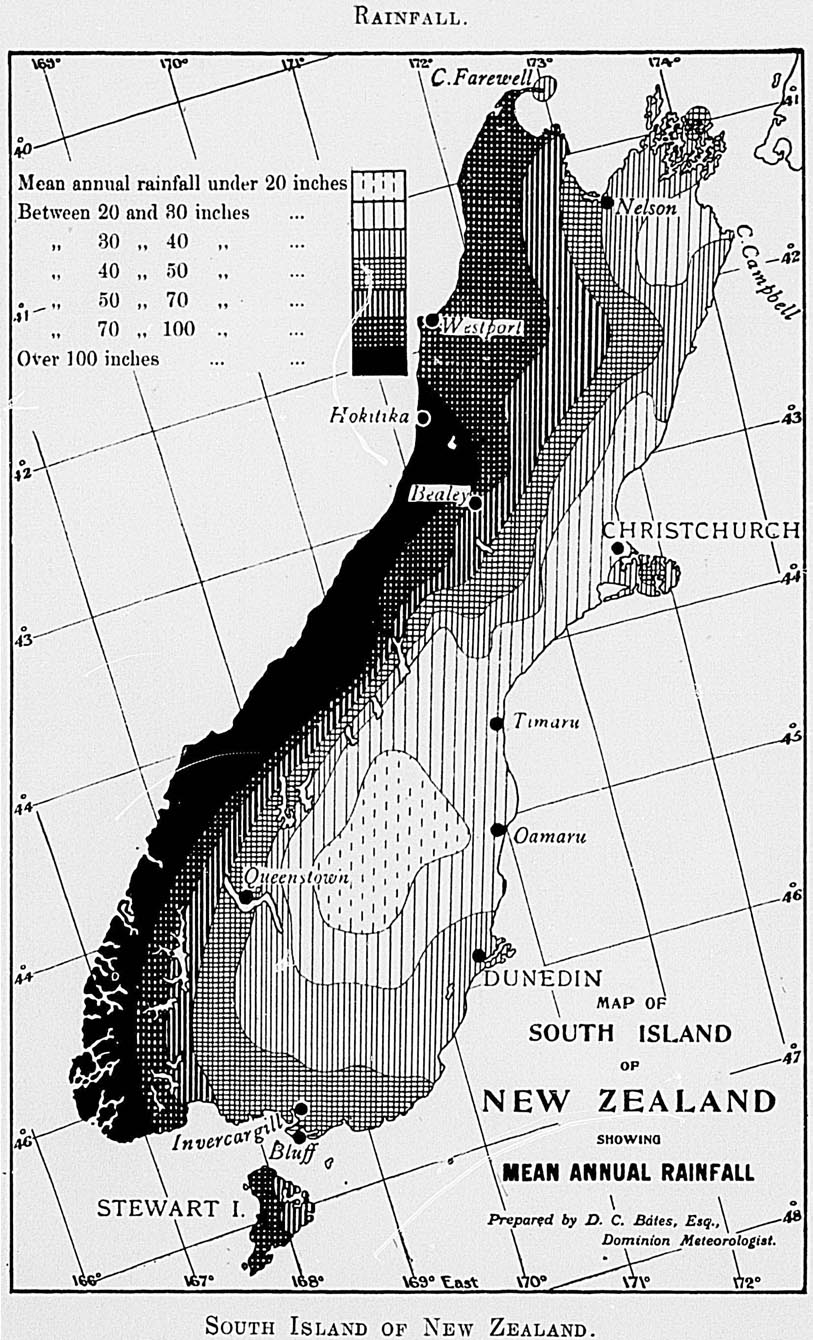

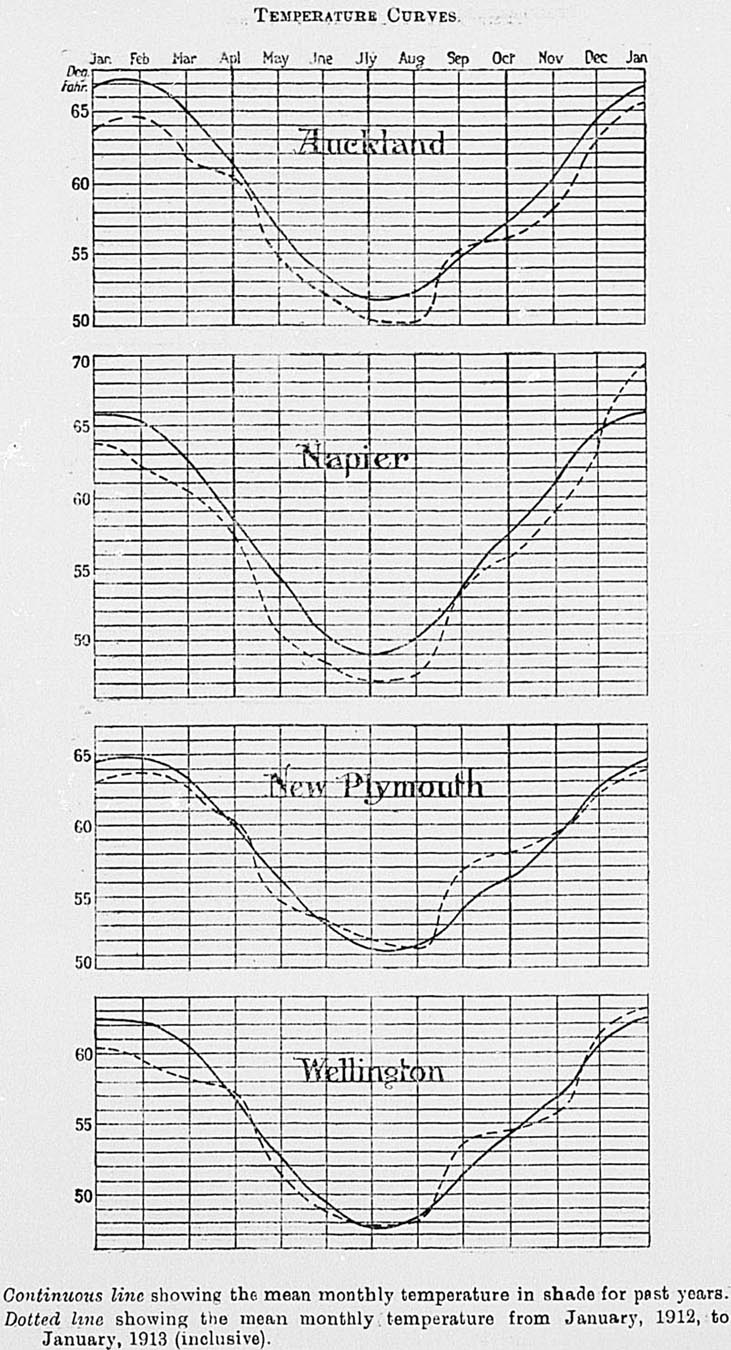

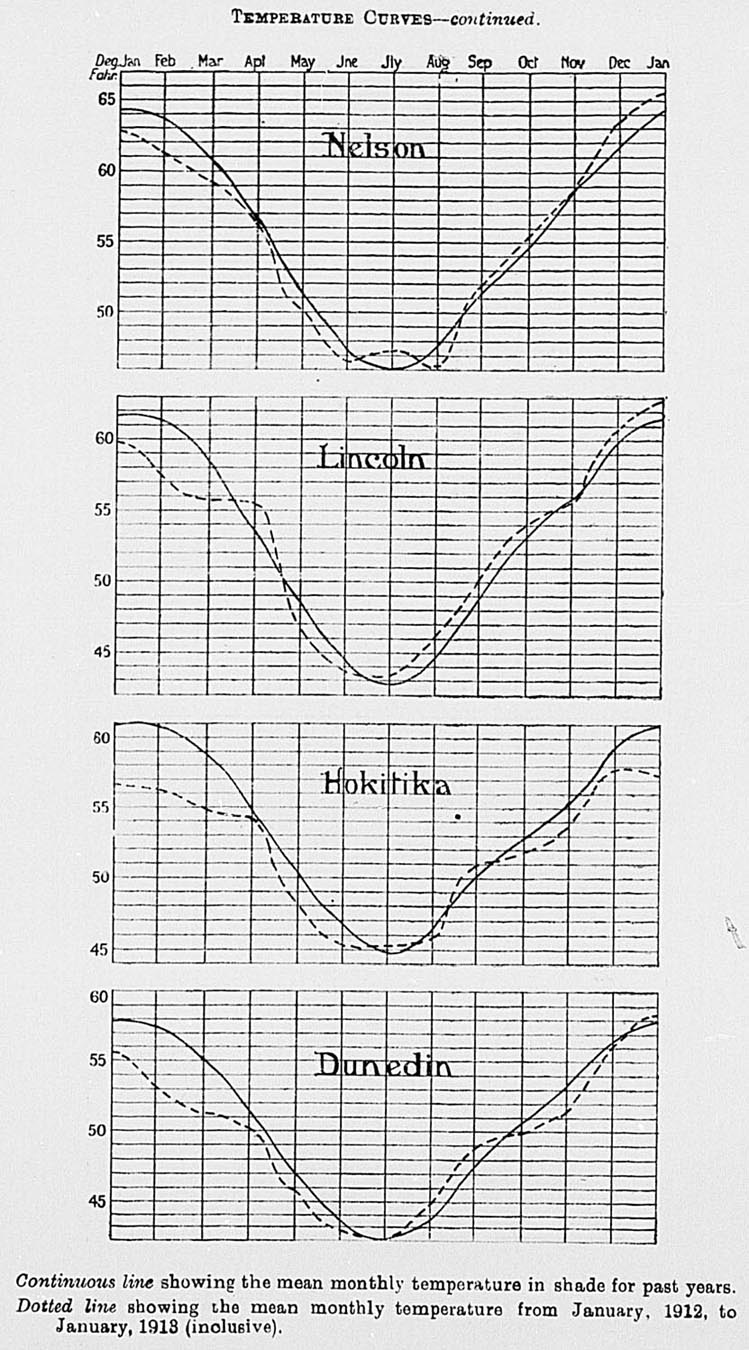

In Part I an article on earthquakes in New Zealand (kindly supplied by G. Hogben, Esq., M.A., F.G.S., Inspector-General of Schools) has been included, and some rainfall and temperature curves have been added to the portion dealing with climate and meteorology, while the historic section has been revised and slightly enlarged. A description of the proposed new Parliament Buildings is given, and a sketch of these as they will appear when completed forms a frontispiece to the book.

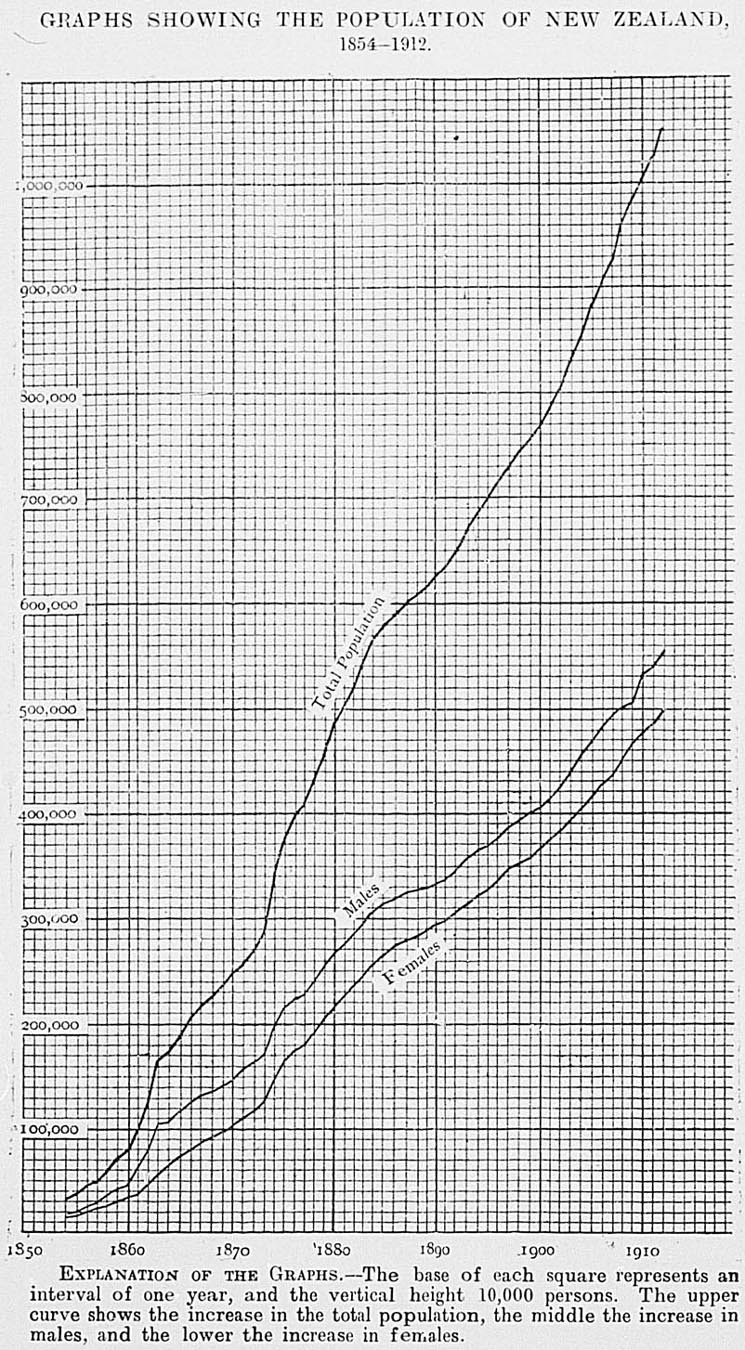

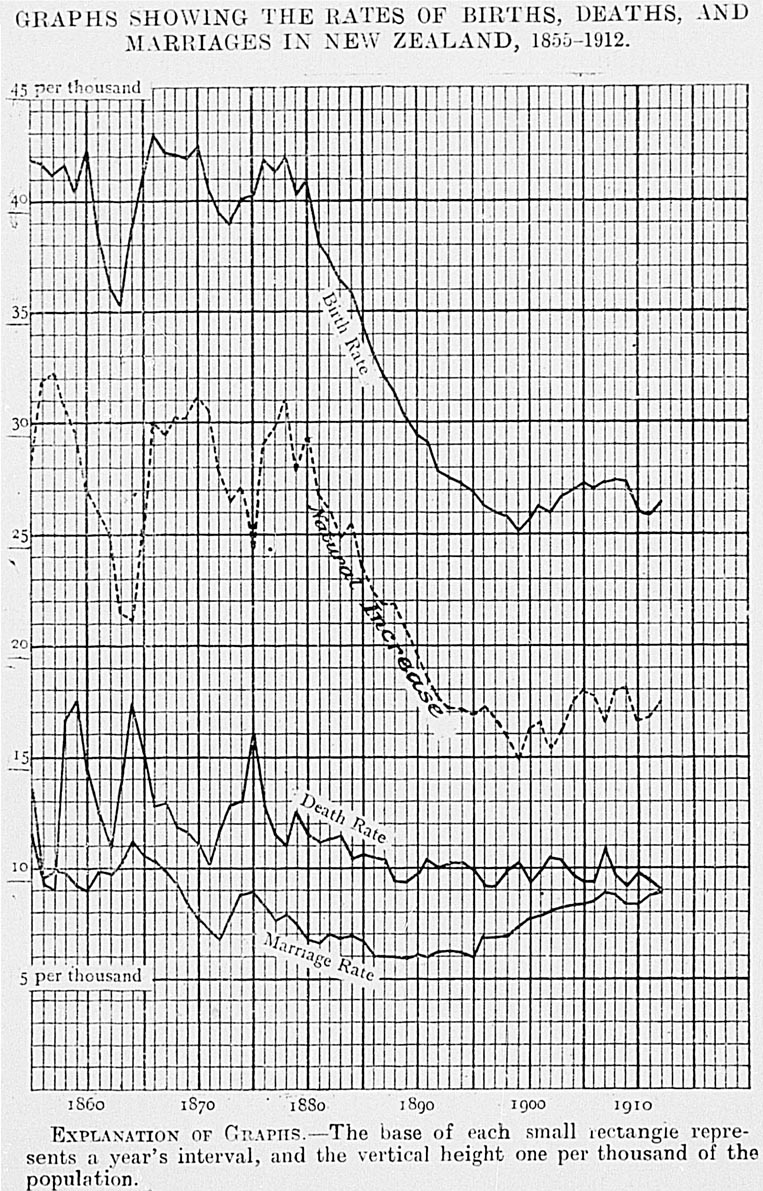

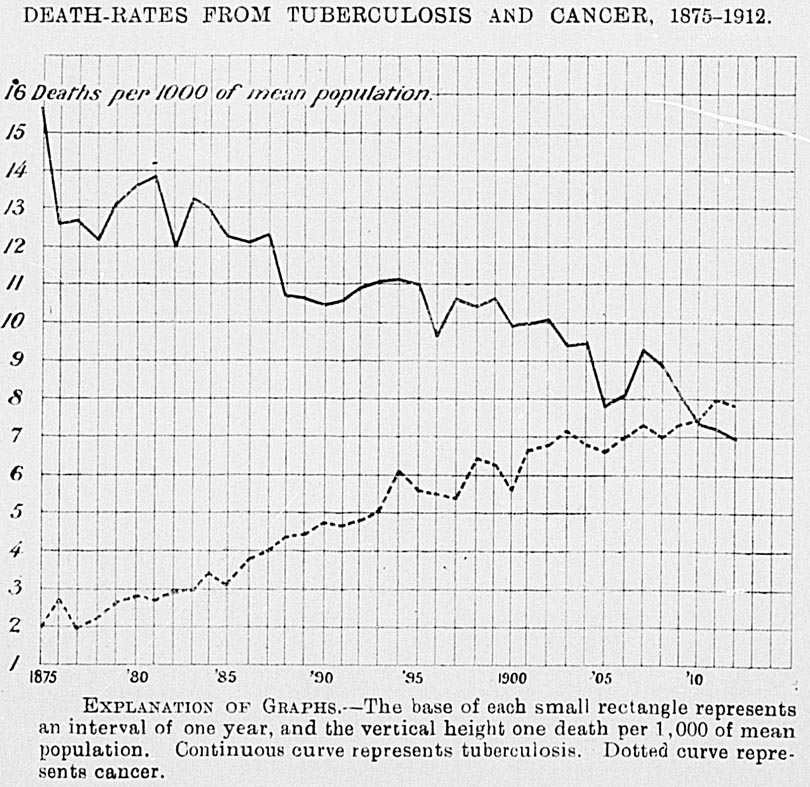

In Part II there have been a number of alterations. Section I, dealing with population, has been rearranged, and contains information re occupations of the people as ascertained at the census of 1911. In this section, and also in that dealing with vital statistics, some interesting tables showing the relative ages, duration of marriage, and issue of parents are given. The vital statistics section also contains some more detailed tables re orphanhood and some new figures in regard to the natural increase, while the portion dealing with causes of death has been rewritten; a diagram on page 180 contrasts the death-rates from consumption and cancer, and is worthy of note as showing on the one hand the great decrease in the tuberculosis death-rate and on the other the large increase in the cancer death-rate.

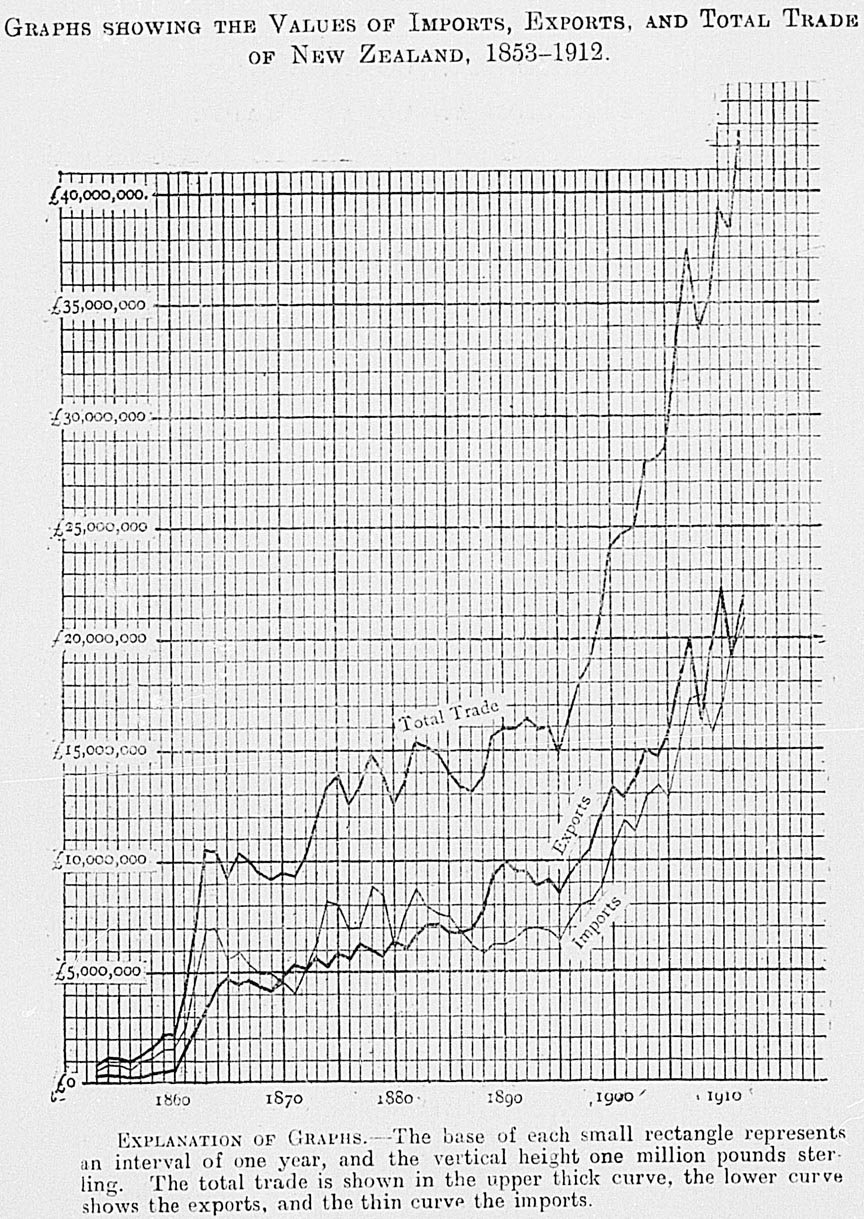

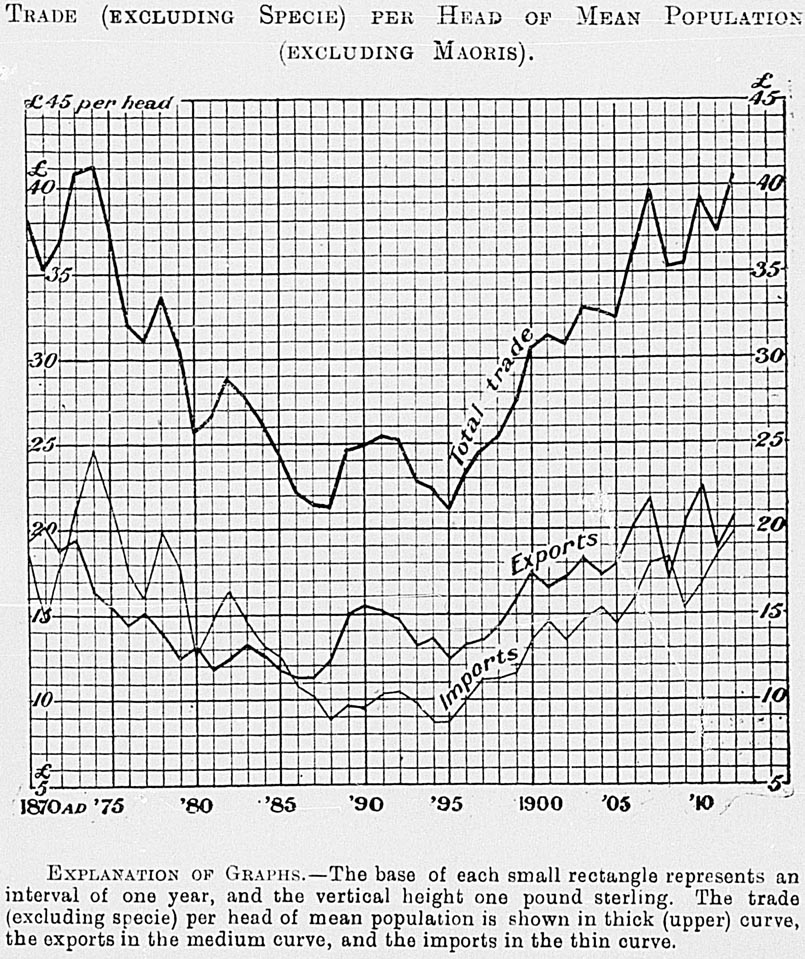

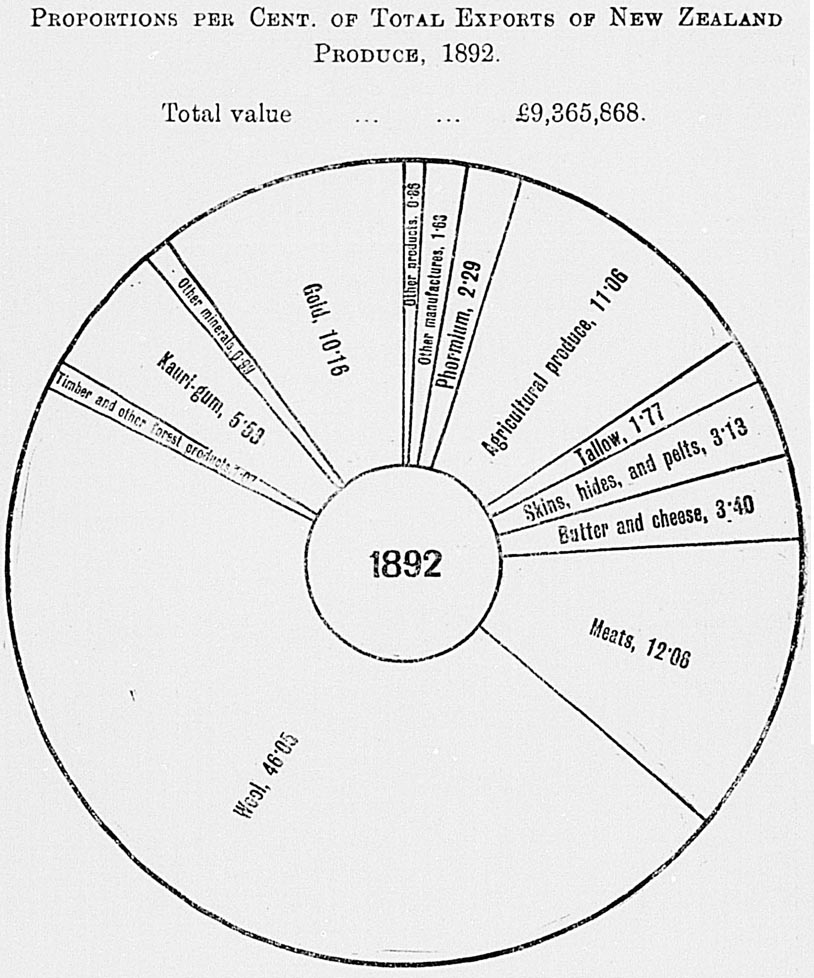

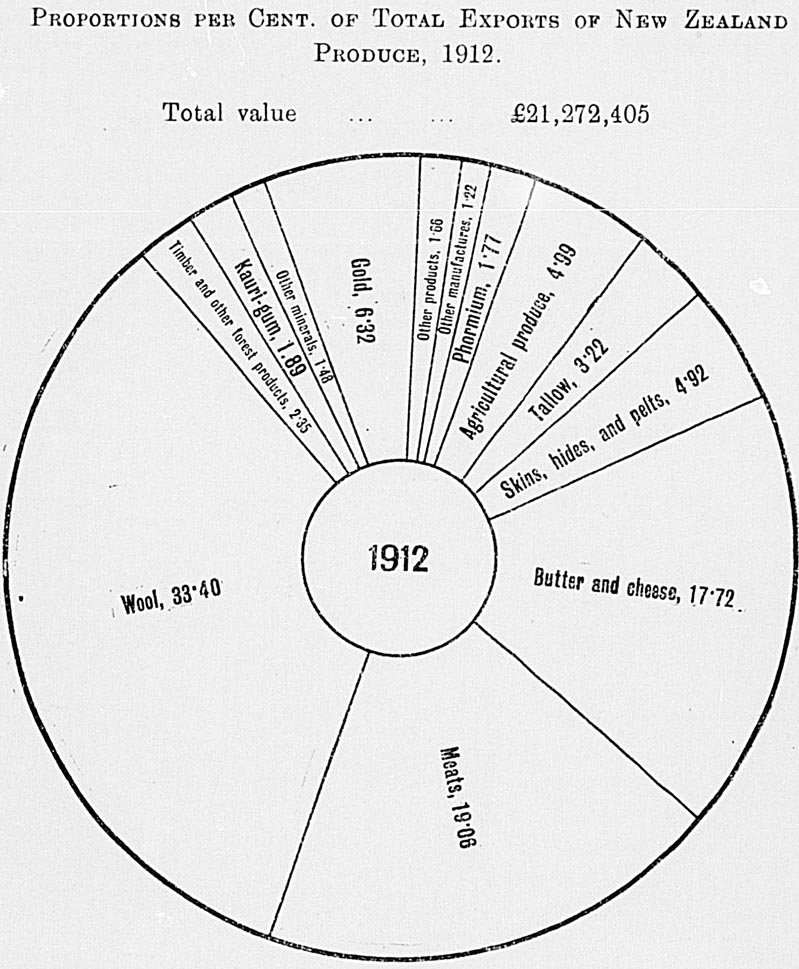

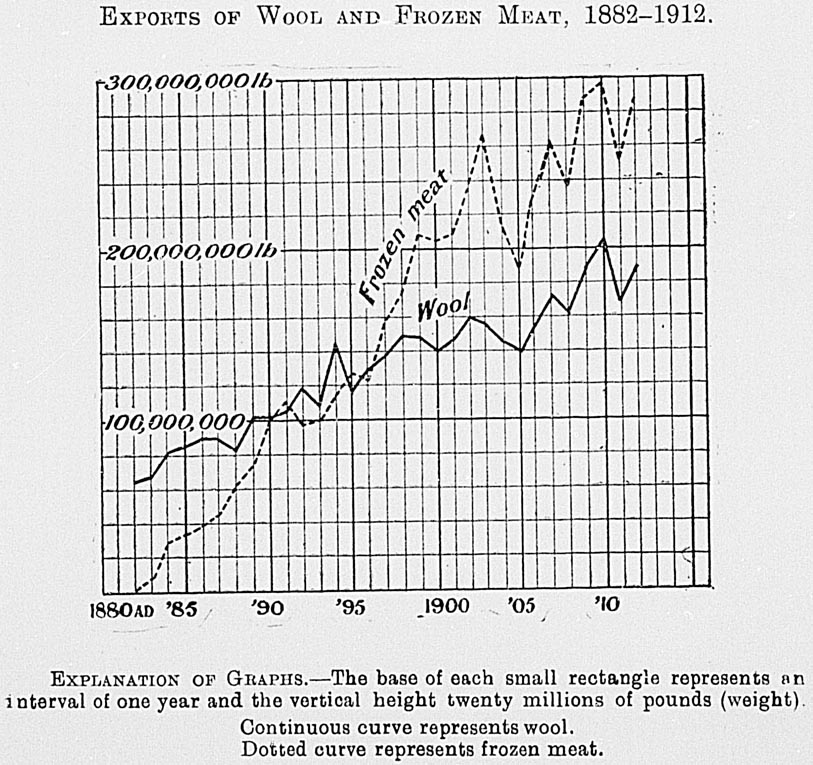

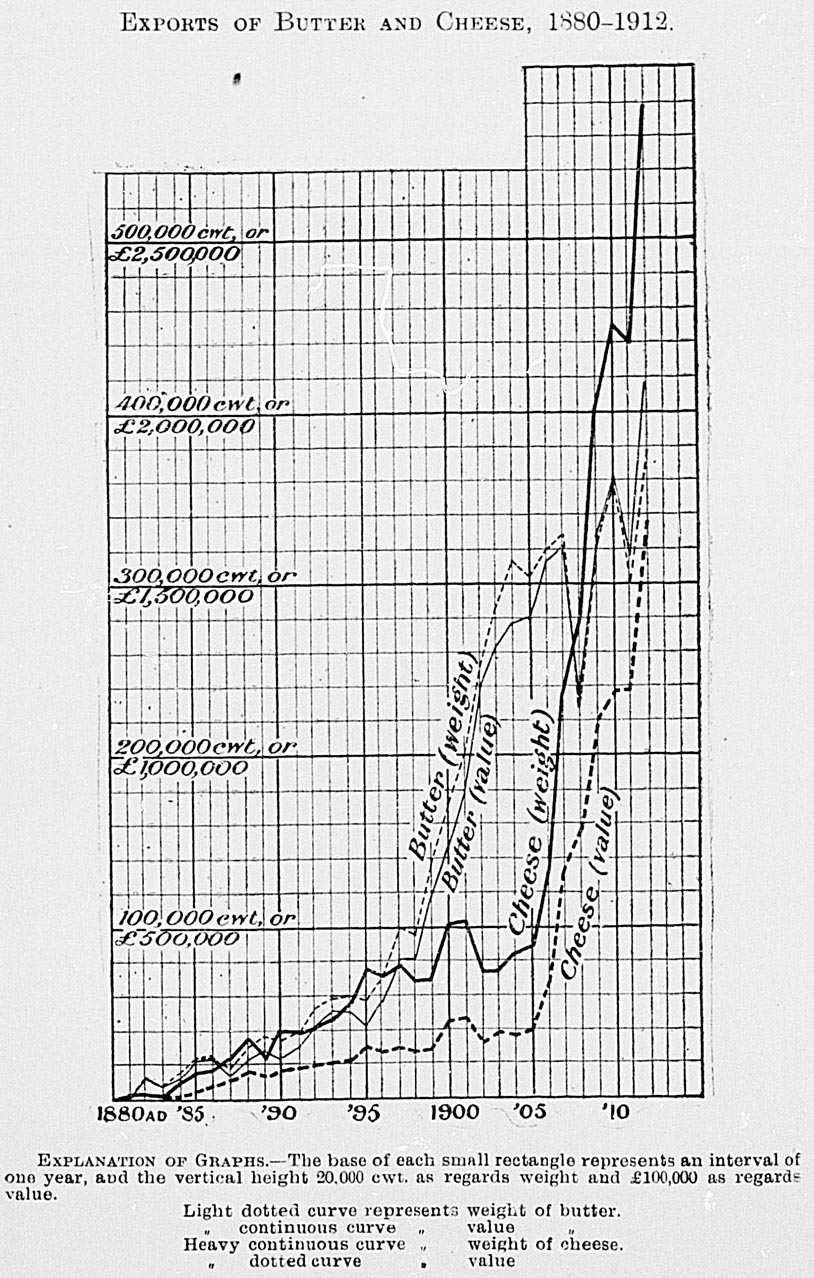

In the trade section some new diagrams have been introduced, dealing with (1) trade per head of population, (2) the proportion per cent. of various articles of export in 1892 and 1912, (3) exports of wool and frozen meat, and (4) exports of butter and cheese.

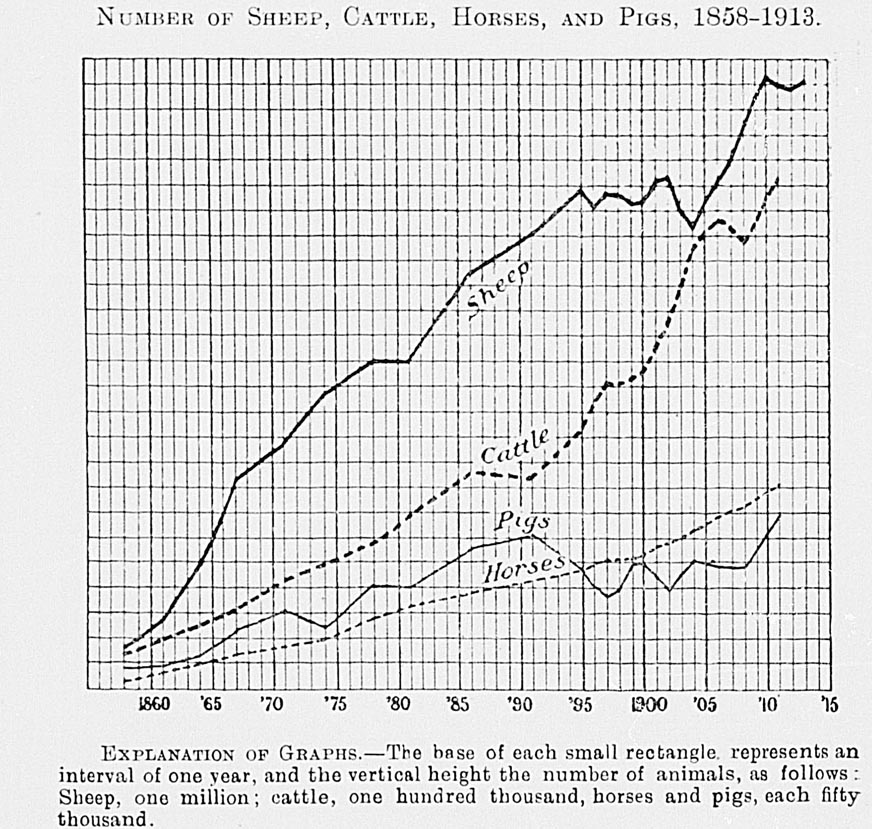

The special article on agriculture in New Zealand by Mr. Murphy has been omitted, and the sections re agriculture and live-stock are now grouped together with a quantity of new matter. The mining section has been largely rewritten, and an article on water-power added thereto. An estimate of the private wealth of the Dominion computed by a new method is given in the section on accumulation, and the explanatory portion of the valuation section has been revised and enlarged.

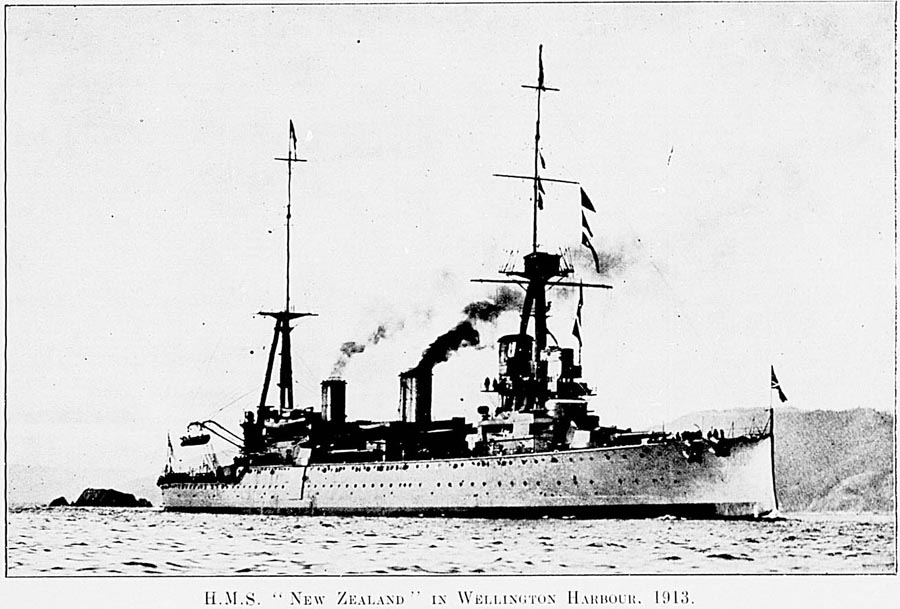

In Part III, “Articles on Special Subjects,” is included an account of the visit of H.M.S. “New Zealand” (supplied by W. E. Spencer, Esq., M.A., M.Sc., Editor of the New Zealand School Journal), accompanied by a photograph of the vessel. There is also a short article on the training-ship “Amokura,” and a summary of the findings of the recent Forestry Commission.

A bibliography of some works on New Zealand has been included in the appendix.

I desire to thank those responsible Government officers who have supplied information and in other ways assisted in the compilation of the book, and my staff for their co-operation and valuable assistance.

The material included has been carefully compiled and checked, but it would be too much to hope that no errors have crept in. I shall be pleased if readers detecting any will supply information as to their nature and position.

Malcolm Fraser, Government Statistician.

Wellington, 28th November, 1913.

CORRIGENDA.

Page 310.—Total of first column, license districts, for “500,733” read “499,733.” No-license districts, for “89,309” read “90,309.”

Table of Contents

Table of Contents

The first authentic account of the discovery of New Zealand is that given by Abel Jansen Tasman, the Dutch navigator. He left Batavia on the 14th August, 1642, in the yacht “Heemskercq,” accompanied by the “Zeehaen” (or “Sea-hen”) fly-boat. After having visited Mauritius, and discovered Tasmania, named by him “Van Diemen's Land,” in honour of Anthony van Diemen, Governor of the Dutch possessions in the East Indies, he steered eastward, and on the 13th December of the same year sighted the west coast of the South Island of New Zealand, described by him as “a high mountainous country.”

Tasman, under the belief that the land he saw belonged to a great polar continent, and was part of the country discovered some years before by Schouten and Le Maire, to which the name of Staten Land had been given, gave the same name of Staten Land to New Zealand; but within about three months afterwards Schouten's “Staten Land” was found to be merely an inconsiderable island. Upon this discovery being announced, the country that Tasman had called Staten Land received the name of “New Zealand,” by which it has ever since been known. Tasman sailed along the coast to a bay, where he anchored. To this he gave the name of Murderers (since termed Massacre or Golden) Bay, on account of an unprovoked attack on a boat's crew by the Natives, and the massacre of four white men. Thence he steered along the west coast of the North Island, and gave the name of Cape Maria van Diemen to the north-western extremity thereof. After sighting the islands of the Three Kings he finally departed, not having set foot in the country.

There is no record of any visit to New Zealand after Tasman's departure until the time of Captain Cook, who, after leaving the Society Islands, sailed in search of a southern continent then believed to exist. He sighted land on the 6th October, 1769, at Young Nick's Head, and on the 8th of that month cast anchor in Poverty Bay. After having coasted round the North Island and the South and Stewart Islands—which last he mistook for part of the South Island—he took his departure from Cape Farewell on the 31st March, 1770, for Australia. He visited New Zealand again in 1773, in 1774, and in 1777.

M. de Surville, a French officer in command of the vessel “Saint Jean Baptiste,” while on a voyage of discovery, sighted the northeast coast of New Zealand on the 12th December, 1769, and remained for a short time. A visit was soon after paid by another French officer, M. Marion du Fresne, who arrived on the west coast, of the North Island of New Zealand on the 24th March, 1772, but was, on the 12th June following, murdered at the Bay of Islands by the Natives.

Captain George Vancouver in the “Discovery,” accompanied by Captain Broughton in the “Chatham,” anchored in Dusky Bay, on the west coast of the South Island, on the 2nd November, 1791, and remained there until the 21st. After leaving Dusky Bay the two vessels parted company during a gale, not meeting again until their arrival at Otaheite. During the passage of the “Chatham” to this place, Captain Broughton discovered and named the Chatham Islands (on the 29th November, 1791).

On the 5th November, 1792, the “Britannia” (Captain Raven) anchored in Facile Harbour, on the west coast of the South Island. She had come from Sydney for the purpose of procuring seal-skins. A party of men was landed and accommodation for them built, and, on the 1st December the “Britannia” sailed for the Cape of Good Hope. On her return on the 27th December, 1793, the men were found to be in good health. So far as is known, this was the first instance of Europeans being left in New Zealand to their own resources.

The Spanish expedition in the vessels “Descubrierta” and “Atrevida,” the former commanded by Alejandro Malaspina and the latter by José de Bustamente y Guerra, sighted the west coast of the South Island on the 25th February, 1793. A boat's crew went into Doubtful Bay, whilst the vessels remained off the entrance. Next morning they unsuccessfully attempted to enter Dusky Bay, but the weather becoming stormy they left for Sydney, after giving Spanish names to several places in and around Dusky and Doubtful Bays.

In 1793 also the “Dædalus,” under the command of Lieutenant Hanson, was sent by the Government of New South Wales to New Zealand, and two chiefs were taken thence to Norfolk Island. There was after this an occasional intercourse between the islands of New Zealand and the English settlements in New South Wales.

On the 23rd May, 1820, Thaddeus Bellingshausen, in command of the two Russian ships “Wostok” and “Mirny,” sailed into Cook Strait, in the course of his voyage round the world. The vessels anchored in Queen Charlotte Sound on the 28th May, and remained there till the 3rd June.

In 1814 the first missionaries arrived in New Zealand—Messrs. Hall and Kendall—who had been sent as forerunners by Mr. Marsden, chaplain to the New South Wales Government. After a short stay they returned to New South Wales, and on the 19th November of that year again embarked in company with Mr. Marsden, who preached his first sermon in New Zealand on Christmas Day, 1814. He returned to Sydney on the 23rd March, 1815, leaving Messrs. Hall, Kendall, and King, who formed the first mission station at Rangihoua, Bay of Islands, under the auspices of the Church Missionary Society. Six years later, in 1821, the work of evangelization was put on a more durable basis; but the first station of the Wesleyan mission, established by Mr. Leigh and his wife, at the valley of the Kaeo, Whangaroa, was not taken possession of until the 10th June, 1823.

Almost immediately after Cook returned to England on the completion of his first voyage round the world there was published in London, on the 29th August, 1771, a pamphlet by Alexander Dalrymple, entitled “Scheme of a Voyage to convey the Conveniences of Life, Domestic Animals, Corn, Iron, &c., to New Zeland [sic], with Dr. Benjamin Franklin's Sentiments upon the Subject.” The idea Dalrymple had in mind was to civilize the Maoris by furnishing them with useful commodities, taking in exchange whatever goods the Natives could supply by way of trade. Dalrymple being unsuccessful in raising money to carry out his plan the matter dropped, but he was the first to suggest the idea of opening up commerce with New Zealand, thus paving the way for its colonization.

The first attempt at colonization was made in 1825 by a company formed in London, and called the New Zealand Company. An expedition was sent out under the command of Captain Herd, who acquired tracks of land at Hokianga, at Manakau, and on the borders of the Thames. The company was prevented by adverse circumstances from forming a settlement.

In the same year two other persons, namely, Baron Charles de Thierry and Mr. William Stewart, were trying to form colonization companies in London. The former chose for his sphere the North Island and the latter Stewart Island, but neither scheme was successful.

In consequence of frequent visits of whaling-vessels to the Bay of Islands, a settlement grew up at Kororareka—now called Russell—and in 1833 Mr. Busby was appointed British Resident there. A number of Europeans gradually settled in different parts of the country, and married Native women.

In 1837 the New Zealand Association was formed, to apply to New Zealand the Wakefield system of colonization. A Royal Charter was applied for, but the terms offered by the British Government not being acceptable, the association dissolved. Some of the members of this association formed a plan for the prosecution of its leading objects by means of a joint-stock company. On the 29th August, 1838, a private copartnership was established under the name of “The New Zealand Colonization Company.” By the spring of 1839 it had raised sufficient funds to purchase an extensive territory (principally surrounding Hokianga and Kaipara Harbours), and to fit out a preliminary expedition for surveying the coasts, making further purchases, and preparing for the early arrival of settlers. On the 2nd May, 1839, the New Zealand Colonization Company ceased to exist, and the New Zealand Company (the second of that name) was formed with a capital of £100,000 in 4,000 shares of £25 each, to establish settlement in New Zealand on systematic principles.

On the 22nd January, 1840, the first body of immigrants arrived in Port Nicholson, and founded the town of Wellington. About the same time—namely, on the 29th January, 1840—Captain Hobson, R.N., arrived at the Bay of Islands, empowered, with the consent of the Natives, to proclaim the sovereignty of Queen Victoria over the Islands of New Zealand, and to assume the government thereof. A compact called the Treaty of Waitangi, to which in less than six months five hundred and twelve names were affixed, was entered into, whereby all rights and powers of sovereignty were ceded to the Queen, all territorial rights being secured to the chiefs and their tribes. New Zealand was then constituted a dependency of the Colony of New South Wales, but on the 3rd May, 1841, was proclaimed a separate colony. The seat of Government had been previously established at Waitemata (Auckland), round which a settlement was formed.

The New Zealand Company having decided to form another settlement, to which the name of “Nelson” was to be given, despatched a preliminary expedition from England in April, 1841, for the purpose of selecting a site. The spot chosen was the head of Blind Bay, where a settlement was established. About the same time a number of pioneers arrived in Taranaki, despatched thither by the New Plymouth Company, a colonizing society which had been formed in England, and had bought 50,000 acres of land from the New Zealand Company.

The next important event in the progress of colonization was the arrival at Port Chalmers, on the 23rd March, 1848, of the first of two emigrant ships sent out by the Otago Association for the foundation of a settlement by persons belonging to or in sympathy with the Free Church of Scotland.

In 1849 the “Canterbury Association for founding a Settlement in New Zealand” was incorporated. On the 16th December, 1850, the first emigrant ship despatched by the association arrived at Port Cooper, and the work of opening up the adjoining country was set about in a systematic fashion, the intention of the promoters being to establish a settlement complete in itself, and composed entirely of members of the then United Church of England and Ireland.

The rich tussock plains of Canterbury yielded at once to the efforts of the settlers, and the province soon became the great, pastoral and agricultural centre of the colony. Grain and wool were exported, and the volume of trade increased rapidly. The district grew prosperous, and many of the settlers became wealthy men. The foresight of the founders of the settlement provided for endowments for schools and churches, and for the construction of roads and bridges, and when the provinces were abolished in 1875 Canterbury not only handed over a well-equipped district but a large credit balance at its bankers.

Up to the early sixties Otago had made a slow but steady advance, much of the province being adapted to agriculture, to which the energies of the majority of the early settlers were devoted. In 1861, however, gold was discovered in the Lindis Valley, and this, together with further rich finds in Gabriel's Gully and various other parts of Otago, attracted people from all parts of Australasia. The province rapidly increased in wealth and prosperity, and Dunedin soon became a thriving and populous commercial centre.

Southland advanced steadily, mainly on account of its rich agricultural and pastoral lands; and in the northern and western parts of the South Island good progress was also made. Marlborough and the eastern portion of Nelson, with their good soil and attractive climate, became the homes of farming communities, while Westland and the west coast of Nelson owed their progress to rich finds of gold and coal.

For many years the North Island lagged behind the South Island. Its progress was retarded by troubles with the Maoris, and in the early days many settlers, terrified by the warlike attitude of the aboriginals, abandoned their farms and left New Zealand. The unrest caused by the wars put a stop to settlement, and for years left the interior of the Island a terra incognita. After the initial conflicts with the Natives when the British flag was hoisted at the Bay of Islands, colonization proceeded quietly at Auckland, New Plymouth, Wanganui, Wellington, and Hawke's Bay.

In 1861, however, a serious misunderstanding arose at Waitara over the question of land, and almost without warning active hostilities were commenced by the Natives. The Taranaki settlers were driven from their homes, and the labour of years was destroyed in a few weeks. Blood was shed, and many men were killed on both sides. Soon the whole country from Auckland to Wellington was in arms. The settlers around Wanganui, Napier, and Wellington were forced to leave their farms and take refuge in the towns, and for a time all progress was stayed. Over ten thousand troops were brought from England to quell the disturbance, and after several years of fighting the Maoris at last sued for peace. The Waikato Natives lost their land, which was confiscated and handed over to military settlers, who soon converted the district into a thriving farming centre. Slowly the settlers restored their homes and farms, and gradually the North Island became settled by an ever-growing industrious community.

The discovery of rich gold at the Thames in 1867 attracted a large number of people from Australia and other parts of New Zealand, and since the termination of the Maori was the North Island has made immense progress, overtaking and, in later years, rapidly outstripping the South Island.

Prior to the colonization of New Zealand by Europeans, the earliest navigators and explorers found a race of people already inhabiting both Islands. Papers written in 1874 by Mr. (afterwards Sir) William Fox and Sir Donald McLean (then Native Minister) state that at what time the discovery of these Islands was made by the Maoris, or from what place they came, are matters of tradition only, and that much has been lost in the obscurity enveloping the history of a people without letters. Nor is there anything on record respecting the origin of the Maori people themselves, beyond the general tradition of the Polynesian race, which seems to show a series of successive migrations from west to east, probably by way of Malaysia to the Pacific. Little more can now be gathered from their traditions than that they were immigrants and that they probably found inhabitants on the east coast of the North Island belonging to the same race as themselves—the descendants of a prior migration, whose history is lost. The tradition runs that, generations ago, the Maoris dwelt in a country named Hawaiki, and that one of their chiefs, after a long voyage, reached the northern island of New Zealand. Returning to his home with a flattering description of the country he had discovered, this chief, it is said, persuaded a number of his kinsfolk and friends, who were much harassed by war, to set out with a fleet of double canoes for the new land. The names of most of the canoes are still remembered, and each tribe agrees in its account of the doings of the people of the principal canoes after their arrival in New Zealand; and from these traditional accounts the descent of the numerous tribes has been traced. Calculations, based on the genealogical staves kept by the tohungas, or priests, and on the well-authenticated traditions of the people, indicate that about twenty-one generations have passed since the migration, which may therefore be assumed to have taken place about five hundred and twenty-five years ago. The position of the legendary Hawaiki is unknown, but many places in the South Seas have been thus named in memory of the mother-land. The Maoris speak a very pure dialect of the Polynesian language, the common tongue, with more or less variation, in all the eastern Pacific islands. When Captain Cook first visited New Zealand he availed himself of the services of a Native from Tahiti, whose speech was easily understood by the Maoris. In this way much information respecting the early history of the country and its inhabitants was obtained which could not have otherwise been had.

For results of recent researches as to probable origin of the Maoris, see Year-book for 1901.

British sovereignty was proclaimed over New Zealand in January, 1840, and the country became a dependency of New South Wales until the 3rd May, 1841, when it was made a separate colony. The seat of Government was at Auckland, and the Executive included the Governor, and three gentlemen holding office as Colonial Secretary, Colonial Treasurer, and Attorney-General—namely, the Hon. Andrew Sinclair, the Hon. Alexander Shepherd, and the Hon. William Swainson.

The successors of these gentlemen, appointed in August, 1841, May, 1842, and January, 1844, respectively, continued in office until the establishment of Responsible Government on the 7th May, 1856. Only one of them—the Hon. Mr. Swainson without ceasing to be Attorney-General—sat as a member of the first General Assembly (being Speaker of the Legislative Council) which was opened on the 27th May, 1854. During the session of that year there were associated with the permanent members of the Executive Council certain members of the House of Representatives. These latter held no portfolios.

The Government of the colony was at first vested in the Governor; who was responsible only to the Crown; but in 1852 an Act granting representative institutions to the colony was passed by the Imperial Legislature. Under it the constitution of a General Assembly for the whole colony was provided for, to consist of a Legislative Council, the members of which were to be nominated by the Governor, and of an elective House of Representatives.

The first session of the General Assembly was opened on the 27th May, 1854, but the members of the Executive were not responsible to Parliament. The first Ministers under a system of Responsible Government were appointed in the year 1856. By the Act of 1852 the colony was divided into six provinces, each to be presided over by an elective Superintendent, and to have an elective Provincial Council, empowered to legislate, except on certain specified subjects. The franchise amounted practically to household suffrage. In each case the election was for four years, but a dissolution of the Provincial Council by the Governor could take place at any time, necessitating a fresh election both of the Council and of the Superintendent. The Superintendent was chosen by the whole body of electors of the province; each member of the Provincial Council by the electors of a district. The Provincial Governments, afterwards increased to nine, remained as integral parts of the Constitution of the colony until the 1st November, 1876, when they were abolished by an Act of the General Assembly, that body having been vested with the power of altering the Constitution Act. On the same day an Act of the General Assembly which subdivided the colony (exclusive of the areas included within municipalities) into counties, and established a system of local government, came into force.

On addresses from both Houses of the General Assembly, His Majesty the King, by Order in Council dated 9th September, 1907, and by Proclamation issued 10th September, 1907, was graciously pleased to change the style and designation of the Colony of New Zealand to “The Dominion of New Zealand"; the change taking effect from Thursday, the 26th day of September, 1907.

The Governor is appointed by the King. His salary is £5,000 a year, with an annual allowance of £1,500 on account of his establishment, and of £500 for travelling-expenses, provided by the Dominion.

Members of the Legislative Council hold their seats under writs of summons from the Governor. Till the year 1891 the appointments were for life; but in September of that year an Act was passed making appointments after that time tenable for seven years only, though Councillors may be reappointed. In either case seats may be vacated by resignation or extended absence.

The members of the House of Representatives (now designated M.P.) are elected for three years from the time of each general election; but at any time a dissolution of Parliament by the Governor may render a general election necessary. Four of the members are representatives of Native constituencies. For the purposes of European representation the Dominion is divided into seventy-six electoral districts, each returning one member. The full number of members composing the House of Representatives is thus eighty. Members of the House of Representatives are chosen by the votes of the electors in every electoral district appointed for that purpose.

In 1889 an amendment of the Representation Act was passed, which contained a provision prohibiting any elector from giving his vote in respect of more than one electorate at any election. In 1893 women of both races were granted by law the right to vote at the elections for members of the House of Representatives. The qualification for registration is the same for both sexes. No person is entitled to be registered on more than one electoral roll within the Dominion. Women are not qualified to be elected as members of the House of Representatives. Every man registered as an elector, and not specially excepted by the Legislature Act now in force, is qualified to be elected a member of the House of Representatives for any electoral district. For European representation every adult person, if resident one year in the Dominion and three months in one electoral district, can be registered as an elector. Freehold property of the value of £25 held for six months preceding the day of registration until 1896 entitled a man or woman to register, if not previously registered under the residential qualification; but in 1896 the property qualification was abolished (except in case of existing registrations), and residence alone now entitles a man or woman to have his or her name placed upon an electoral roll. For Maori representation every adult Maori resident in any Maori electoral district (of which there are four only in the Dominion) can vote. Registration is not required in Native districts. [The above provisions are now incorporated in the Legislature Act, 1908, which consolidates the electoral laws.] The electoral laws are the subject of special comment further on in this work.

Up to the year 1865 the seat of Government of New Zealand was at Auckland. Several attempts were made by members of Parliament, by motions in the Legislative Council and House of Representatives, to have it removed to some more central place; but it was not until November, 1863, that Mr. Domett (the then ex-Premier) was successful in carrying resolutions in the House of Representatives that steps should be taken for appointing some place in Cook Strait as the permanent seat of Government. The resolutions adopted were: “(1.) That it has become necessary that the seat of Government in the colony should be transferred to some suitable locality in Cook Strait. (2.) That, in order to promote the accomplishment of this object, it is desirable that the selection of the particular site in Cook Strait should be left to the arbitrament of an impartial tribunal. (3.) That, with this view, a Bill should be introduced to give effect to the above resolutions.” On the 25th November an address was presented to the Governor, Sir George Grey, K.C.B., by the Commons of New Zealand, requesting that the Governors of the Colonies of New South Wales, Victoria, and Tasmania, might each be asked to appoint one Commissioner for the purpose of determining the best site in Cook Strait. Accordingly, the Hon. Joseph Docker, M.L.C., New South Wales; the Hon. Sir Francis Murphy, Speaker of the Legislative Council, Victoria; and R. C. Gunn, Esq., Tasmania, were appointed Commissioners.

These gentlemen, having made a personal inspection of all suitable places, arrived at the unanimous decision “that Wellington, in Port Nicholson, was the site upon the shores of Cook Strait which presented the greatest advantages for the administration of the government of the colony.”

The seat of Government was, therefore, in accordance with the recommendation of the Commissioners, removed to Wellington in February, 1865.

On the 11th December, 1907, the Parliament Buildings, situated in Molesworth Street, Wellington, were, with the exception of the library wing, destroyed by fire. Since then old Government House, occupying an adjoining site, has been utilized as temporary quarters for Parliament, a new residence for the Governor being erected at the southern end of the city.

Plans for new Parliament Buildings have been approved, and the foundations have already been prepared by the Public Works Department, the foundation-stone being laid on the 23rd March, 1912.

A sketch of the new Parliament Buildings, as they will appear when completed, is published as a frontispiece to this book. The building was designed by the Government Architect, by whom the following description is furnished:—

The new building now in course of erection occupies a commanding site facing Charlotte and Molesworth Streets to the front, Bowen Street to the side, and Sydney Street behind.

The completed building will be in the form of a large parallelogram 395 ft. in length and 243 ft. in breadth. The apartments and corridors range round this from and across the centre of it from front to rear, leaving two large courtyards, or quadrangles, which are, however, each occupied in the centre by a block of buildings, the one in the north court being the House of Representatives, and that in the south court the library. The central dividing-block will contain the members' lounge lobby and the Legislative Council chamber. At present 226 ft. of frontage, or rather more than half of the building, is being erected, and the accommodation provided in this portion consists of the two legislative chambers, the members' lounge lobby, nine suites of Ministers' rooms, two Speakers' suites of rooms, rooms for the Clerks of Parliament and other officials, for the Whips, for the Leader of the Opposition, and for Chairman of Committees, three Bill offices, six committee-rooms, press, typists' and reporters' rooms, ladies' and gentlemen's waiting-rooms, messengers' rooms, members' writing and social rooms, members' bath-rooms and lavatories, record and store rooms, &c. The remaining portion of the building to be erected later will contain accommodation for a library of 150,000 volumes in one large hall 83 ft. by 66 ft. and a hall of similar dimensions for newspaper files and books with rooms for the staff, newspaper and map rooms, binding-room, &c. Bellamy's dining and refreshment rooms with numerous rooms for the staffs, members' billiard-room, law draughtsmen's rooms, a large number of committee-rooms, numerous members' private rooms, and three additional suites of rooms for Ministers comprise the accommodation in this portion.

The building will be erected of brick faced with stone, and will be of fireproof construction throughout. The style of architecture is Classic Renaissance. A colonnade on either side of the main entrance block will be a feature of the front. A dome 130 ft. high will ultimately be a dominant central feature. The building is generally of three stories in height, but the central block is of four stories, whilst a basement containing the heating and ventilating chambers and large storage space extends beneath the portion now being erected.

It is anticipated that the cost when completed will be about £250,000.

Table of Contents

New Zealand, formerly a colony, has, since the 26th September, 1907, by Royal Proclamation, been granted the designation of “Dominion,” and is referred to accordingly in this book. It consists of three main islands, with several groups of smaller islands lying at some distance from the principal group. The main islands, known as the North, the South, and Stewart Islands, have a coastline 4,330 miles in length: North Island, 2,200 miles; South Island, 2,000 miles; and Stewart Island, 130 miles. Other islands included within the Dominion are the Chatham, Auckland, Campbell, Snares, Antipodes, Bounty, and Kermadec Islands. The annexation of the Cook and sundry other islands has necessitated an enlargement of the boundaries of the Dominion, which will be specially treated of further on.

New Zealand is mountainous in many parts, but has, nevertheless, large plains in both North and South Islands. In the North Island, which is highly volcanic, is situated the famous Thermal-Springs District. The South Island is remarkable for its lofty mountains, with their magnificent glaciers, and for the deep sounds or fiords on the western coast.

New Zealand is firstly a pastoral and secondly an agricultural country. Sown grasses are grown almost everywhere, the extent of land laid down being more than fourteen millions of acres. The soil is admirably adapted for receiving these grasses, and, after the bush has been burnt off, is mostly sown over without previous ploughing. In the South Island a large area is covered with native grasses, all used for grazing purposes. The large extent of good grazing-land has made the Dominion a great wool, meat, and dairy-produce country; while its agricultural capabilities are, speaking generally, very considerable. The abundance of water and the quantity of valuable timber are other natural advantages.

New Zealand is, besides, a mining country. Large deposits of coal are met with, chiefly on the west coast of the South Island. Gold, alluvial and in quartz, is found in both Islands, the yield having been over eighty millions in value to the present time. Full statistical information on this subject is given further on, compiled up to the latest dates.

The Proclamation of Captain Hobson on the 30th January, 1840, gave as the boundaries of what was then the colony the following degrees of latitude and longitude: On the north, 34° 30' S. lat.; on the south, 47° 10' S. lat.; on the east, 179° 0' E. long.; on the west, 166° 5' E. long. These limits excluded small portions of the extreme north of the North Island and of the extreme south of Stewart Island.

In April, 1842, by Royal Letters Patent, and again by the Imperial Act 26 and 27 Vict., c. 23 (1863), the boundaries were altered so as to extend from 33° to 53° of south latitude and from 162° of east longitude to 173° of west longitude. By Proclamation bearing date the 21st July, 1887, the Kermadec Islands, lying between the 29th and 32nd degrees of south latitude and the 177th and 180th degrees of west longitude, were declared to be annexed to and to become part of the then Colony of New Zealand.

By Proclamation bearing date the 10th June, 1901, the Cook Group of islands, and all the other islands and territories situate within the boundary-lines mentioned in the following Schedule, were included:—

A line commencing at a point at the intersection of the twenty-third degree of south latitude and the one-hundred-and-fifty-sixth degree of longitude west of Greenwich, and proceeding due north to the point of intersection of the eighth degree of south latitude and the one-hundred-and-fifty-sixth degree of longitude west of Greenwich; thence due west to the point of intersection of the eighth degree of south latitude and the one-hundred-and-sixty-seventh degree of longitude west of Greenwich; thence due south to the point of intersection of the seventeenth degree of south latitude and the one-hundred-and-sixty-seventh degree of longitude west of Greenwich; thence due west to the point of intersection of the seventeenth degree of south latitude and the one-hundred-and-seventieth degree of longitude west of Greenwich; thence due south to the point of intersection of the twenty-third degree of south latitude and the one-hundred-and seventieth degree of longitude west of Greenwich; and thence due east to the point of intersection of the twenty-third degree of south latitude and the one-hundred-and-fifty-sixth degree of longitude west of Greenwich.

The following now constitutes the Dominion of New Zealand:—

The island commonly known as the North Island, with its adjacent islets, having an aggregate area of 44,130 square miles, or 28,243,632 acres.

The island known as the South Island, with adjacent islets, having an aggregate area of 58,120 square miles, or 37,197,183 acres.

Stewart Island, and adjacent islets, having an area of 662 square miles, or 423,735 acres.

The Chatham Islands, situate 536 miles eastward of Lyttelton in the South Island, with an area of 372 square miles, or 238,100 acres.

The Auckland Islands, about 200 miles south of Stewart Island, extending about 30 miles from north to south, and nearly 15 from east to west, the area being 143,422 acres.

Campbell Island, in latitude 52° 33′ 26″ south, and longitude 169° 8′ 41″ east, about 30 miles in circumference, with an area of 28,000 acres.

The Antipodes Islands, about 458 miles in a south-easterly direction from Port Chalmers, in the South Island. These are detached rocky islands, and extend over a distance of between 4 and 5 miles from north to south. Area, 8,600 acres.

The Bounty Islands, a small group of islets, thirteen in number, lying north of the Antipodes Islands, and about 415 miles in an east-south-easterly direction from Port Chalmers. Area, 752 acres.

The Snares Islands, situate about 56 miles to the south-west of Stewart Island, and comprising six islands of a total area of about 600 acres.

The Kermadec Islands, a group lying about 614 miles to the north-east of Russell, in the Bay of Islands. Raoul, or Sunday Island, the largest of these, is about 20 miles in circuit. The next in size is Macaulay Island, about 3 miles round. Area of the group, 8,208 acres.

The total area of the main group of islands forming the Dominion is thus 66,292,232 acres, or 103,581 square miles.

Islands forming the Cook Group:—

Rarotonga.—Distance from Auckland, 1,638 miles; circumference, 20 miles; height, 2,920 ft.

Mangaia. — Distance from Rarotonga, 116 miles; circumference, 30 miles; height, 656 ft.

Atiu.—Distance from Rarotonga, 116 miles: circumference, 20 miles; height, 374 ft.

Aitutaki. — Distance from Rarotonga, 140 miles; circumference, 12 miles; height, 366 ft.

Mauke.—Distance from Rarotonga, 150 miles; circumference, 6 miles; height, about 60 ft.

Mitiaro.—Distance from Rarotonga, 140 miles; circumference, 5 miles; height, about 50 ft.

Takutea.—Distance from Rarotonga, 125 miles.

The Herveys (Manuae and Aoutu).—Distance from Rarotonga, 120 miles.

Total area of above Group, 150 square miles.

Islands outside the Cook Group:—

Savage or Niue.—Distance from Rarotonga, 580 miles; circumference, 40 miles; height, 200 ft.; area, about 100 square miles.

Palmerston.—Distance from Rarotonga, 273 miles; an atoll, 4 miles by 2 miles.

Penrhyn, or Tongareva.—Distance 735 miles from Rarotonga; an atoll, 12 miles by 7 miles.

Humphrey, or Manahiki.—Distance from Rarotonga, 650 miles; an atoll, 6 miles by 5 miles.

Rierson, or Rakaanga.—Distance from Rarotonga, 670 miles; an atoll, 3 miles by 3 miles.

Danger, or Pukapuka.—Distance from Rarotonga, 700 miles; an atoll, 3 miles by 3 miles.

Suwarrow.—Distance from Rarotonga, 530 miles; an atoll.

Total area of islands outside the Cook Group, 130 square miles.

The area of the Dominion of New Zealand is about one-seventh less than the area of Great Britain and Ireland, the South Island of New Zealand being a little smaller than the combined areas of England and Wales.

| United Kingdom. | Area in Square Miles. |

| England and Wales | 58,311 |

| Scotland | 30,463 |

| Ireland | 32,531 |

| Total | 121,305 |

| New Zealand. | Area in Square Miles. |

| North Island and adjacent islets | 44,130 |

| South Island | 58,120 |

| Stewart Island | 662 |

| Chatham Islands | 372 |

| Other islands | 577 |

| Total | 103,861 |

The areas of the several Australian States, as stated by different authorities, vary considerably. The total area of the Australian Continent is given as 2,944,628 square miles, according to a computation made by the late Surveyor-General of Victoria, Mr. J. A. Skene, from a map of Continental Australia compiled and engraved under his direction; but the following areas are taken from latest official records:—

| Square Miles. | |

|---|---|

| Queensland | 670,500 |

| New South Wales | 310,372 |

| Victoria | 87,884 |

| South Australia | 903,690 |

| Western Australia | 975,920 |

| Total, Continent of Australia | 2,948,366 |

| Tasmania | 26,215 |

| Total, Commonwealth of Australia | 2,974,581 |

| Dominion of New Zealand | 103,861 |

| Grand total, Commonwealth and Dominion | 3,078,442 |

The size of the Australian States and New Zealand may be better realized by comparison of their areas with those of European countries. The areas of the following countries—Austria-Hungary, Germany, France, Belgium, Holland, Denmark, Sweden and Norway, Portugal, Spain, Italy (including Sardinia and Sicily), Switzerland, Greece, Roumania, Bulgaria, Servia, Eastern Roumelia, and Turkey in Europe—containing on the whole rather less than 1,600,000 square miles, amount, to little more than half the extent of the Australian Continent. If the area of Russia in Europe be added to those of the other countries the total would be about one-seventh larger than the Australian Continent, and about one-twelfth larger than the Australian States, with New Zealand.

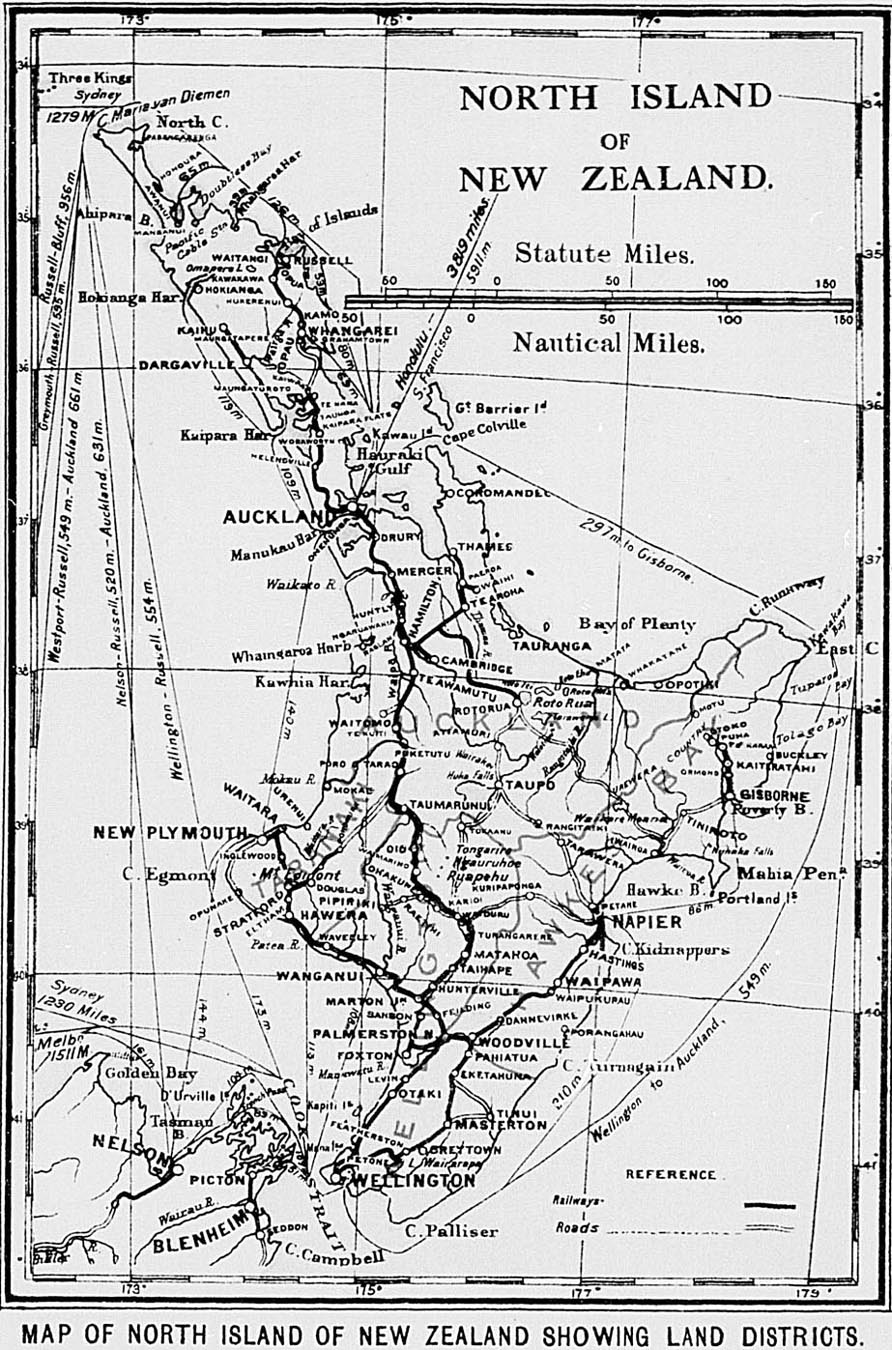

The North Island extends over a little more than seven degrees of latitude, a distance in a direct line from north to south of 430 geographical or 498 statute miles; but, as the northern portion of the Dominion, which covers more than three degrees of latitude, trends to the westward, the oblique distance in a straight line from the North Cape to Cape Palliser, the extreme northerly and southerly points of the island, is about 515 statute miles.

This Island is, as a whole, hilly, and in parts mountainous, in character, but there are large areas of plains or comparatively level country that are, or by clearing can be made, available for farming purposes. Of these the principal are the plains in the Hawke's Bay District, on the east coast; the Wairarapa Plain, in the Wellington District; a strip of country along the west coast, about 250 miles in length, extending from a point about thirty miles from the City of Wellington to a little north of New Plymouth; and the Waikato Plains, extending from the Firth of the Thames to within about fifty miles of Lake Taupo. The largest plain in the North Island, Kaingaroa, extends in a north-easterly direction to the sea-coast in the Bay of Plenty. There are also the pumiceous Waimarino and Murimotu Plains, at the base of the volcanoes, and in other localities several smaller but fertile plains. Though the greater portion of the central plateau is covered with a volcanic ash or sand, now principally bearing a plant growth of tea-tree scrub (manuka), bracken, and tussock, and is now to a large extent waste land, it must not be supposed that these lands are valueless. In many places there are swampy areas even now carrying good crops of flax which, when prices are good, are cut and milled. Between Taupo and Rotorua and the Rangitaiki River there are several sheep-runs. In many places where old Maori kaingas have been, European fruit-trees, such as apples, cherries, peaches, raspberries, &c., are still to be found in healthy condition (though quite unattended to), thus proving that these lands are in many places suitable, as far as soil and climate are concerned, for fruitgrowing; and it is probable that these cheap and neglected lands will before many years have elapsed be utilized for fruit-production. The existence in many places of fine forests proves the suitability of the district for tree-growth, and on this evidence the Government have made very extensive plantations of exotic trees of commercial value, which are all thriving most satisfactorily. The greater part of these plains has in comparatively recent times been covered with valuable forest, but repeated burnings by Maoris have caused its disappearance. The frequent burnings of the scrub and tussock by Maoris and Europeans during the last sixty years have so impoverished the soil of its humus-content that the present state of comparative barrenness is the result. This repeated burning-off of the scrub is also responsible for the lessened fertility of the gum lands. The level or undulating country in this Island fit, or capable of being made fit, for farming has roughly been estimated at 13,000,000 acres. This includes lands now covered with standing forest and swamps that can be drained, also large areas of clay gum-lands and pumice-covered lands. The clay gum-lands are in their natural state cold and uninviting to the farmer, but by proper drainage and cultivation they can be brought into a high state of productiveness. Although the area of bush land is still very great, yet year by year the amount is being reduced, chiefly to meet the demands of settlement, the trees being cut down and burnt, and grass sown on the ground fertilized by their ashes.

Hilly as the country is, yet from the nature of the climate it is especially suited for the growth of English grasses, which will flourish wherever there is any soil, however steep the land may be; once laid down in grass there is very little land too poor to supply food for cattle and sheep. The area of land in the North Island deemed purely pastoral or capable of being made so is estimated at 14,200,000 acres. It is estimated that the area of mountain-tops and barren country at too high an altitude for sheep, and therefore worthless for pastoral purposes, amounts, in the North Island, to 300,000 acres.

The area of land in the North Island still remaining in forest is about 8,500,000 acres, but every year the forested area is fast diminishing as settlement advances. In the Auckland District are found the celebrated kauri forests, which produce perhaps the most valuable of the pine timbers.

The mountains in the North Island are estimated to occupy about one-tenth of the surface, and do not exceed 4,000 ft. in height, excepting a few volcanic cones and the highest peaks of the Kaimanawa, Ruahine, and Tararua Ranges. Of the volcanoes the following are the most important:—

Ruapehu: This mountain lies about twenty-seven miles south-southeast from Lake Taupo. Its highest peak is 9,175 ft., so it rises far above the line of perpetual snow. It is in the solfatara stage, and has on its summit a remarkable crater-lake which is surrounded by walls of ice several hundred feet in height. The waters of this crater-lake are highly charged with sulphuric acid. The water is always warm enough to remain liquid, but there are times when it boils, and is heaved into the air to fall and besmirch the snowy mantle of the surrounding heights. The Wangaehu River has its source in this crater, and its waters are so poisonous to plants that they will not grow on its banks even for miles after the river has reached the plains and received numerous tributaries.

To the north-north-east of Ruapehu lie Ngauruhoe (7,515 ft.) and the several coalesced cones of Tongariro (6,140 ft.). There was a considerable discharge of ashes from Ngauruhoe in 1909, but no loss of life occurred. Molten lava has been seen in the crater, but it has not overflowed since the European occupation of the country. From the crater of Te Mari there was a flow of lava in 1868.

The country around these volcanoes has been created a National Park, and by reason of its varied interests—active craters, blowholes, glaciers, hot medicinal springs, crateral lakes, varied alpine flora, and exhilarating climate—it will be certain later on to attract great numbers of visitors.

Mount Egmont: This is an extinct volcanic cone, rising to a height of 8,260 ft. The upper part is always covered with snow. The mountain is from many directions a nearly perfect cone, and rising as it does from a plain only a few hundred feet above sea-level, it forms a view of imposing beauty. It is called the “sentinel of Taranaki.” Close to its base on the north lies the thriving town of New Plymouth, and the surrounding country is some of the most fertile in New Zealand.

Ruapehu, Tongariro, Taupo, and the thermal vents in the Rotorua district are all on a line of weakness in the earth's crust which reaches its visible terminal at White Island, which is an active volcano in the Bay of Plenty, about thirty-five miles from the main-land.

Without a doubt the hot springs form the most remarkable feature of the North Island. They are found over a large area, extending from Tongariro, south of Lake Taupo, to Ohaeawai, in the extreme north — a distance of some 300 miles; but the principal seat of hydrothermal action appears to be in the neighbourhood of Lake Rotorua, about forty miles north-north-east from Lake Taupo. By the destruction of the famed Pink and White Terraces at Lake Rotomahana during the eruption of Mount Tarawera on the 10th June, 1886, the neighbourhood has been deprived of attractions unique in character and of unrivalled beauty; but the natural features of the country—the numerous lakes, geysers, and hot springs, some of which possess remarkable curative properties in certain complaints—are still very attractive to tourists and invalids. The vast importance of conserving this region as a sanatorium for all time has been recognized by the Government, and it is dedicated by Act of Parliament to that purpose.

The principal lakes in the North Island are Taupo, with an area of 238 square miles, Rotorua, Tarawera, Rotoiti, Waikaremoana, Wairarapa, and several smaller ones. The effluent waters from some of these lakes will in the near future be utilized for the generation of electrical power.

The chief rivers of the North Island are the Waikato (which has its source in the Kaimanawa Range), and is slightly under two hundred miles in length, the Northern Wairoa, the Waihou, the Southern Wairoa, the Manawatu, Rangitikei, Wanganui, and Mokau. All these rivers except the Rangitikei are navigable for small vessels. There are numerous smaller rivers in this well-watered Island, and many of these are capable of being used for the production of electrical power.

For its great length of irregular coast-line the North Island has few harbours that will admit the largest modern liners. There are, however, two (Auckland and Wellington) that will do so, and these are so situated that they form the most convenient receiving and distributing centres. There are several on the west coast—Hokianga. Kaipara, Manukau, and Kawhia—and on the east coast—the Bay of Islands, Whangaroa, Whangarei. Thames, Mercury Bay, and Tauranga—that are already or can be made available for vessels of 2,000 tons. There are also the artificial harbours of Gisborne, Napier, and New Plymouth, which can accommodate liners in their bays or coastal vessels behind their moles. There is a magnificent harbour at the Great Barrier Island, which, though of little commercial value, would give certain shelter to the largest modern fleet.

The chief capes are Cape Maria van Diemen, North Cape, Cape Brett. Cape Colville, East Cape, Table Cape, Cape Palliser, Cape Terawhiti, and Cape Egmont.

The chief peninsulas are Cape Colville Peninsula (where the celebrated Waihi Gold-mine is situated) and the Mahia Peninsula.

There are numerous islands scattered along the coast, and the chief of these are the Three Kings, a cluster of islets lying thirty-eight miles west-north-west of Cape Maria van Diemen. They were discovered in 1643 by Tasman, and named in honour of the day of discovery, is being the feast of the Epiphany. Owing to these islets being incorrectly charted, the steamer “Elingamite” was wrecked here some years ago, and many valuable lives lost. Since this, however, their correct position has been found. Other islands are Great Barrier, Little Barrier, Waiheke, Great Mercury, Mayor, and Kapiti. The last-named was the home and stronghold of the famous Maori warrior Ruaparaha; it is now mostly a public reserve and sanctuary for native flora and fauna.

Cook Strait separates the North from the South Island. It is some sixteen miles across at its narrowest point, but in the widest about ninety. The strait is invaluable for the purpose of traffic between the east and west coasts of the Dominion.

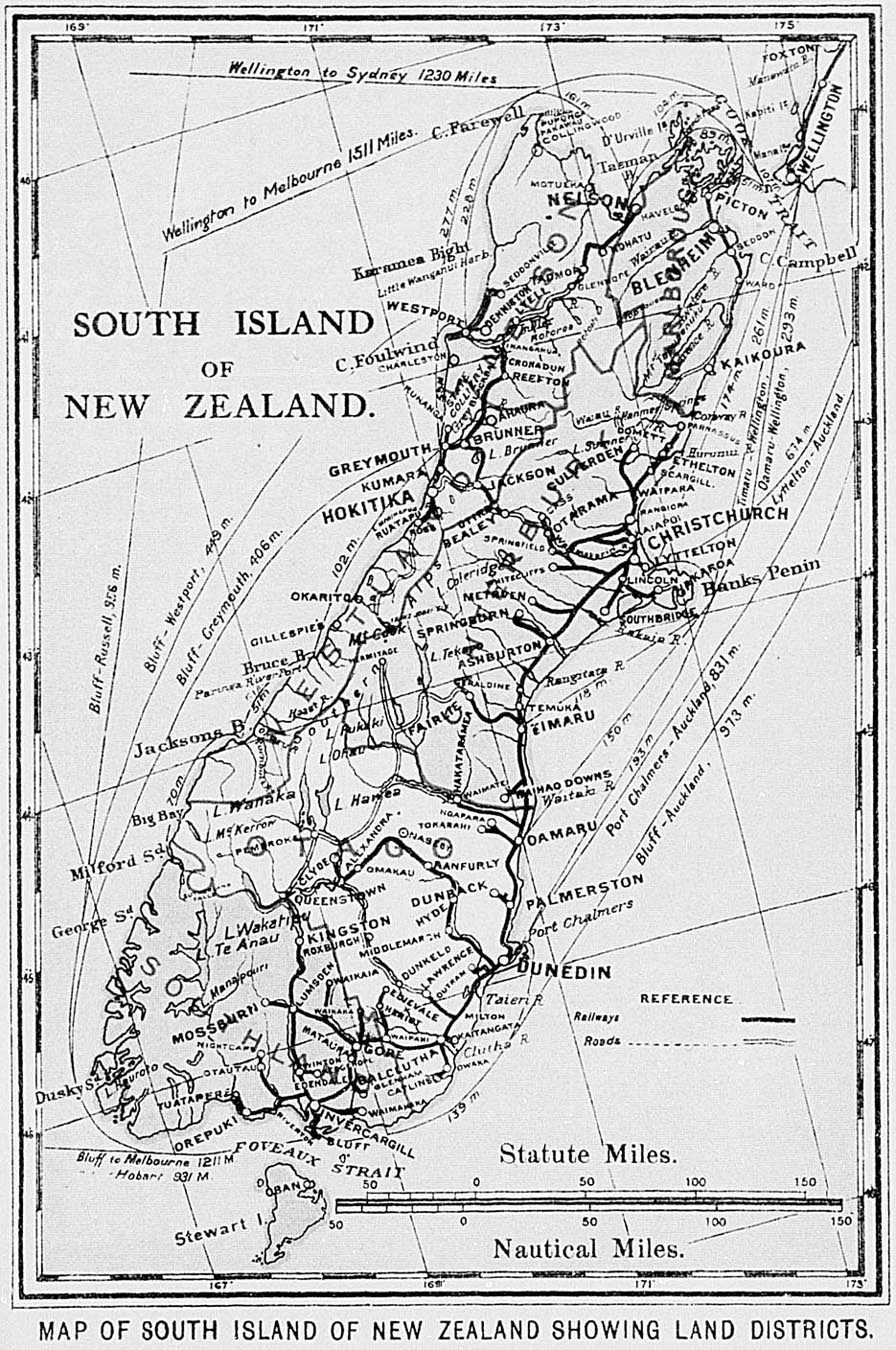

The extreme length of the South Island, from Jackson's Head, in Cook Strait, to Puysegur Point, at the extreme south-west, is about 525 statute miles; the greatest distance across at any point is in Otago (the southernmost), District, about 180 miles.

The South Island is intersected along almost its entire length by a range of mountains known as the Southern Alps. Some of the summits reach a height of from 10,000 ft. to 12,000 ft., Mount Cook, the highest peak, rising to 12,349 ft.

In the south, in the neighbourhood of the sounds and Lake Te Anau, there are many magnificent peaks, which, though not of great height, are, owing to their latitude, nearly all crowned with perpetual ice and snow. Further north the mountains increase in height—Mount Earnslaw, at Lake Wakatipu; and Mount Aspiring, which has been aptly termed the New Zealand Matterhorn, 9,949 ft. in height, at Lake Wanaka. Northward of this again are Mount Cook (or Aorangi), Mount Sefton, and other grand peaks.

For beauty and grandeur of scenery the Southern Alps of New Zealand may worthily compare with, while in point of variety they are said actually to surpass, the Alps of Switzerland. Until recently few of the mountains in New Zealand had been scaled; many of the peaks and glaciers are as yet unnamed; and there is still, in parts of the South Island, a field for exploration and discovery—geographical, geological, and botanical. The wonders of the Southern Alps are only beginning to be known; but the more they are known the more they are appreciated. The snow-line in New Zealand being so much lower than in Switzerland, the scenery, though the mountains are not quite so high, is of surpassing grandeur.

There are extensive glaciers on both sides of the range, those on the west being of exceptional beauty, as, from the greater abruptness of the mountain-slopes on that side, they descend to within about 700 ft. of the sea-level, and into the midst of the evergreen forest. The largest glaciers on either side of the range are easily accessible.

The following gives the sizes of some of the glaciers on the eastern slope:—

| Name. | Area of Glacier. | Length of Glacier. | Greatest Width. | Average Width. | |||

|---|---|---|---|---|---|---|---|

| Acres. | Miles | ch. | Miles | ch. | Miles | ch. | |

| Tasman | 13,664 | 18 | 0 | 2 | 14 | 1 | 15 |

| Murchison | 5,800 | 10 | 70 | 1 | 5 | 0 | 66 |

| Godley | 5,312 | 8 | 0 | 1 | 55 | 1 | 3 |

| Mueller | 3,200 | 8 | 0 | 0 | 61 | 0 | 50 |

| Hooker | 2,416 | 7 | 25 | 0 | 54 | 0 | 41 |

The Alletsch Glacier in Switzerland, according to Ball, in the “Alpine Guide,” has an average width of one mile. It is in length and width inferior to the Tasman Glacier.

Numerous sounds or fiords penetrate the south-western coast. They are long, narrow, and deep (the depth of water at the upper part of Milford Sound is 1,270 ft., although at the entrance only 130 ft.), surrounded by giant mountains clothed with foliage to the snow-line, with waterfalls, glaciers, and snowfields at every turn. Some of the mountains rise almost precipitously from the water's edge to 5,000 ft. and 6,000 ft. above the sea. Near Milford; the finest of these sounds, is the great Sutherland Waterfall, 1,904 ft. high.

There are several small hot springs in Canterbury and Westland, but they fade into insignificance when compared with those in the North Island.

The general surface of the northern portion of the South Island, comprising the Provincial Districts of Nelson and Marlborough, is mountainous, but the greater part is suitable for grazing purposes. There are some fine valleys and small plains suitable for agriculture, of which the Wairau Valley or Plain is the largest. Deep sounds, extending for many miles, break the coast-line abutting on Cook Strait. The City of Nelson is situated at the head of Blind Bay, which has a depth inwards from Cook Strait of about forty statute miles.

The Provincial District of Canterbury lies to the south of the Marlborough District and to the eastern side of the Island. Towards the north the land is hilly and undulating; followed by a stretch of plain one hundred miles long by thirty miles broad, rising at the rate of about 30 ft. to the mile from the sea to the hills, after which the coastal land is part flat and part undulating to the boundary of the Otago Provincial District. To the west of the above-mentioned plain the country is, generally speaking, hilly and mountainous.

Large rivers rising in the snow-clad ranges find their way through wide valleys and across the plain to the sea.

Many lakes and high plateaux of considerable size lie within the mountainous area. The most notable of the plateaux is the Mackenzie Plain, with its glacial lakes Tekapo, Pukaki, and Ohau. Many of the lakes may some day be utilized for generating electric power. At the present time an electric plant is being installed at Lake Coleridge, which will supply power for the city of Christchurch. To the east of the main plain the volcanic hills of Banks Peninsula jut out into the sea and form several good harbours, the principal being Port Cooper, on the north, whereon is situated Lyttelton, the chief port of the district; and the harbour of Akaroa, one of the finest in the Dominion, on the south.

There are no other natural harbours in Canterbury, but a good artificial one has been made at Timaru, in the south of the Province.

The Provincial District of Otago, under which denomination is also included the old Province of Southland, is an extensive one, and its physical features are much diversified.

The Southern Alps Range, which forms a distinct backbone throughout the northern part of the Island, is more divided into separate mountain chains in the north-west and west of Otago, though it still remains the watershed from which short rapid rivers reach the Tasman Sea on the west, and long and more slowly flowing ones empty themselves into the Pacific Ocean on the east and south, after passing through much hilly country and many fertile plains.

On the whole the province may be described as hilly with parts mountainous, though there is much flat alluvial land in the extreme south, and many good plains and cultivable downs throughout it. Originally there were extensive forests in the south, many of which are only partially cut out, and the west coast is still densely forest-clad, but by far the larger area of the province is open tussock and grass land suitable for grazing sheep, &c.

The whole province is auriferous, and there are goldfields of considerable extent in the interior.

The inland lakes are very remarkable features. Lake Wakatipu extends over fifty-four miles in length, but its greatest width is not more than four miles and its area only 114 square miles. It is 1,070 ft. above sea-level, and has a depth varying from 1,170 ft. to 1,296 ft. Lake Te Anau is somewhat larger, having an area of 132 square miles.

These lakes are bounded on the west by broken mountainous and wooded country, extending to the Tasman Sea, and deeply indented with numerous fiords or sounds.

There are also many other lakes, notably Hawea, Wanaka, Manapouri, and Hauroto, some of these being of considerable size.

The chief harbours in Otago are Otago Harbour, at the head of which the city of Dunedin is situated, and Bluff Harbour at the extreme south, the port of the town of Invercargill, and the old Provincial District of Southland.

The district of Westland, extending along the west coast of the South Island, abreast of Canterbury, embraces all the land lying between the tops of the Southern Alps and the Tasman Sea.

It is a narrow forest-clad strip of steep mountainous country fringed along the sea by alluvial flats or easier slopes. It is auriferous throughout, and has produced much gold. It also contains the chief coal-deposits of the Dominion.

Westland has many interesting lakes and glaciers, the latter of which have been referred to above.

The rivers in the South Island are for the most part mountain-torrents, fed by glaciers in the principal mountain-ranges. When the snow melts they rise in flood, forming, where not confined by rocky walls, beds of considerable width, generally covered by enormous deposits of shingle. The largest river in the Dominion as regards volume of water is the Clutha or Molyneux. It is 154 miles in length, but is navigable only for boats or small river-steamers and for about thirty miles. The Rivers Buller, Grey, and Hokitika, on the west coast, are navigable for a short distance from their mouths. They form the only ports in the Nelson south-west and Westland Districts. It their unimproved state they admitted, owing to the bars at their mouths, none but vessels of small draught; but, in consequence of the importance of the Grey and Buller Rivers as the sole ports available for the coal-export trade, large harbour-works have been undertaken, resulting in the deepening of the beds of these rivers, and giving a depth up to 26 ft. of water on the bars.

The area of level or undulating land in the South Island available for agriculture is estimated at about 15,000,000 acres. About 13,000,000 are suitable for pastoral purposes only, or may become so when cleared of forest and sown with grass-seed The area of barren land and mountain-tops is estimated at about 9,000,000 acres.

Foveaux Strait separates the South from Stewart Island. This last island has an area of only 423,735 acres.

Stewart Island is a great tourist resort during the summer months, and is easily reached by steamer from the Bluff, distant about 25 miles.

The principal peak is Mount Anglem, 3,200 ft. above sea-level. Most of the island is rugged and forest-clad; the climate is mild; and the soil, when cleared of bush, is fertile.

The chief attractions are the numerous bays and fiords. Paterson Inlet is a magnificent sheet of water, about ten miles by four miles, situated close to Half-moon Bay, the principal port, where over two hundred people live. Horseshoe Bay and Port William are within easy reach of Half-moon Bay. Port Pegasus, a land-locked sheet of water about eight miles by a mile and a half, is a very fine harbour. At “The Neck” (Paterson Inlet) there is a settlement of Maoris and half-castes. The bush is generally very dense, with thick undergrowth. Rata, black-pine, white-pine, miro, and totara are the principal timber trees. Fish are to be had in great abundance and variety; oysters form an important industry. Wild pigeons, ducks, and mutton-birds are plentiful.

The outlying group of the Chatham Islands, lying between the parallels of 43° 30' and 44° 30' south latitude, and the meridians of 175° 40' and 177° 15' west longitude, 480 statute miles east-south-east from Wellington, and 536 miles eastward of Lyttelton, consists of two principal islands and several unimportant islets. They were discovered by Lieutenant Broughton and named by him in honour of the Earl of Chatham. The largest island (Chatham Island) contains about 222,490 acres, of which an irregularly-shaped lake or lagoon absorbs 45,960 acres. About one-quarter of the surface of the land is covered with forest, the rest with fern or grass. The hills nowhere rise to a great height. Pitt Island is the next in size; the area is 15,330 acres. The greater portion of both islands is used for grazing sheep.

The Kermadec Croup of islands is situated between 29° 10' and 31° 30' south latitude, and between 177° 45' and 179° west longitude. They are named the Raoul or Sunday Island, Macaulay Island, Curtis Islands, and L'Espérance or French Rock. The principal Island, Sunday, is 600 miles distant from Auckland, and lies a little more than half-way to Tonga, but 100 miles to the eastward of the direct steam route to that place. It is 300 miles eastward of the steam route to Fiji, and 150 miles westward of the steam route from Auckland to Rarotonga. Macaulay Island (named after the father of Lord Macaulay) and Curtis Islands were discovered in May, 1788, by Lieutenant Watts, in the “Penrhyn,” a transport ship. The remainder of the group was discovered in 1793, by Admiral Bruni d'Entrecasteaux. The Admiral gave the name of “Kermadec” to the whole group of islands, after the captain of his consort ship “L'Espérance,” and the name of the Admiral's ship “La Recherche” was given to the largest island. The name so given was not continued, but that of “Raoul” has taken its place, which would appear to have been given after the sailing-master of the “La Recherche,” whose name was Joseph Raoul. The name of “Sunday” may also have become attached to the island from the fact that it was discovered on a Sunday. The islands are volcanic, and in two of them signs of activity are still to be seen. The rainfall is plentiful, but not excessive. The climate is mild and equable, and slightly warmer than the north of New Zealand. The following are the areas of the islands and islets of the group: Sunday Island, 7,200 acres; Herald group of islets, 85 acres; Macaulay Island, 764 acres; Curtis Islands, 128 acres and 19 acres; L'Espérance, 12 acres: total, 8,208 acres. Sunday Island is twenty miles in circumference, roughly triangular in shape, and at the highest point 1,723 ft. above the sea-level. It is rugged and broken over a very large extent of its surface, and, except in a few places, covered with forest. The soil everywhere on the island is very rich, being formed by the decomposition of a dark-coloured pumiceous tuff and a black andesitic lava, with which is closely mixed a fine vegetable mould. The great luxuriance and richness of the vegetation bear witness to the excellence of the soil, which is everywhere—except where destroyed by eruptions, and on the steep cliffs—the same rich loam. Want of water is one of the drawbacks. Three of the four lakes on the island are fresh, but so difficult of approach as to be practically useless.

The Auckland Islands were discovered during a whaling voyage on 18th August, 1806, by Captain Abraham Bristow, in the ship “Ocean.” The discoverer named the group after Lord Auckland, again visited the islands in 1807 and then took formal possession of them. They lie about 290 miles south of Bluff Harbour, their accepted position being given as latitude 50° 32' S., and longitude 166° 13' E. They have several good harbours. Port Ross, at the north end of the principal island, was described by the eminent French commander D'Urville as one of the best harbours of refuge in the known world. At the southern end of the island there is a through passage extending from the east to the west coast. It has been variously named Adams Strait and Carnley Harbour, and forms a splendid sheet of water. The largest of the islands is about 27 miles long by about 15 miles broad, and is very mountainous, the highest part being about 2,000 ft. above the sea. The west coast is bold and precipitous, but the east coast has several inlets. The wood on the island is, owing to the strong prevailing wind, scrubby in character. The New Zealand Government maintains at this island a depot of provisions and clothing for the use of shipwrecked mariners.

The Antipodes, an isolated group, consisting of several detached rocky islands lying nearly north and south over a space of four to five miles; accepted position, 49° 41' 15” south, and longitude 178° 43' east.

The Bounty Islands, a little cluster of islets, thirteen in number and without verdure, discovered in 1788 by Captain Bligh, R.N., of H.M.S. “Bounty.” Position verified by observation, 47° 43' south, longitude 179° 01/2' east.

Campbell Island was discovered in 1810 by Frederick Hazelburgh, master of the brig “Perseverance,” owned by Mr. Robert Campbell, of Sydney. It is mountainous, and of a circumference of about thirty miles. There are several good harbours.

The Cook Islands, with others now included within the extended boundaries of the Dominion, are as under:*—

Rarotonga: A magnificent island, rising to a height of 3,000 ft., clothed to the tops of the mountains with splendid vegetation. It has abundant streams, considerable tracts of sloping land, and rich alluvial valleys. The two harbours are poor.

Mangaia, the south-easternmost of the Cook Group, is of volcanic origin, and about thirty miles in circumference. The productions, which are numerous and cheap, are obtained by assiduous labour.

Atiu resembles Mangaia in appearance and extent. It is a mere bank of coral, 10 ft. or 12 ft. high, steep and rugged, except where there are small sandy beaches and some clefts, when the ascent is gradual.

Aitutaki presents a most fruitful appearance, its shores being bordered by flat land, on which are innumerable coconut and other trees, the higher ground being beautifully interspersed with lawns. It is eighteen miles in circuit.

* See article “New Zealand's Extended Boundaries” in a later portion of this book.

Mauke or Parry Island is a low-lying island; it is about two miles in diameter; well wooded, and inhabited.

Mitiaro is a low-lying island, from three to four miles long and one mile wide.

Hervey Islands: This group consists of two islands, surrounded by a reef, which may be 101/2 miles in circumference.

Niue, or Savage Island, lying east of the Friendly Islands, is a coral island, thirty-six miles in circumference, rising to a height of 200 ft. It has the usual tropical productions.

Palmerston Island, lying about 500 miles east of Niue and about 220 from the nearest island of the Cook Group (Aitutaki), is remarkable as the “San Pablo” of Magellan, the first island discovered in the South Sea. It has no harbour. The soil is fairly fertile, and there is some good hardwood timber.

Penrhyn Island (Tongareva) lies about 300 miles north-east of Manahiki. It is one of the most famous pearl islands in the Pacific, and there is a splendid harbour, a lagoon with two entrances, fit for ships of any size.

Manahiki, lying about 400 miles eastward of Danger Island, is an atoll, about thirty miles in circumference, valuable from the extent of the coconut groves. The interior lagoon contains a vast deposit of pearl-shell.

Rakaanga is an atoll, three miles in length and of equal breadth.

Danger Island (Pukapuka): Next to the 10th parallel, but rather north of the latitude of the Navigators, and east of them are a number of small atolls. Of these, the nearest to the Samoan Group—about 500 miles—is Danger Island, bearing north-west of Suwarrow about 250 miles.

Suwarrow Island has one of the best harbours in the Pacific. It lies about 500 miles east of Apia, the capital of the Samoan Group. It is a coral atoll, of a triangular form, fifty miles in circumference, the reef having an average width of half a mile across, enclosing a land-locked lagoon twelve miles by eight, which forms an excellent harbour. The entrance is half a mile wide, and the accommodation permits of ships riding in safety in all weathers, with depths of from three to thirty fathoms. It is out of the track of hurricanes, uninhabited, but capable by its fertility of supporting a small population. As a depot for the collection of trade from the various islands it ought to be very valuable.

The geological history of New Zealand is long and complicated, and is as yet by no means clearly deciphered. Many times the land has risen and fallen. Now it has been part of some great continent: again the major portion or the whole has disappeared beneath the waves of the ocean. Now the land consists mainly of huge mountain-chains: later it exhibits a nearly flat surface over which meander sluggish streams: still later it is once more mountainous, and from the highlands great streams of ice deploy on the lowlands. Now the climate is more genial than it is to-day: anon more rigorous than that of Central Russia. At times volcanic action proceeds on a vast scale: at others the subterranean forces are dormant. If the student of geology would rightly interpret the story of the rocks he must ever bear in mind that New Zealand in the past has never been quite or even nearly the same as we see it now. With the scanty materials at hand he must endeavour to reconstruct the land as it existed during past ages. A rich field for original research is open to the geologist. There are many important problems, some of high economic value, some of world-wide interest, awaiting solution by the patient worker in science.

The oldest rocks in New Zealand appear to be those of western Otago, where over a large area is exposed a complex of gneisses and schists, intruded by granite and other igneous rocks. The gneisses in the main are altered granites and diorites, but some of the schists, at any rate, are of sedimentary origin. A pre-Cambrian age was assigned to these rocks by Professor F. W. Hutton, but Professor James Park considers them to be probably of Cambrian age, and includes them in his Maniototo Series.

Perhaps next in age to the western Otago gneisses and schists are the mica, chlorite, and quartz schists of Central Otago. In the absence of fossils, however, the age of these rocks is uncertain. Professor Hutton regarded them as pre-Cambrian, Professor Park assigns a Cambrian age, whilst Dr. P. Marshall considers them to be little, if at all, older than the Triassic. Some schistose rocks in north, central, and western Nelson may be as old as, or even older than, the Otago mica-schists. The gneisses and schists on the western side of the Southern Alps may for the present be classed with the Nelson schists.

The oldest known fossiliferous rocks in New Zealand are the Ordovician argillites (“slates”), greywackes, and quartzites occurring near Collingwood (Nelson), and Preservation Inlet in south-west Otago. Ultimately these rocks may be found to have a considerable development in various parts of Nelson and Westland.

Rocks containing Silurian fossils occur in the Mount Arthur district, Nelson. They are principally altered limestone (practically marble), calcareous shale or argillite, sandstone, and quartzite.

At Reefton a small area exhibits quartzite, limestone, and slaty shale containing fossils believed to be of Devonian age. Elsewhere considerable areas have been assigned to the same period by Mr. Alexander McKay, but owing to the non-discovery of recognizable fossils definite proof of age is wanting. For a similar reason the age of most of the rocks placed in the Carboniferous period (“Maitai Series”) by McKay is uncertain. At Reefton the supposed Carboniferous rocks, which here contain many auriferous quartz veins, may quite possibly be of Ordovician age. In the typical locality near Nelson the fossils found in the Maitai rocks indicate a Trias-Jura age, though possibly older rocks may be present also.

So far Permian rocks have not been satisfactorily identified in New Zealand. Park, however, considers his Aorangi and Kaihiku Series to be of Permian age.

During some of the Palæozoic periods it is conjectured that New Zealand formed part of or was the foreland of a large land-mass that extended far to the west. This land-mass possibly persisted to late Palæozoic times, and may have been the now-dismembered and all-but-lost continent known to geologists as Gondwana-land.

As yet the early and middle Mesozoic rocks of New Zealand have not been clearly separated by means of unconformities or fossil evidence. What may be called a Trias-Jura system is extensively developed in both the North and South Islands. The most fossiliferous localities are Hokonui Hills (Southland), near Nugget Point (Otago), Wairoa Valley, near the City of Nelson, Kawhia Harbour, and Waikato Heads, the two latter localities both on the west coast of Auckland. A broad belt of Trias-Jura or, according to Park, of Permo-Jurassic rocks extends through western Canterbury and Marlborough, and is continued as a somewhat narrower belt on the north side of Cook Strait from Wellington to near East Cape. Rocks of much the same age occur in the Mokau River watershed, in the Lower Waikato Valley, in the Coromandel Peninsula, and in North Auckland.

The supposed Jurassic rocks of Kawhia Harbour and Waikato Heads, mentioned above, may possibly be of Lower Cretaceous age. Admittedly Cretaceous rocks extend in a not-quite-continuous belt from Cape Campbell in Marlborough to the neighbourhood of Waipara in North Canterbury. At Amuri Bluff they are richly fossiliferous. Here and in several other localities the fossils include saurian remains. To the Cretaceous may also be assigned a somewhat extensive belt of rocks near the east coast of Wellington and southern Hawke's Bay. A continuation of this belt extends from somewhere to the north-west of Gisborne to the East Cape district.

The oldest known workable coal-seams in New Zealand probably occur in Cretaceous rocks. Much controversy, however, concerning the age of our coalfields has arisen. The late Sir James Hector, and with him Mr. Alexander McKay, considered that the coal-measures belonged to a Cretaceo-Tertiary system that extended from the Upper Cretaceous to the Middle Tertiary. For many years Mr. McKay was practically the sole exponent of this theory, but quite recently Dr. Marshall has advocated a very similar if not identical view. The truth, however, seems to be that the coal-measures concerning which there is a dispute are of two different ages. The Shag Point, Malvern Hills, and North Auckland coalfields are probably of Upper Cretaceous age. To these Park would add the Milton-Kaitangata coalfield and a small portion of the Green Island coalfield. The other coalfields, as mentioned below, are Tertiary.

Although there is certainly a palæontological break between the Upper Cretaceous (Waipara Series) and the Early Tertiary, the existence of an unconformity, as may be inferred from the previous paragraph, is a matter of doubt. The subdivision of the Tertiary strata, which are well represented in New Zealand, is still more or less tentative. To the Eocene may be assigned the bituminous coal-measures of the Grey, Buller, and Collingwood districts, and probably also some of the coal-bearing patches of central Nelson. Elsewhere Eocene rocks are not recognized.